The latest episode of On the Record is now available!

In this week's episode, we cover Titan Machinery's strong second quarter of fiscal year 2022, which saw revenues increase 24.4%. In the Technology Corner, Michaela Paukner shares a close look at 360 Yield Center's 360 RAIN autonomous irrigation system. Also in this episode, the Ag Economy Barometer shows farmer sentiment recovered slightly in August, Raven Industries' Senior Director of Global Sales Sarah Waltner shares some opportunities for the technology company after its acquisition by CNH Industrial closes. Finally, Ben Thorpe takes a look at the latest forecast for net cash farm income, which is estimated to be up 17% in 2021.

This episode of On the Record is brought to you by Weasler Engineering.

Deliver a seamless transfer of power between a tractor and its attached machinery with one of Weasler’s three ASABE-compliant drive shaft product lines; the Standard, the Classic and the Professional. Weasler’s Newest product line – the Standard- offers a selection of pre-configured driveshafts. The Classic and Professional lines offer variety of standard components to choose from, allowing you to customize your PTO drive shaft to meet the specifications of your job. Learn more about what Weasler can do for you by visiting Weasler.com.

On the Record is now available as a podcast! We encourage you to subscribe in iTunes, the Google Play Store, Soundcloud, Stitcher Radio and TuneIn Radio. Or if you have another app you use for listening to podcasts, let us know and we’ll make an effort to get it listed there as well.

We’re interested in getting your feedback. Please feel free to send along any suggestions or story ideas. You can send comments to kschmidt@lessitermedia.com.

Titan’s 2Q Revenue Up 24%

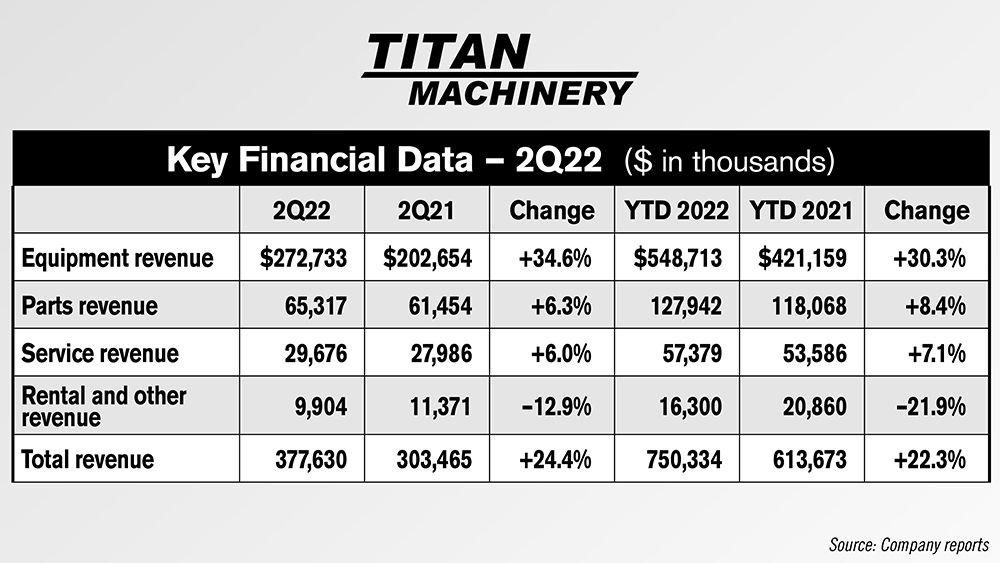

Titan Machinery reported its revenues for the second quarter of fiscal year 2022 increased 24.4% to nearly $378 million from about $303 million during the same quarter last year. For the first half of the year, revenues were up about 22% to $750.3 million.

Equipment revenues for the quarter were up nearly 355 to $273 million, and up 30% for the first 6 months. Parts revenue and service revenue were each up about 6% to $65 million and about $30 million, respectively. For the first half of the year, parts revenues were nearly $128 million, up 8.4% vs. the first half of 2021. For service, revenue was up 7% to $57.4 million for the first 6 months.

Ag segment revenue for the second quarter of fiscal 2022 was $219.4 million, compared to $169.1 million in the second quarter last year. The increase in revenue was primarily driven by strong demand for equipment.

Cash at the end of the second quarter of fiscal 2022 was $65.6 million. Inventories increased to $427.1 million as of July 31, 2021, compared to $418.5 million as of January 31, 2021. This inventory increase includes a $10.6 million increase in parts inventory and a $2.5 million decrease in equipment inventory, which reflects an increase in new equipment inventory of $31.4 million and a $34.0 million decrease in used equipment inventory.

Dealers on the Move

This week’s Dealer on the Move is Marshall Machinery.

The Honesdale, Pa., based Kubota dealership has acquired Goodrich Implement in Johnson City, N.Y. This adds a 5th locations for Marshall Machinery.

360 Yield Center Introduces Autonomous Irrigation System

Gregg Sauder, president of 360 Yield Center, demonstrated the 360 RAIN autonomous irrigation system at the 2021 Farm Progress Show in August. The technology follows an RTK path created by a planter and delivers water, nitrogen and micronutrients directly to the base of the plant.

“What we're talking about is a completely new way to farm,” Sauder says. “We're saying what if we were able to time technology to come in and water a half inch a week? And not only just add water, but add nitrogen and micronutrients. So we're really excited about this technology.

“Very simply, it follows the planter. The planter creates an RTK path, and our 360 Rain comes in and follows that path exactly. We're watering at the base of the plant. We have nitrogen pumps and micronutrient pumps soak up that water stream. And then in the future, within the next six months, we're going to be doing a manure injection in that water stream.”

The 360 RAIN machine operating at the show had 3,000 feet of hose on it, enough to cover at least a 160 acre field. Sauder said it's designed to put on a half inch of water a week at the base of the plant.

“That's totally different than the requirement that you would see through a pivot that's putting water in the air,” Sauder says, “so the fact that we're banding it next to the root, you got to take it times 2. If we're putting a half inch next to the root, once a week, that's really equivalent to an inch of water.”

360 Yield Center provides the technology to create the paths used for the map 360 RAIN follows. The equipment goes on the center of the planter, and paths are uploaded directly to 360 Yield Center’s Cloud account. The map is sent back the same day, allowing the farmer to start 360 RAIN within a day of planting.

“I want it to be that way because if rain comes in and crusts that soil surface, I want to be able to soften it with the rain unit,” Sauder says. “The GPS RTK is our own, and it's really not compatible with others in the industry for reasons. It's simple, and (we) want to be in a closed system so that we know we have the kind of path generation we need. Plenty of science has gone into all the geo-fence and safety. There are probably six different steps for safety to keep our RAIN unit in a safe position in every field.”

Sauder says there are currently 6 360 Rain Units running in Illinois. Next year, the company plans to have 10 prototypes and a beta running in fields around the country, and open sales will follow in 2023.

He sees more than just the technology as part of 360 RAIN’s future.

“We think of camera equipment that we're going to be able to add on a 360,” Sauder says. “At the speed we're going, we're going to be able to almost name every corn plant. We're going to be able to tell you if we have silk clipping, if we have gray leaf and rust on the leaf. My farm this year got tar spot — that's going to be easy to spot. And so immediately then your iPhone is going to light up, and we're going to say, we're going to need to treat, so direct inject comes in. We're going to be looking at a drop on every row. We'll have our 360 UNDERCOVER putting material from the bottom up and from the boom down. The science will be information always drives the correct decision.”

Learn more about 360 RAIN and Gregg Sauder.

Farmer Sentiment Recovers Slightly in August

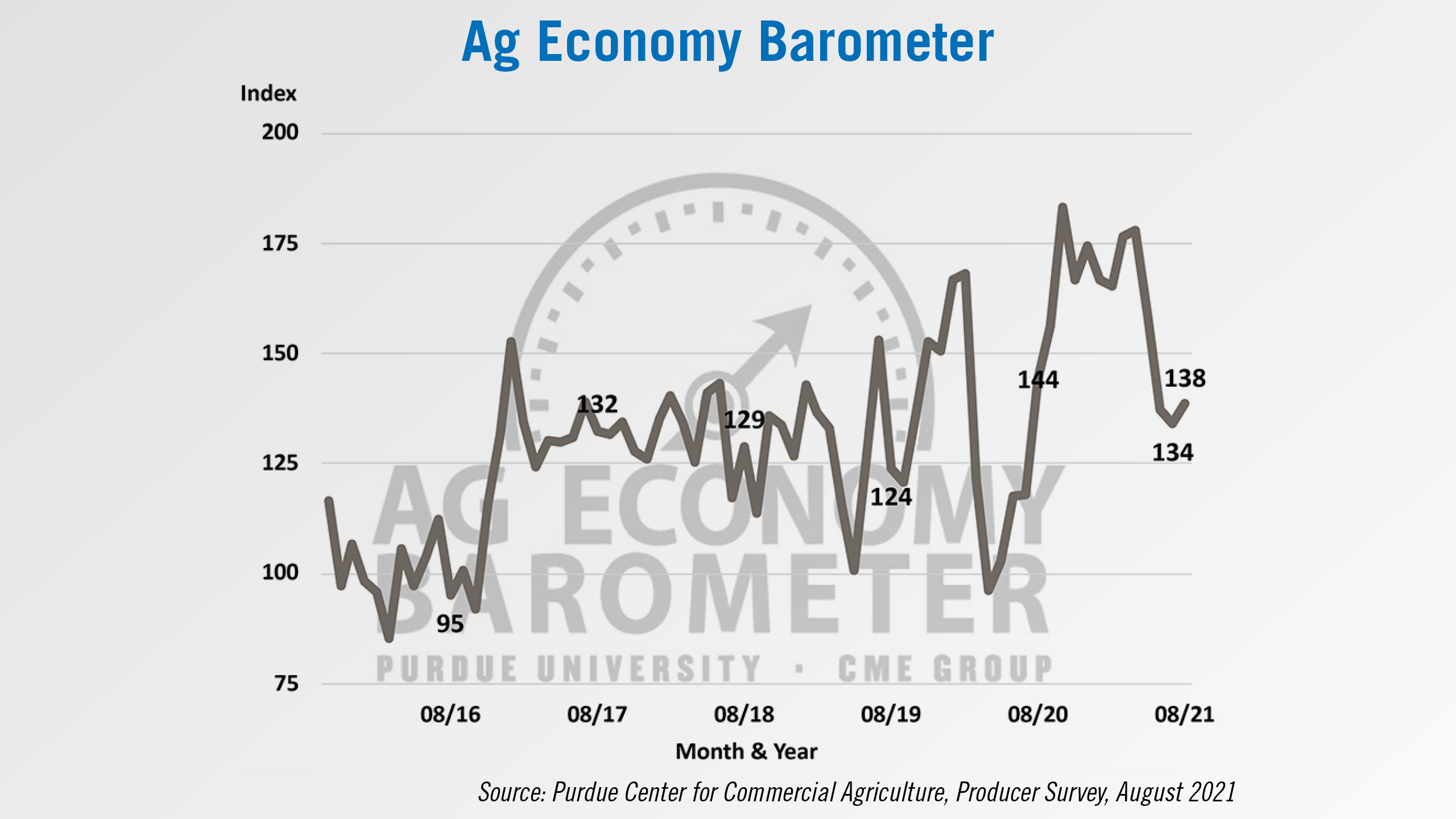

Farmers’ sentiment improved slightly in August compared to July as the Ag Economy Barometer rose four points to a reading of 138, vs. 134 a month earlier.

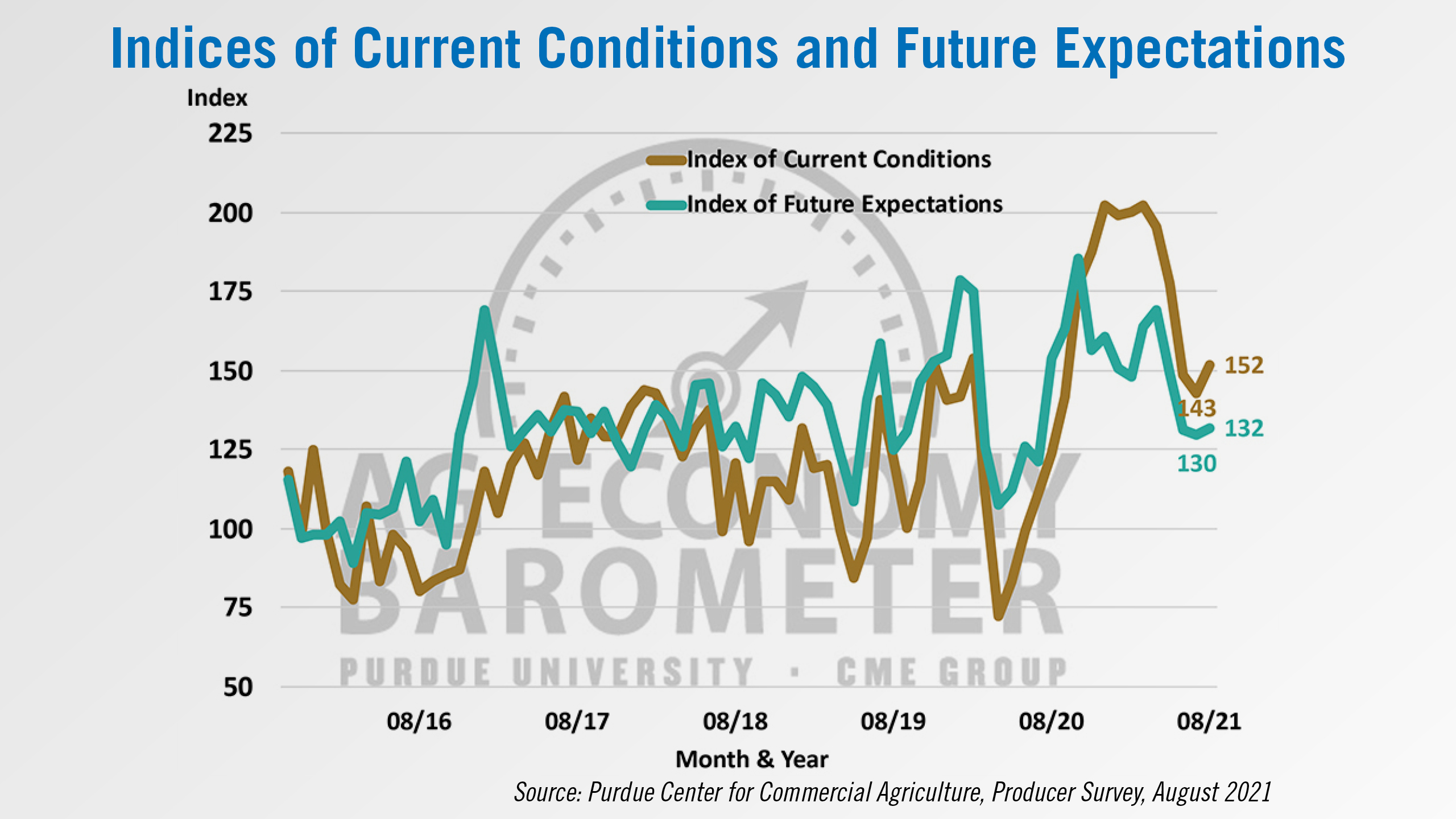

The modest rise in the barometer was primarily attributed to an improvement in the Index of Current Conditions, which climbed 9 points to 152, while the Index of Future Expectations rose just 2 points to 132. Although the barometer and its two key sub-indices improved in August compared to July, all three indices remain well below the very positive sentiment readings posted this past spring.

The improvement in the Current Condition Index was tied to producers’ more positive view of their farms’ financial situation. The Farm Financial Performance Index rose 11 points to 110, its highest reading since May, as farmers indicated they expect profitability this year to be better than a year earlier.

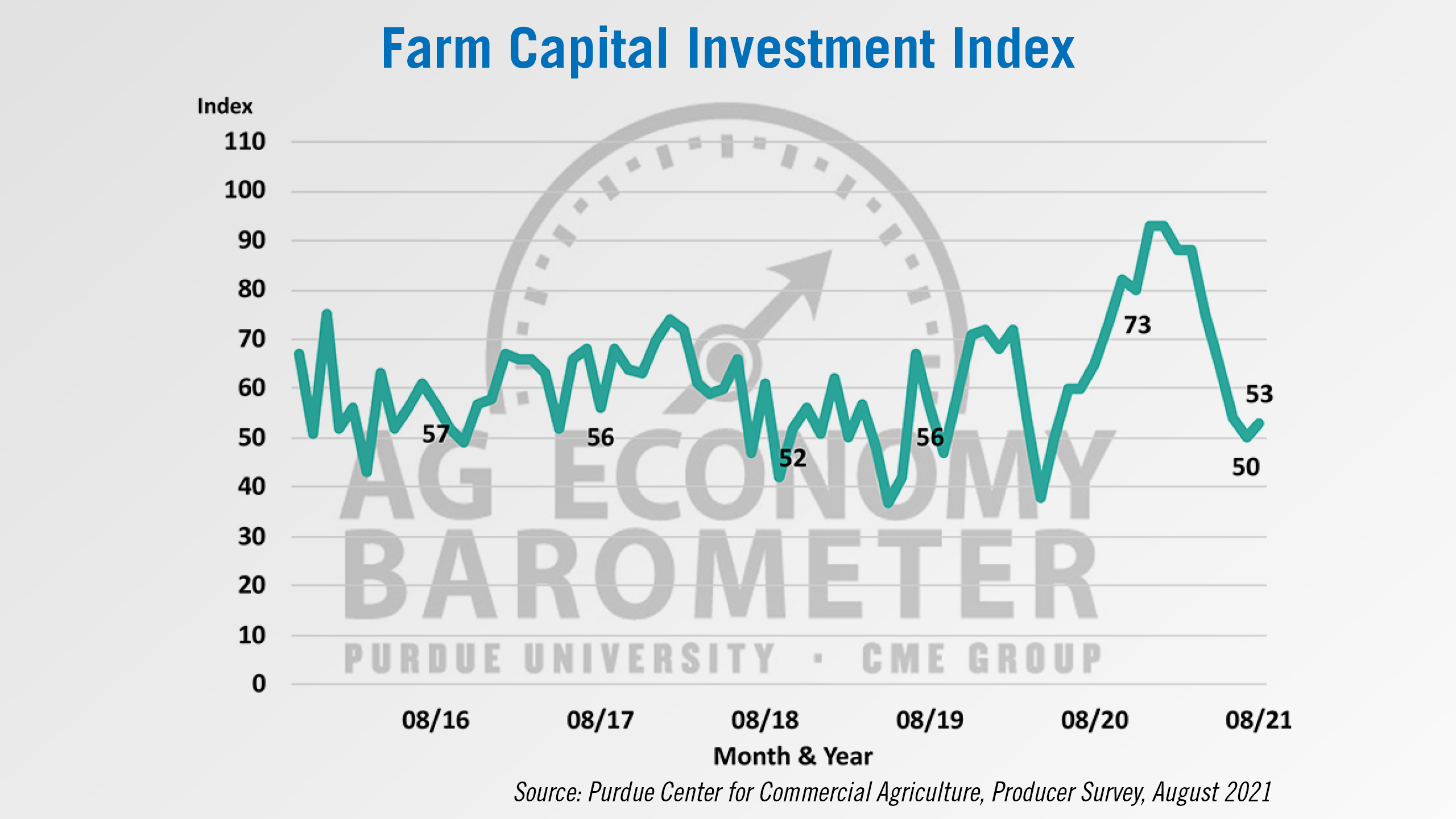

The Farm Capital Investment Index improved modestly in August, rising to a reading of 53, up 3 points compared to July. The small improvement in the index could be traced to fewer producers in August saying they planned to reduce their farm construction activity compared to a year ago. At the same time, farmers said their machinery purchase plans were unchanged from those reported in July. Industry reports continue to suggest that supply chain challenges are hampering farmers’ machinery purchase plans.

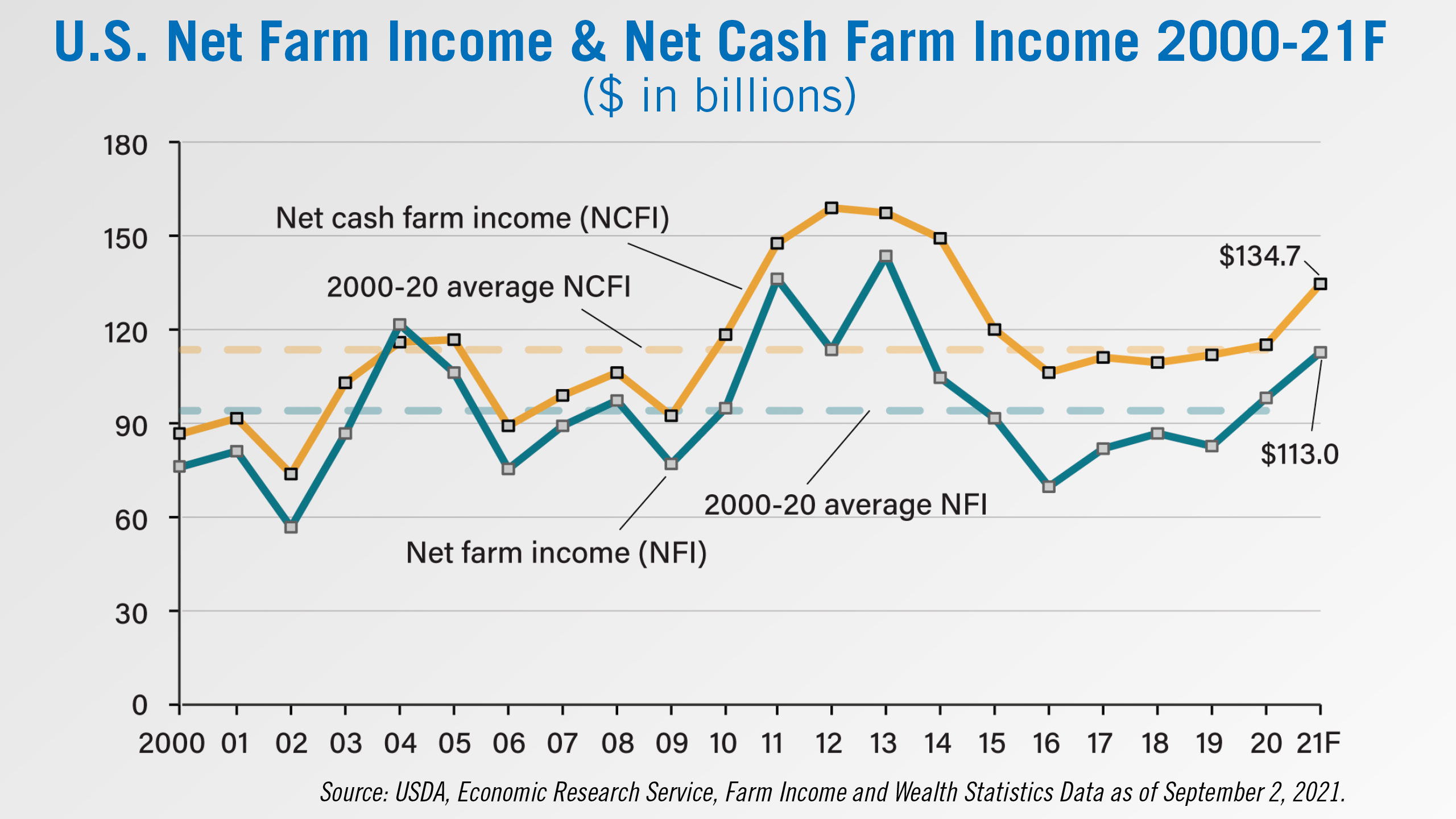

Net Cash Farm Income Forecast to Increase 17% in 2021

USDA’s Economic Research Service recently forecast net cash farm income to increase by nearly $20 billion from 2020 to $135 billion in 2021, at year-over-year increase of 17%. U.S. net farm income is forecast to increase by $15 billion or 15% to $113 billion in 2021.

If this forecast is realized, net farm income would be more than 20% above its 2000-20 average and would be the highest since 2013. Net cash farm income would be almost 19% above its 2000-20 average and would be the highest since 2014.

Underlying these forecasts, cash receipts for farm commodities are projected to rise by $51 billion or nearly 14% in 2021, their highest level since 2015. Production expenses are expected to grow by almost $13 billion or 3.5% during the same period, somewhat moderating income growth.

Direct government payments to farmers are expected to fall by $19 billion or 41% in 2021 compared with 2020’s record high payments, largely caused by lower anticipated payments from supplemental and ad hoc disaster assistance for COVID-19 relief.

Raven Looks to Expand International Markets after CNHI Acquisition

In a recent interview with Raven Industries Senior Director of Global Sales Sarah Waltner, Waltner gave context to the opportunities Raven will see after its acquisition by CNH Industrial closes. She mentions both Raven’s potential to integrate its technology more directly into machinery platforms, as well as increase its presence internationally, particularly in Asia.

“Some of what this does for us is we’re able to get technology into regions of the world where we aren’t as present today. We are present, but not as present. It enables us to get onto more platforms than maybe we are a lot today. And also I think as you think about bringing autonomy and further levels of automation, there’s a lot that happens that has to interact between the platform, where it’s a tractor, an OMNiPOWER, a combine, a sprayer, whatever it is. There’s so much interaction. That’s not to say that we can’t have stuff in the aftermarket, we do in aftermarket and we plan to continue to, but there are areas where it does set us up better to be on platform, especially as we get more and more automated as we go to the future.

“We are not yet in anything in Asia, and so that might be something. CNH is in that market to a certain extent, and so that might be a new market for us.”

Additionally, when asked about a recent report from Argus Leader about CNHI planning to “double or triple” the staff in Raven Industries’ applied technology division in Sioux Falls, S.D., Waltner couldn’t confirm the numbers but said there were plans in the works to see “more and more” investment come into the company’s Sioux Falls headquarters.

![[Technology Corner] Quantifying the Impact of a Precision Ag Pioneer](https://www.agequipmentintelligence.com/ext/resources/2024/08/23/Quantifying-the-Impact-of-a-Precision-Ag-Pioneer.png?height=290&t=1724422794&width=400)

Post a comment

Report Abusive Comment