The latest episode of On the Record is now available! In this episode, we have a follow up on the UAW Deere strike, including where dealers stand on the issue. In the Technology Corner, Michaela Paukner discusses how some dealers are digging out old GPS receivers for customers amid ongoing equipment shortages due to supply chain challenges. Also in this episode, we look at AGCO’s strong third quarter results, the continued equipment inventory and challenges dealers are facing, along with price increases.

This episode of On the Record is brought to you by Weasler Engineering.

Deliver a seamless transfer of power between a tractor and its attached machinery with one of Weasler’s three ASABE-compliant drive shaft product lines; the Standard, the Classic and the Professional. Weasler’s Newest product line – the Standard- offers a selection of pre-configured driveshafts. The Classic and Professional lines offer variety of standard components to choose from, allowing you to customize your PTO drive shaft to meet the specifications of your job. Learn more about what Weasler can do for you by visiting Weasler.com.

On the Record is now available as a podcast! We encourage you to subscribe in iTunes, the Google Play Store, Soundcloud, Stitcher Radio and TuneIn Radio. Or if you have another app you use for listening to podcasts, let us know and we’ll make an effort to get it listed there as well.

We’re interested in getting your feedback. Please feel free to send along any suggestions or story ideas. You can send comments to kschmidt@lessitermedia.com.

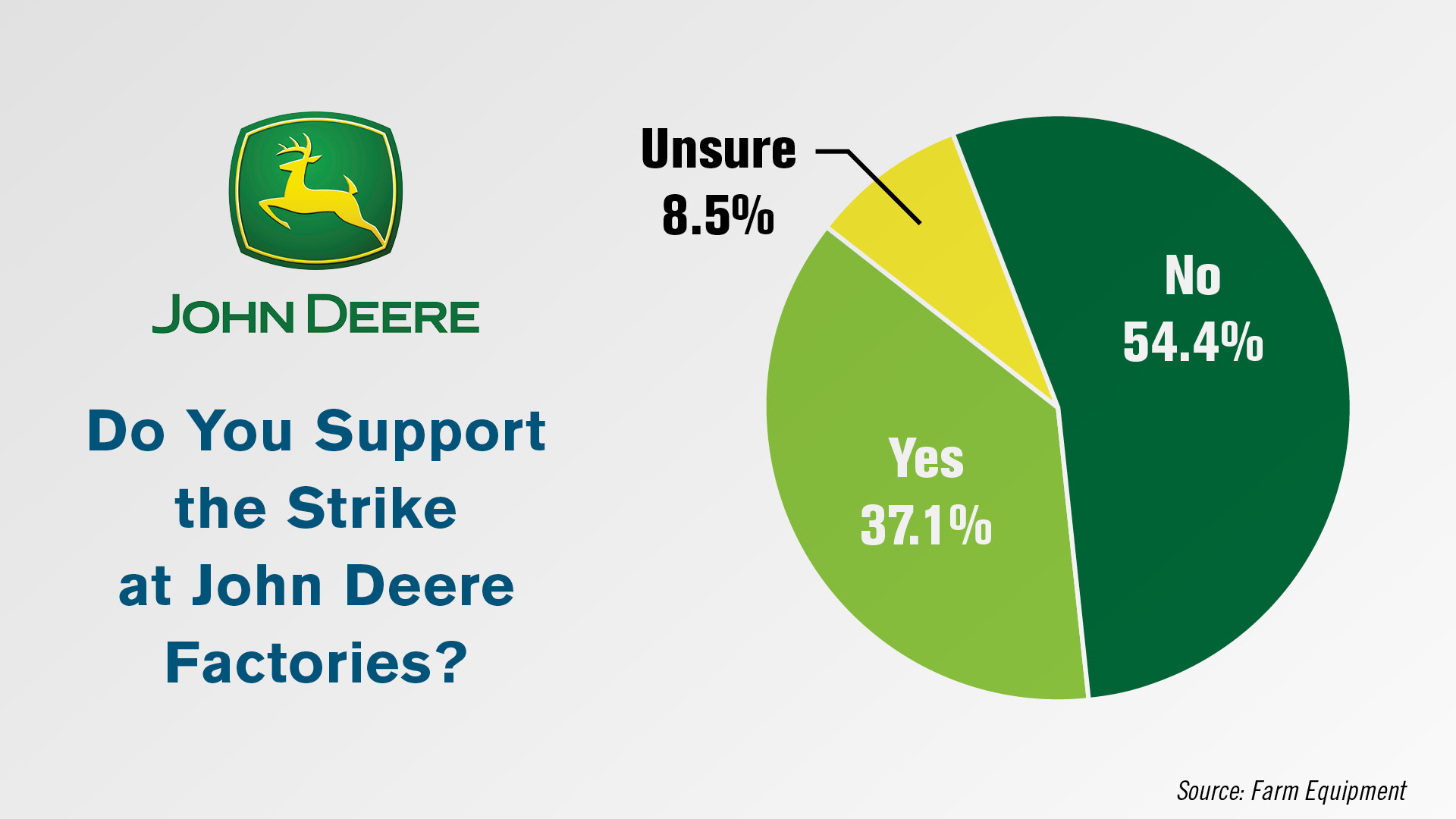

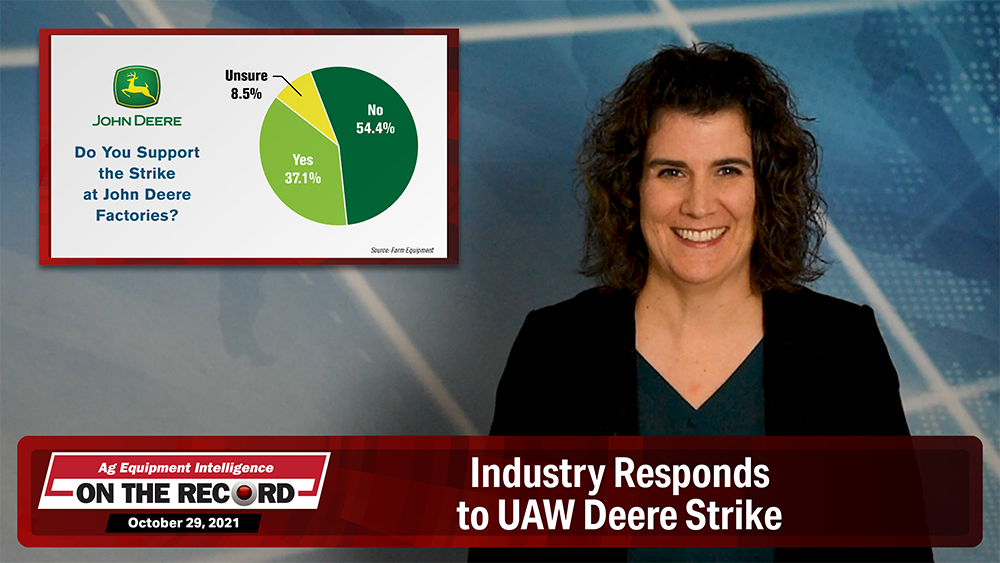

54% of Dealers Do Not Support John Deere Strike

In the last two weeks since UAW John Deere workers went on strike after rejecting a labor agreement, the strike has shown no signs of slowing down. To gauge industry sentiment regarding the situation, a recent Farm Equipment poll asked dealers if they support the strike or not.

Roughly 54% of dealers indicated they do not support the strike, while 37% said they did and 8.5% weren’t sure.

Commentary from dealers who do not support the strike suggested Deere’s record profits don’t necessarily mean employees should see raises. One dealer said, “When every business is struggling to find good employees, a strike is the kind of thing that holds a company back from progressing. Just because the employees see their company having large profits isn't a green light for the rank and file to get big raises.”

Some stated the UAW was taking advantage of the pandemic as leverage, with one John Deere dealership employee stating, “While a pay raise may be justified, I believe they are taking advantage of the current ‘worker shortage’ and pinning Deere down when they have no other option. I believe this will set a precedent in many industries and further exacerbate the product shortages.”

Still others mentioned that Deere employees are paid at a higher rate than union employees at their competitors’ plants and suggested dealers that support the strike are likely not Deere dealers.

Dealers that do support the strike accused Deere of prioritizing its shareholders, with one dealer saying, “It seems to me the senior management at Deere are only interested in shareholder value and have completely forgot about what it is that has made the company successful.”

Another dealer who supports the strike said, “Take some of your record profits that you (Deere) have been trumpeting for the last year and invest back into your employees that make you who you are. And hurry every chance you get. Your dealers would like to sell parts.”

Former Case IH Vice President of North America Jim Walker offered some insights on the strike and said,

“I think the entire UAW is looking at the Deere strike and negotiations to set the tone for future contracts with them by all manufacturers. Considering the profitability of Deere, back order of pre-sold product and intense atmosphere the production workers have been working on during COVID, I think the Deere initial offer was a bit paltry. Much more will need to be offered to satisfy both UAW Deere as well as UAW in general.”

We will continue to keep you updated on the strike as events occur.

Dealers on the Move

This week’s Dealers on the Move include Stoltz Sales & Service and Hub International, Brandt Tractor, Titan Machinery and Florida Coast Equipment.

Canadian Case IH dealers Stoltz Sales & Service and Hub International will be merging their two organizations to form Equipment Ontario. The merger will take effect December 1, 2021. The combined dealer group will have 6 locations.

Brandt Tractor has completed its acquisition of Cervus Equipment, creating Canada’s largest equipment dealer group. The acquisition adds 64 agriculture, transportation and material handling equipment locations to Brandt’s existing John Deere Construction & Forestry dealerships. Brant now owns and operates 120 full-service equipment dealerships across Canada, Australia and New Zealand, and operates an additional 50-plus service points. The new organization employees over 5,100 people.

Case IH dealer Titan Machinery has acquired Jaycox Implement. The acquisition adds 3 locations in Worthington, Minn., Luverne, Minn. And Lake Park, Iowa. The deal is expected to close in December 2021.

Kubota dealership Florida Coast Equipment has acquired 3 stores from Agricon Kubota Superstore. The dealership now has 10 stores across Florida.

Ohio Dealer Uses 2004 GPS Receivers to Help Customers Amid Shortages

Supply chain shortages have some dealers digging out decades-old precision equipment to help their customers get crops off the fields.

An industry-wide shortage of the GPS receivers used to run tractor guidance and data systems is leaving dealers — and farmers — without the equipment needed to record digital harvest maps. To fill in the gap during the busy September-November harvest season, Deere dealer Ag-Pro is putting GPS units from 2004 back to work.

Alex Kutz, integrated solutions consultant for Ag-Pro Ohio, is one of five employees who helps precision customers at Ag-Pro’s 28 Ohio and Kentucky stores.

He said all of the company’s 78 stores are offering John Deere Starfire iTC receivers, one of Deere’s earliest GPS receivers, to customers waiting for the new StarFire 6000 units. Other Deere dealers across the U.S. are doing the same.

As of Jan. 1, 2021, iTC receivers can’t receive the satellite signal needed for Autotrac, making them useless — up until recently.

The receivers can still use the Wide Area Augmentation System, known as WAAS, signal, so they’re able to document yield data. Deere also came out with an update a couple months ago to make the documentation signals more accurate and reliable in the field.

The new Deere equipment is backward compatible, so Kutz says it takes next to nothing to get a customer up and running with the old receivers.

“The guys that just want to do the documentation, they're pretty happy about that because it is a lot cheaper than buying a whole new receiver,” Kutz says. “Some of them are bummed out that they can't run the autosteer system. But this is something that we've got to work through, and fortunately, our customers have been very understanding.”

The lack of GPS receivers is a result of the worldwide semiconductor chip shortage. As factories and ports shut down in 2020 due to the COVID-19 pandemic, production slowed and bottlenecks ensued. The shortage has impacted technology companies across industries, including agriculture.

Andreas Reichhardt, founder of Reichhardt Electronic Innovations, says the company has felt the impact of the chip shortage in the last six to seven months. The lead time on chips is more than 50 weeks and still unstable, according to Reichhardt. He hopes the market will start to improve by the end of spring of 2022. In the meantime, he’s leveraging his supplier relationships to meet dealers’ and customers’ demands.

“We have to openly discuss our situations quite often, and there are always chances that if you talk, you find a different solution. We can maybe move material from A to B. We can exchange things. Shortage here is an overstock here, things like that. But the first thing is to keep contact with the farmers and dealers to frequently discuss.”

The procurement and ops teams at precision technology company Trimble have also been taking action to mitigate the shortage. Guillermo Perez-Iturbe, director of marketing at Trimble, says it’s difficult to guess when the shortage will end, as conditions and predictions change day-to-day.

“It's a challenging time. Absolutely. We all are experiencing that. Nonetheless, we never stopped shipping equipment, and we never closed our doors. We never stopped taking orders. We've always been very practical and working with our partners to keep delivering a high level of simple and compatible technology to the market.”

Share how your dealership is balancing customer needs with supply shortages by emailing mpaukner@lessitermedia.com or answering this Precision Farming Dealer poll.

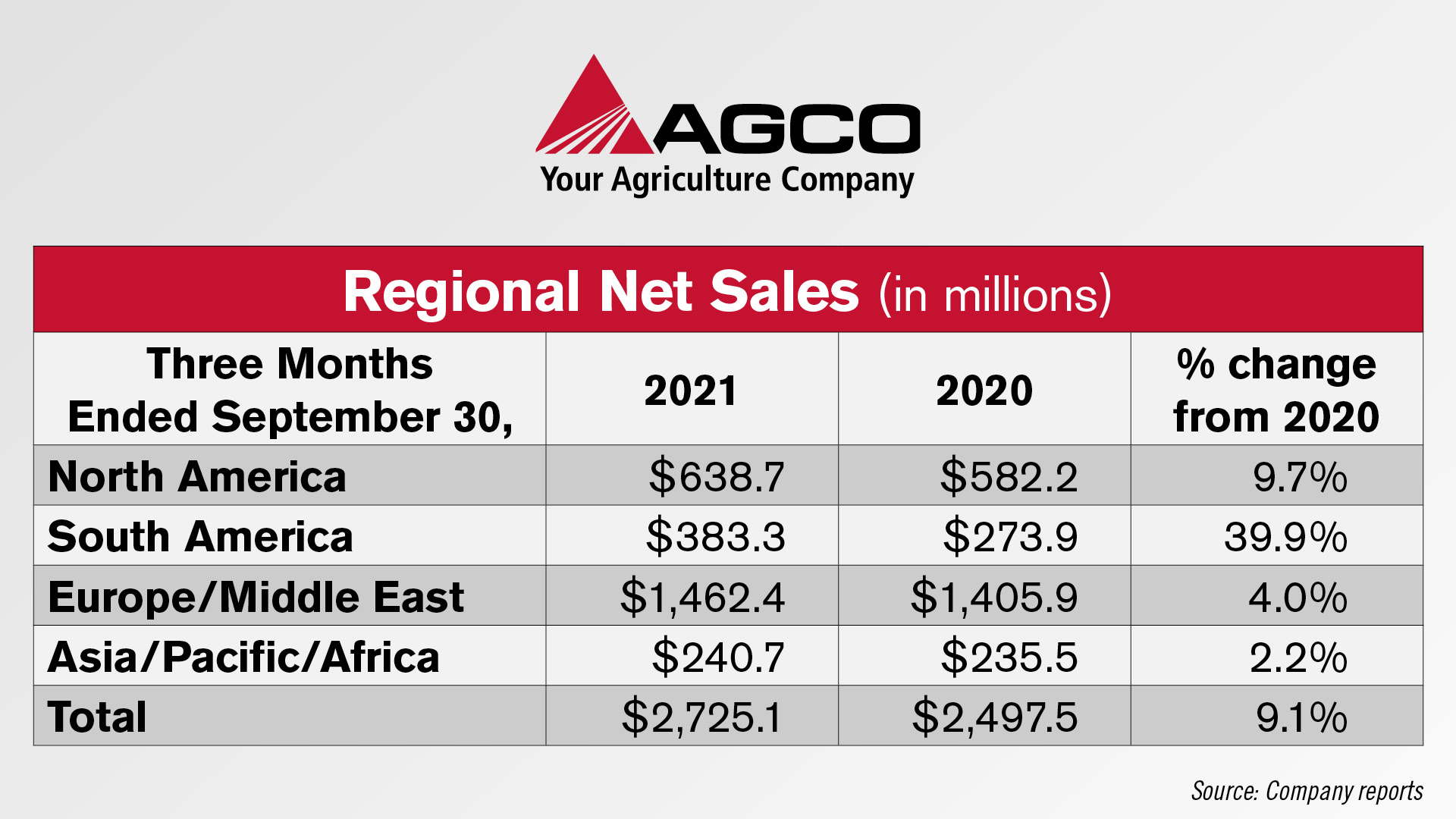

AGCO 3Q Net Sales Improve 9%

AGCO reported its 3rd quarter net sales of about $2.7 billion, an increase of 9.1% over the same period last year. Net sales for the first nine months of 2021 were approximately $8 billion, an increase of approximately 24% compared to the same period in 2020.

Eric Hansotia, AGCO’s chairman, president and chief executive officer, said,

“AGCO continues to face unprecedented supply chain and logistics disruptions as well as material and freight cost inflation. Supply chain constraints have intensified in the recent weeks limiting our ability to meet our production and sales projections. Our efforts are focused on minimizing the impact of the supply chain disruptions to deliver strong full-year sales and earnings growth. Global market conditions remain positive as favorable farm economics are allowing farmers to upgrade and replace their aging fleets. With order boards significantly ahead of last year, we continue to see a strong response for our technology-focused products. AGCO will continue its investment in premium technology, smart farming solutions and enhanced digital capabilities to support our farmer-first strategy and profitably grow the business and earn high returns for its stockholders.”

AGCO’s sales increased across all regions during the third quarter. The largest improvement coming in South America, where sales were up by nearly 40% to $383.3 million vs. the same period last year. In North America, net sales for the quarter were $638.7 million, up 9.7%. The Europe/Middle Easter region had sales of nearly $1.5 billion, up 4% over the third quarter of 20202. And in the Asia/Pacific/Africa region, sales were up 2.2% to $240.7 million in the quarter.

Looking ahead, net sales for the full year of 2021 are expected to range between $10.9 billion and $11.1 billion.

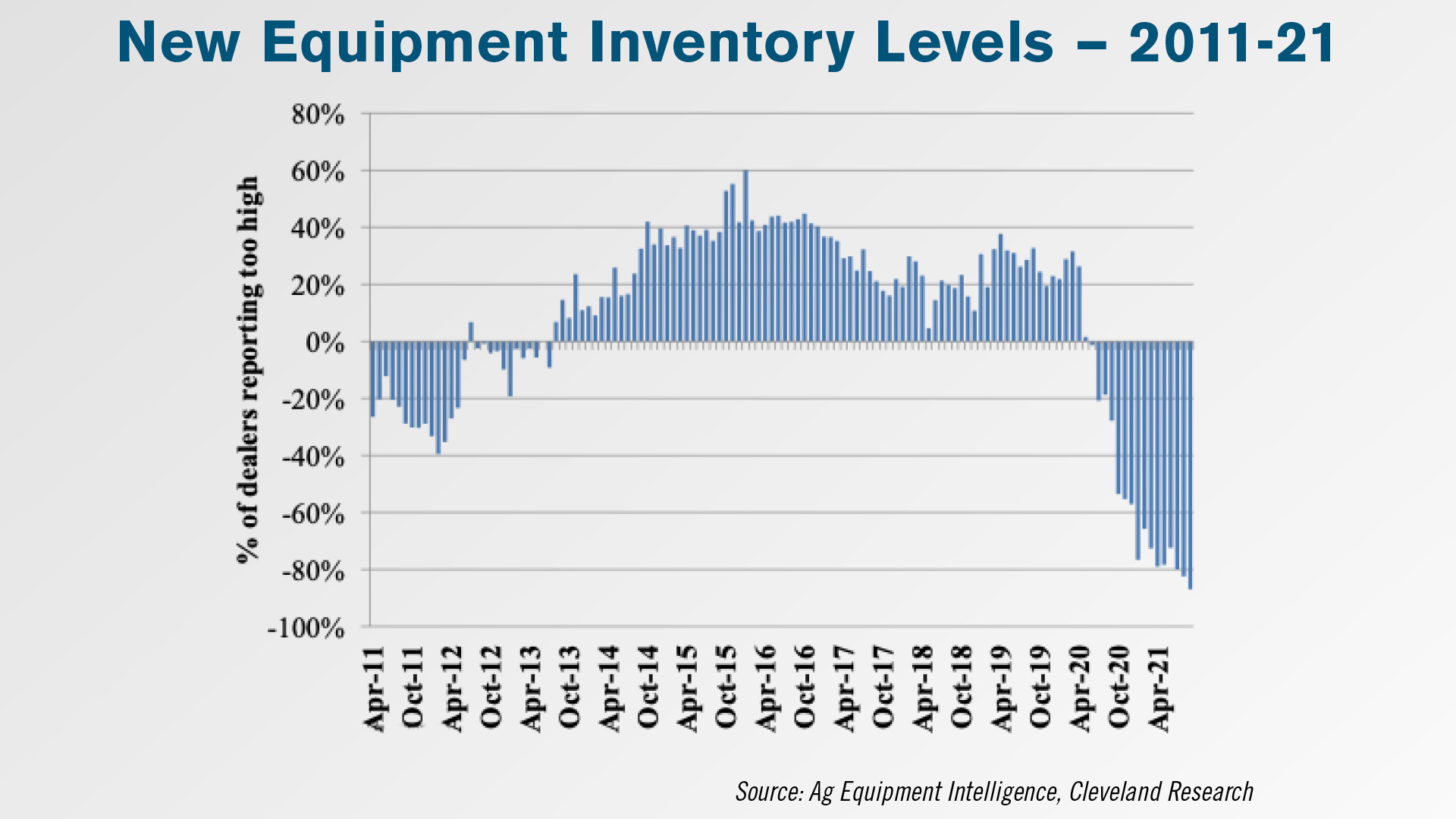

New Equipment Inventory, Pricing Struggles Continue

Results from the latest Dealer Sentiments & Business Conditions Update found that a net 87% of surveyed dealers reported their new inventory “too low” in September, down from the 82% reported in the previous month and a new record low for the last 10 years.

Among the 87% of dealers reporting their new equipment inventory “too low,” none reported their inventory as “too high” and just 13% reported their new inventory in line with the previous month.

Several dealers mentioned having their 2021 orders pushed out to 2022 and having their availability reduced. One dealer from the Lake States region said they have sold equipment that they don’t expect to see until the end of next year.

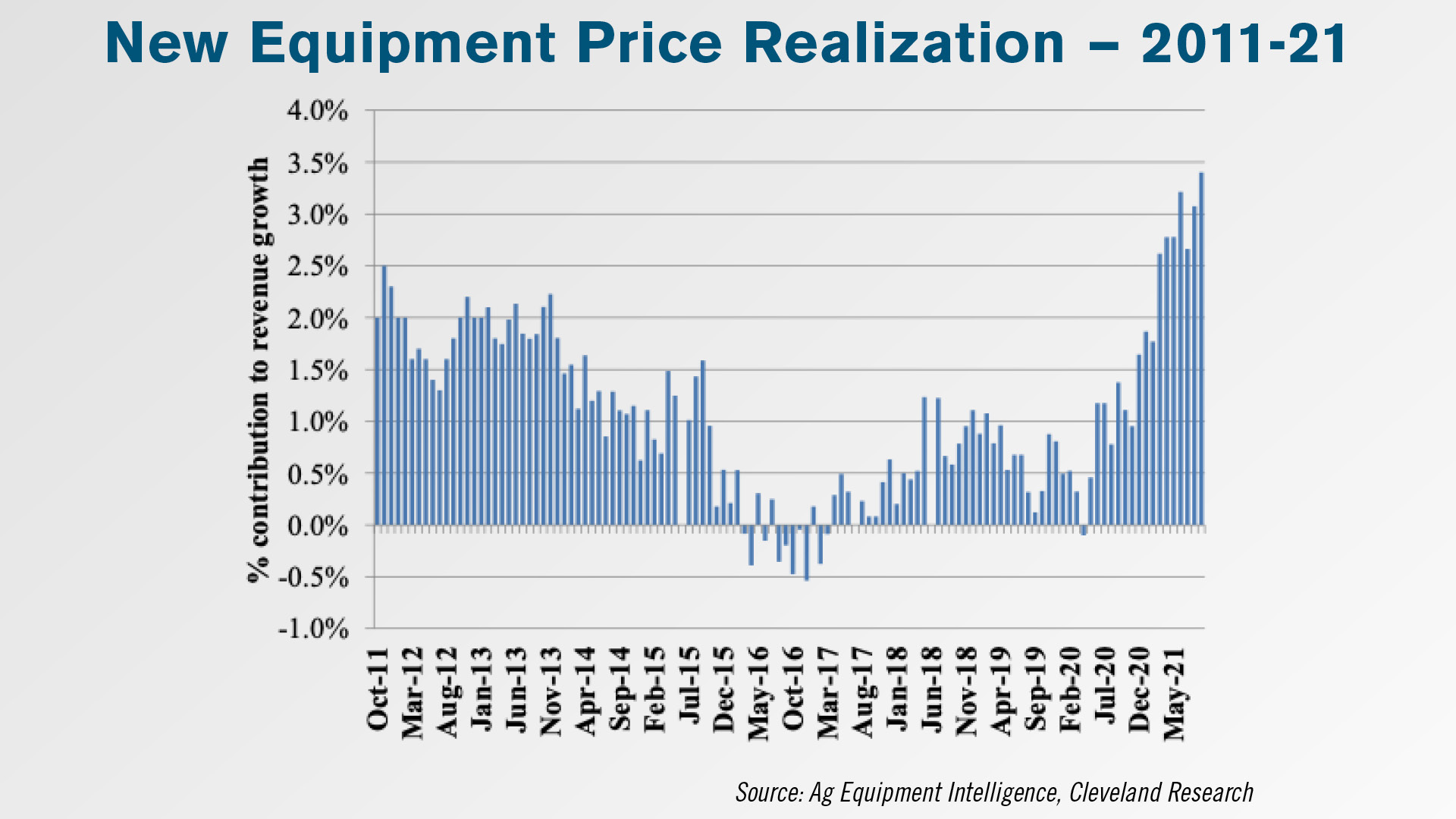

Price realization was reported up 3.4% in September, surpassing the 3.1% reported in the previous month. Like previous months, commentary suggests price increases are being caused by freight and material surcharges.

One dealer from the Appalachia region reported seeing price increases, saying, “Supply of equipment is down, but pricing is up. We were able to sell some inventory and make decent margins.” Another dealer from the Pacific region said they were surprised by the amount of people buying equipment despite recent price increases.

Post a comment

Report Abusive Comment