The latest episode of On the Record is now available!

In this week's episode we take a first look at the UAW strike at 14 of Deere's U.S. facilities. In the Technology Corner, Michaela Paukner examines Kubota's planned acquisition of AgJunction for $72.8 million. Also in this episode, California Gov. Gavin Newsom has signed a bill that will ban gas-powered small-off road engines. Ben Thorpe reports on dealers early orders heading into 2022, based on the results of Ag Equipment Intelligence's Dealer Business Outlook & Trends report. Art's Way reported its second straight profitable quarter, and saw Agriculture Products segment sales for the third quarter improve by 27% vs. last year.

This episode of On the Record is brought to you by Weasler Engineering.

Deliver a seamless transfer of power between a tractor and its attached machinery with one of Weasler’s three ASABE-compliant drive shaft product lines; the Standard, the Classic and the Professional. Weasler’s Newest product line – the Standard- offers a selection of pre-configured driveshafts. The Classic and Professional lines offer variety of standard components to choose from, allowing you to customize your PTO drive shaft to meet the specifications of your job. Learn more about what Weasler can do for you by visiting Weasler.com.

On the Record is now available as a podcast! We encourage you to subscribe in iTunes, the Google Play Store, Soundcloud, Stitcher Radio and TuneIn Radio. Or if you have another app you use for listening to podcasts, let us know and we’ll make an effort to get it listed there as well.

We’re interested in getting your feedback. Please feel free to send along any suggestions or story ideas. You can send comments to kschmidt@lessitermedia.com.

Deere Workers Strike

Deere failed to reach an agreement with its workers and the UAW on a new labor agreement, resulting in 10,000 workers going on strike — the first time Deere employees have gone on strike in 30 years. Depending on how long the strike lasts, it could exacerbate the inventory challenges dealers are facing.

One dealer noted that impact could range from insignificant to substantial, depending on how long the strike lasts and how Deere potentially uses other employees to keep things moving. Multiple dealers noted that Deere was bringing in salaried employees from other regions to help.

After 90% of union members rejected the proposed contract agreement the parties had until Oct. 13 at 11:59 p.m. to reach an agreement.

The details on the rejected agreement, posted on UAW's website, mention maintained healthcare copays, improved pensions and retirement and wage increases as summary points.

The rejected agreement would have provided an immediate 5-6% raise for most workers, according to UAW vice president Chuck Browning. Workers said the pay raises were inadequate given that John Deere is expected to make nearly $6 billion in profits this year, according to a report by The Hill. Union members also disapproved of how the pay hikes would be offset by pension cuts for new hires.

According to an earlier report from Deere, the facilities involved include In Iowa, the facilities are Davenport Works, Des Moines Works, Dubuque Works, Ottumwa Works and Waterloo Works, including Tractor and Cab Assembly, Engine Works and the Foundry. In Illinois, the facilities are Harvester Works in East Moline, North American Parts Distribution Center in Milan and the Seeding Group and Cylinder Division in Moline. In Kansas, there is one facility, Coffeyville Works.

One dealer noted that for 12 of their locations, they currently have 2,800 line items on back order from Deere. Those parts are all serviced from the Milan distribution cente. Some of those orders go back a few months, and with the strike he now fears increased back orders and delayed deliveries.

In response to the strike, Deere released the following statement from Brad Morris, vice president of labor relations:

"John Deere is committed to a favorable outcome for our employees, our communities, and everyone involved. We are determined to reach an agreement with the UAW that would put every employee in a better economic position and continue to make them the highest paid employees in the agriculture and construction industries. We will keep working day and night to understand our employees' priorities and resolve this strike, while also keeping our operations running for the benefit of all those we serve."

Deere & Company does not currently have an estimate of when employees affected by the strike will resume activities or the timing for completion of negotiations with the UAW.

Kubota Corp. plans to acquire AgJunction, a company that develops guidance, autosteer and autonomy technology, for $72.8 million.

Kubota to Acquire AgJunction for $72.8 Million

AgJunction announced the acquisition on Oct. 8. The company plans to hold a special meeting for shareholders in November to seek approval for the acquisition, and the transition would likely close shortly after approval.

In a statement, Lori Ell, chair of AgJunction’s board of directors, said,

“The Transaction is expected to accelerate the execution of AgJunction's business plan, enhance access to additional customers and markets, provide efficiencies from greater scale and allow the opportunity for the retention of many AgJunction employees in the go-forward entity."

AgJunction’s board of directors determined that the acquisition was a good strategic move for the company as it’s faced with a competitive landscape that demands tighter vehicle integration and large-scale distribution.

The acquisition also fills a gap for Kubota acknowledged by its Director and Executive Vice President Masato Yoshikawa at a recent earnings meeting. He said the company was “a little behind” its overseas competitors in smart farming and automation initiatives.

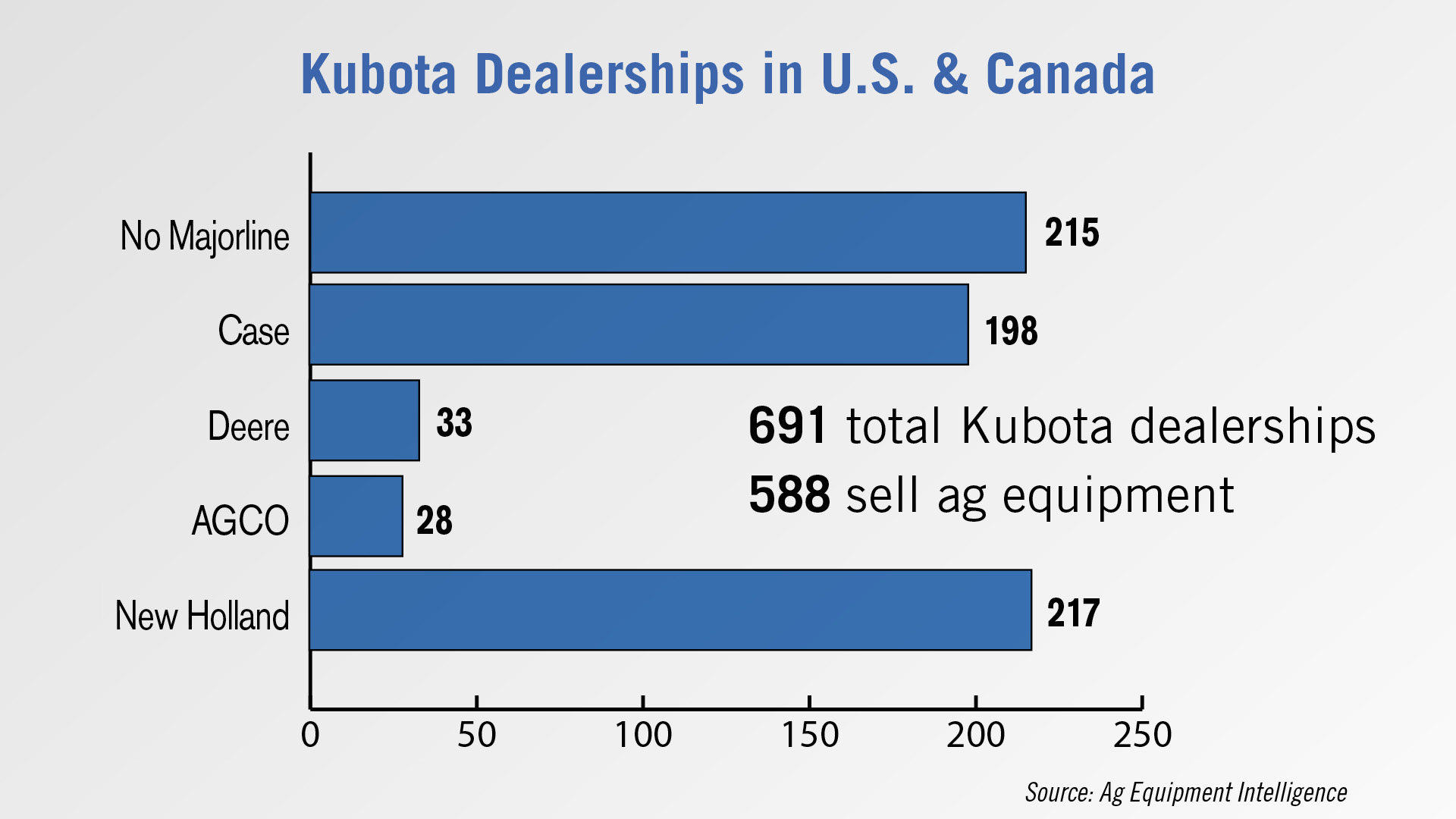

An Ag Equipment Intelligence review of the 691 Kubota dealerships in the U.S. and Canada reveals about 69% of those dealers also carry a major line and about 21% also carry a precision brand.

This data points to potential for the large-scale distribution that AgJunction’s board viewed as vital for success in ag equipment automation. It also gives Kubota the opportunity to directly compete with some of the majors’ offerings in the precision ag equipment space.

Leo Johnson, president of the 5-store dealer group Johnson Tractor in Wisconsin and Illinois, says the acquisition announcement is great for Kubota dealers. He says, quote

“Kubota saw that they had a precision farming gap and did something about it. Not by forming a ‘strategic alliance,’ but getting out their checkbook and buying a company.”

The acquisition is the next chapter in the companies’ shared history. In 2019, AgJunction sued Kubota and several of its subsidiaries for patent infringement related to automated machine control and implement steering.

The lawsuit settled in October of 2020, and at the time, the parties agreed to begin discussions about AgJunction supplying or developing autosteer and autonomous solutions for Kubota products worldwide.

California Bans Gas Powered Lawn Equipment

On Saturday Oct. 9, 2021, California Gov. Gavin Newsom signed a bill that will ban gas-powered small off-road engines (SORE), used primarily in lawn care equipment, as soon as 2024.

According to the bill’s author, Assemblyman Marc Berman (D), “The Governor’s Executive Order No. N-79-20 of Sept. 23, 2020, directs the state board to implement strategies to achieve 100% zero emissions from off-road equipment in California by 2035, where feasible and cost-effective. The state will not achieve that goal without further regulation of SORE, including a mandate to transition all sales of new equipment to zero-emission equipment.”

The bill states that in 2020, California daily nitrogen oxides (NOx) and reactive organic gases (ROG) emissions from small off-road engines were high than the emissions from light-duty passenger cars. “SORE emitted an average of 16.8 tons per day of NOx and 125 tons per day of ROG. Without further regulatory action, those emission levels are expected to increase with increasing numbers of SORE in California.”

The bill goes on to state that operating a commercial leaf blower for one hour can emit as much ROG plus Nox as driving 1,100 miles in a new passenger vehicle.

Dealers Report Record Highs for Early Orders in 2021

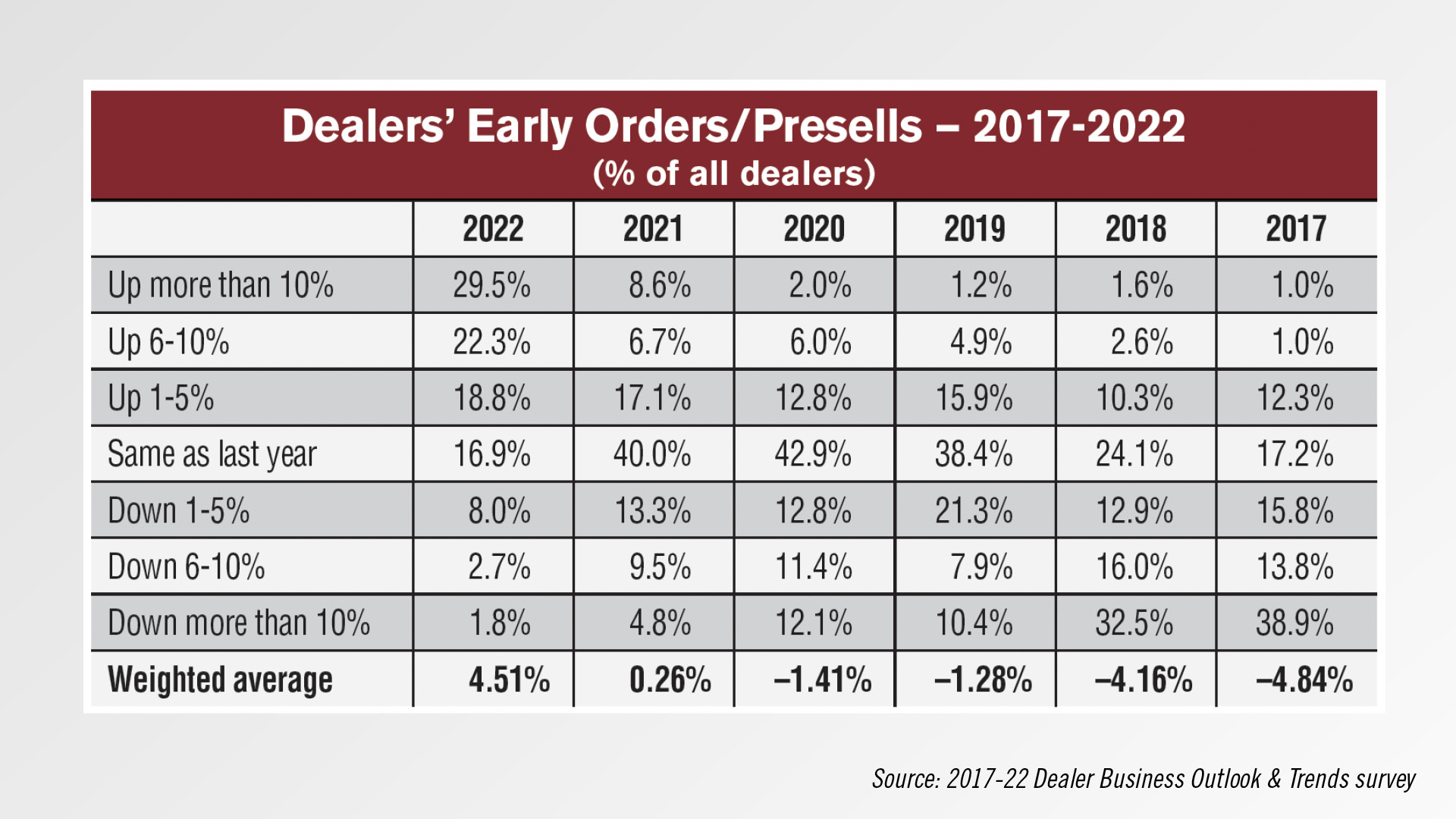

With the ongoing equipment shortage, early orders have become an increasingly important part of how dealers are doing business. As a result, this year’s Dealer Business Outlook & Trends report shows early order estimates are up significantly vs. last year.

Roughly 30% of dealers estimate their early orders are up 10% or more year-over-year in 2021, compared to 8.6% indicating the same in last year’s study. Overall, 71% of dealers say their early orders are up at least 1% vs. the previous year, compared to 32% who said the same in the previous study. Only 17% of dealers reported their early orders were unchanged from the previous year, a record low for the last 6 years.

Some 13% of dealers reported their early orders were down compared to 2020, with 8% indicating early orders were down 1-5%. This is well below the 27.6% who reported a decrease of at least 1% or more in last year’s study.

Art’s Way 3Q Ag Products Sales Increase 27%

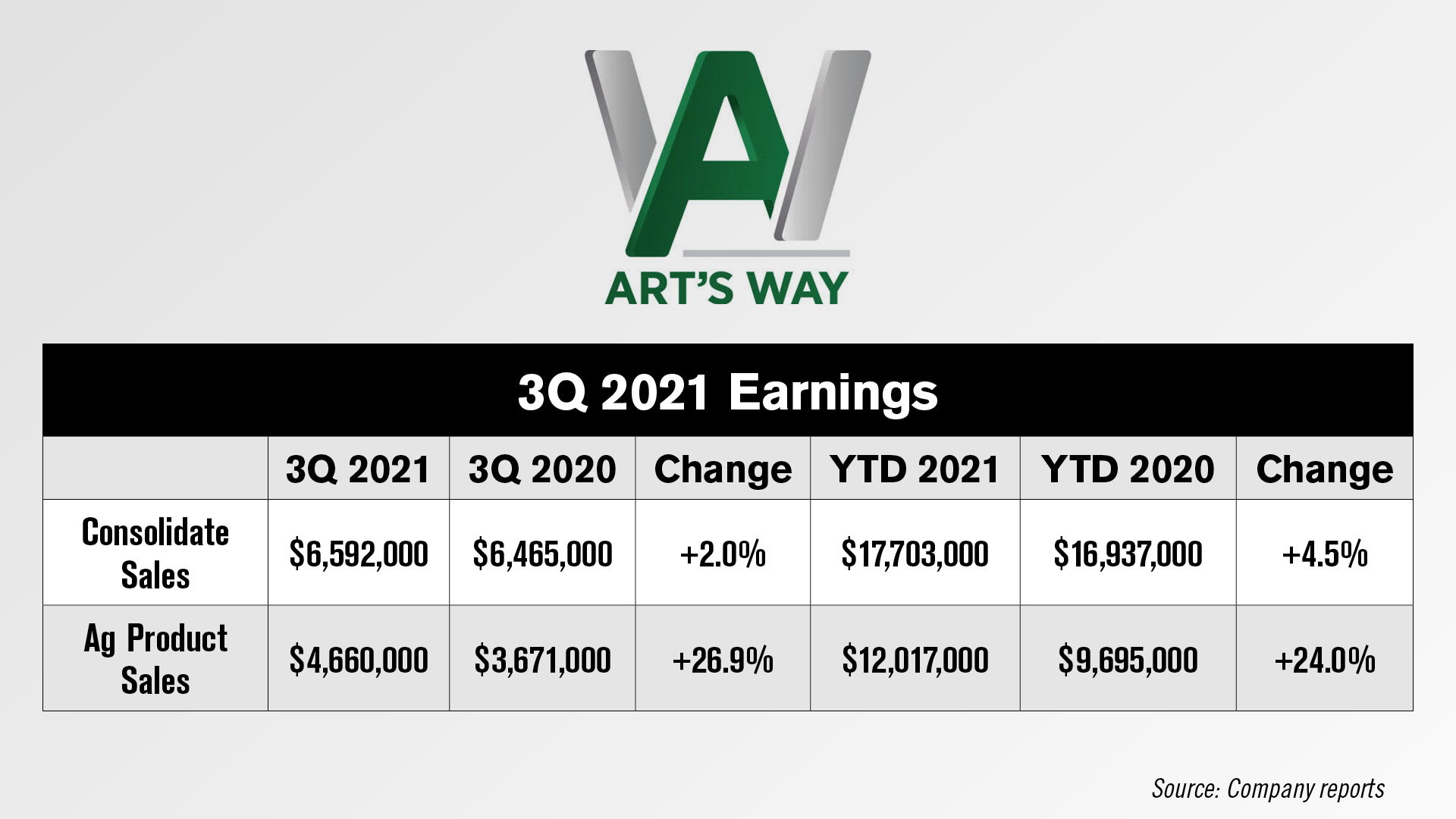

Shortline manufacturer Art’s Way reported its third quarter consolidated corporate sales were $6.6 million, up 2% vs. the same period of 2020. This marked 2 straight profitable quarter, the company notes.

For the 9 months ending Aug. 31, 2021, the company reported consolidate sales of $17.7 million, up 4.5% compared to the same period last year.

Art’s Way’s Agricultural Products segment had third quarter sales of nearly $4.7 million, up nearly 27% vs. the third quarter of last year. Year-to-date, ag segment sales were up 24% to about $12 million.

The company attributes the large increase in revenue to a strengthening agricultural economy that is producing 5-10 year highs in commodity and livestock prices along with government assistance programs that provided farmers with much needed government assistance during the COVID-19 pandemic.

Art’s Way says grinder mixer sales were up 71% year-over-year and beet equipment sales are up 60%. Manure spreaders are up 13% vs. last year.

The company says, “We are seeing continued demand in the fourth quarter with our current ag backlog up 269% from a year ago. Supplier delays have improved but are not gone completely. We also continue to receive price increases from our suppliers regularly. Further price increases before our early order program will be necessary to maintain strong margins on our products. We are still struggling to get new production hires on board with the lack of available workforce in our community and a highly competitive job market. We are taking steps to automate production tasks with the use of robotic welding and other new equipment to help us increase efficiency and output.”

![[Technology Corner] Pessl Instruments CEO Talks Dealer Benefits From Lindsay Corp. Investment](https://www.agequipmentintelligence.com/ext/resources/2024/04/25/Pessl-Instruments-CEO-Talks-Dealer-Benefits-From-Lindsay-Corp.-Investment.png?height=290&t=1714144307&width=400)

Post a comment

Report Abusive Comment