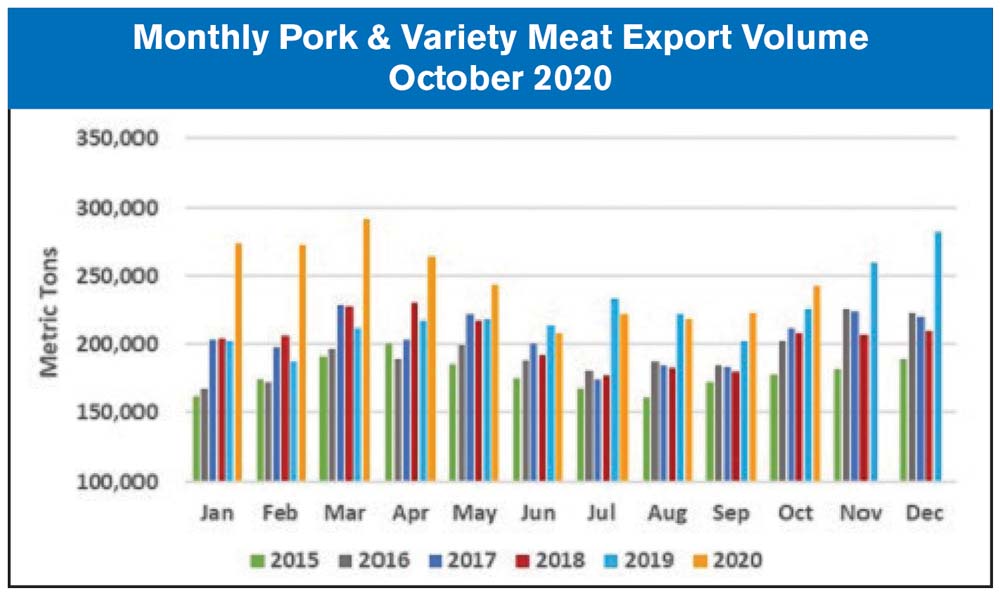

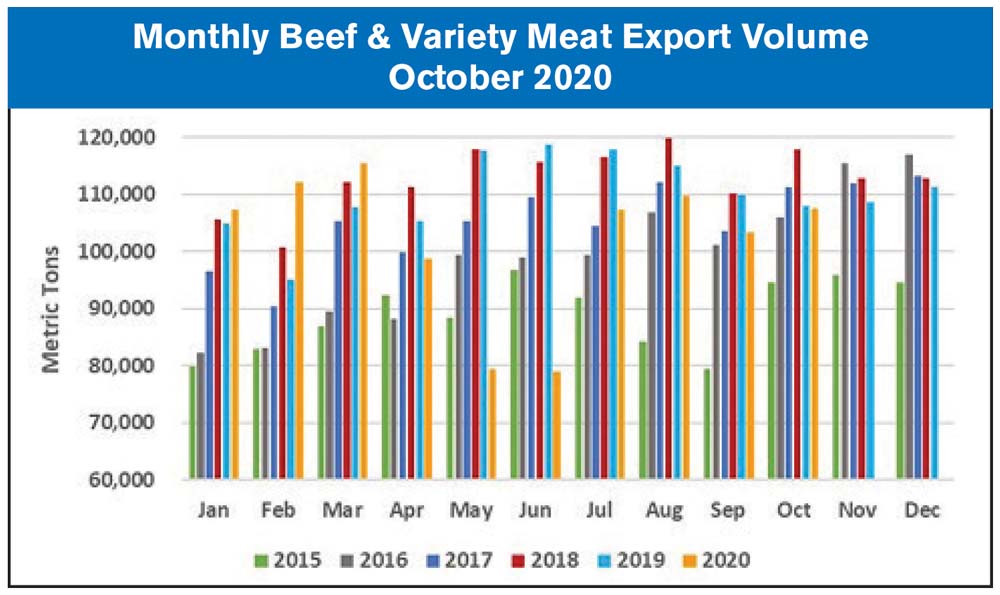

U.S. pork exports posted broad-based gains in October, solidifying 2020’s record pace, according to data released by USDA and compiled by the U.S. Meat Export Federation (USMEF). Beef muscle cut exports were also higher than a year ago in October, though lower variety meat volumes pushed total beef exports slightly below last year.

October pork exports were up 8% year-over-year to 242,536 metric tons (mt), with value also increasing 8% to $641.1 million. Through the first 10 months of the year, exports were 15% ahead of last year’s record pace at 2.46 million mt, with value up 16% to $6.33 billion. October muscle cut exports posted double digits gains at 201,723 mt (up 11%), with value up 10% to $551.8 million. This pushed January-October totals for pork muscle cuts to 2.07 million mt (up 20%) valued at $5.49 billion (up 18%).

October beef exports were slightly lower than a year ago at 107,591 mt (down 0.4%), valued at $646 million (down 0.5%). For January through October, exports trailed last year’s pace by 7% in volume (1.02 million mt) and 8% in value ($6.2 billion). Beef muscle cut exports trended higher than a year ago in October, increasing 5% to 85,445 mt valued at $573.8 million (up 1%). January-October muscle cut exports were 5% below last year in volume (791,694 mt) and 8% lower in value ($5.48 billion).

Pork Exports Gaining Strength in Wide Range of Markets

While China/Hong Kong remains this year’s leading destination for U.S. pork exports, October data showed rising momentum in several key markets. Exports to Japan were the largest since April at 34,854 mt (up 18% from a year ago), valued at $146.9 million (up 20%). These results pushed January-October exports to Japan 4% above last year’s pace in volume (318,962 mt) and 6% higher in value ($1.34 billion). U.S. pork continues to increase its share of Japan’s ground seasoned pork imports, which is now 72% compared to 57% last year. Value of these imports reached $275 million through October, up 51% year-over-year, reflecting tariff reductions in the U.S.-Japan Trade Agreement and strong consumer demand for sausages and other processed pork products.

October pork exports to Mexico were the largest since March at 60,798 mt, up 11% from a year ago, valued at $104.8 million (up 8%). January-October exports to Mexico were still down 6% in volume (551,691 mt) and 12% in value ($895.5 million) from a year ago, but U.S. pork is well-positioned for a strong finish to 2020 in Mexico.

Though below 2019 levels, pork exports to Central and South America were also the largest since March. Led by strong performances in Honduras and Panama, October exports to Central America reached 8,853 mt valued at $21.2 million, each down slightly year-over-year. Through October, exports to the region trailed last year’s pace by 2% in both volume (75,637 mt) and value ($182.5 million). A surge in exports to Chile pushed October exports to South America to 12,941 mt (down 7% from a year ago) valued at $30.5 million (down 15%). January-October exports to South America remained 25% below last year’s pace in volume (96,651 mt) and 26% lower in value ($238.7 million), but demand in the region continues to show signs of recovery.

Pork exports to China/Hong Kong remained well above year-ago levels in October but made up a significantly smaller share of total U.S. shipments when compared to totals posted earlier this year. October exports were 70,865 mt, up 16% from a year ago, valued at $157.5 million (up 11%). Through October, exports to China/Hong Kong were 86% above last year’s pace in volume (871,612 mt) and 104% higher in value at just under $2 billion.

Beef Exports to China Soaring; Established Asian Markets Also Strong

October beef exports to China climbed to a record 6,831 mt valued at $48.1 million, easily exceeding previous record levels reached in recent months. Through October, exports to China were up 219% in volume (24,709 mt) and 187% in value ($177.7 million) from a year ago, but have been especially strong since China’s foodservice sector rebounded from COVID-19 related restrictions imposed earlier in the year. In Hong Kong, where the foodservice recovery has seen more interruptions, January-October exports were down 5% from a year ago in volume (67,882 mt) and 9% lower in value ($541.4 million).

Beef exports to leading market Japan achieved solid growth in October, topping last year by 10% in volume (23,353 mt) and 8% in value ($146.8 million). Through October, exports to Japan trailed last year’s pace by 2% in both volume (257,083 mt) and value ($1.61 billion). Japan has increased imports of U.S. short plate, largely for use in gyudon beef bowl restaurants which have performed relatively well due to their quick-serve and takeaway nature. But this growth has been partially offset by smaller volumes of chuck and loin cuts that are more reliant on full service, sit-down dining. U.S. market share for Japan’s total beef imports was 43.7% through October, up from 40.5% last year, as Australia’s share declined from 45.5% to 41.2%.

Exports to South Korea were slightly below last October at 19,389 mt, with value down 2% to $135.4 million. January-October exports to Korea were 3% below last year’s record pace at 209,101 mt, while value was down 6% to $1.46 billion. However, chilled exports to Korea were up 29% from last year’s record at 58,370 mt, valued at $554 million (up 27%). U.S. market share for Korea’s chilled beef imports was 64.2% through October, up from 61.7% last year. U.S. market share for total beef imports also increased, climbing from 50.4% last year to 52.9% in 2020.

U.S. beef is also coming off a record year in Taiwan, and could set new highs in 2020. October exports to Taiwan reached 5,877 mt (up 15% from a year ago) valued at $46.7 million (up 9%). Through October, exports exceeded last year’s pace by 2% at 54,162 mt, though value was down 2% to $460.3 million. Chilled exports to Taiwan were up 21% to 22,140 mt, valued at $256 million (up 15%). The U.S. dominates Taiwan’s chilled beef market, capturing a 76% share in 2020.

![[Technology Corner] What are the Top 5 Applications in Autonomy Right Now?](https://www.agequipmentintelligence.com/ext/resources/2024/11/08/What-are-the-Top-5-Applications-in-Autonomy-Right-Now-.png?height=290&t=1731094940&width=400)

Post a comment

Report Abusive Comment