Canada’s two largest farm equipment dealers, Rocky Mountain Dealerships and Cervus Equipment reported their third quarter earnings this month and both posted strong sales for the 3 month period and for the first 9 months of 2017.

Rocky Mountain Dealerships: ‘Best Quarter Since 2012’

Rocky Mountain Dealerships, Case IH’s largest dealership group in Canada, reported strong sales in the third quarter, continuing a trend that started earlier this year. The company sees this a further sign that the market for farm machinery in the country’s western provinces is in a solid recovery phase.

“The forward economic indicators for our sector are strong,” said Garrett Ganden, Rocky’s president & CEO. “There is mounting evidence that the Western Canadian market for agricultural equipment is returning to normal levels after being depressed for a number of years.”

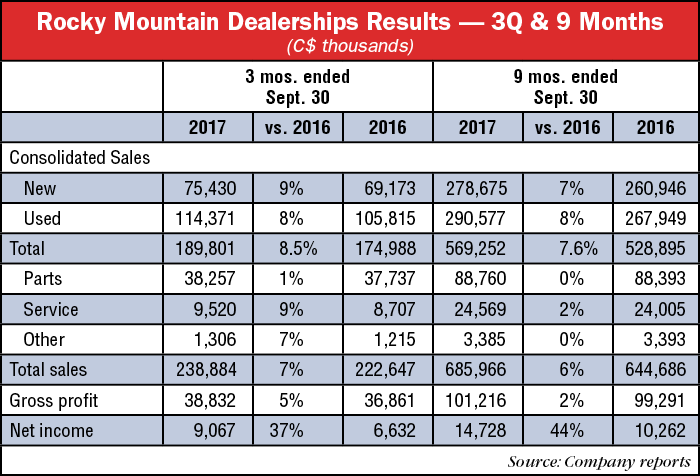

The company’s total sales increased $16.2 million, or 7.3%, to $238.9 million compared with the same period in 2016 due to growth across all revenue streams. Gross profit for the 3 months ended Sept. 30, 2017, increased by $2 million, or 5.3%, to $38.8 million vs. the same period in 2016 due to increased sales.

Focus on Sales & Inventory Management

“These results, the best that Rocky has posted since 2012, were achieved with all divisions contributing to a 7% year-over-year increase in sales which, coupled with our streamlined cost structure, allowed us to deliver a great quarter,” said Ganden. “Our focus on sales and inventory management allows us to reduce debt, contain costs, increase inventory turnover and increase our return on assets.”

Compared with the same period last year, Rocky reports that inventory turnover increased 16% to 1.86 in the third quarter of 2017 compared with 1.60. Total inventory decreased by $30.3 million, or 6.8%, to $415.4 million compared with $445.6 million. Floorplan payables decreased by $33.8 million, or 11.3%, to $265.6, or 72.4%, of equipment inventory.

In its third quarter filing on Nov. 8, the company added, “We continued to apply cash generated by our operations to reduce interest-bearing debt, resulting in a $0.6 million or 16.1% year-over-year decrease in finance costs this quarter.

As of Sept. 30, 2017, our equipment inventory declined by $36.1 million, or 9%, and $34 million, or 8.5%, compared with Dec. 31, 2016 and Sept. 30, 2016, respectively.”

Solid Execution

“Operating SG&A continues to reflect the savings associated with management’s restructuring efforts, declining 40 bps and 70 bps year-over-year as a percent of sales for the third quarter and 9 months of 2017, respectively,” Ben Cherniavsky, analyst with Raymond James, said in a note. “This, combined with the aforementioned sales growth, has generated 16% and 17% more EBITDA for the same periods.”

“The combined improvements in Rocky’s costs and balance sheet position it to scale growth more effectively and capitalize on opportunities going forward, including potential dealer acquisitions.

“Beyond a bigger footprint and more revenue, M&A historically did very little for Rocky’s shareholders. We, however, believe that management’s integration efforts over the past few years, combined with its heightened discipline on valuation, should produce different results in the future.”

Cervus Equipment: New Ag Equipment Sales Jump 34%

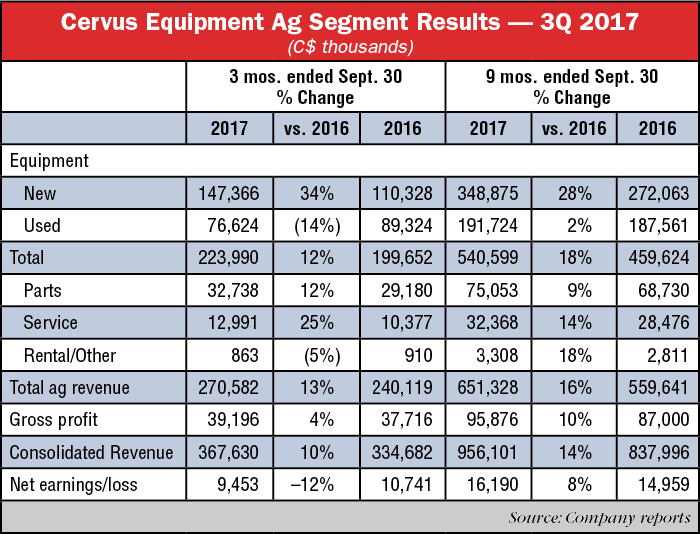

Cervus Equipment, John Deere’s largest Canadian dealer group, posted third quarter 2017 consolidated revenue gains of 10% as its ag and construction equipment markets continue to show signs of recovery. Overall revenue increased by $32.9 million for the 3 month period ended Sept. 30 vs. the same period of 2016.

The company reported, “The positive year to date equipment sales trend continued in our agriculture segment, achieving record third quarter equipment sales of $224 million.”

New Up, Used Down

While total ag equipment revenue increased by 12% in the third quarter, new equipment sales soared by 34%. A drop of 14% in used equipment sales blunted some of the overall improvement.

Summarizing third quarter operations, Cervus management said, income from operating activities for the quarter increased by $0.5 million, as a $1.5 million increase in gross profit more than offset a $0.5 million increase in SG&A. Revenue increased $30.5 million on record third quarter new equipment sales, buoyed by a positive harvest outlook and favorable exchange rates for new equipment in the quarter.

However, expectations of an early harvest reduced used equipment sales in the quarter, as producers’ need for additional machine hours in a narrow harvest window was less critical than in the third quarter of 2016. The earlier 2017 harvest also increased parts and service sales by $6.2 million in the quarter. Our optimization initiatives resulted in a 4% increase in our service department gross profit margin percentage. The sales mix impact of the substantial increase in new equipment sales diluted overall gross profit margin percentage by 1.2%, although gross profit increased $1.5 million.

Healthy Canadian Incomes

In his analysis of Cervus’ third quarter performance, Cherniavsky said, “Ag revenues were ahead of our estimate on strong tractor sales, while gross margins were below forecast and down 130 bps year-over-year. Healthy Canadian farm incomes are expected to keep demand robust into 2018. Also, producers are accelerating their machine buying to make-up for deferred capital purchases over the past few years.”

![[Technology Corner] Pessl Instruments CEO Talks Dealer Benefits From Lindsay Corp. Investment](https://www.agequipmentintelligence.com/ext/resources/2024/04/25/Pessl-Instruments-CEO-Talks-Dealer-Benefits-From-Lindsay-Corp.-Investment.png?height=290&t=1714144307&width=400)

Post a comment

Report Abusive Comment