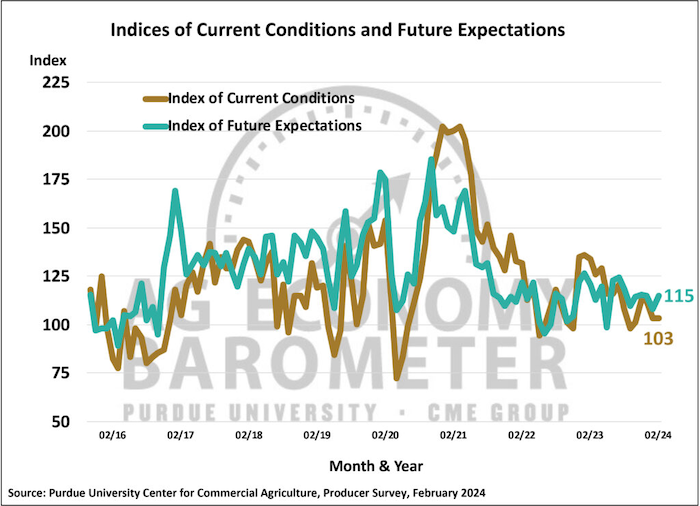

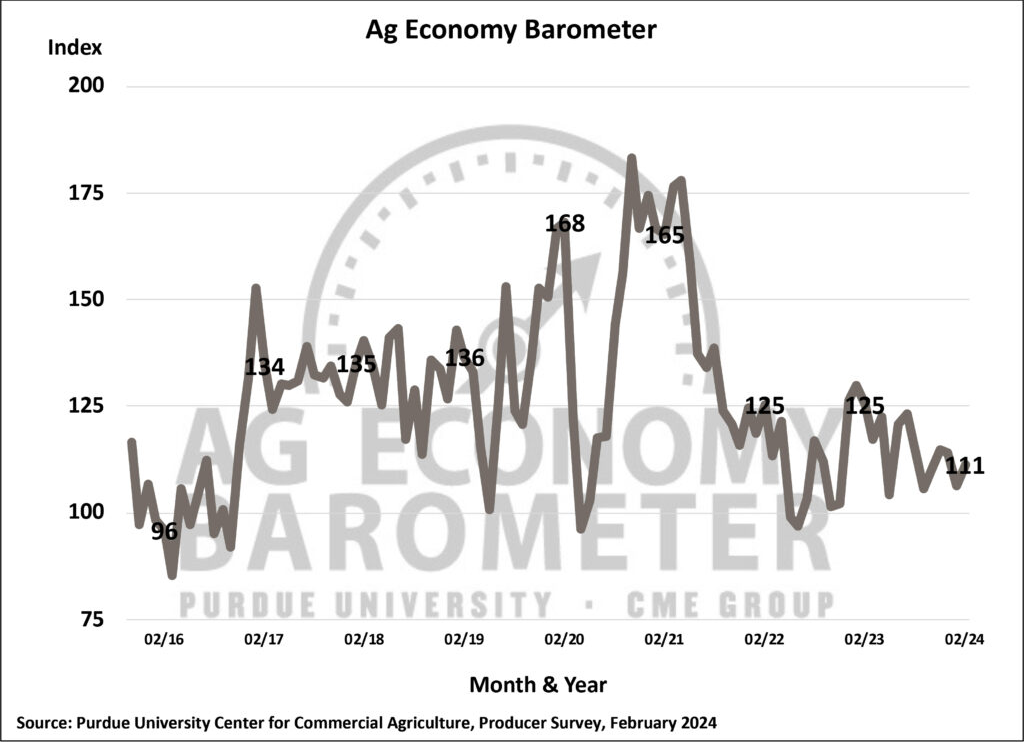

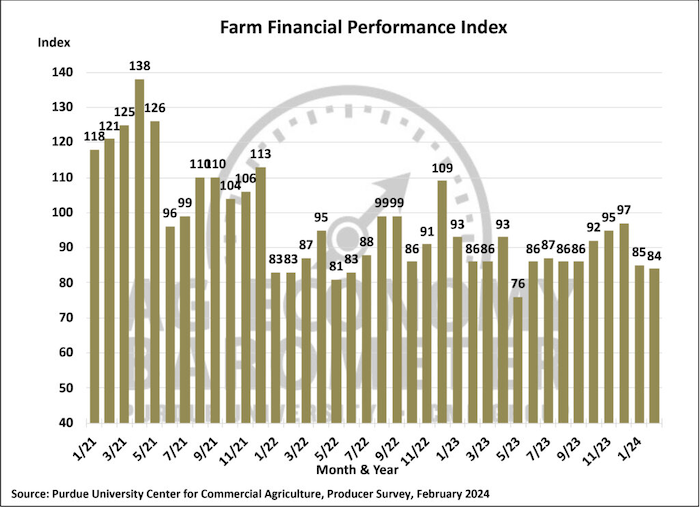

The Purdue University-CME Group Ag Economy Barometer rose modestly in February posting a reading of 111, 5 points higher than a month earlier. The modest rise in the barometer was attributable to producers expressing somewhat more optimism about the future as the Future Expectations Index rose 7 points to a reading of 115 while the Current Conditions Index was unchanged, both compared to a month earlier. Although farmers’ expectations for the future improved in February, their financial performance expectations did not. February’s Farm Financial Performance Indexreading of 85 was 1 point lower than in January and 13 points below its most recent peak in December. Weak crop prices continue to weigh on financial expectations as mid-February Eastern Corn Belt cash prices for corn and soybeans were 7 and 8% lower, respectively, than two months earlier when the December survey was conducted. The February Ag Economy Barometer survey was conducted from February 12-16, 2024.

Figure 2. Indices of Current Conditions and Future Expectations, October 2015-February 2024.

When asked about their biggest concerns for their farm operation in the upcoming year, producers in this month’s survey continued to point to “high input costs” (34% of respondents) and “lower crop/livestock prices” (28% of respondents) as their top two concerns. Interest rate worries among agricultural producers might have peaked as just 18% of February respondents cited “rising interest rates” as a top concern, down from 26% as recently as last November.

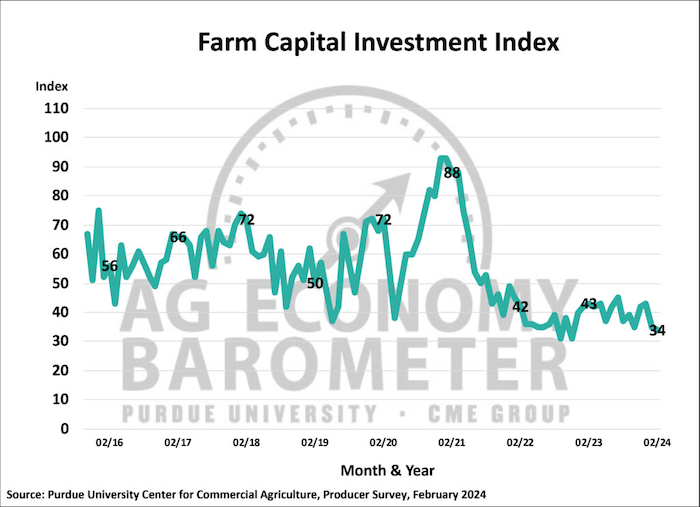

The Farm Capital Investment Index remained weak in February, declining 1 point to a reading of 34 which was 9 points lower than a year earlier. Responses from producers who said now is a bad time to make large investments reflected their concerns about high production costs and weak output prices. The percentage of farmers who said it’s a bad time because of “uncertainty about farm profitability” has tripled since last October. This month 22% of respondents pointed to farm profitability concerns compared to just 7% who cited that as a key reason to hold back on investments last fall.

Producers’ short-run expectations for farmland values were unchanged from January’s as the Short-Term Farmland Values Expectations Index reading was 115 in both months. Compared to a year earlier, however, the index was down 4 points, and it was also 30 points lower than two years ago. Although more producers expect farmland values to rise than fall in the next 12 months causing the index value to be above 100, it’s clear that sentiment among producers about future increases in farmland values is weaker than it was a couple of years ago. The optimists in barometer surveys continue to point to “non-farm investor demand” as the primary reason they expect farmland values to continue rising.

Producers expressed a bit more optimism about the future in the February survey than in January, which pushed the Ag Economy Barometer up slightly. However, expectations for their farms’ financial performance in the upcoming year did not improve as the Farm Financial Performance Index remained 13 points lower than in December. Although farmers’ short-run expectations for farmland values were unchanged compared to a month earlier, it’s clear that producers are not as confident that farmland values will continue to rise as they were two years ago when the short-run farmland index was 30 points higher than it was this month. Finally, producers who have engaged in discussions with companies about solar leasing their farmland indicate that per acre payment rates following construction have been rising with over half of them indicating they were offered a rate of $1,000 or more per acre.

![[Technology Corner] Pessl Instruments CEO Talks Dealer Benefits From Lindsay Corp. Investment](https://www.agequipmentintelligence.com/ext/resources/2024/04/25/Pessl-Instruments-CEO-Talks-Dealer-Benefits-From-Lindsay-Corp.-Investment.png?height=290&t=1714144307&width=400)

Post a comment

Report Abusive Comment