In this episode of On the Record, we look at the latest results of Purdue University’s Ag Economy Barometer and how producer sentiment toward capital expenditures hit a 6-year low. In the Technology Corner, Michaela Paukner digs into AGCO’s latest sustainability report. Also in this episode, Buhler Industries release its annual report and Todd Bachman, CEO of Florida Coast Equipment, shares some insights into Kubota’s dealer network.

This episode of On the Record is brought to you by Agrisolutions.

Agrisolutions is the market leader in wearable parts, components, accessories and solutions for tillage, seeding, planting, fertilizing, hardware and inventory management solutions. Improve performance and durability with a wide range of ground engaging wear parts and extended life solutions.

To learn more about Agrisolutions and their globally recognized brands, such as Bellota, Ingersoll Tillage and Trinity Logistics, visit Agrisolutionscorp.com.

On the Record is now available as a podcast! We encourage you to subscribe in iTunes, the Google Play Store, Soundcloud, Stitcher Radio and TuneIn Radio. Or if you have another app you use for listening to podcasts, let us know and we’ll make an effort to get it listed there as well.

We’re interested in getting your feedback. Please feel free to send along any suggestions or story ideas. You can send comments to kschmidt@lessitermedia.com.

Farm Capital Index Hits New Low

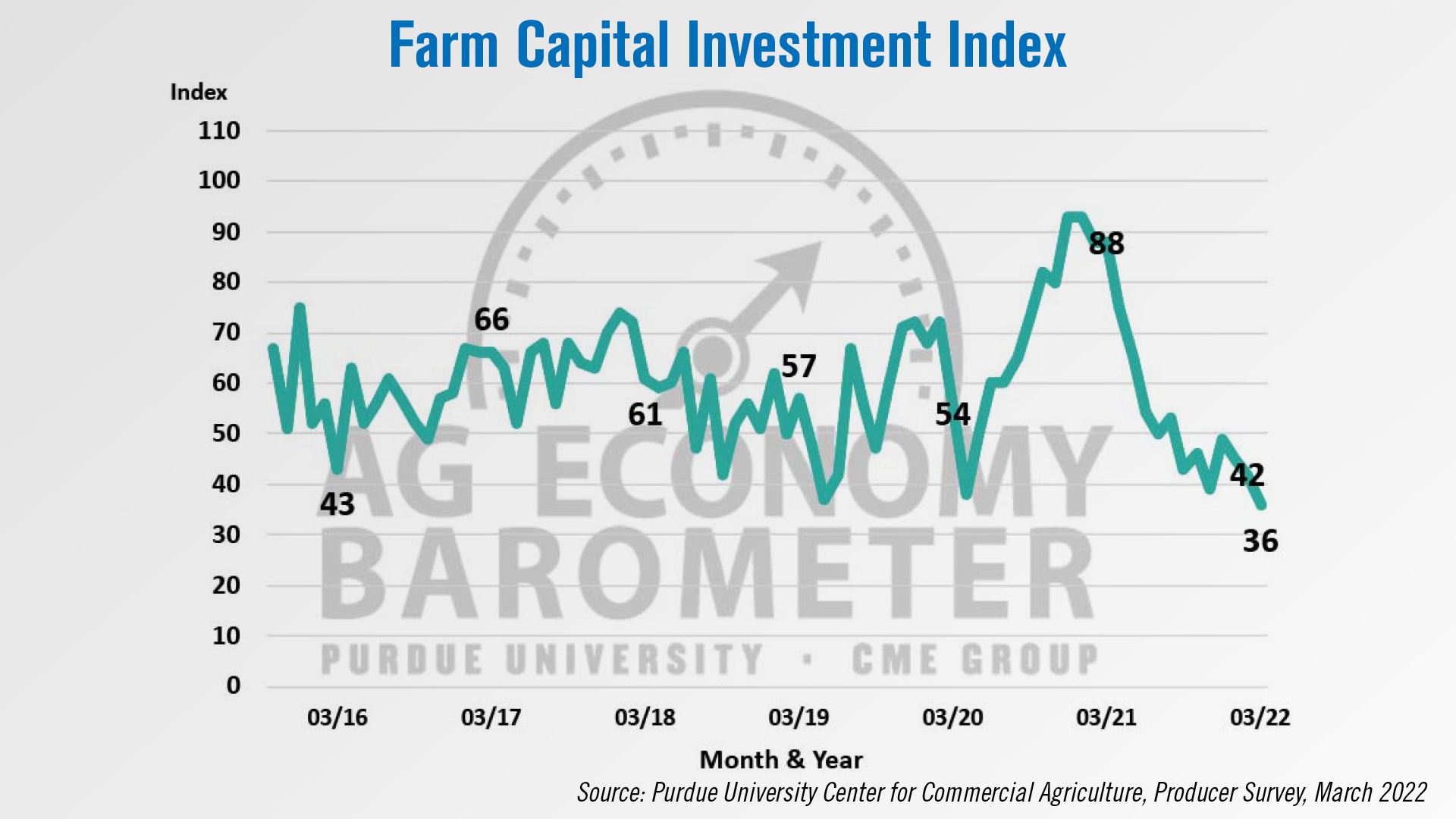

According to the results of the latest Ag Economy Barometer update, the Farm Capital Investment Index dropped to a reading of 36.

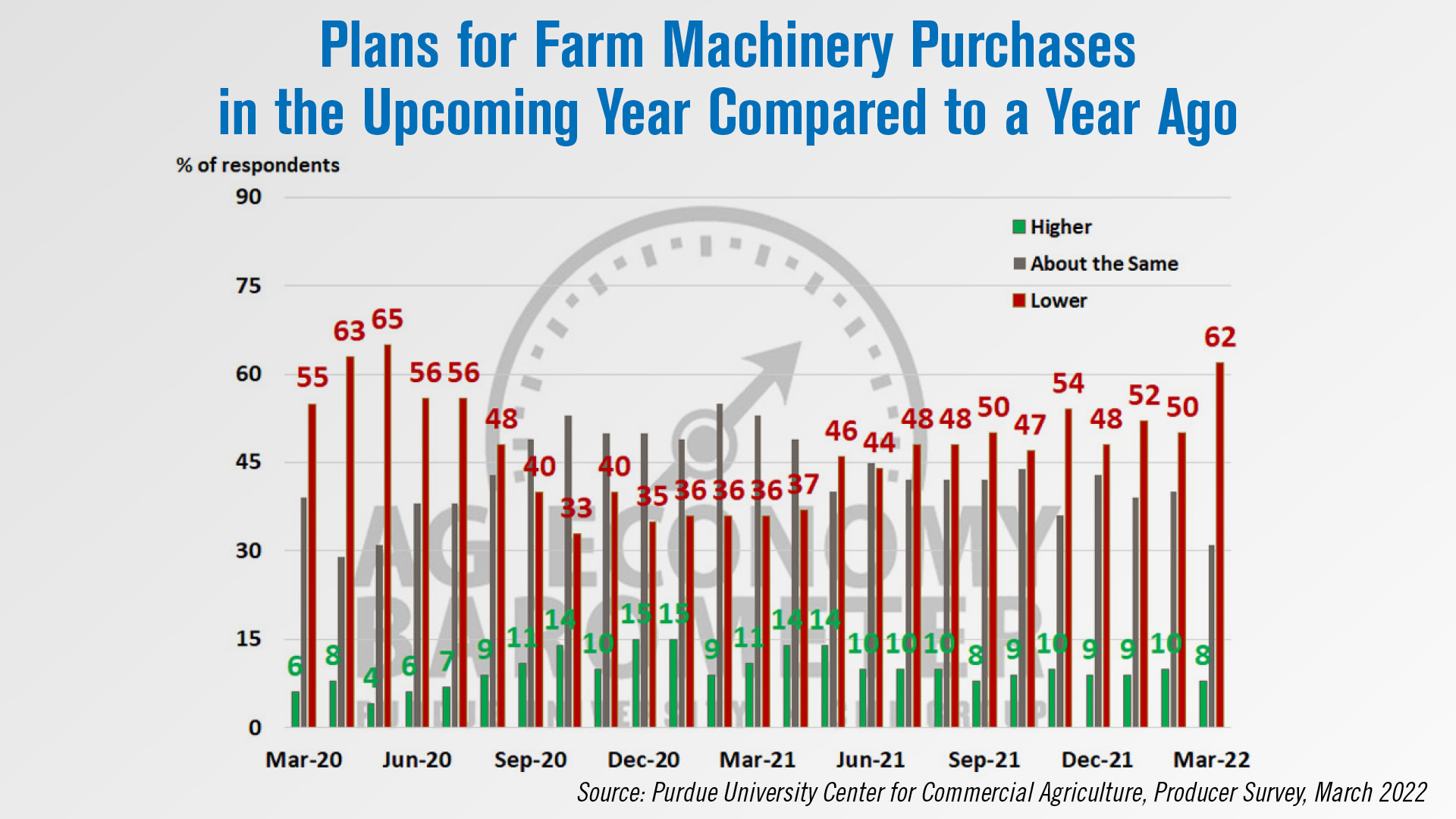

This is the lowest reading recorded in the last 6 years. The report stated that, "In a pair of follow-up questions, 62% of respondents said their plans for farm machinery purchases in the upcoming year are lower than a year earlier, which is the most negative response to that question since May 2020.”

When asked a similar question about farm building and grain bin construction plans, 68% of respondents chose “lower” which was the most negative response received to that question since its first inclusion in a barometer survey in May 2021."

It was reported that 42% of surveyed farmers cited low farm equipment inventories as having an impact on their purchasing plans.

The Ag Economy Barometer itself also fell in the April update to a reading of 113, "the weakest farmer sentiment reading since May 2020 which was in the early days of the pandemic."

Dealers on the Move

This week’s Dealers on the Move include Green Tractors, Ag-Pro and Titan Machinery.

Canadian John Deere dealer Green Tractors Inc. announced that effective April 11, 2022, Evergreen Farm & Garden, Located in Orono, Ont., will be joining the Green Tractors dealer group.

John Deere dealer group Ag-Pro acquired Findlay Implement Company on March 16, 2022. Findlay Implement operated 8 John Deere dealership locations across Northwest Ohio.

Case IH dealer Titan Machinery has entered into a definitive purchase agreement to acquire the assets of 2-store Case IH dealer Mark's Machinery in Wagner and Yankton, S.D.

Technology Corner

AGCO’s latest sustainability report links the company’s precision agriculture initiatives to progress toward its sustainability goals.

The company released its 2021 sustainability report March 30, providing an overview of 2021 precision investments and achievements.

AGCO CEO Eric Hansotia writes that the company launched 23 new precision ag products in 2021 and announced developments in targeted spraying technology using vision systems, artificial intelligence and machine learning.

The targeted spraying developments include a collaboration with Robert Bosch, BASF Digital Farming and Raven Industries to evaluate spraying technology that can reduce crop inputs. AGCO also made an equity investment in the precision spraying company Greeneye Technology.

Hansotia says the company increased its research and development spending by more than $60 million in 2021.

Other AGCO investments in 2021 include the acquisition of software and hardware development company Appareo Systems, acquisition of app developer Creative Sites Media and an investment in Apex AI, a software provider for driverless solutions.

The report says these investments have the potential to turn AGCO’s on-farm products into an active information network for optimizing and automating operations.

More than 300,000 AGCO machines were connected as of 2021, according to the report, meaning the equipment and its data can be remotely accessed and monitored. The company’s goal is to deliver a 100% connected fleet by 2025.

This year, AGCO plans to launch FendtONE, a consistent interface for the tractor and office used for managing farm processes and data. AGCO first debuted the FendtONE operator interface in 2020.

In 2021, AGCO also successfully tested Xaver, a prototype autonomous row unit for planting. The electric units are meant to work in a swarm to plant fields and are controlled by FendtONE software linked to a phone app.

“These early results have confirmed that our commitment to precision agriculture innovation places us on the right path to addressing sustainability,” Hansotia writes in the report.

The report also details AGCO’s commitment to the Fendt e100 all-electric tractor, as well as other alternative-fuel machines. Click here to read an article with those details and the full sustainability report.

Buhler Industries Releases Annual Report

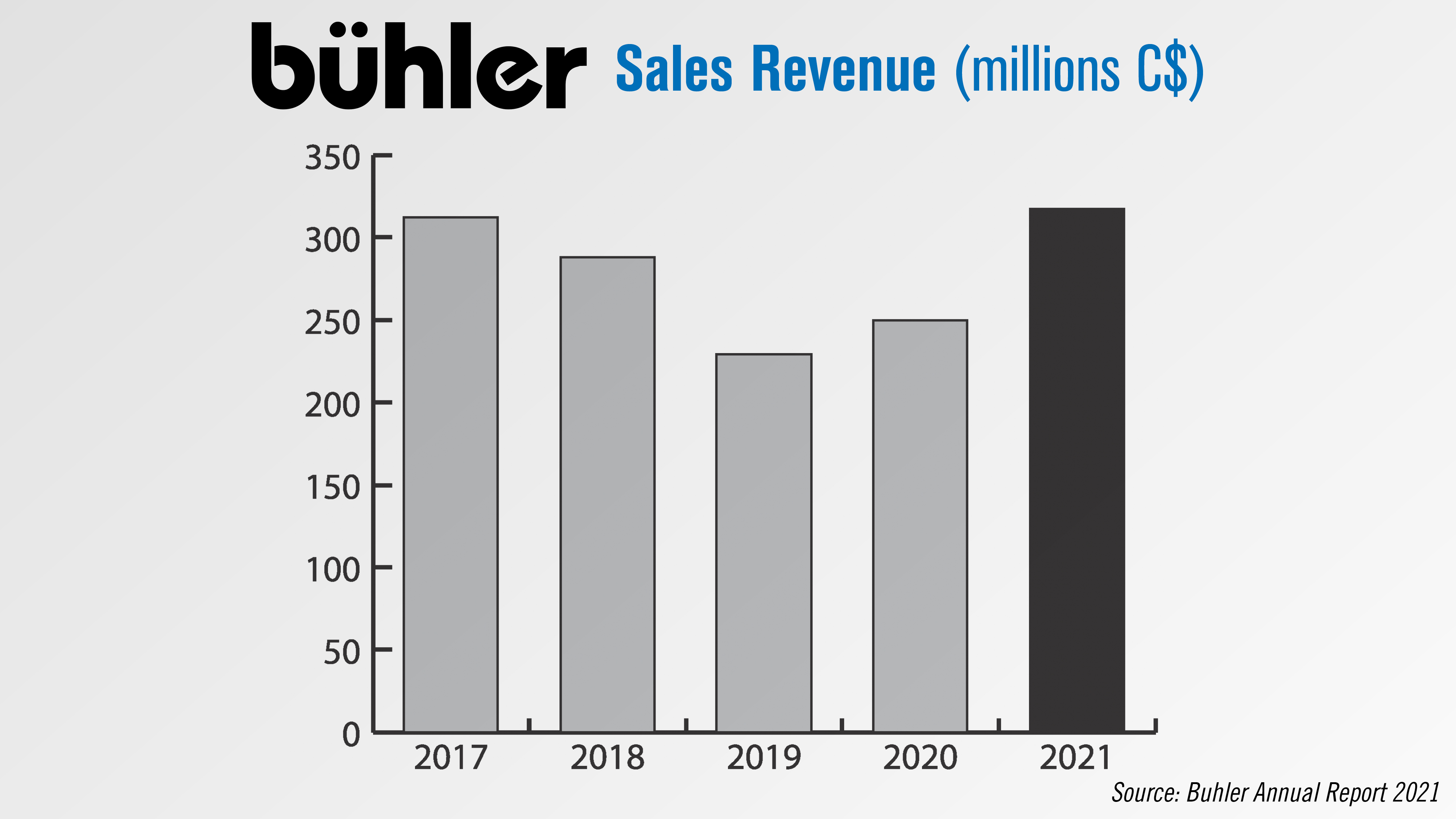

Buhler Industries, the manufacturer of the Versatile and Farm King brands of farm equipment, released its annual report on March 31. For the 15-month period, revenue was $317.2 million, up nearly $68 million from 2020.

Buhler’s increase in sales growth for the period is primarily the result of the accounting change to a December year end in 2021. The 2021 numbers represent 15 months of sales vs. 12 months in 2020.

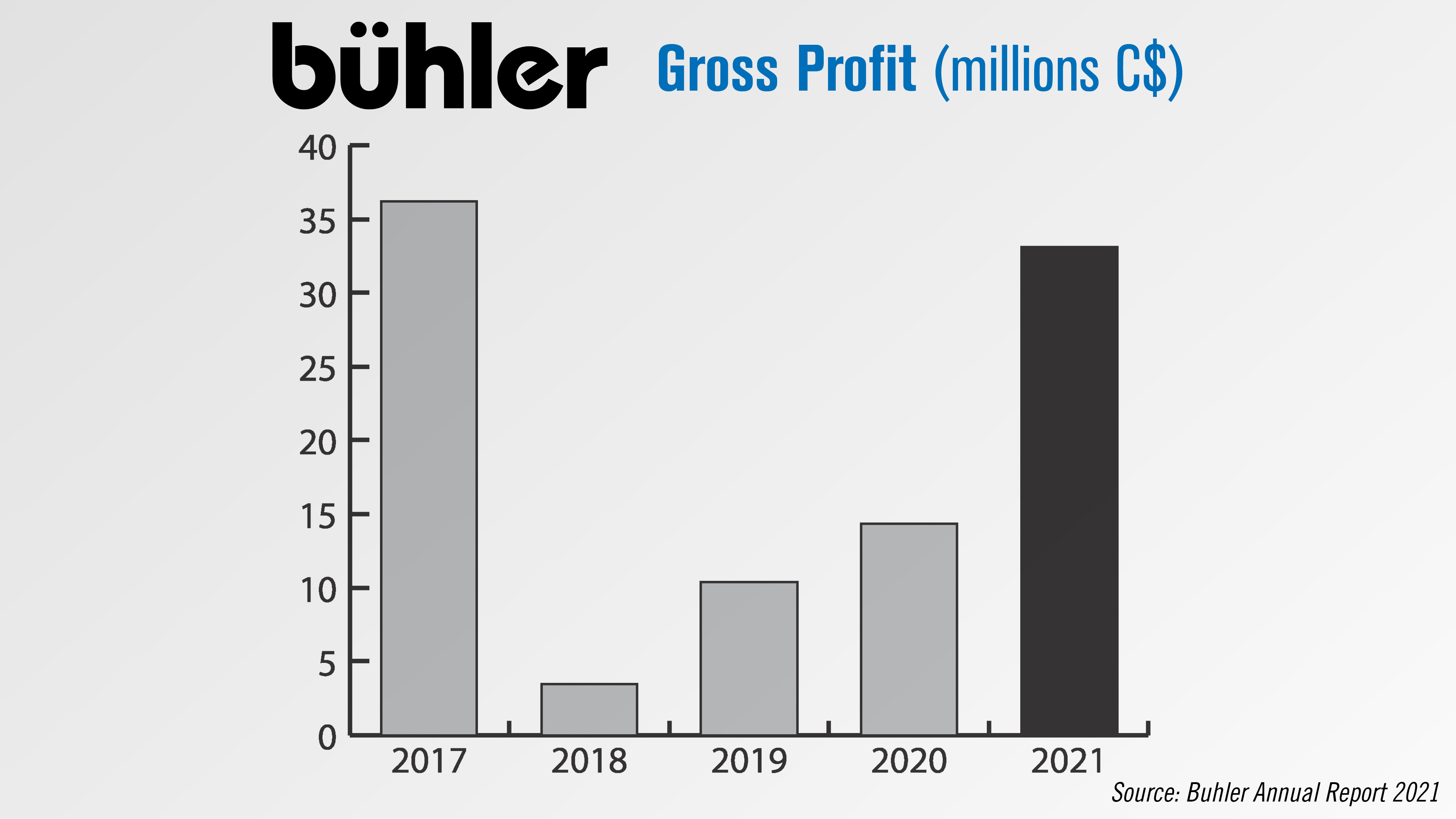

Gross profits jumped to $33.1 million, an increase of $21.4 million from the prior year’s $11.7 million. As a percentage of sales, gross profits were 10.4%, an increase from 4.7% in 2020.

In the report, Adam Reid, vice president of sales and marketing for Versatile, noted that during the past year Versatile continued to grow its dealer network and focus on all areas of business that strengthen their dealer relationships. In 2021, the brand received its highest overall satisfaction rating in the annual Equipment Dealers Assn. Dealer-Manufacturer Relations survey.

Starting in 2022, the Winnipeg plant will begin manufacturing tillage equipment following the closure of the Vegreville, Alberta, plant in September 2021. Reid noted this change will improve logistics and bring the product closer to key markets throughout Canada and the U.S.

Kubota’s ‘Well Thought Out’ Approach to M&A

Todd Bachman, CEO of Kubota dealer Florida Coast Equipment, told Ag Equipment Intelligence he believes Kubota “maturing as a manufacturer” helped prompt the dealership’s recent string of acquisitions. Florida Coast Equipment has announced 3 acquisitions since October of last year and currently has 11 locations in Florida.

Bachman says that aside from a few other “forward-thinking” dealers, the company’s aggressive M&A activity is unique in the realm of Kubota dealers. However, he believes others will begin to follow. He attributes this to Kubota’s growth as a manufacturer and the expansion of its equipment offerings and market shares. Bachman says the OEM will begin to “ask more” of its dealers. He believes, however, that Kubota will leave room for smaller dealerships and take different approaches to different markets vs. what he calls the “broad strokes” other manufacturers have made.

“They're not nearly as reactive. Things are a little bit more well thought out, and they look long-term. I think Kubota has seen some of the mistakes some of the other guys have done in consolidation. Versus making a broad stroke and making certain requirements across the board, they’ve lasered in and said, ‘This is what this market needs. This is what this market needs.’ And as long as what dealers are presenting to them match the requirements and needs of the market, I think there’ll be support. And that may mean there’s single stores in a lot of places too.”

Ag Equipment Intelligence reached out to Kubota for commentary but did not receive a response in time for this newscast.

Post a comment

Report Abusive Comment