It is commonly quoted that Jeff Bezos said “Your margin is my opportunity” in seeing the “large” margins of competitive retailers or the margins in other industries that Amazon had not expanded to, inferring Amazon could one day absorb that margin in their business.

There are questions as to whether Bezos said the quote or not, but regardless if we look at the Amazon way, we know Bezos sees a competitor’s focus on margins and other financial ‘ratios’ as an opportunity for Amazon since the competitor will cling to them and their way of doing things while Amazon focuses on doing what’s in the best interest of the customer and accruing the highest absolute free cash flow on a long time horizon filtering through the Amazon business vs. short term margin KPI’s.

This same quote could come from John Deere, specifically singling out crop input manufacturers margins.

(Note: For clarity, John Deere has NOT stated this publicly nor have I heard anyone from Deere say it ever…I simply am using it as an interesting point of reference to illustrate a potential point of weakness in crop input manufacturers current revenue model as new technology comes to the market place)

At John Deere’s Leaps Analyst event there was an emphasis that their new technologies are going to “unlock” $150 billion in total market benefit to farmers. Some of this might be in new value creation by enabling precision harvest management (eg: less harvest losses) on their combines for example, but some of it will come from cutting out certain expenses of farmers, like crop protection product waste, directly hindering crop input manufacturers sales and margins. Deere has been building out tools that are centered around the future of farming, not what it has historically been.

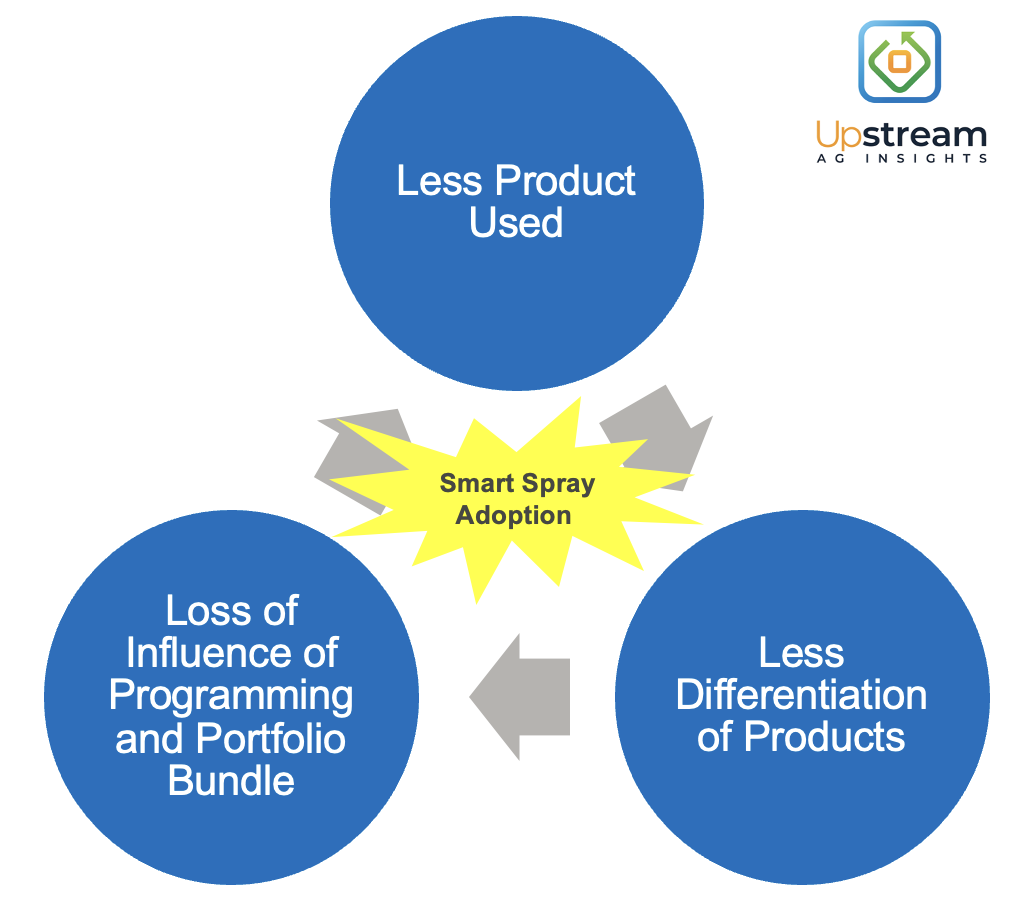

When it comes to smart spraying technology, specifically green on green, coming to the market there has been an emphasis on the reduction in herbicide usage. This may occur in instances, but there is actually a double whammy that I have neglected to talk about until now: the commoditization of active ingredient IP, trait IP and customer relationships.

In order to illustrate this I will walk through the concept of “commoditizing your complement” and how the ramifications could impact crop input manufacturers and retailers, reinforcing a necessity to rethink business models, bundles and go-to-market strategies.

Substitutes vs. Complements

From economics class we will all remember that every product in the marketplace has substitutes and complements.

A substitute is a different product you might buy if the first product is too expensive. Chicken can be a substitute for pork. If you’re a chicken farmer and the price of pork goes up, the people will want more chicken. Basic supply and demand.

A complement is a product that you usually buy together with another product. Gas and cars are complements. Coffee and cream are complements. Computer hardware is a classic complement of computer operating systems.

The key insight regarding complements is that demand for a product increases when the prices of its complements decrease.

An area we can look at this in agriculture is crop protection products and sprayer equipment. Sprayers are complements to crop protection and seed products.

Commoditize Your Complement

In 2002 Joel Spolsky identified and began highlighting the pattern of companies commoditizing their complement. Companies would seek to own a “choke point” in the value chain where they were a necessity and they could commoditize the layers above or below them in the value chain.

This can be effectively illustrated by Microsoft with IBM in the 80’s. IBM licensed the PC-DOS operating system from Microsoft without Microsoft giving them exclusivity. This made it possible for Microsoft to license the same thing to other computer hardware manufacturers who had essentially cloned (legally) the IBM PC using IBM’s own documentation. Microsoft was working to commoditize the computer hardware. Soon, the computer itself was basically a commodity with lowering margins, while Microsoft essentially made themselves into a monopoly because it was relied upon, growing in sales and margins.

The Jobs-to-be-Done Lens Behind Crop Input Decision Making

Business strategy legend Clay Christensen came up with Jobs to Be Done theory.

The theory of Jobs to Be Done is a framework for better understanding customer behavior.

Basically the framing is that people don’t “buy” products, they “hire” them to perform some job in their life or within their business that moves them forward to an outcome or goal.

It’s based on the classic quote that “people don’t want a quarter-inch drill bit, they want a quarter-inch hole”. The basic premise of the idea is to figure out what kinds of situations people might find themselves in, what kind of pains they experience, and why they might go looking for solutions to solve that problem.

In the instance of agriculture there are a lot of pains and problems that needs to be solved.

In the instance of crop protection products, there is a need to protect the crop from a specific pest. If we think about weeds in a field, then we would naturally say the “job to be done” is to kill the weed. But the “job to be done” at a level higher is to have a weed free field (which could be supportive of other future efforts from John Deere in the combine, but that’s for a different article) and then there are a continuum of parameters that each herbicide is measured upon before “hiring” the right herbicide for the job, including:

- efficacy on target weeds

- crop type (and trait)

- crop safety

- price (and programming)

- tank mixability

- soil residual

In the system we currently operate in, each herbicide will be differentiated in some way (either worse or better) vs. competitors across each of those continuums to which a farmer or agronomist will determine the best fit based on their specific needs. Along those parameters are how the majority of how herbicides are marketed and positioned today, being differentiated across one or some combination of those parameters allows organizations like Corteva or Syngenta to make incremental margins on their IP protected products and compete against generic products or one another.

Additionally in the system we currently operate in, the sprayer has to spray the entire field. Today, performance of a herbicide, which is the ultimate arbiter of the job to be done (weed free field), will deliver essentially the same outcome whether using a John Deere 612R or a Case IH Patriot 4450. There is some nuance in efficiencies due to water tank size, service thanks to dealership choice or even a tweak in nozzles but generally the efficacy and all other performance parameters of a herbicide on Palmer Amaranth in corn or kochia in wheat comes down to the herbicides unique performance capabilities and the herbicide trait in the crop variety, not what sprayer is being used. Today, the sprayer is a complement to the herbicide.

What happens when the system changes and the biggest point of differentiation is the sprayers ability to identify and spray weeds with precision while having multiple tanks? All of a sudden the value of tank mixability, crop safety, price and even to a degree, relative efficacy fundamentally decrease in importance and the ability to “see and spray” effectively becomes the “choke point” in where value accrues to, commoditizing the value of differentiated herbicides leading to lower margins for crop input companies. And it might not stop at herbicides and herbicide traits.

Disruption Through Complements

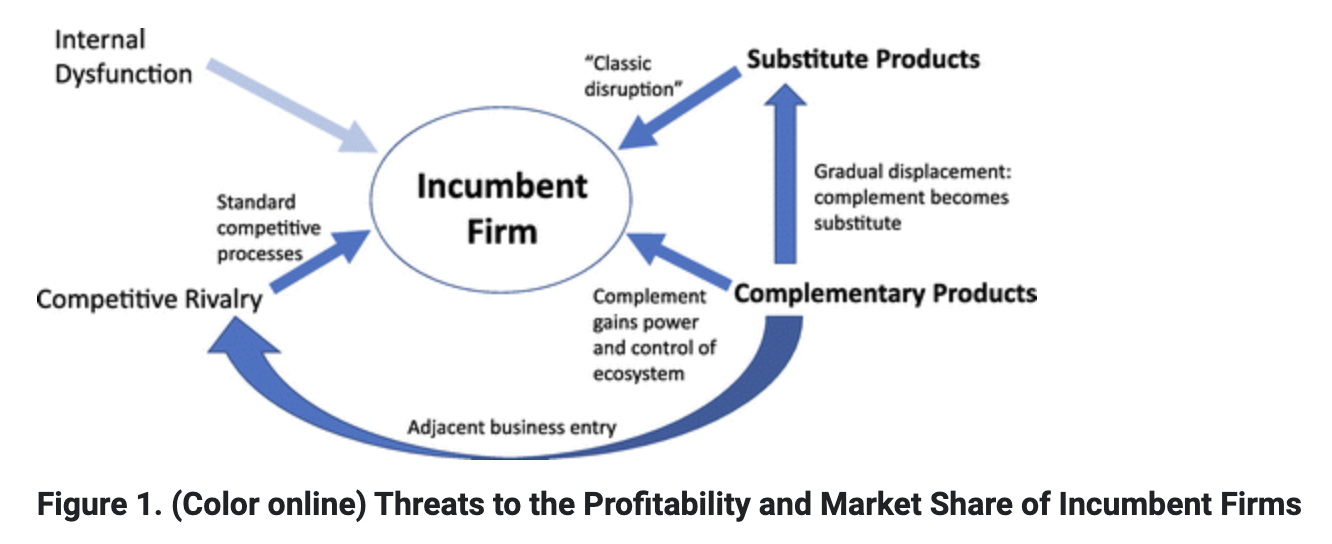

Disruption through complements arises from a combination of forces according to strategy leaders Ron Adner and Marvin Lieberman:

- technological change alters the calculations of cost and benefit

- organizational learning alters the understanding of opportunity

- capability building alters the complementor’s effectiveness in pursuing new goals.

Source: Disruption Through Complements, Ron Adner and Marvin Lieberman

Smart spraying more specifically commoditizes herbicides in a combination of two different types of disruption through complements.

The first and less commonly talked about with this technology is through reduced influence and margin, which is what was alluded to above. From Adner and Lieberman’s study (emphasis mine):

The first mode of disruption through complements involves commoditization of the core offer. Unlike traditional substitution, the impact here is not reduced demand for the core but, rather, reduced influence and margin. Commoditization shifts the “locus of differentiation” from one position in the system to another.

If we read the below explanation of disruption through compliments, we get almost a perfect illustration of what I have talked about with herbicides and sprayers (emphasis mine):

Firm A, which produces the core offer, is initially dominant in the ecosystem, but a strategic change empowers firm B, which produces the complement. As the power of the complement rises, the added value of firm A falls, contributing to a commoditization of firm A’s role. Commoditization occurs when (1) the complement reduces the entry barriers to participation in the core, for example, by reducing the fixed costs of operation required for entry, or (2) the complement becomes a key driver of differentiation, determining the pace and direction of innovation, or (3) the complement becomes the guarantor of quality, increasing the substitutability among core producers in the eyes of consumers.

The second way disruption through compliments occurs is by what we have typically focused on with green on green smart spraying; a reduction in usage of the core product:

Most critical for understanding ecosystem disruption is the third trajectory, value inversion, whereby the complement’s continued improvement beyond a certain point begins to undermine the focal offer’s value.

In the paper, they even highlight almost our specific example for this second means of complement disruption:

Smart tractors reduce waste in planting and, hence, volumes of seeds and fertilizer used.

If we think through the lens of “stacking the deck” in ones favor, a company eroding the influence of its complementor across two different mechanisms theoretically increases the chance of commoditization over time and the value accruing to a company like John Deere, or anyone else with novel optical intelligence systems.

Both of these happening in unison turns itself into a classic negative fly wheel for input companies surrounding their core business:

This gives generic products an in-road and forces manufacturers to try and differentiate across other areas in search for generating higher margins and more revenue. Crop protection companies can attempt to create unique bundles, say through novel types of insurance or financing to differentiate and be the commoditized product of choice, however that will still eat into product margins.

Commoditizing Other Crop Input Segments

The point of emphasis today has been herbicides and herbicide traits, but this framework can be a way to understand what technologies might commoditize other portions of the crop input value chain. Just like with influence erosion in ag retail, when the source of information and differentiation shifts, your offering gets commoditized.

If we think about this in the context of other hardware solutions partnering with autonomous sprayers we can see it’s not just about what capabilities the sprayer has, but what hardware it is connected to (the ecosystem) and data it can access; consider remote sensing of insects and new business model creation highlighted in the December 5th 2021 edition of Upstream Ag Insights. Insects and insecticides are different than herbicides and weeds therefore the commoditization dynamics are changed, but not eliminated.

What about connecting plants so that a sprayer sensor knows before humans the exact abiotic stress a plant is feeling? How does that influence management of diseases? The utilization of products? The business models offered? Companies like *InnerPlant and their ability to create the Internet of Plants bring these capabilities to a realm of possibility.

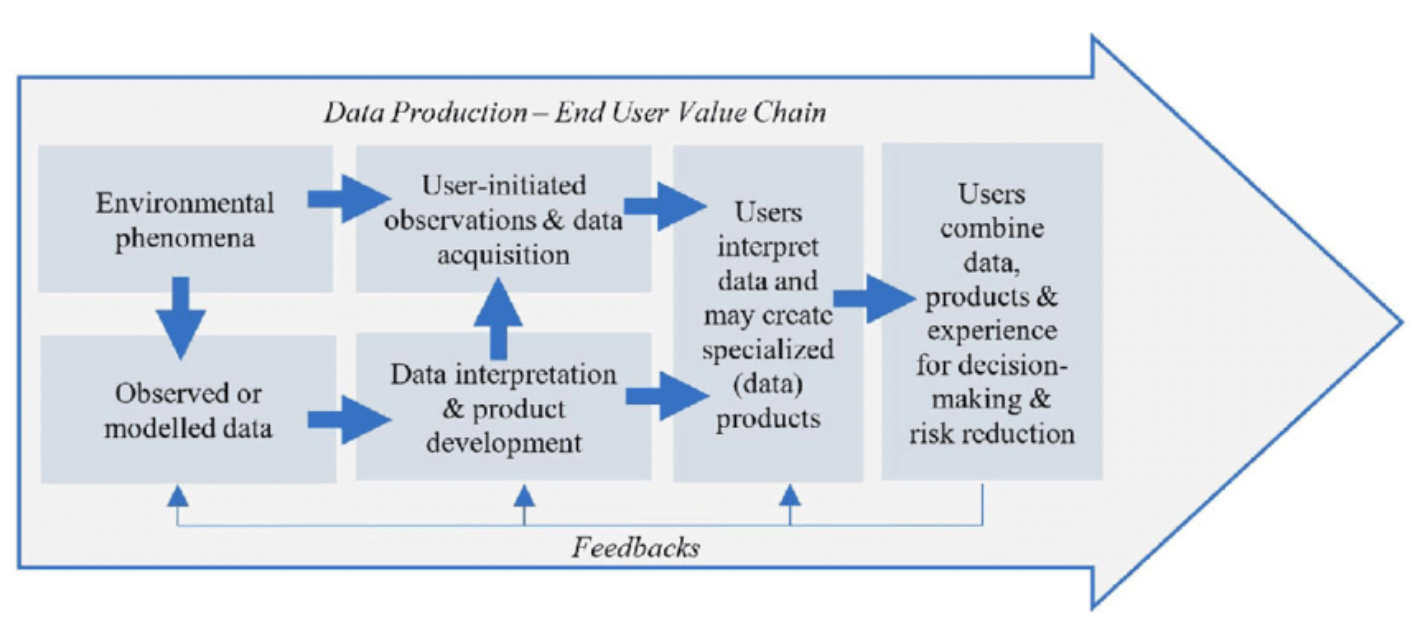

We often think about ag in the physical supply chain, but it’s interesting to consider how the information value chain shifts when new technologies are introduced to the current system:

Source: Research Gate

When thinking about the information value chain it brings up the obvious need to collaborate in order to innovate. What companies can crop input manufacturers partner with to re-imagine their business model? Differentiate their products? Inform their business and ultimately get ahead of any potential complement disruption? We are already seeing companies like Syngenta move towards a soil offering and we see partnerships like that of xarvio, Bosch, AGCO and Raven in the smart spray world as well.

When the point of power changes in a value chain, it can fundamentally shift the product selection approach and customer purchase journey. There is a chance we see this through smart spray technology, whether it is the likes of John Deere or an up and coming company like Swarm Robotics or Precision.ai. This could even lead to adapting distribution strategies of crop input products and lead novel partnerships. For example, if a company like Deere leverages their ecosystem and they bring certain players in, say a generic crop protection provider, that optimizes around the Deere system in a strategic partnership, what does this do to customer product selection and therefore retail margins and competitor crop protection manufacturer margins? It’s likely Deere doesn’t want to pick and choose, but for the groups that more openly collaborate with Deere (I assume Deere has been collaborating at some level currently) they are likely to be in a better position long term.

There will always be a need to physically distribute products and to support that product use, but where the margin disproportionately accrues to in the value chain changes because of who has the information to inform the decision and the ability to execute towards the best possible outcome.

Final Words

The framework of commoditizing your complement can be applied to other areas of agriculture, such as farm management software and satellite imagery as one example. But the glaring fit is at the $100+ billion dollar crop protection and trait market.

There could be a chance that novel ingredients become disproportionately valuable in some instances of smart spraying (eg: new mode of action to manage complex multi group resistance), the general application being made will not need this level of differentiation.

With new technology comes the need to re-think traditional systems along with where we stand within the system. As Alvin Toffler says:

The illiterate of the 21st century will not be those who cannot read and write, but those who cannot learn, unlearn, and relearn.

To apply this to the inputs space, as smart spray technology (specifically green on green or other technologies) becomes a staple in the coming decade, the groups that can unlearn their current business model and go-to-market strategies and relearn or build one that fits into a new system, will have the highest likelihood of maintaining margins and gaining a disproportionate share in the market.

*Disclosure: I am an investor in InnerPlant.

![[Technology Corner] What an OEM Partnership Means to an Autonomy Startup](https://www.agequipmentintelligence.com/ext/resources/2024/09/26/What-an-OEM-Partnership-Means-to-an-Autonomy-Startup.png?height=290&t=1727457531&width=400)

Post a comment

Report Abusive Comment