The latest episode of On the Record is now available! In this week’s episode, we discuss the continued challenges hitting Canadian dealers. We also take a look at how dealers have responded to the COVID-19 pandemic and how its impacting the commodities market. Also in this episode: How Bobcat’s return to tractors boosted its bottom line and digital strategies for dealers.

On the Record is brought to you by Ingersoll Tillage.

This episode of On the Record is brought to you by Ingersoll Tillage. Ingersoll specializes in seedbed solutions. Whatever seedbed challenges you have, Ingersoll can give you the right tools to get the job done. For every tillage and planting practice, there’s an ideal Ingersoll application.

On the Record is now available as a podcast! We encourage you to subscribe in iTunes, the Google Play Store, Soundcloud, Stitcher Radio and TuneIn Radio. Or if you have another app you use for listening to podcasts, let us know and we’ll make an effort to get it listed there as well.

We’re interested in getting your feedback. Please feel free to send along any suggestions or story ideas. You can send comments to kschmidt@lessitermedia.com.

Headwinds Continue to Pummel Canadian Dealers

Rocky Mountain Dealerships, Case IH’s largest Canadian dealer group, and Cervus Equipment, John Deere’s largest dealer in Canada, issued their 2019 earnings reports last week. Their results show that sales of farm machinery in Canada remain in the doldrums with little optimism for any improvement in the near term.

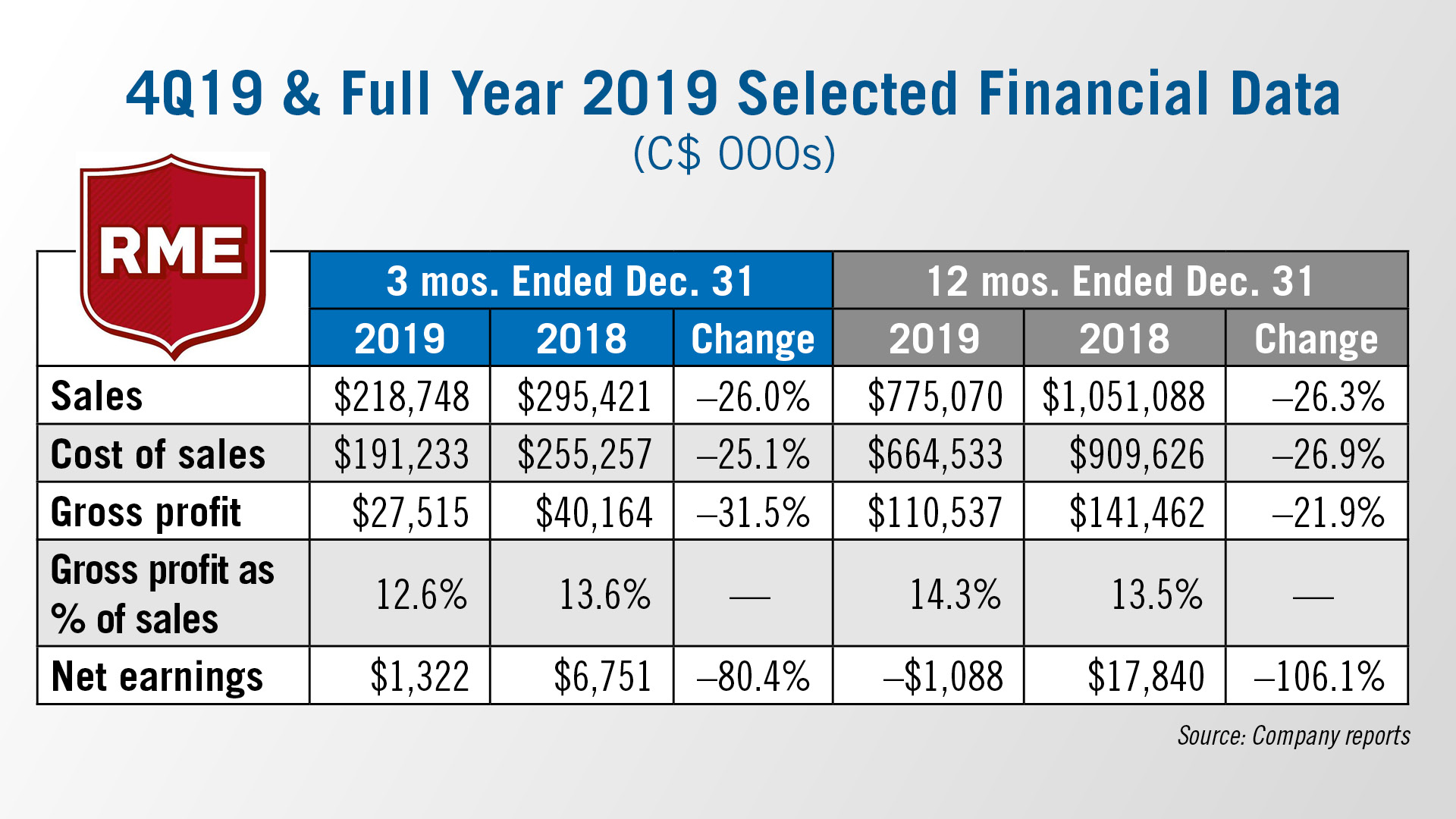

Rocky Mountain Dealerships reported on March 11 that its fourth quarter and full year 2019 revenues were down 26% compared to 2018 to $775 million from about $1 billion. Gross profit dollars decreased by 22% to $111 million from $142 for the same period in 2018 on reduced sales.

Gross margin increased by 0.8% to 14.3% from 13.5% for the year as the dealership’s sales mix shifted toward higher margin parts and service sales. Product support revenues improved last year to $152 million, which was about $8 million more than in 2018.

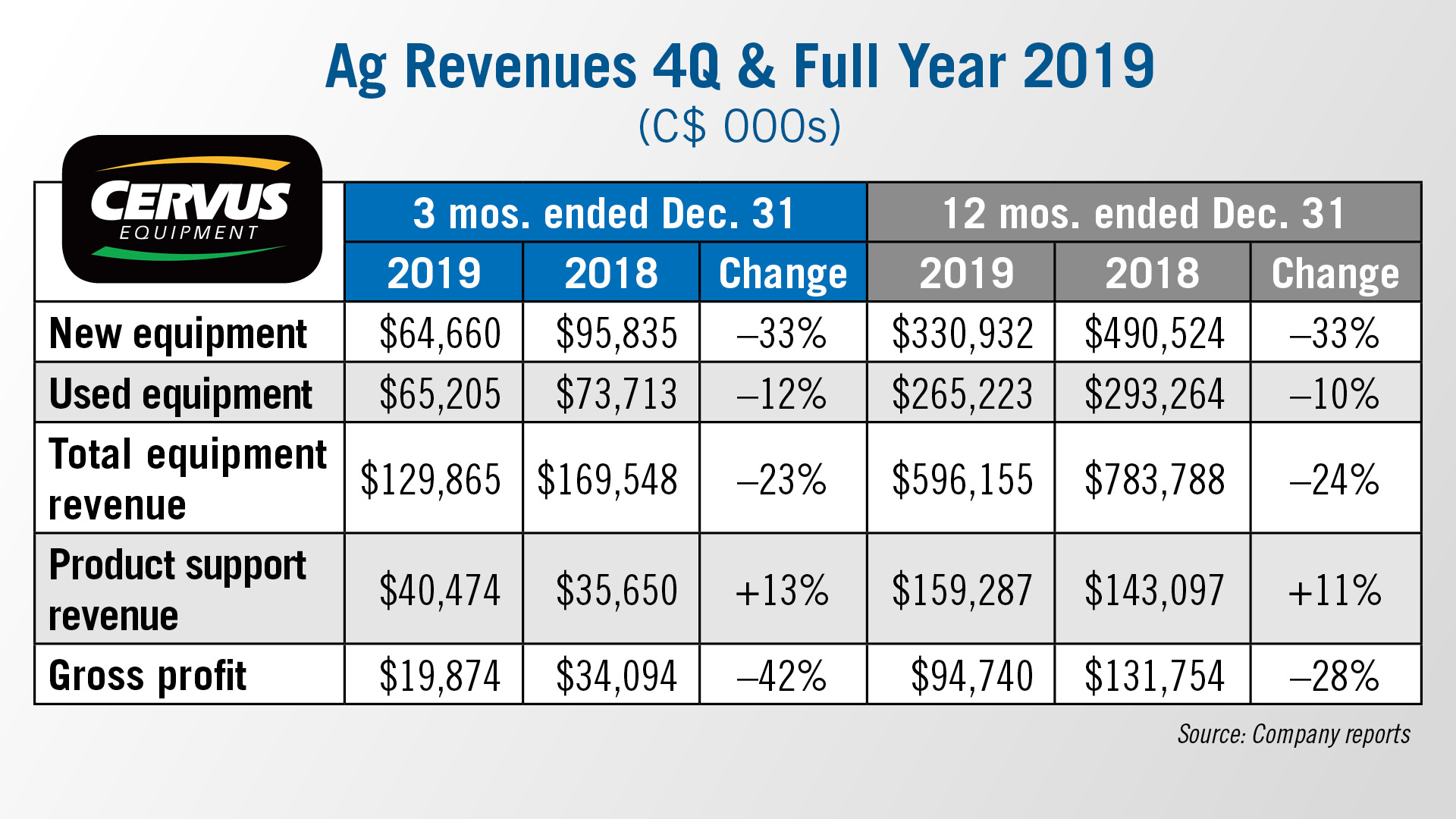

Cervus Equipment reported that its agriculture equipment revenue declined 24% for 2019 to $596 million from $784 million. New equipment revenue was down 33%, while used sales fell 10% to $265 million from $293 million in 2018.

Used equipment inventory decreased $67 million, or 37%, as of Dec. 31, 2019 vs. June 30, 2019. The company reported that excess used equipment inventory in its ag segment resulted in inventory impairments of $10 million in the fourth quarter and $24 million for the year in 2019.

Gross profit declined 19%, or $40 million, for the year due to a decrease in both new and used equipment gross profit in the ag segment associated with lower revenues and margins. Growth in product support revenue contributed an additional $7 million of gross profit for the year compared to 2018.

Both Rocky Mountain and Cervus attributed their poor showings in 2019 to ongoing headwinds, including reduced 2018 farm income, increased input costs, reduced commodity prices and trade disputes, all compounded by poor growing and harvesting conditions in parts of western Canada.

In a note to investors, Ben Cherniavsky, analyst with Raymond James, said, “Cervus and the entire ag equipment industry continues to work its way through a painful restructuring that we believe will take more time to complete.”

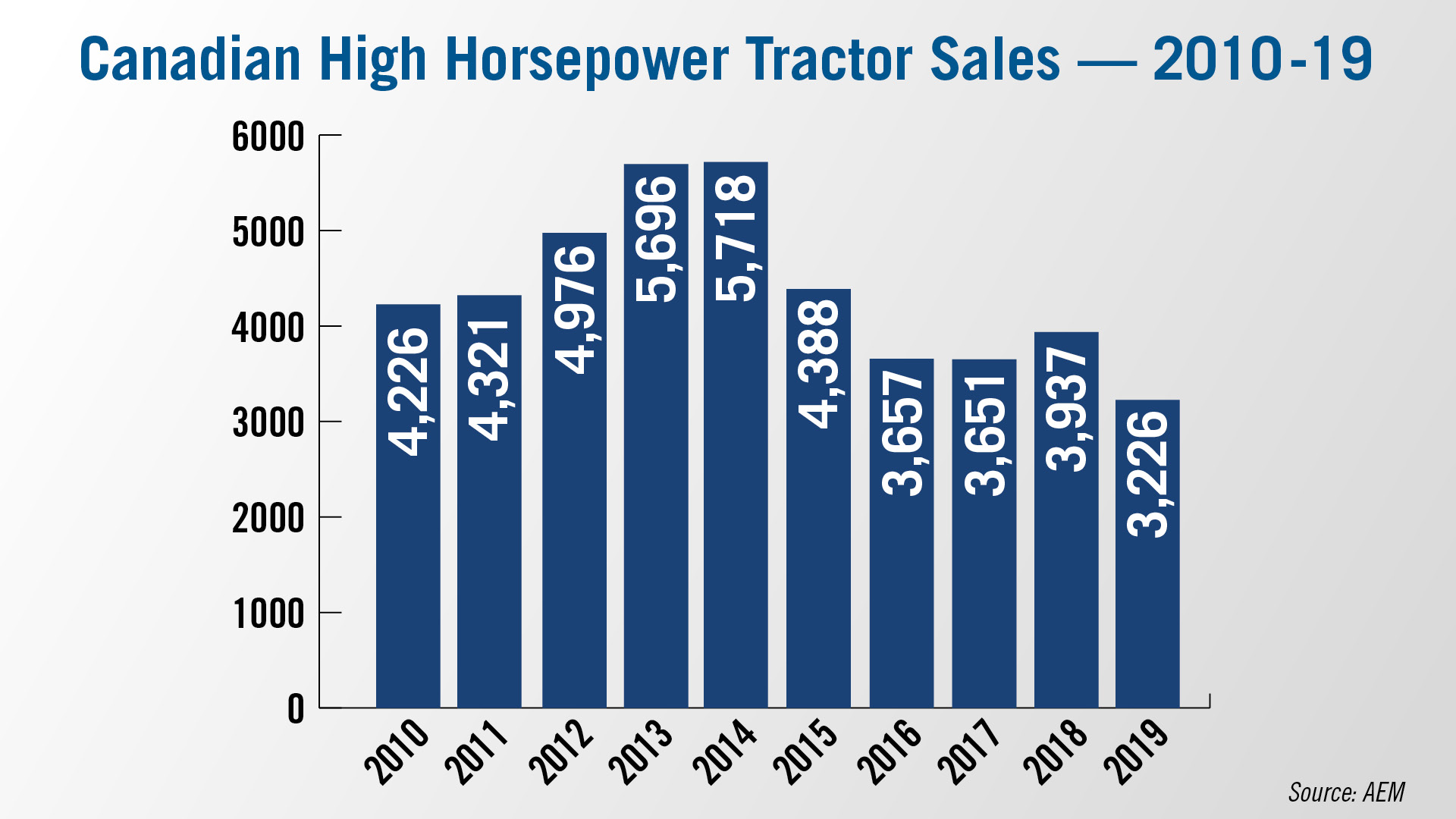

According to sales figures released by the Assn. of Equipment Mfrs., sales of high horsepower tractors for 2019 bears out the difficult market for ag equipment sales in Canada.

High horsepower tractor sales in 2019 finished the year 29% behind units sold in 2018. And sales last year were nearly 78% behind 2014, which was the peak year for sales of this equipment in the last decade.

Dealers on the Move

This week’s Dealers on the Move include S&H Farm Supply, Webb’s Machinery and Sloan Implement.

S&H Farm Supply has officially opened its 5th location in Branson, Mo., which the dealership announced plans for in December 2019.

New Holland dealer Webb’s Machinery has acquired Tri-Ag Implement, adding 3 locations for a total of 6 throughout Alberta.

Joan Deere dealer Sloan Implement acquired Arends-Awe, a 2 store dealership with locations in Winchester and Perry, Ill. Sloan will now have 20 stores in Illinois and Wisconsin.

Marketing the Value of Your Precision Business

On the cusp of spring planting in many areas, farmers are preparing to put their precision farming systems to the test. And in many cases, planter clinics have been cancelled or postponed this year, making it all the more important that farmers have alternative opportunities to get answers.

A dealership’s website can be a valuable resource for farmers, but only if properly stocked with the right information. This time of year, that can include product demonstrations, planter tips videos and other tutorials to proactively solve customers’ problems before they get into the field.

Heather Hetterick, ag marketing strategist, took an analytical look at different farm equipment dealership websites and shared several essential strategies that should be part of a dealership’s digital playbook, to include easy-to-find information on precision products, services and specials.

“What products you carry. This is a big one. I honestly think that when you go back to your website and you look at this, you're probably going to find that you added something that you forgot to add to your website. It’s common to get all excited when you sign up one of these new vendors and there’s new products coming out every day. But did you remember to say and to tell people that you carry it?

What you offer should be on there. We talked a lot, I know here, about a lot of people getting into data. But did you tell your customers about what you really have to offer? You have to be a little bit careful with this. I noticed several dealers not only with precision, but also in service, that they do have it on their website but it’s a brochure and a PDF. Google can’t read that. That will become important in a moment. You have to have what you actually offer. Don’t assume that people know what you do.

Lastly, I find that very few dealers put their precision offers on there. In my experience, these precision offers — monitor upgrades or special discounts — can sometimes be complicated. I know I didn’t love putting it on our website but that’s important. You can’t go and promote it and retargeting or put it on Facebook or anywhere else unless it’s housed on your website. It’s so important when you get to linking and things later, to have those offers on your site.”

Hetterick adds that modern websites tend to be fluid in their content, allowing visitors to scroll and interact with videos, chats or even polls. Adding some or all of these tools can increase customer engagement and retention.

Ag Industry Responds to COVID-19

As the coronavirus, or COVID-19, continues to spread across North America and social distancing is put into practice, farm equipment dealers are responding to the disruption in business.

Ag Equipment Intelligence asked dealers what steps if any they have taken to reduce the risk of spreading the virus and how they have communicated those precautions to customers and employees. From canceling customer events like planter clinics to cleaning more frequently and requiring anyone with symptoms to stay home, dealers in the U.S. and Canada have made adjustments, but for many it is still business as usual.

A number of dealers noted that they are trying to do as much business over the phone as possible, and at Stotz Equipment, salespeople have been told to request permission from the customer before going onto their farm.

At Birkey’s Farm Stores in Illinois and Indiana, while stores are remaining open, customers are being encouraged to call in parts orders or to shop online. President and CEO Mike Hedge told customers in an email that they will provide curbside pickup during store hours.

Jon Castongia, president of Castongia Tractor says the dealership is establishing an emergency paid time off fund that is jointly funded by employees and the company to assist any employee who needs to take care of themselves or a loved one who may be battling COVID-19 so they can still receive a paycheck.

Bob Clements International hosted 2 webinars for dealers this week, sharing advice on how to manage their response from customer service to human resources concerns. We caught up with Sara Hey, vice president of business development, afterward. As non-essential businesses close, Hey says that to the best of their understanding dealerships are considered essential businesses and will be able to remain open.

In terms of what to do if an employee contracts the virus, Hey had this to say.

There's a few steps that they have to do, like starting by calling their local health organization, and then they have to inform the employees.

Keep it confidential, they can not tell anybody in the dealership who it was out of the mouth of the owner or the manager.

And then they've got to come up with a cleaning plan that everybody is aware of. If somebody in their dealership calls and says, I have the coronavirus, those are the pieces that they have to follow.

Doug Vahrenberg, owner of Vahrenberg Implement in Higginsville, Mo., says they are operating as business as usual and their biggest concern right now is assuring customers that they are in fact open for business and taking care of their needs. He says, “99.9% of customers are claiming over reaction of the media, and it’s effecting their bottom line as it’s reduced commodity prices.”

Associate Research Editor Ben Thorpe has more details on how COVID-19 is impacting the commodity market.

Soybeans, Corn Demand Hit by COVID-19

While COVID-19 has become a major concern in the U.S., the virus’ larger impact on demand for U.S. commodities may become a growing hurdle for the ag industry. Coupled with dropping commodity prices, reduced demand could impact farm income and potentially hurt dealer and manufacturer sales in 2020.

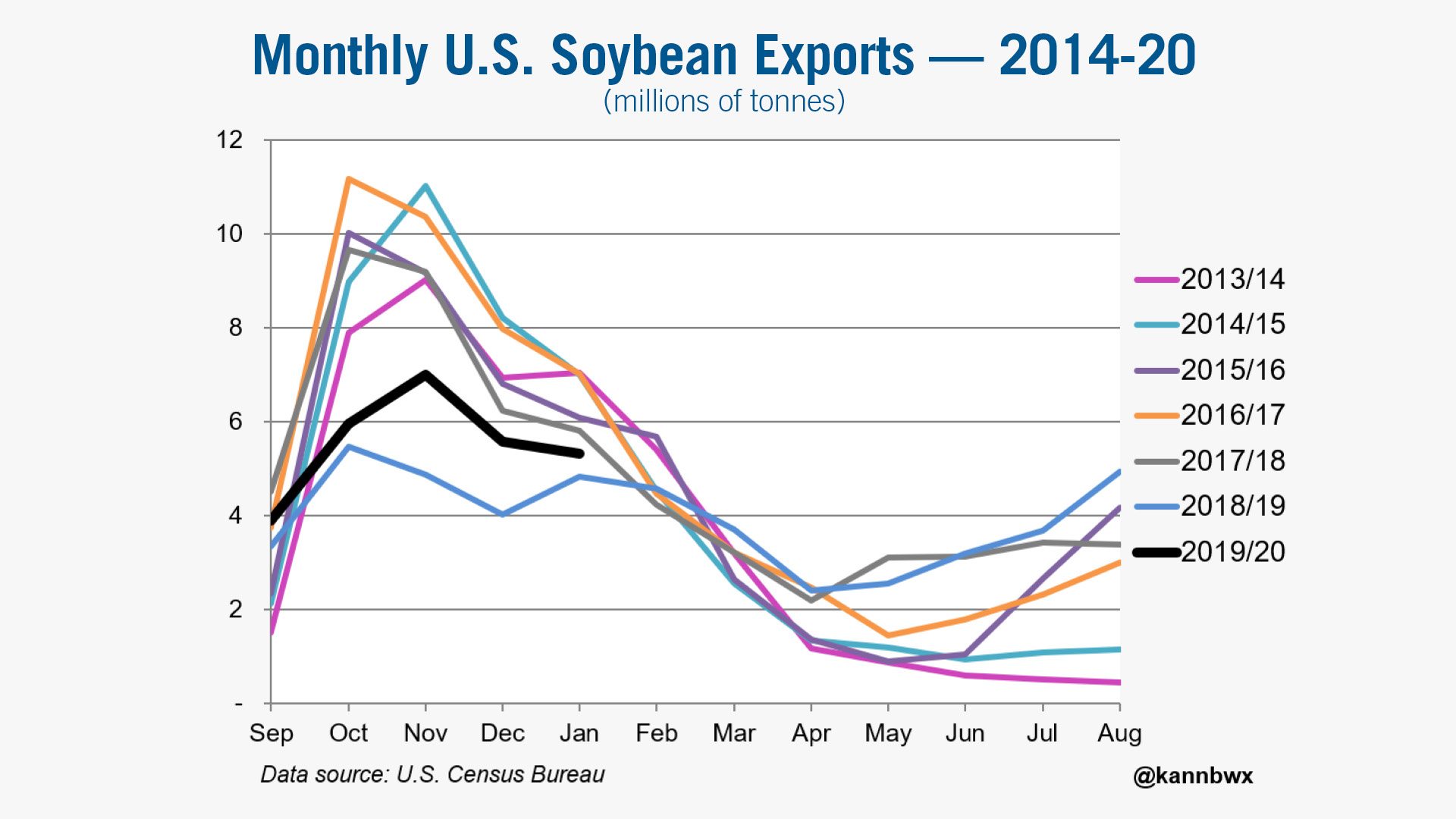

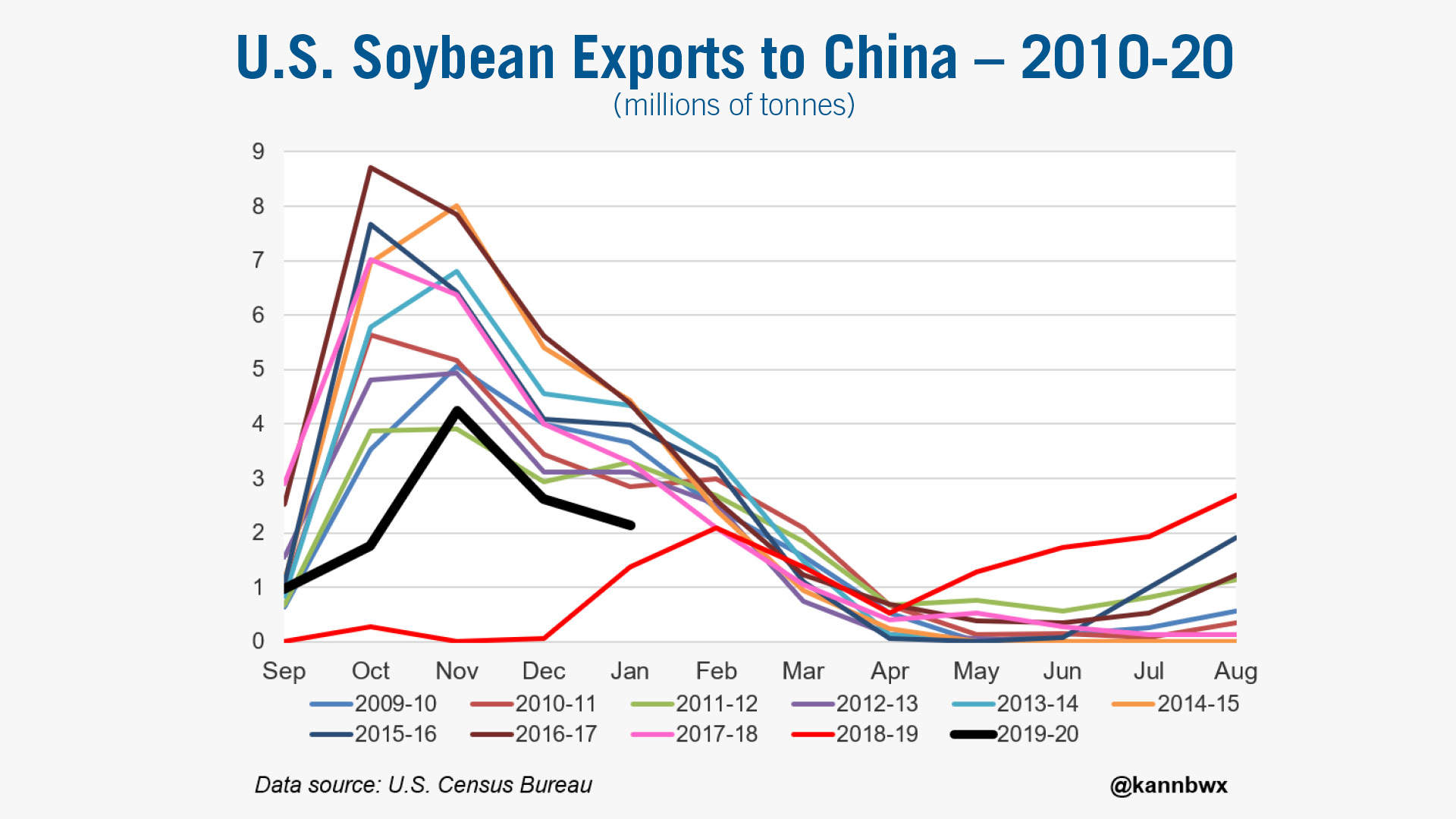

Soybean exports dipped with the spread of COVID-19, according to a report from Reuters. In January, the U.S. exported a total of 5.3 million metric tons of soybeans, up 10% month-over-month but 19% below the 2014-18 average. About 40% of all U.S. soybean exports in January went to China, below the 2014-18 average of 62%.

USDA estimates for February show total U.S. soybean exports at around 3.2 million metric tons, which would be a 14 year low for the month. The data also estimates China received 600,000 metric tons of soybeans in February, potentially a 20 year low for the month.

To reach the USDA soybean export forecast of 1.8 billion bushels for 2020, Reuters estimates some 18.8 million metric tons of soybeans would need to be exported in the second half of the year, requiring a record number of soybean sales in spite of China’s now lowered rate of soybean purchases.

Other commodities are also being impacted within the U.S. as a result of COVID-19, with corn potentially facing a reduced ethanol demand. According to the University of Illinois’ Todd Hubbs, the rise in canceled public events in the U.S. could lead to a decrease in gasoline consumption. Hubbs says a drop of 15-20% in gasoline use is expected from many industry analysts in the coming months, which may lead to a decrease in corn for ethanol by 120-170 million bushels. He notes that lowered corn prices have increased exports, though the export rate is still behind the USDA 2020 export forecast of 1.7 billion bushels.

Bobcat’s Return to Tractors Boosts Bottom Line

Returning to the compact tractor market in North America last year helped Doosan Bobcat record a 5.4% increase in fourth quarter 2019 sales and contributed to a 7.2% rise in full year sales to $3.8 billion.

The launch of the Daedong-sourced tractors — reported exclusively in Ag Equipment Intelligence last August — bodes well for the current financial year, with Doosan Bobcat managers forecasting 5% sales growth in 2020 as the tractors, the newly introduced R-Series skid steer loaders and forthcoming new compact wheel loaders make their mark.

The new tractors and zero-turn landscaping mowers from last year’s Bob-Cat acquisition also aim to help Doosan Bobcat reduce its reliance on compact construction equipment sales.

As products selling into new sectors, they should also help strengthen the company’s dealer network. Last year the network expanded to 565 dealers in North America — almost 6% more than in 2016. The company anticipates recruiting 40-50% more dealers by 2024 to help reach $4 billion in sales revenues.

The company’s upbeat 2019 performance helped parent Doosan Infracore offset a slight decline in excavator and other heavy construction equipment sales to record $6.7 billion in revenues, with Doosan Bobcat contributing 54% of the total.

Implement & Tractor Archive

In the agriculture business, Vermeer is best known for its introduction of the first round baler in the early 1970s. Like most of Gary Vermeer’s inventions, the round baler came to be out of trying to find a better way. As the story goes, Vermeer was out walking with his friend and fellow farmer Arnold Van Zee, who shared that he was thinking about selling his cattle because he was tired of putting up hay, explains Bob Vermeer, Gary’s son and now the Chair Emeritus of the Board of Directors at Vermeer.

At the time, putting up hay was at least a 4 person job. After that conversation with Van Zee, Gary Vermeer set out to find a better way for his friend and, ultimately, the industry. The first Vermeer round baler formed a bale of hay 6 foot high with a 7 foot diameter, and it weighed more than a ton.

![[Technology Corner] Pessl Instruments CEO Talks Dealer Benefits From Lindsay Corp. Investment](https://www.agequipmentintelligence.com/ext/resources/2024/04/25/Pessl-Instruments-CEO-Talks-Dealer-Benefits-From-Lindsay-Corp.-Investment.png?height=290&t=1714144307&width=400)

Post a comment

Report Abusive Comment