We hope all of our readers and viewers are staying safe during these unprecedented times. In this week’s episode we provide details on how some of the taxation and lending provisions of the CARES Act will help farm equipment dealerships. In the Technology Corner, Jack Zemlicka shares how some dealers are using remote support amid restrictions put in place because of COVID-19. Also in this episode: Titan Machinery annual revenues were up 3.5%, CNH Industrial announces management changes and Raven Industries acquires the remaining shares of Dot Technology.

On the Record is brought to you by B&D Rollers.

This episode of On the Record is brought to you by B&D Rollers. B&D Rollers is the only manufacturer in the world to make new aftermarket hay conditioner rollers. The Crusher hay conditioning rollers have the ability to run on any machine, regardless of color or brand. Between 2018 and 2019, B&D Rollers saw 93.7% growth purely in hay conditioning rollers and is continuing to see similar growth trends into 2020. For more information or OEM inquiries, visit bdrollers.com.

On the Record is now available as a podcast! We encourage you to subscribe in iTunes, the Google Play Store, Soundcloud, Stitcher Radio and TuneIn Radio. Or if you have another app you use for listening to podcasts, let us know and we’ll make an effort to get it listed there as well.

We’re interested in getting your feedback. Please feel free to send along any suggestions or story ideas. You can send comments to kschmidt@lessitermedia.com.

CARES Act Offers Dealers & Manufacturers Relief

On March 27, President Donald Trump signed a $2.2 trillion economic rescue package into law to support businesses, rush resources to overburdened health care providers and to help struggling families during the new coronavirus pandemic.

The CARES Act contains $9.5 billion in assistance for agriculture producers who have been impacted by COVID-19 along with a $14 billion replenishment to the Commodity Credit Corporation, according to USDA. In addition, the legislation includes $100 million in ReConnect grants to expand access to broadband in rural America for educational purposes, business and access to critical telehealth services.

In addition to the benefits for agriculture and the rural community at large, the provisions to small business will be beneficial to farm equipment dealers. The Small Business Administration defines a small business as an operation with less than 500 employees.

Eric Wareham, vice president of government affairs for the Western Equipment Dealers Assn., says the areas likely to impact dealers the most are lending and taxation provisions of the paycheck protection program, which is covered by an extension of the SBA’s 7a loans and will be 100% backed and federally guaranteed and are forgivable directly to small businesses.

“The covered period for when to apply for a loan is up to June 30th. That doesn't sound really close, but in terms of the fact that from today, he SBA has 30 days to issue guidelines and rules and regulations on this. And then to get all of the loan applications processed, that's a short window. And then from the date, from the date of the loan origination, you have an 8 week covered period to use those funds for designated purposes. And then you also need to be aware that you've got to keep track of things to certify what you use those funds for in order to get the loan forgiven down the road.”

During a Farm Equipment webinar, Wareham and Curt Kleoppel, WEDA CFO, went over these provisions in greater detail, and a replay of the webinar can be found on the Farm Equipment website for additional details.

Dealers on the Move

This week’s Dealer on the Move is Ritchie Implement. The Case IH dealership has acquired Finney Implement in Lancaster, Wis. Finney was the oldest Case IH dealer in the state of Wisconsin. Ritchie now has 4 locations.

Working Remote a Plus for Precision Specialists

On the cusp of spring planting, dealerships are facing the dilemma of accepting the new reality of social distancing and self-quarantine, or taking advantage of the tools and talent they have to continue delivering high-quality service to farm customers.

One way dealers are compensating for a change to traditional pre-season plans is to pivot from in-person planter clinics to online versions. Several are delivering helpful YouTube links and tutorials to customers, but still making on-farm visits as needed for setups and installations.

Joel Kaczynski, product specialist manager with RDO Equipment, a 35-ag store operation in 8 states, notes the dealership has also emphasized digital learning tools for customers by creating videos and recommendations and then getting links to customers who had planned to attend one of their in-person spring events.

This all plays into an increase in remote support opportunities that Kaczynski and other say are becoming increasingly valuable to troubleshoot precision problems for customers.

“Social distancing has presented us with an opportunity to use technology we have to virtually connect. In many instances this is requiring us and our customers to culturally adapt. I've already seen an uptick of using tools to connect remotely. One example we had was the cancellation of spring planning clinic. In order to get the information to our customers the team created a video with the information that was going to be presented at the clinic that can be shared with customers.”

But dealers acknowledge the remote communication still has its limitations, especially as farmers get closer to getting into the field. While dealers are passing along social distancing guidelines to customers ahead of on-farm visits, the reality is specialists still need to climb into a tractor cab, manually check planter drives or test run prescriptions in the field.

Parts, Service Revenues Lift Titan Machinery

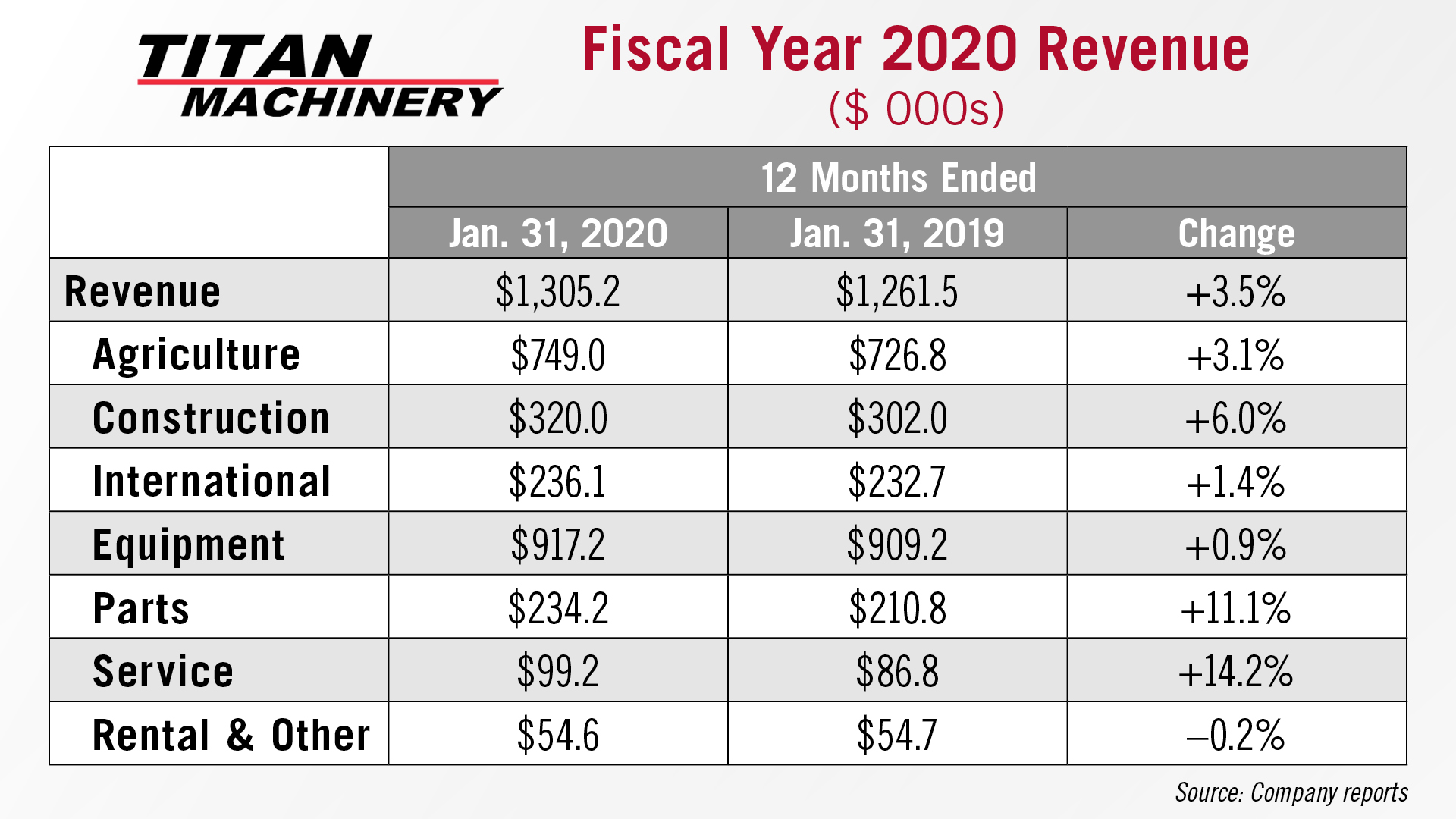

Despite a slowdown in the fourth quarter of its fiscal 2020 period, Titan Machinery’s annual revenues were up 3.5% on strong aftermarket results, as parts sales rose 11% and service grew by 14% for the year. Overall, equipment sales increased by slightly under 1%.

Revenue for its fiscal 2020, which ended on Jan. 31, increased 3.5% to $1.3 billion, up from $1.26 billion. Net income for fiscal 2020 was $14 million compared to $12.2 million for the prior year. Revenue for parts were $234 million up from $211 million in fiscal 2019. Service revenue increased to $99 million vs. $87 million last year.

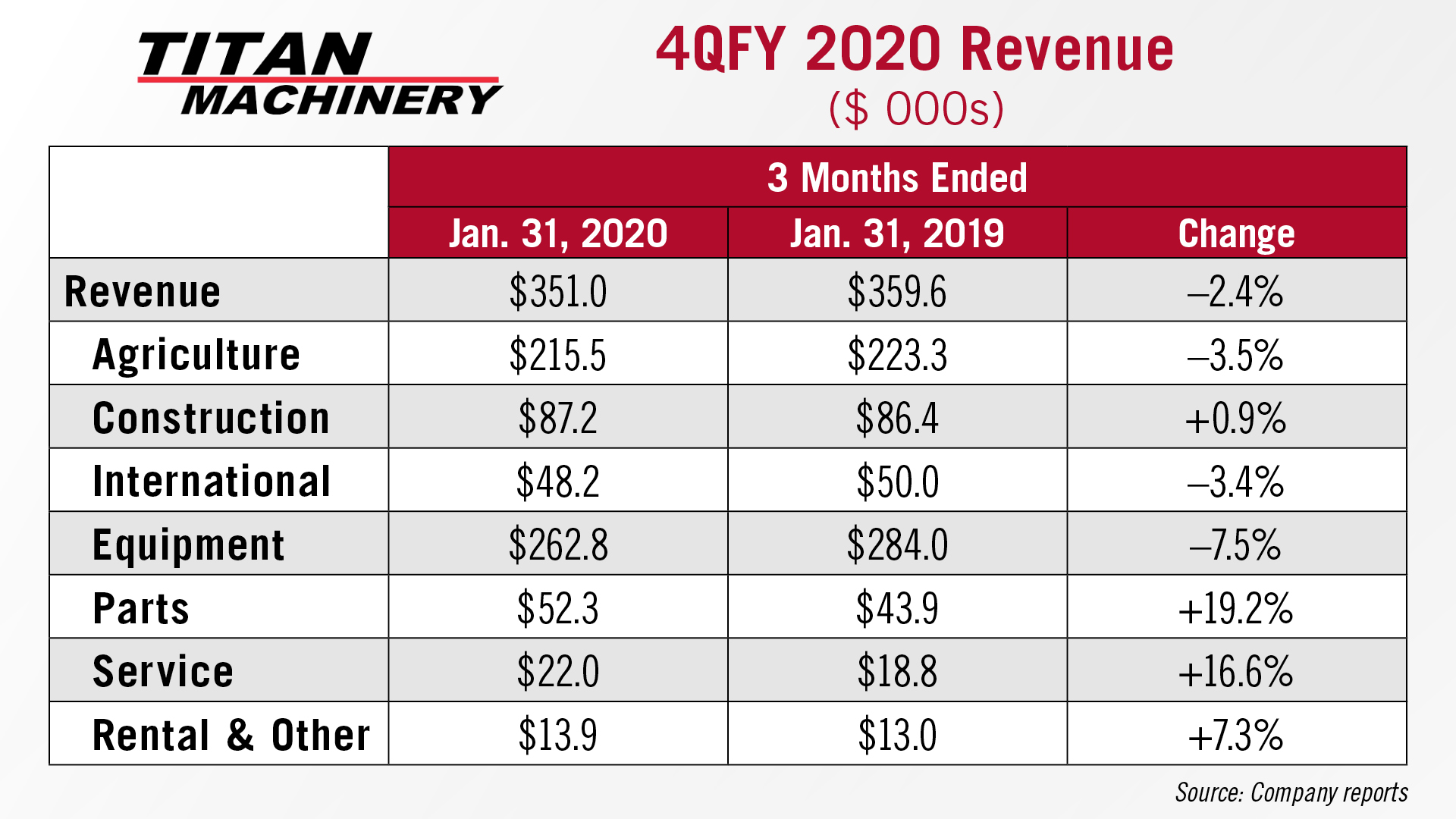

In the fourth quarter, total revenues declined by 2.4%, with equipment sales dropping 7.5% to $263 million from $284 million. Parts sales increased to $52 million from $44 million in the fourth quarter of fiscal 2019. Service revenue was up nearly 17% to $22 million from $19 million in the same period last year.

Ag equipment revenue during the fourth quarter fell to $216 million vs. $223 million during the same period of 2019.

Looking ahead, David Meyer, Titan’s chairman and CEO, said that due to the uncertainty surrounding COVID-19, the company believes it is prudent to not provide specific full year fiscal 2021 guidance at this time.

CNHI Appoints New CEO, Suspends Manufacturing

CNH Industrial has announced several changes to its management team in the last two weeks. Aside from changes to executive positions, the announcements have been fueled, at least in part, by the growing international impact of COVID-19.

The Board of CNH Industrial accepted the resignation of CEO Hubertus Mühlhäuser on March 23, appointing Suzanne Heywood as acting CEO until a permanent replacement is selected. The Board confirmed that Mühlhäuser left the company to pursue other interests. In addition, the Board appointed Oddone Incisa as the company’s new CFO.

While announcing Mühlhäuser’s resignation, the Board also confirmed its continued commitment to the company’s “Transform 2 Win” initiative, which will separate CNH Industrial’s assets into “On-Highway” and “Off-Highway” groups. However, an internal memo sent by Heywood and obtained by Reuters hinted that the company may be looking to delay the spin-off. In the notice to employees, Heywood stated that, “While the fundamentals of our ... strategy are strong and remain valid, we will also need to be flexible and intelligent in how we adapt to the challenges we face.” CNH Industrial has made no public announcement confirming a delay in the initiative.

On March 27, the company also announced the appointment of Brad Crews as temporary general manager of North America. The company said his role will be to “ensure cross-functional governance and coordinate all North American regional efforts during the COVID-19 situation.”

The company also announced the temporary suspension of its manufacturing in both North and South America. Most component facilities will remain operational “at low speed” to support the company’s supply chain to other facilities, as well as to dealerships and their customers.

Each of the major farm equipment manufacturers, including CNH, along with Deere & Co. and AGCO, have announced that they have withdrawn the 2020 financial guidance for the year because of the COVID-19 outbreak.

Raven Acquires Full Ownership of DOT

Raven Industries has entered into agreements to acquire the remaining equity of DOT Technology. In November 2019, Raven had acquired the majority share of the autonomous ag solutions company.

DOT is the developer of the “Dot Power Platform,” an autonomous power unit that has the ability to pair with a wide range of implements. The company is currently moving forward with commercialization of Raven Autonomy and will expand its portfolio with new offerings.

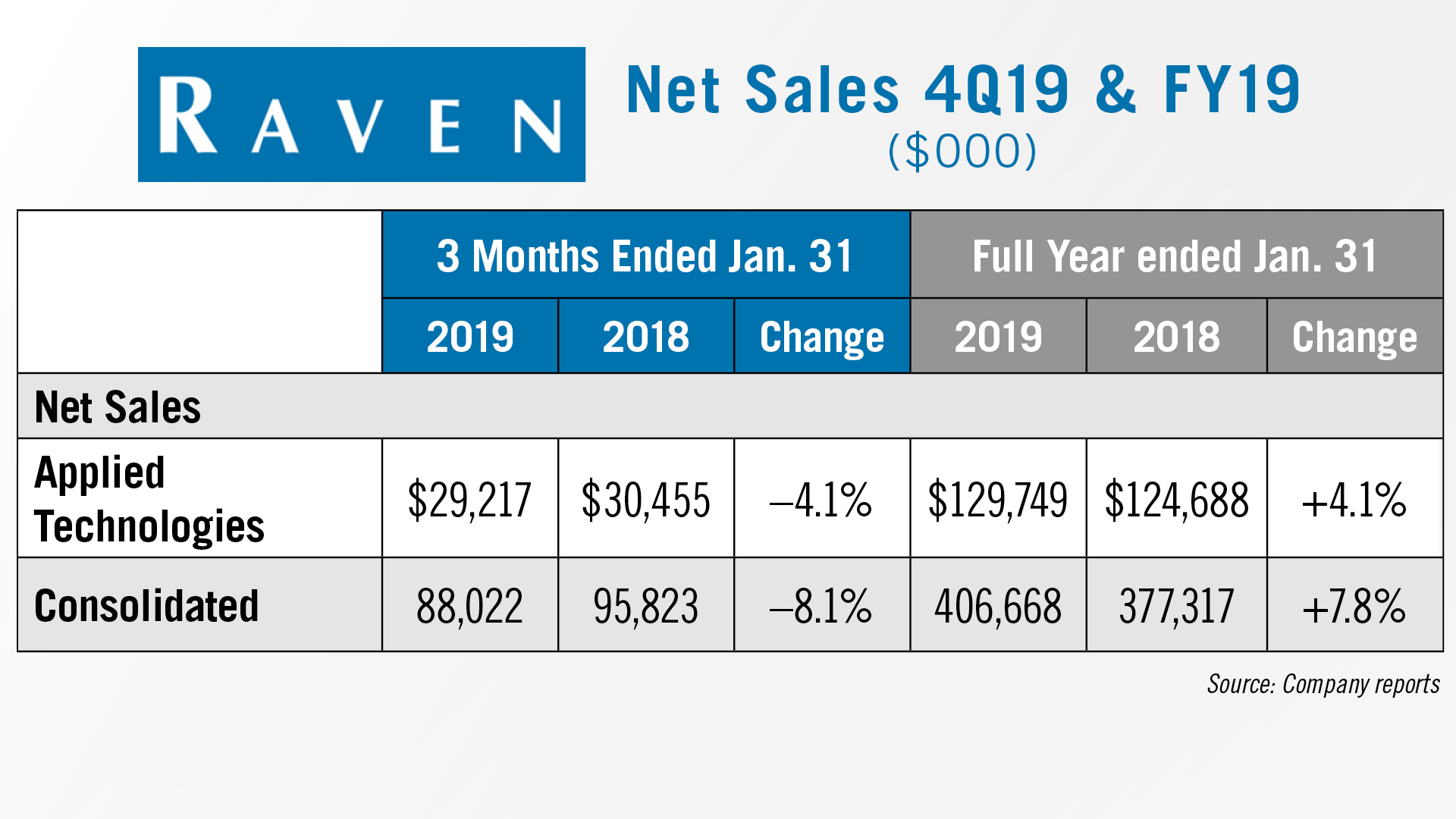

On March 23, Raven reported net sales for the fourth quarter of fiscal 2019 were $88 million, down 8.1% vs. the fourth quarter of fiscal 2018. For the Applied technology division, net sales for the quarter were $29.2 million, down 4% compared to the fourth quarter of 2018.

Net sales for the full 2019 were $407 million, up nearly 8% vs. fiscal 2018. This is a new record sales year for the company, surpassing the previous record from fiscal 2013. For the full year, net sales for the applied technology division were up 4.1%.

As always, we welcome your feedback. You can send comments and story suggestions to kschmidt@lessitermedia.com. Please stay safe and healthy during these very trying times. Ag Equipment Intelligence and Farm Equipment will continue to keep you abreast of news impacting the industry. Over on the Farm Equipment website, you’ll find regular Day in the life journal updates from dealerships across North America, sharing how they are navigating during this time. Until next time, thanks for joining us and be well.

![[Technology Corner] What are the Top 5 Applications in Autonomy Right Now?](https://www.agequipmentintelligence.com/ext/resources/2024/11/08/What-are-the-Top-5-Applications-in-Autonomy-Right-Now-.png?height=290&t=1731094940&width=400)

Post a comment

Report Abusive Comment