Canada’s two publicly traded dealerships, Cervus Equipment and Rocky Mountain Dealerships, posted strong earnings reports earlier this month, especially considering the sluggish sales many farm equipment dealers have experienced during the past year.

While new equipment sales were down slightly for both dealership groups (Cervus –3%, Rocky –2%) vs. their third quarters a year ago, both reported a significant pick up in their year-over-year sales of used machinery (Cervus +44%, Rocky +23%).

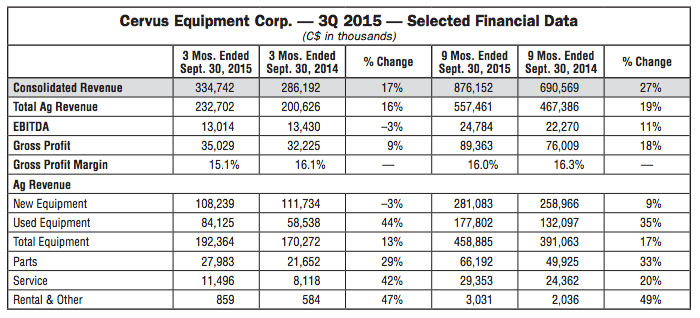

Cervus: 3Q15 Ag Sales Up 13%

Cervus Equipment Corp. (CVE) posted an increase in total ag equipment reve¬nue of 16% for the period ending Sept. 30 and 19% through the first 9 months of 2015. During its third quarter, John Deere’s largest farm machinery dealer in Western Canada registered strong sales across the board: equipment rev¬enues were up 13% (new –3%, used +44%), parts +29%, service +42%, rent¬al and other +47%.

“Agricultural sentiment varied dur¬ing the quarter as mid-season concerns gave way to optimism with late season rains resulting in an average harvest across most of our geography. Against this backdrop, our agriculture segment generated strong used equipment sales, while an earlier harvest benefitted parts and service in the quarter,” said Graham Drake, president and CEO of Cervus.

Total revenues for the third quarter increased by $48.6 million to $876,152, up 17%, during the third quarter.

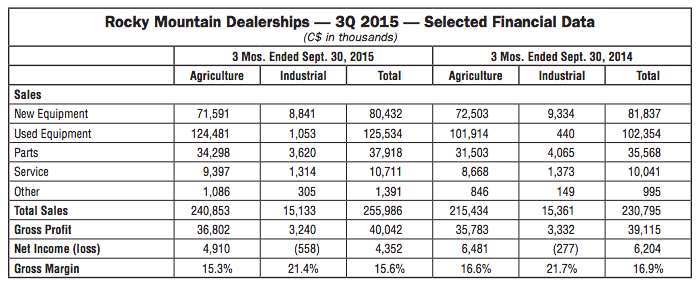

Rocky Makes Progress in Its Turnaround

For its third quarter, Rocky Mountain Dealerships (RME) reported total revenues were up by 10.9% to $256 million from $230.8 million a year ago. While new equipment sales were off by 2% vs. the same period last year, used equipment sales were up by 23%. Inventory decreased by $51.3 million or 9.5% to $489.7 million.

Product support revenues were strong, improving by 6.6% to $48.6 million from $45.6 million: parts +7%, service +7% and other +40%.

“Encouragingly, Rocky managed a $51 million inventory reduction from the second quarter. This helped reduce net-debt by $31 million, although leverage remains high,” Ben Cherniavsky of Raymond James told investors in a note.

He added, “Rocky, in our view, continues to make small steps toward a comprehensive turnaround in its operations.”

Post a comment

Report Abusive Comment