The latest episode of On the Record is now available! In this week's program we discuss AGCO and CNH Industrials 4Q and full year 2020 earnings, with both reporting revenues up during the quarter. In the Technology Corner, Jack Zemlicka talks about Tim Norris' new consulting business focused on precision ag companies with 5-10 employees. Also in the episode, we look at the latest numbers for UK tractor market share and Art's Way's 2020 earnings.

This episode of On the Record is brought to you by Weasler Engineering.

Deliver a seamless transfer of power between a tractor and its attached machinery with one of Weasler’s three ASABE-compliant drive shaft product lines; the Standard, the Classic and the Professional. Weasler’s Newest product line – the Standard- offers a selection of pre-configured driveshafts. The Classic and Professional lines offer variety of standard components to choose from, allowing you to customize your PTO drive shaft to meet the specifications of your job. Learn more about what Weasler can do for you by visiting Weasler.com.

On the Record is now available as a podcast! We encourage you to subscribe in iTunes, the Google Play Store, Soundcloud, Stitcher Radio and TuneIn Radio. Or if you have another app you use for listening to podcasts, let us know and we’ll make an effort to get it listed there as well.

We’re interested in getting your feedback. Please feel free to send along any suggestions or story ideas. You can send comments to kschmidt@lessitermedia.com.

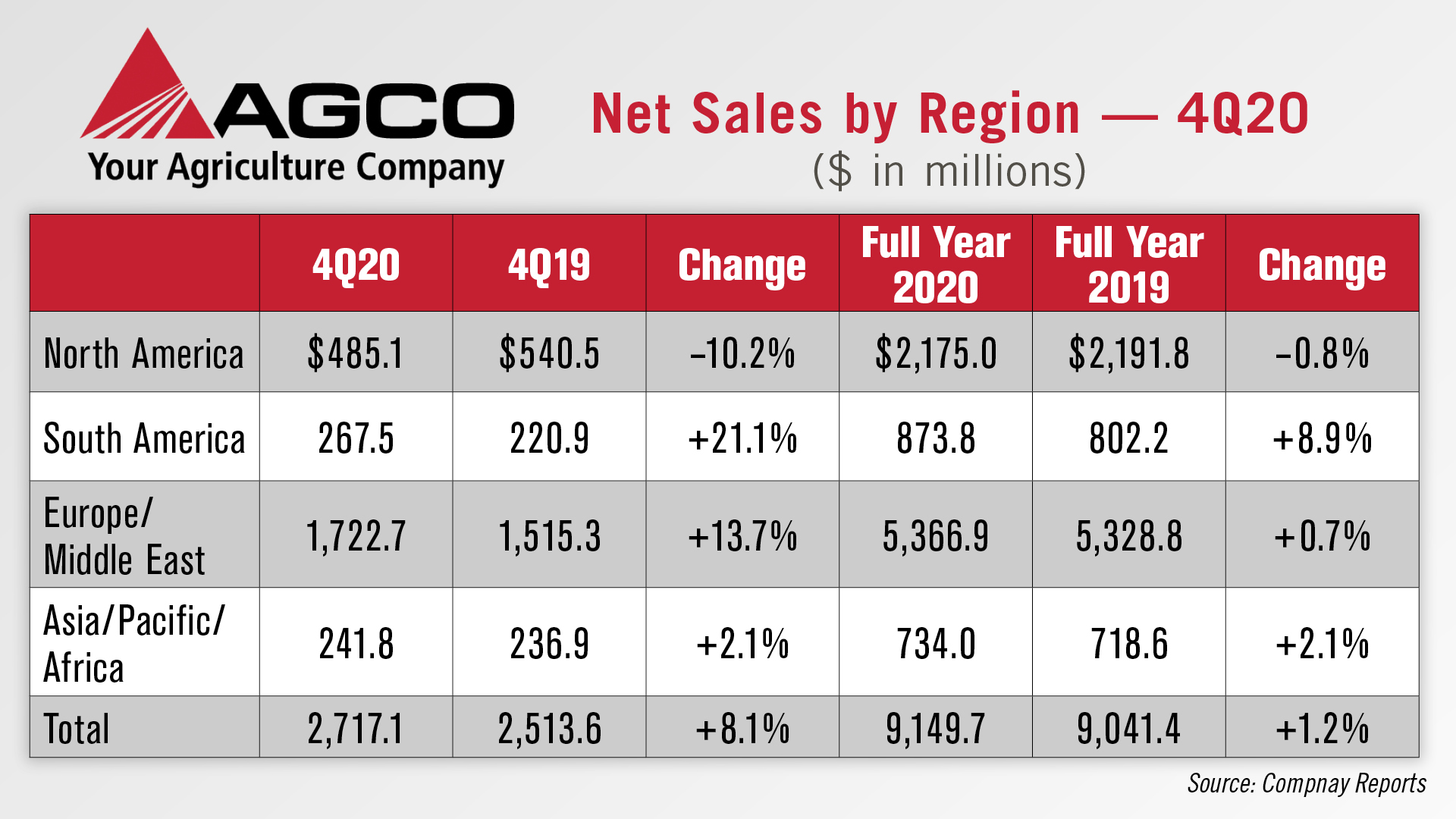

AGCO 4Q20 Sales Up 8%

AGCO reported net sales of about $2.7 billion for the fourth quarter of 2020, an increase of about 8% compared to the fourth quarter of 2019. For the full year, net sales in 2020 were approximately $9.1 billion, an increase of about 1% compared to 2019.

On a regional basis, North America was the only region where AGCO’s net sales in the fourth quarter were down, but were flat for the year. For the quarter, North American sales were down 10%. In South America, AGCO’s fourth quarter sales were up 21% and up nearly 9% for the full year. Europe/Middle East quarterly net sales were about 14% for the fourth quarter and flat for the year. Net sales in Asia/Pacific/Africa were up 2% for both the quarter and the full year.

Looking ahead, AGCO is forecasting 2021 net sales to be in the range of $10.2-$10.4 billion.

Dealers on the Move

This week’s Dealer on the Move is Cervus Equipment. The Canadian John Deere dealership group announced it will be combining its Red Deere and Olds, Alta., locations into a new 44,000 square foot facility near Penhold, Alta. The new facility is anticipated to be in service in early 2022.

Thinking Outside the Precision Box

Growing a small precision farming dealership — especially during the last year — hasn’t been easy. But the pandemic aside, the ability for ownership of a one-store or single-digit employee operation to expand its business is a challenge.

From anticipating opportunities to adapting to change — the flexibility that small precision businesses tend to enjoy can also be a limiting factor — without the right structure and foresight.

This is a developmental void in the ag industry that long-time independent precision dealer Tim Norris had seen and experienced. The realization led to a partnership with Belinda Hughes, an experienced financial advisor of small business, and the launch of Box Concepts Consulting this month.

The Ohio-based company will specialize in providing a 5-sided approach to 5-10 employee companies — primarily in the precision ag space — that defines vision, team, products, customers and resources.

Norris notes that one of the pitfalls that small business leadership tends to fall into — himself included — is hiring only like-minded people to try and expand the business. This approach can stunt the growth of a dealership, preventing owners from working on the business rather than in it.

“My first hire, I was like, I need a clone. I need somebody that can do what I’m doing and do things the way I do them. So I hired someone that was along those lines and then kept going with that second, third or fourth team member and hire a clone again. And you end up getting 4 people on your team and all 4 have the same passion and drive and skill sets that you have. But you’re lacking the person with the skill set of the person that actually can do some of the things you don’t want to do, like on the accounting side or having a vision for the company. Maybe you have that vision, but you aren’t able to spend time working on the business.”

Norris adds that Box Concepts has 2 dealerships enrolled in its consulting program, with an expectation of working with 6-8 companies per year.

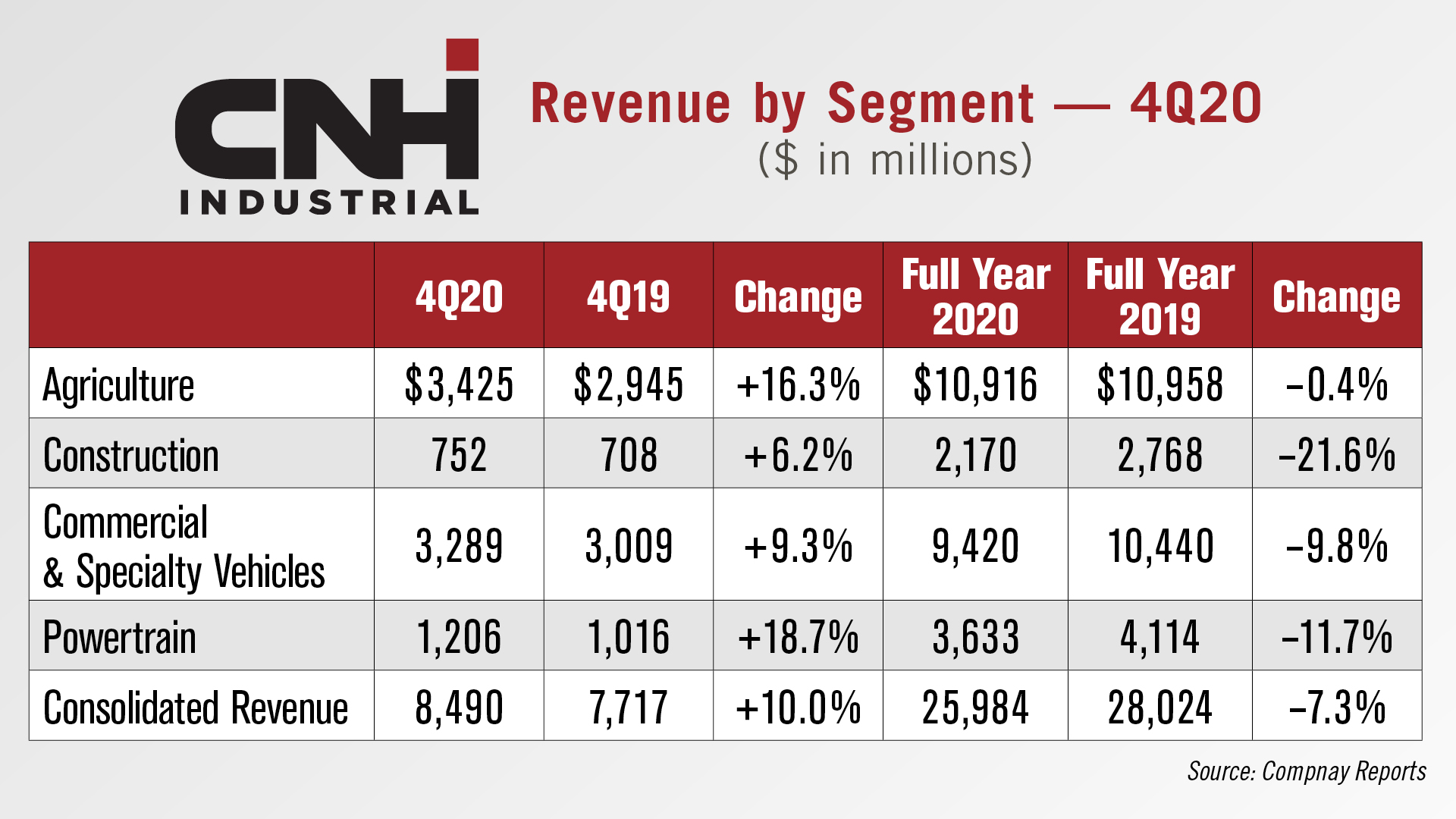

CNH Industrial 4Q20 Ag Revenue Up 16%

CNH Industrial reported strong results for the fourth quarter of 2020, with consolidated revenues up 10% to $8.5 billion. For the full year, revenues were $26 billion, down just over 7% from $28 billion in 2019.

Ag equipment revenue for the quarter came in at $3.4 billion, up 16% compared to the fourth quarter of 2019. For the full year, ag sales were flat at $10.9 billion.

Agriculture equipment demand was up in most regions. In North America, tractor demand was up 27% for tractors under 140 horsepower, and up 17% for tractors over 140 horsepower; combines were down 1%. In Europe, tractor and combine markets were up 7% and 22%, respectively. South America tractor markets were up 29% and combine markets were up 22%. Significant increase in demand for tractors was also noted in Rest of World while demand for combines was flat.

Looking ahead to 2021, CNH is forecasting net sales to be up 8-12%, including any currency translation effects.

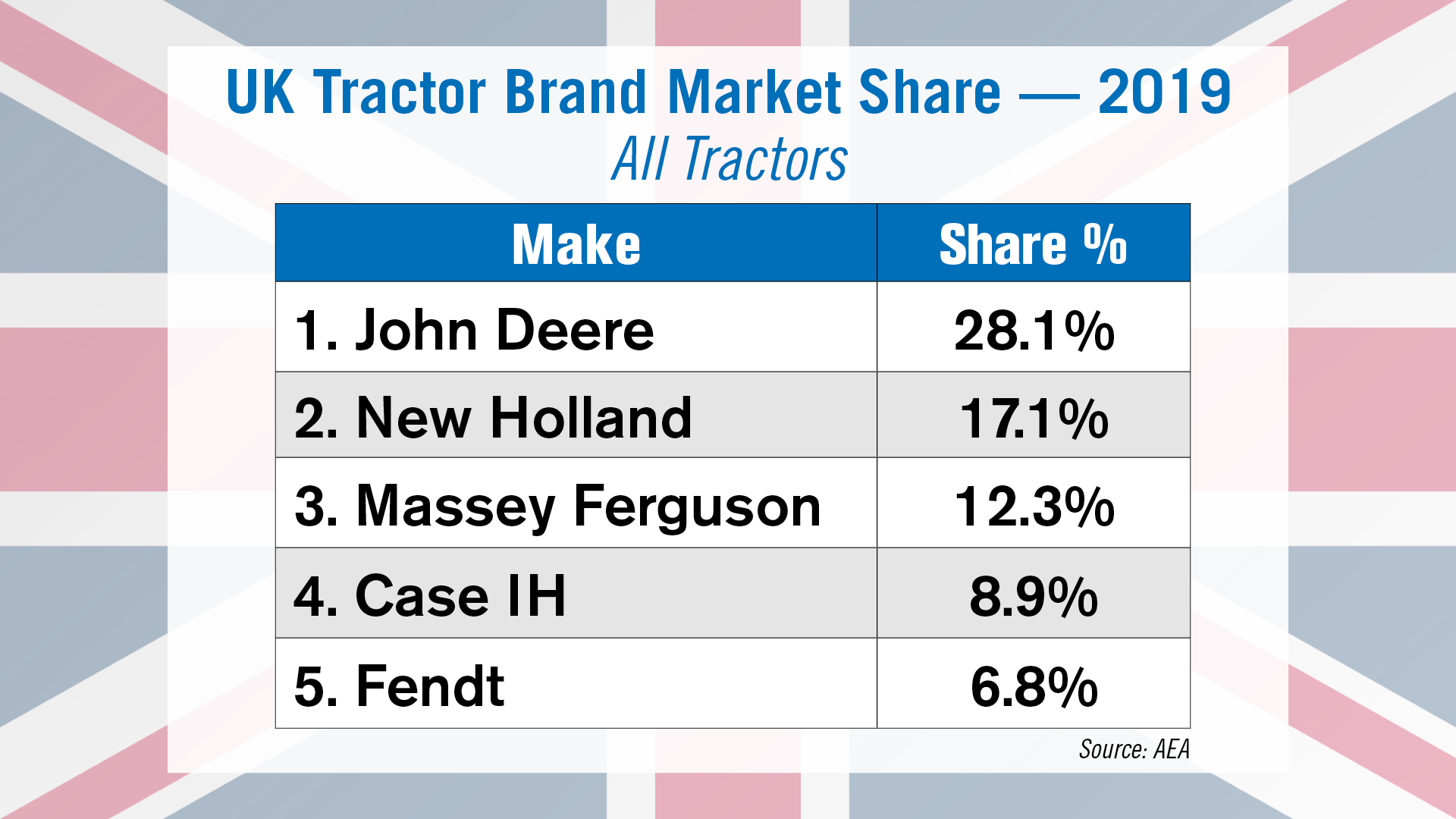

Deere Maintains Largest Share of UK Tractor Market

According to the latest data from the Agricultural Engineers Assn., the UK experienced an unusually volatile shift in tractor brands through 2019. Total volumes of new tractor registrations were mostly unchanged year-over-year, with sales of tractors 50 horsepower and over coming in at 12,040 units.

Deere continued to lead with 3,800 units registered but suffered a 3.8 percentage point drop in market share to 28.1% overall. Deere also saw a 605 unit decline in its total registrations, down 13.7% year-over-year.

Case IH reported the largest decline in percentage, dropping 296 units year-over-year to an 8.9% market share. New Holland, meanwhile, claimed 17.1% of the UK market in 2019, after a sales drop of 8.6%.

Massey Ferguson came in third following a 23% increase in sales to a 12.3% market share. Fendt held its ground with a 6.8% market share, while Valtra reported a modest increase in sales to a 5.5% market share. Among its brands, AGCO came within 1.4 percentage points of CNHI’s total market share.

Claas reported the largest increase in comparative performance in the UK in 2019, registering an additional 250 units for a 5.7% market share.

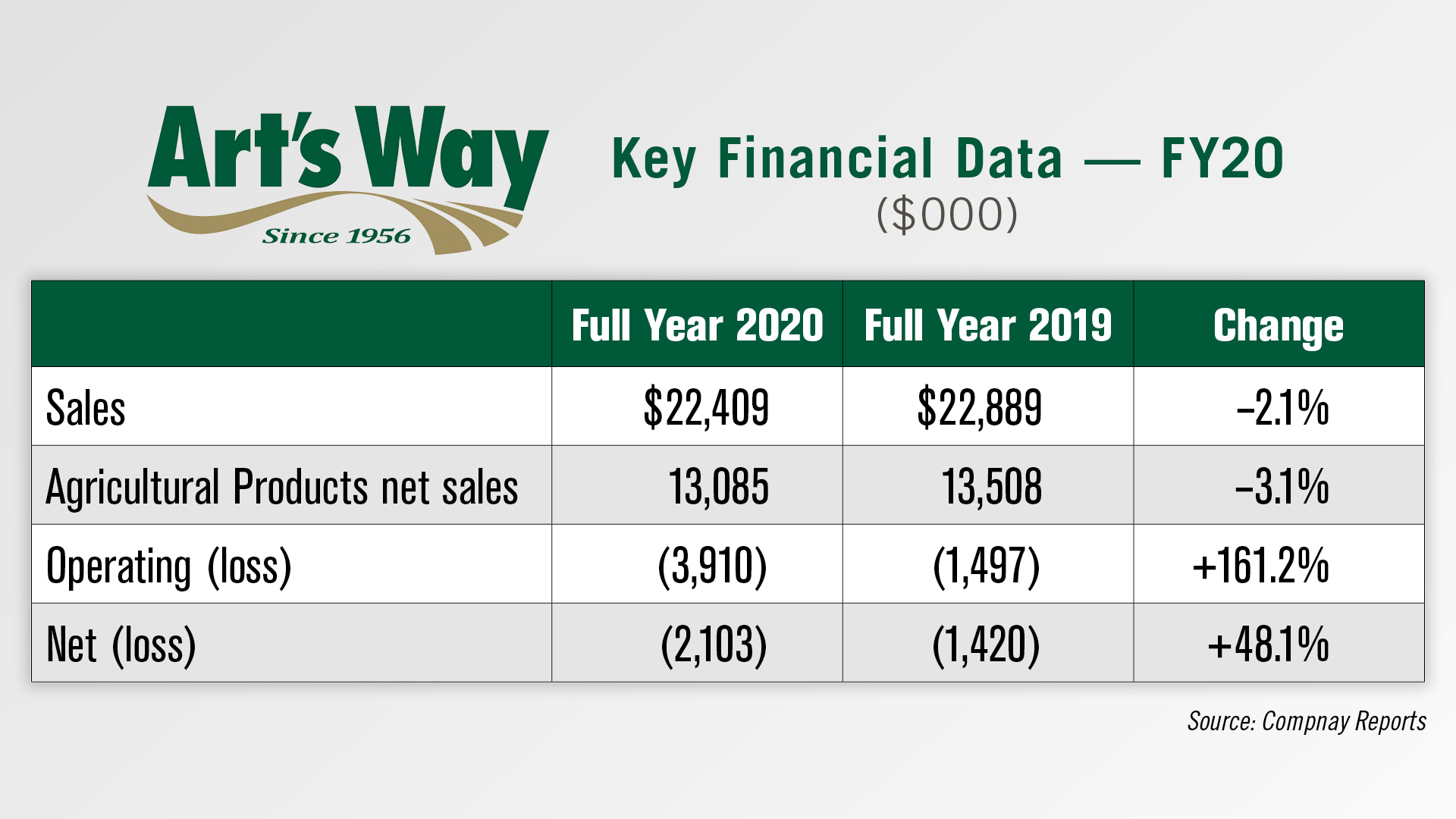

Art’s Way FY20 Ag Sales Drop 3%

Shortline manufacturer Art’s Way reported net sales of $22.4 million for the 2020 fiscal year, a 2% drop from 2019.

The Agricultural Products segment's net sales for 2020 were $13.1 million, down about 3% from $13.5 million during 2019. The company says the decrease in sales can be primarily attributed to the loss of low-margin OEM business. Art’s Way also saw decreased demand for beet equipment and forage and receiver boxes in 2020 compared to 2019.

The company, however, expects increased demand for these lines in fiscal 2021 as backlog indicates the company will have improved sales of beet equipment and will be launching a new Art's Way forage box.

Sales of manure spreaders, dump boxes and grinders improved in fiscal 2020 over fiscal 2019. The improved success of these lines provides optimism for the future as the company believes these are the core products it can market towards future growth.

Post a comment

Report Abusive Comment