The latest episode of On the Record is now available!

In this episode of On the Record, according to the latest Ag Economy Barometer reading from Purdue, producers say they will spend less on machinery than they did last year. In the Technology Corner, Michaela Paukner looks at Deere’s latest See & Spray advancement. Also in this episode: an update from a Ukrainian AGCO dealer, a look at the 14th Annual No-Till Benchmark Study and dealer optimism hits a 16-month low.

This episode of On the Record is brought to you by Weasler Engineering.

Deliver a seamless transfer of power between a tractor and its attached machinery with one of Weasler’s three ASABE-compliant drive shaft product lines; the Standard, the Classic and the Professional. Weasler’s Newest product line – the Standard- offers a selection of pre-configured driveshafts. The Classic and Professional lines offer variety of standard components to choose from, allowing you to customize your PTO drive shaft to meet the specifications of your job. Learn more about what Weasler can do for you by visiting Weasler.com.

On the Record is now available as a podcast! We encourage you to subscribe in iTunes, the Google Play Store, Soundcloud, Stitcher Radio and TuneIn Radio. Or if you have another app you use for listening to podcasts, let us know and we’ll make an effort to get it listed there as well.

We’re interested in getting your feedback. Please feel free to send along any suggestions or story ideas. You can send comments to kschmidt@lessitermedia.com.

Producers Lower Machinery Purchase Plans

Overall, Purdue’s Ag Economy Barometer rose 6 points to a reading of 125 in February. A more optimistic view of future conditions pushed the sentiment measure higher as the Index of Future Expectations rose 10 points in February to 122, the most positive reading regarding the future provided by farmers since last August.

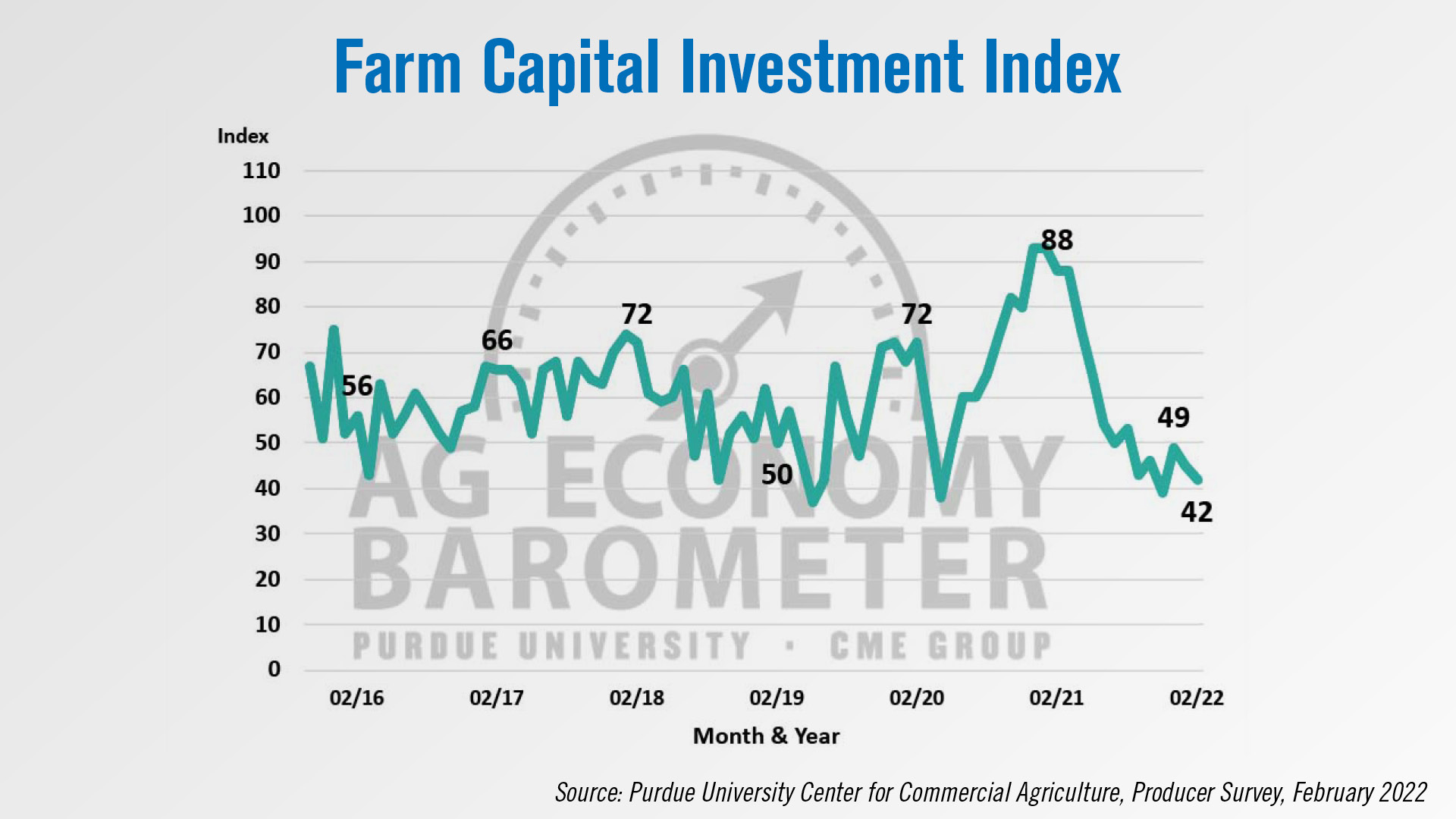

When it comes to capital investment plans, producers are planning to spend less than a year ago. The Farm Capital Investment Index dropped in February to 42, a 3-point decline compared to January.

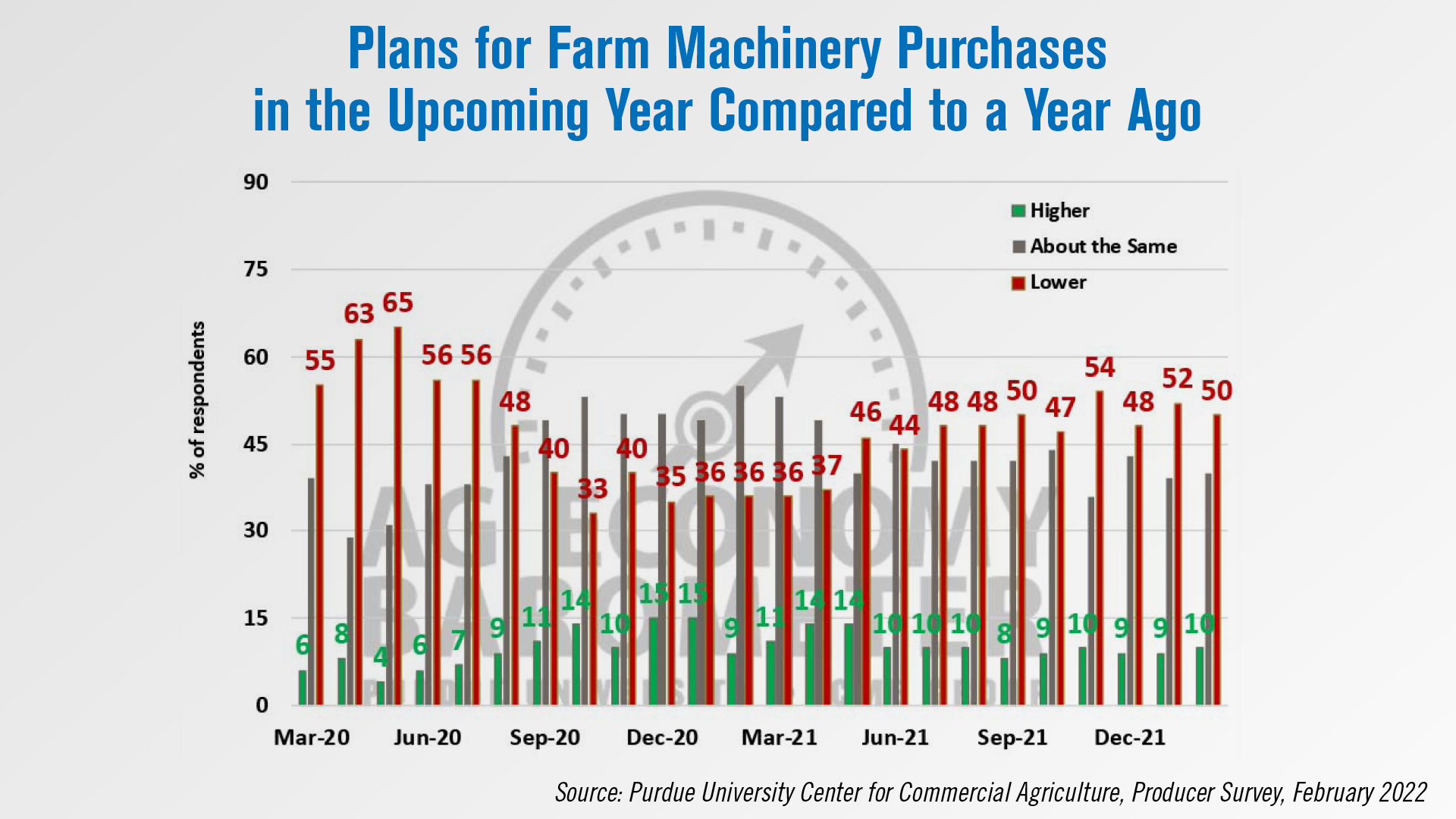

Half the producers in this month’s survey said their plans for farm machinery purchases in the upcoming year are lower than a year earlier. Tight machinery inventories continue to be an issue with over 40% of producers in this month’s survey saying that low farm machinery inventories are holding back their investment plans.

Looking at supply chain issues, farmers indicated the herbicide supply chain is most problematic, followed by fertilizer and farm machinery parts. According to the February survey, 23% of farmers reported having difficultly purchasing parts, down from 25% in January.

Dealers on the Move

This week’s Dealers on the Move include Hutson Inc., Livingston Machinery and Binkley & Hurst.

John Deere dealer Hutson Inc. has acquired Lappans in Gaylord, Mich. Previously the location only had Deere’s turf contract, but with the acquisition it now will have the full ag contract. Hutson now has 30 locations throughout Kentucky, Indiana, Illinois, Tennessee and Michigan.

AGCO dealer Livingston Machinery is expanding its service area with a new dealership in Liberal, Kan. An existing facility is being renovated and is expected to open in April. This is the 6th location for Livingston.

AGCO dealers MM Weaver and Binkley & Hurst are in discussions to merge the two companies. The combined group would have 7 locations.

Technology Corner

A limited production of John Deere’s debut green-on-green See & Spray Ultimate targeted spraying system will be available for order later this year.

Deere launched See & Spray Ultimate March 3.

The factory-installed system consists of 36 cameras mounted on a 120-foot boom to detect weeds among corn, soybeans and cotton using artificial intelligence and machine learning.

Blue River Technology, an artificial intelligence developer acquired by Deere in 2017, created the technology behind the green-on-green solution.

The sprayer has a split tank with dual product capability, allowing the user to broadcast and target spray at the same time.

Franklin Peitz, marketing manager at John Deere, says at 12 mph, See & Spray Ultimate can reduce non-residual herbicide use by more than two-thirds, while maintaining a hit rate comparable to traditional spraying.

See & Spray Ultimate can be factory installed on model year 2023 John Deere 410R, 412R and 612R sprayers.

The Des Moines Works sprayer factory, which already produces those sprayer models, will manufacture See & Spray Ultimate.

Peitz says “double-digit” units will be made available for ordering later this year, which is also when pricing will be released.

Deere will limit the first year production supply to dealers in the Midwest, Mississippi Delta and Texas, followed by a wider rollout in the coming years.

“Our goal is for this to be a very simple transition for dealers who are currently selling and supporting ExactApply technology. That's our individual nozzle control technology. That's the foundation of this See & Spray. Absolutely there's new diagnostics and other things, but we're working hand-to-hand with dealers this spring with some of the units that we'll have out there to really get them trained up and comfortable with supporting this technology.”

In addition to the limited number of dealers who will have See & Spray Ultimate for sale, Peitz says another “double-digit” amount of ag retailers will have demo units out this spring.

No-Tillers’ Equipment Spend Grows in 2021

According to the 14th Annual No-Till Operational Benchmark Study, published by No-Till Farmer, growers spent a record high on machinery related expenses in 2021 compared to the previous 6 years.

Between a higher net farm income and the price increases for farm equipment, it’s no surprise equipment spend was up for no-tillers. According to the study, the average net income per farm in 2021 was $112,154. That is up from $61,851 in 2020.

No-tillers spent $115,095 on equipment purchases, machinery service and parts and precision equipment in 2021. That’s up nearly $35,000 from what was spent in 2020. Looking ahead to this year, no-tillers forecast spending $94,267 on average on these equipment related purchases. While down from 2021, that is still up from 2020’s spend of $80,255.

Looking at equipment purchases specifically, no-tillers said they spent $81,269 on average. For 2022, on average, they expect to spend $62, 327. Parts and service spending is up just slightly for 2022 over 2021. And when it comes to precision equipment, no-tillers are forecasting spending a little more than half of what they spent in 2021.

While no-tillers forecast spending less in 2022 on machinery related purchases compared to 2021, the total of $94,267 is still well above the 7-year average of $76,881.

Ukrainian Dealer CEO: ‘Everything has Come to a Standstill’

Ukrainian farmers are still working their fields and still need service, according to a recent interview with Adriano Luz, CEO of Ukrainian Massey Ferguson and Iveco dealer Amako. Ag Equipment Intelligence conducted a video interview with Luz on March 7 to discuss the situation on the ground for both their dealership and the farmers they serve. We must note that some facts presented here may have changed in the time between the recorded interview and the airing of this newscast.

Luz says some farmers went from buying whatever they could to some asking for refunds.

“We have some customers operating. Remember, the situation was great. We came from a time, where if we have — whatever we have, we’d sell 3 times more, to now customers are asking [for their] money back.

“We have a few customers that are still collecting machines. Even during the weekend and even today, some customers even came to collect trucks. We also represent Iveco, by the way. So they’re coming to collect. Some customers are — we are now working to some customers to collect some tractors. But it’s very minimal compared to total.”

He says the current challenges in Ukraine’s agricultural market have reverted to the most basic tasks. Farmers are limited by export restrictions, as well as an inability to use the U.S. dollar or any other hard currency or send money in or out of the country, which also affects the dealership’s ability to bring in parts and equipment.

“All this today, the challenges are very, very basic. Get fertilizers now, how to import fertilizers. Russia, I’m sure you know. So farmers are struggling.

“Even if the farmers, they sold — again you understand the exports are very strong — but we cannot pay suppliers outside [the country]. And let’s say for a farmer, even if you sold your production, you cannot get money to country. So we can only operate inside the country with local currency. So everything came to a standstill. That’s how it is.”

Other challenges Luz mentions includes fuel shortages keeping technicians from driving out to customers as well as establishing new routes to bring equipment into the country. He says they can only plan a few days at a time, as the situation in Ukraine changes daily.

Amako had initially shut down its physical locations, but recently began operating again in Western Ukraine. Their field technicians continue to make service calls where they can. Amako’s Massey Ferguson area of responsibility includes some regions of Ukraine that have experienced fighting.

Luz said technicians are still venturing to Amako’s main parts warehouse just outside Kiev to get parts for customers and, at the time of recording, all Amako’s staff were safe and accounted for. Luz and his family are currently safe in the UK.

Dealer Sentiment Declines Heading into 2022

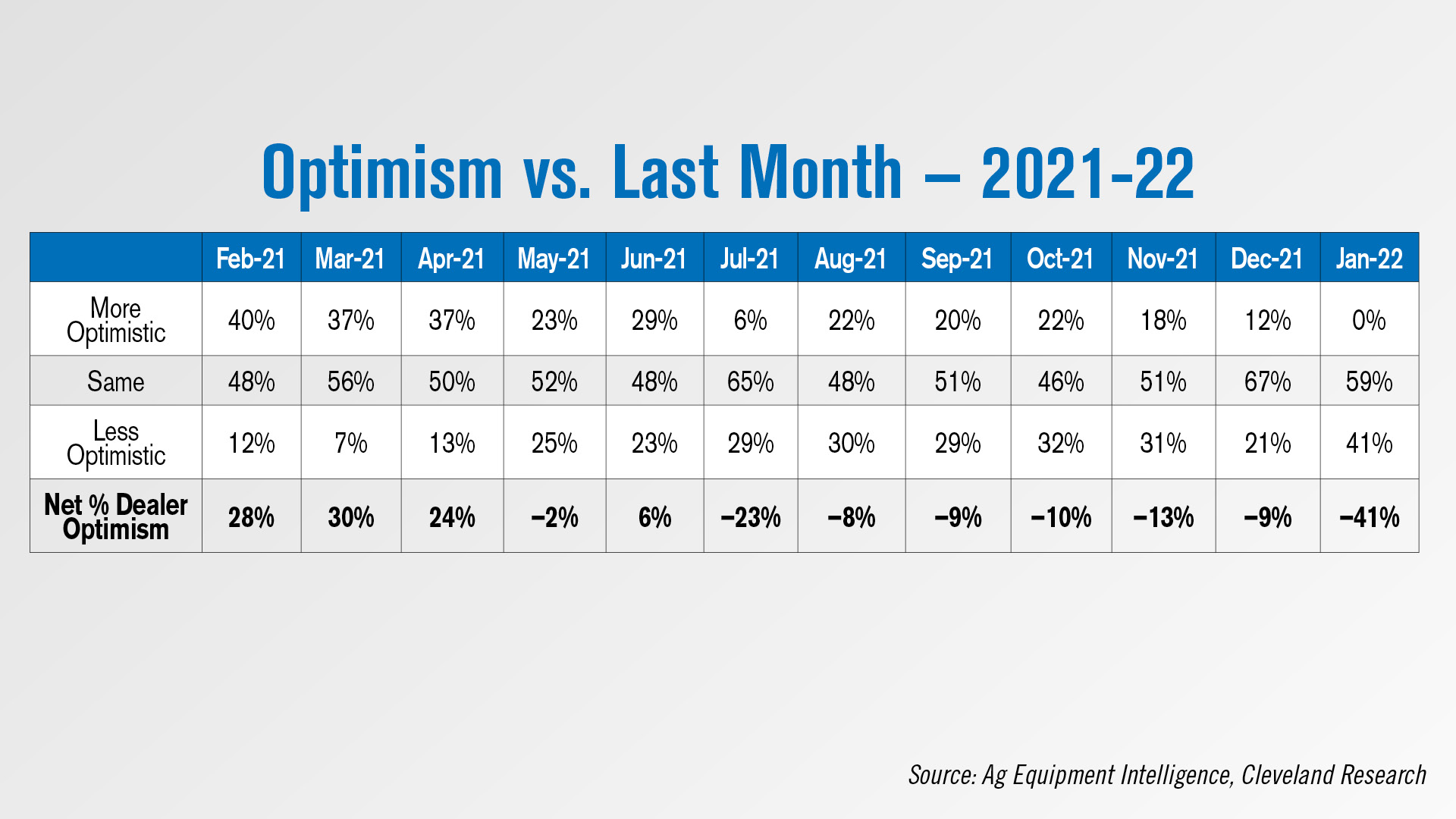

Dealer sentiment hit a 16-month low in the first reading of 2022, according to the latest Ag Equipment Intelligence Dealer Sentiments & Business Conditions Update.

A net 41% of dealers were less optimistic in January vs. the previous month, with no dealers indicating they were “more optimistic” in January. Some 59% said they had the same level of optimistic they’d had in the previous month and 41% said they were less optimistic. Concern seemed to be caused by the decrease in both new and used inventories, delayed deliveries, inflation, elevated farmer input costs and continued supply chain headwinds.

In their commentary, product pricing, equipment delays and inputs costs came up as reasons for dealers’ concern. One dealer from the Lake States said, “Interest rates rising on top of input costs are causing farmers to relook at their books.” One dealer from the Southeast said the equipment shortages would keep the dealership from reaching its full potential.

Another dealer in the Lake States was optimistic, however, saying, “We feel optimistic on the year based on the amount of orders still coming in. 2022 depends on if manufacturers can actually ship equipment.”

![[Technology Corner] Pessl Instruments CEO Talks Dealer Benefits From Lindsay Corp. Investment](https://www.agequipmentintelligence.com/ext/resources/2024/04/25/Pessl-Instruments-CEO-Talks-Dealer-Benefits-From-Lindsay-Corp.-Investment.png?height=290&t=1714144307&width=400)

Post a comment

Report Abusive Comment