According to recent analysis from Karreta Advisors, Kubota is seeing "firm demand in key markets such as the U.S. hampered by raw material prices pressuring margins."

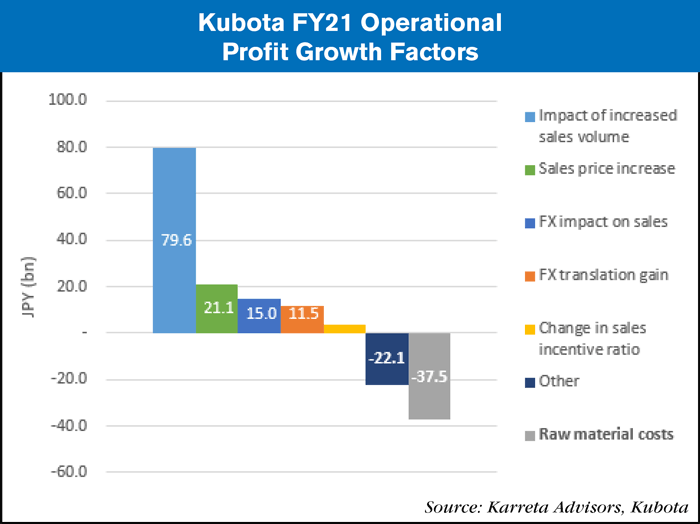

The firm points to $300 million in increased costs in Kubota's most recent 2021 earnings report due to increasing raw material prices, as well as "the positive impact of the weakening yen."

"Raw material costs rising also had a noticeable impact on inventory and consequently free cash flow generation," the analysis said. "The inventory balance skyrocketed by 36% year-over-year (despite full year sales growth of 18.5% year-over-year) to $4.1 billion. This placed pressure on working capital, resulting in low free cash flow generation which fell to only $132.8 million. We note that Kubota's track record here is rather patchy."

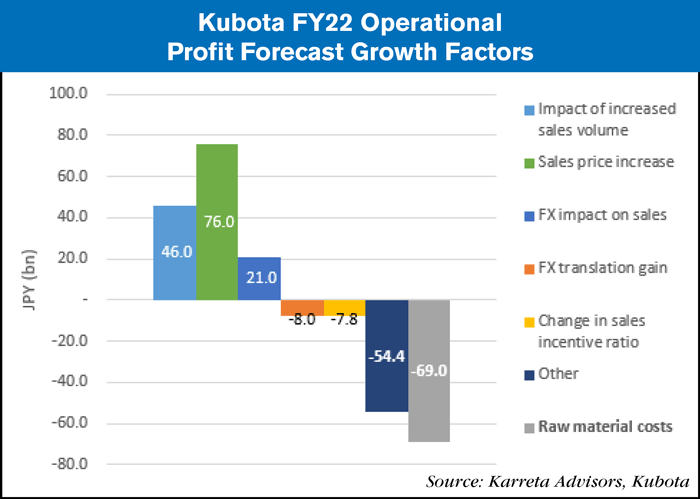

When it comes to Kubota's fiscal year 2022 guidance, Karreta Advisors' analysis noted Kubota's goal of 11.5% revenue growth and 1.5% operational profit growth were below consensus.

"We note consensus is being more bullish, with sales growth at 10.9% year-over-year and operational profit growth at 13.2% year-over-year. The company does a good job outlining its expectations as to why operational profit will only grow by $30.4 million. Straightaway we see that sales volume growth will be more muted compared to fiscal year 2021 and despite planned sales price hikes (from now an even tighter market with component shortages), the impact from raw material prices will be significant.

"With earnings growth declining year-over-year and working capital management under continued pressure, we expect to see limited free cash flow generation. Kubota has also guided Capex of $1.52 billion for fiscal year 2022 which shows a sustained commitment to investing in its business."

Karreta Advisors did note the potential for Kubota to increase prices further than currently forecast based on a tight market, saying, "Inventory constraints will give manufacturers greater pricing power, and sales channels remain relatively depleted of products."

![[Technology Corner] What are the Top 5 Applications in Autonomy Right Now?](https://www.agequipmentintelligence.com/ext/resources/2024/11/08/What-are-the-Top-5-Applications-in-Autonomy-Right-Now-.png?height=290&t=1731094940&width=400)

Post a comment

Report Abusive Comment