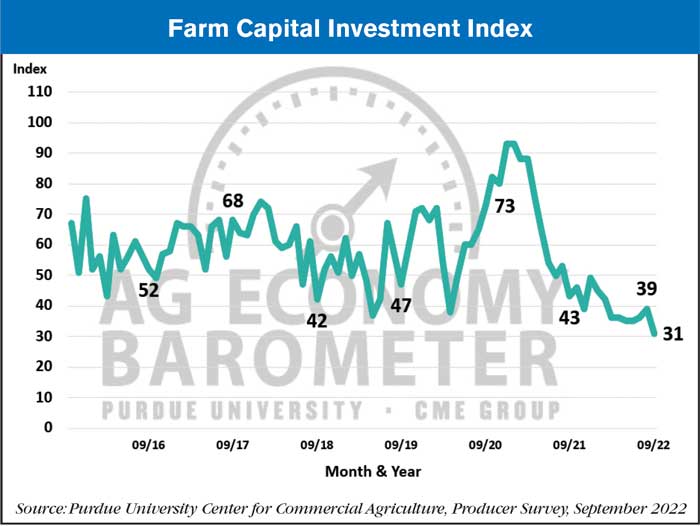

According to the latest update to the Ag Economy Barometer from Purdue/CME Group, the Farm Capital Investment Index hit another record low reading in September at 31, with producers continuing to indicate they do not view this as a “good time” to make large investments in their farming operations

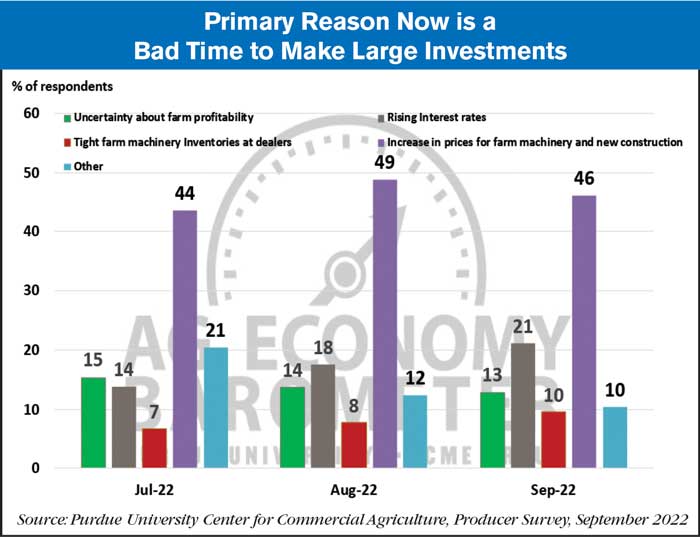

Among those farmers who believe it's a bad time to make large investments, the percentage choosing rising interest rates as the primary reason has risen from 14% in July to 21% in September. The percentage citing increasing farm machinery prices as the primary reason has remained above 44% since July.

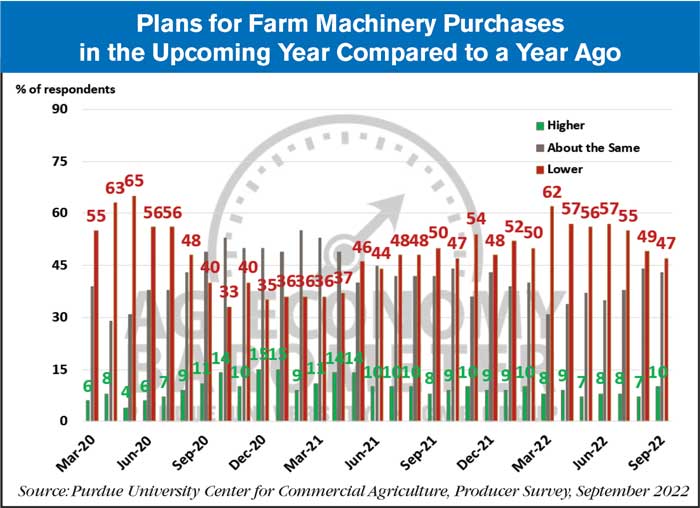

At the same time, however, the percentage of farmers saying they plan to lower their farm machinery purchases plans for the coming year has been declined for 3 months in a row, from 57% in June to 47% in September.

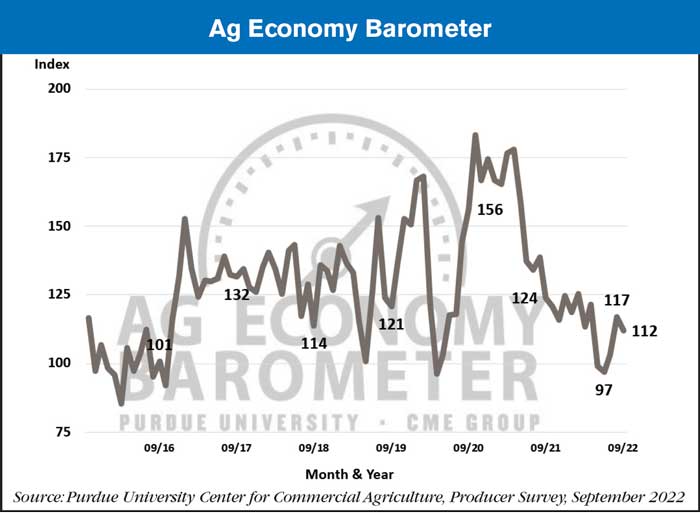

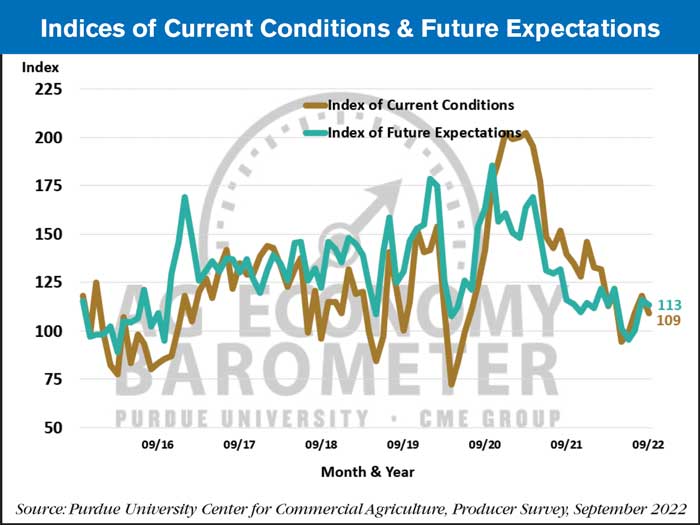

The Ag Economy Barometer index drifted lower to a reading of 112 in September which was 5 points lower than a month earlier. The decline in farmer sentiment was primarily the result of producers’ weaker perception of current conditions as the Current Conditions Index declined to 109, 9 points lower than in August. The Index of Future Expectations also weakened slightly, declining 3 points from a month earlier to a reading of 113.

![[Technology Corner] What an OEM Partnership Means to an Autonomy Startup](https://www.agequipmentintelligence.com/ext/resources/2024/09/26/What-an-OEM-Partnership-Means-to-an-Autonomy-Startup.png?height=290&t=1727457531&width=400)

Post a comment

Report Abusive Comment