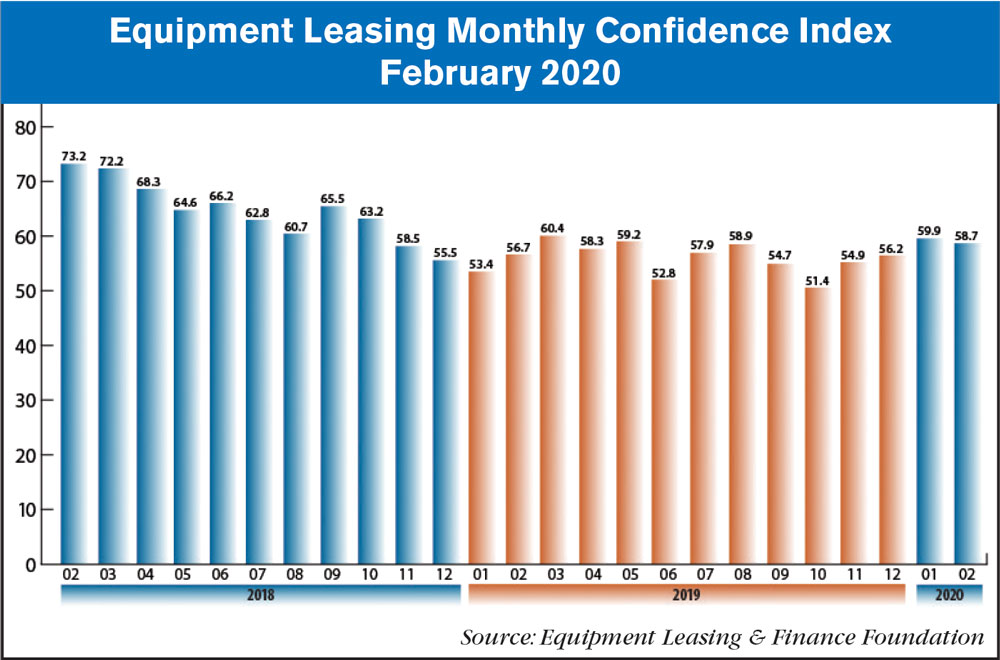

The Equipment Leasing & Finance Foundation has released the February 2020 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI). Designed to collect leadership data, the index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $900 billion equipment finance sector. Overall, confidence in the equipment finance market in February is 58.7, easing but steady with the January index of 59.9.

When asked about the outlook for the future, MCI-EFI survey respondent Adam Warner, president, Key Equipment Finance, said, “Thankfully, the economy seems to have ignored the political wrangling in Washington. We are hopeful, both personally and professionally, that the coronavirus can be effectively managed globally.”

February 2020 Survey Results

The overall MCI-EFI is 58.7, a decrease from 59.9 in January.

- When asked to assess their business conditions over the next 4 months, 11.5% of executives responding said they believe business conditions will improve over the next 4 months, down from 14.8% in January. 84.6% of respondents believe business conditions will remain the same over the next 4 months, an increase from 81.5% the previous month. 3.9% believe business conditions will worsen, unchanged in January.

- 7.7% of the survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase over the next 4 months, a decrease from 11.1% in January. 88.5% believe demand will “remain the same” during the same 4-month time period, an increase from 85.2% the previous month. 3.9% believe demand will decline, unchanged from January.

- 19.2% of the respondents expect more access to capital to fund equipment acquisitions over the next 4 months, an increase from 11.1% in January. 76.9% of executives indicate they expect the “same” access to capital to fund business, a decrease from 85.2% last month. 3.9% expect “less” access to capital, unchanged from the previous month.

- When asked, 30.8% of the executives report they expect to hire more employees over the next 4 months, a decrease from 33.3% in January. 61.5% expect no change in headcount over the next 4 months, a decrease from 63% last month. 7.7% expect to hire fewer employees, up from 3.7% the previous month.

- 38.5% of the leadership evaluate the current U.S. economy as “excellent,” up from 37% the previous month. 61.5% of the leadership evaluate the current U.S. economy as “fair,” down from 63% in January. None evaluate it as “poor,” unchanged from last month.

- 4% of the survey respondents believe that U.S. economic conditions will get “better” over the next six months, a decrease from 13.3 in January. 88% indicate they believe the U.S. economy will “stay the same” over the next six months, an increase from 80% last month. 8% believe economic conditions in the U.S. will worsen over the next six months, up from 6.7% the previous month.

- In February, 50% of respondents indicate they believe their company will increase spending on business development activities during the next six months, an increase from 48.2% last month. 42.3% believe there will be “no change” in business development spending, a decrease from 48.2% in January. 7.7% believe there will be a decrease in spending, an increase from 3.7% last month.

February 2020 Survey Comments from Industry Executive Leadership

Bank, Small Ticket

“Continued strong origination volume, approval rates and portfolio performance all support an optimistic view of near-term strong performance.” David Normandin, CLFP, president and CEO, Wintrust Specialty Finance

Independent, Small Ticket

“I’m optimistic because the overall economy is doing well. I’m concerned about decreases in capital expenditures, the shipping recession, and the uncertainty caused by the upcoming election.” Quentin Cote, CLFP, president, Mintaka Financial, LLC

Bank, Middle Ticket

“Low commodity and trade tariff headwinds continue to mute large capital investment. We are seeing activity with replacement assets and solar, which we expect to continue throughout the year.” Michael Romanowski, president, Farm Credit Leasing

Post a comment

Report Abusive Comment