The latest episode of On the Record is now available! In this week's episode, the latest Dealer Sentiments report shows a net 54% of dealers report their new equipment inventory is too low, the highest since 2011 when we first started gathering this data. In the Technology Corner we take a look at Raven's new Autonomous AutoCart. Also in this episode, Titan Machinery reports 3Q ag revenues were up 3%, Deere's FY20 ag sales were down 6%, and a look at how the election impacted farmer sentiment.

On the Record is brought to you by Bellota.

For Bellota, the key to quality in their planting and tillage parts is the perfect balance between hardness and toughness that is attributed to the 8 million product units they produce every year.

Professionals around the world understand that working with Bellota products makes their tilling, planting and seeding work more precise and uniform, producing less breakages and time-consuming stops. Improve profitability with Bellota’s durable, long lasting line of products. Visit BellotaAgrisolutions.com

Bellota - a growing brand of Agrisolutions.

On the Record is now available as a podcast! We encourage you to subscribe in iTunes, the Google Play Store, Soundcloud, Stitcher Radio and TuneIn Radio. Or if you have another app you use for listening to podcasts, let us know and we’ll make an effort to get it listed there as well.

We’re interested in getting your feedback. Please feel free to send along any suggestions or story ideas. You can send comments to kschmidt@lessitermedia.com.

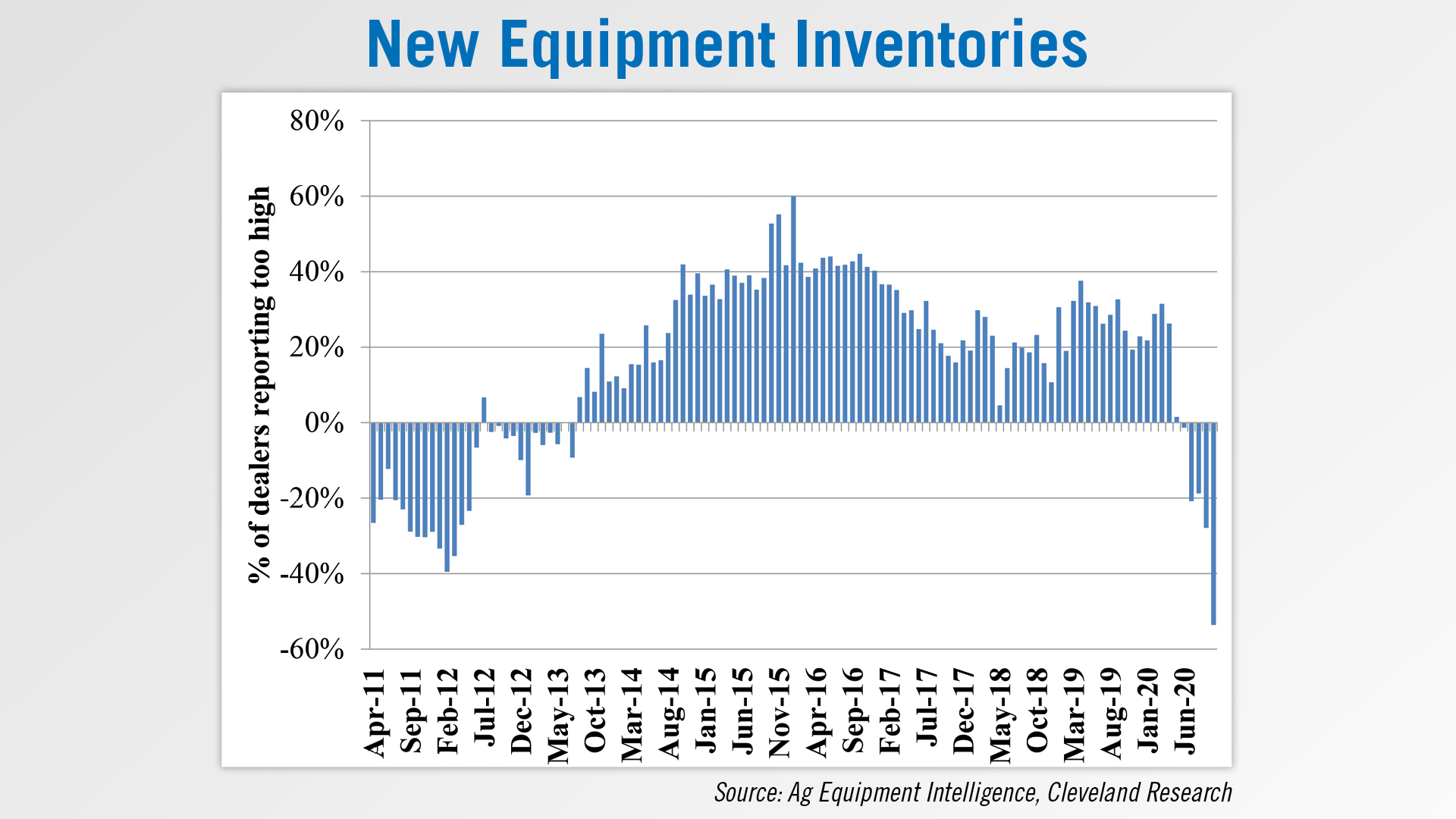

Dealers Report Record Low New Inventory

According to the November Dealer Sentiment & Business Conditions Update, over half of surveyed dealers reported their new equipment inventories “too low” in October.

A net 54% of dealers reported inventories “too low” in October vs. a net 28% reporting inventories “too low” in September. This is the highest net percentage of dealers reporting new equipment inventories “too low” since the data was first collected in 2011. Among surveyed dealers in the most recent update, 2% reported their new equipment inventories “too high,” 42% reported them in line with the previous month and 56% reported them “too low.”

Dealer commentary suggested survey respondents were having trouble stocking new equipment. One dealer from Canada said, “Our sales were doing great but then we could not get product. If we could get the unit, we could not get the attachment.”

Another dealer from the Corn Belt mentioned an increased interest in new equipment, saying, “With the aging equipment on the farm and equipment worn out beyond repair, there are many customers not trading their used and buying new outright.”

Dealers on the Move

This week’s Dealer on the Move is Fennig Equipment. The shortline-only dealer added a second location in Norwalk, Ohio.

Increasing Autonomous Availability

Anticipation mixed with a little anxiety as to how soon autonomous vehicles will be roaming farm fields in North America continues to build. But this week, Raven Autonomy announced it is accepting pre-orders for its first commercially-available autonomous system.

AutoCart, an autonomous grain cart system, will be available for the 2021 harvest season. The technology allows operators to control and monitor a driverless tractor from the combine cab, allowing a single grain cart driver to cover 340 hours in the tractor cab during harvest.

The announcement is another step in the gradual commercialization of autonomous vehicles in ag. So what type of farm operation will be prime candidate for autonomous systems?

Paul Bruns, business development manager with Raven Autonomy, shares his outlook for the size and growth needs that could determine the interest and need for autonomous equipment.

The conversations I’ve had throughout the Midwest to start with, have been producers that are anywhere from 1,000 – 3,500 acres in size. They’re trying to grow, they want to grow, but it’s really hard to add that one extra person full-time. And it’s even harder to find that person for part of the season. That’s been the big push.

You can hear more from Paul Bruns who will part of our autonomy panel at the Ag Equipment Intelligence 2021 Executive Briefing.

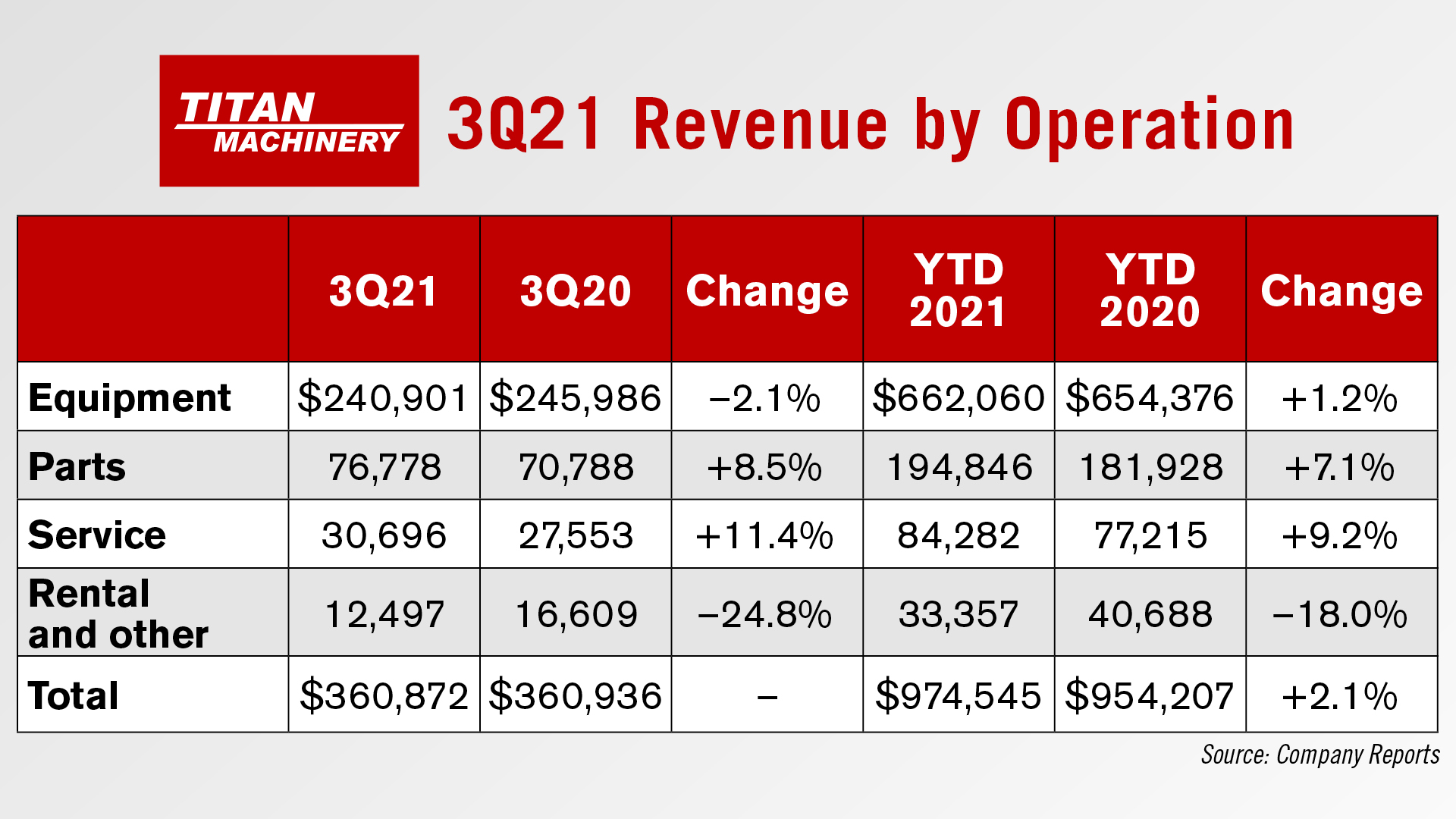

Titan 3Q20 Ag Revenues Up 3.1%

Titan Machinery, Case IH’s largest dealership group in the U.S., recently reported its third quarter earnings for fiscal 2021.

Revenue for the quarter was $361 million, flat with the same period last year. Equipment sales were $241 million for the third quarter of fiscal 2021, compared to $246 million in the third quarter last year. Parts sales were nearly $77 million for the third quarter of fiscal 2021, compared to about $71 million in the third quarter last year. Revenue from service was about $31 million for the third quarter, compared to $28 million last year.

Ag segment revenue for the third quarter was $221 million, compared to $214 million in the third quarter last year. The increase in revenue was driven by on-going strength in the parts and service business the dealership says.

David Meyer, Titan Machinery's chairman and chief executive officer, said, "We exceeded our third quarter top-line expectations due to strong parts and service performance in our Agriculture segment and better than anticipated equipment sales in our Construction and International segments. The stronger revenue, combined with continued success controlling operating expenses and driving down interest expense, resulted in a significant improvement to our pre-tax income.”

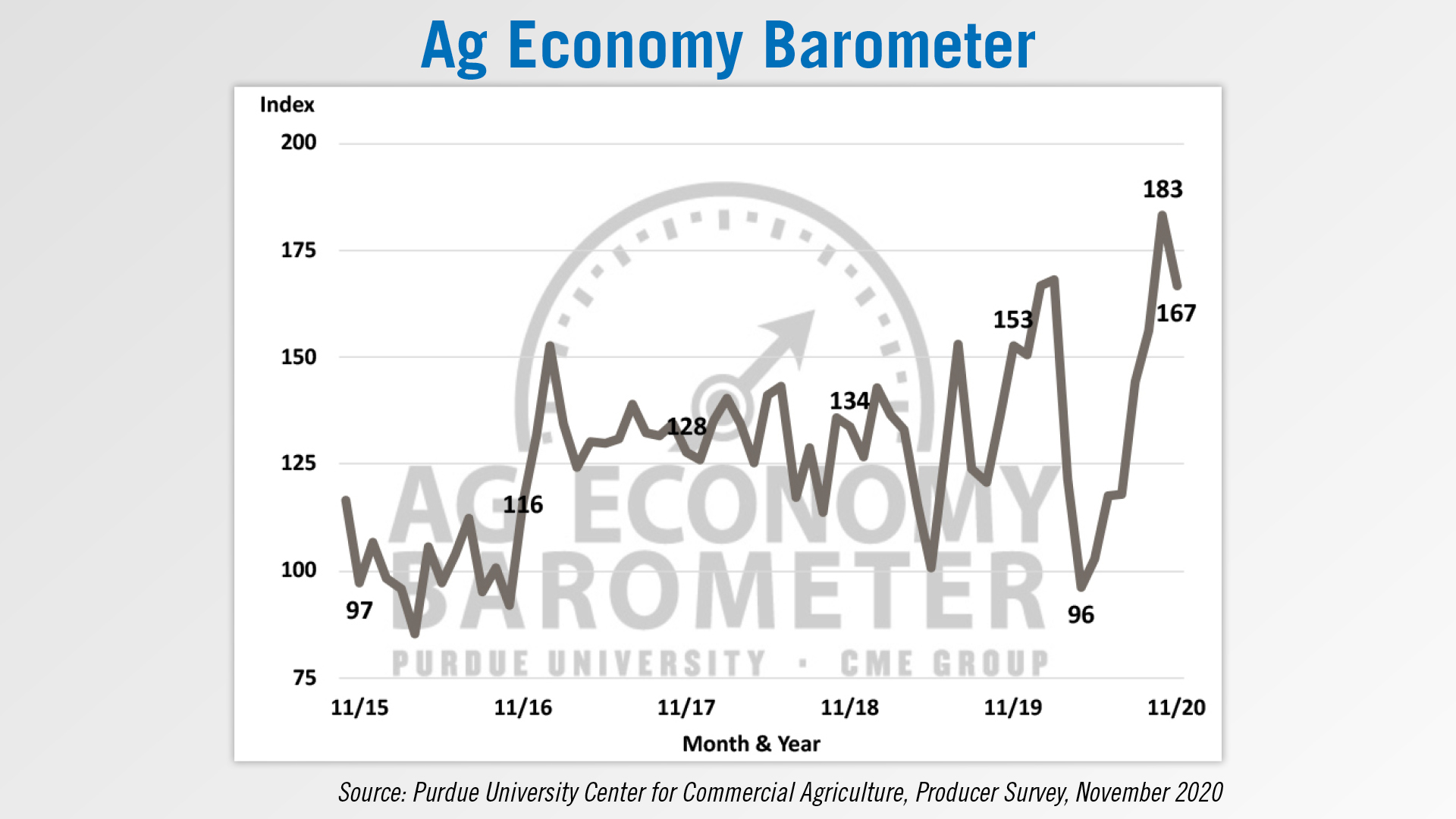

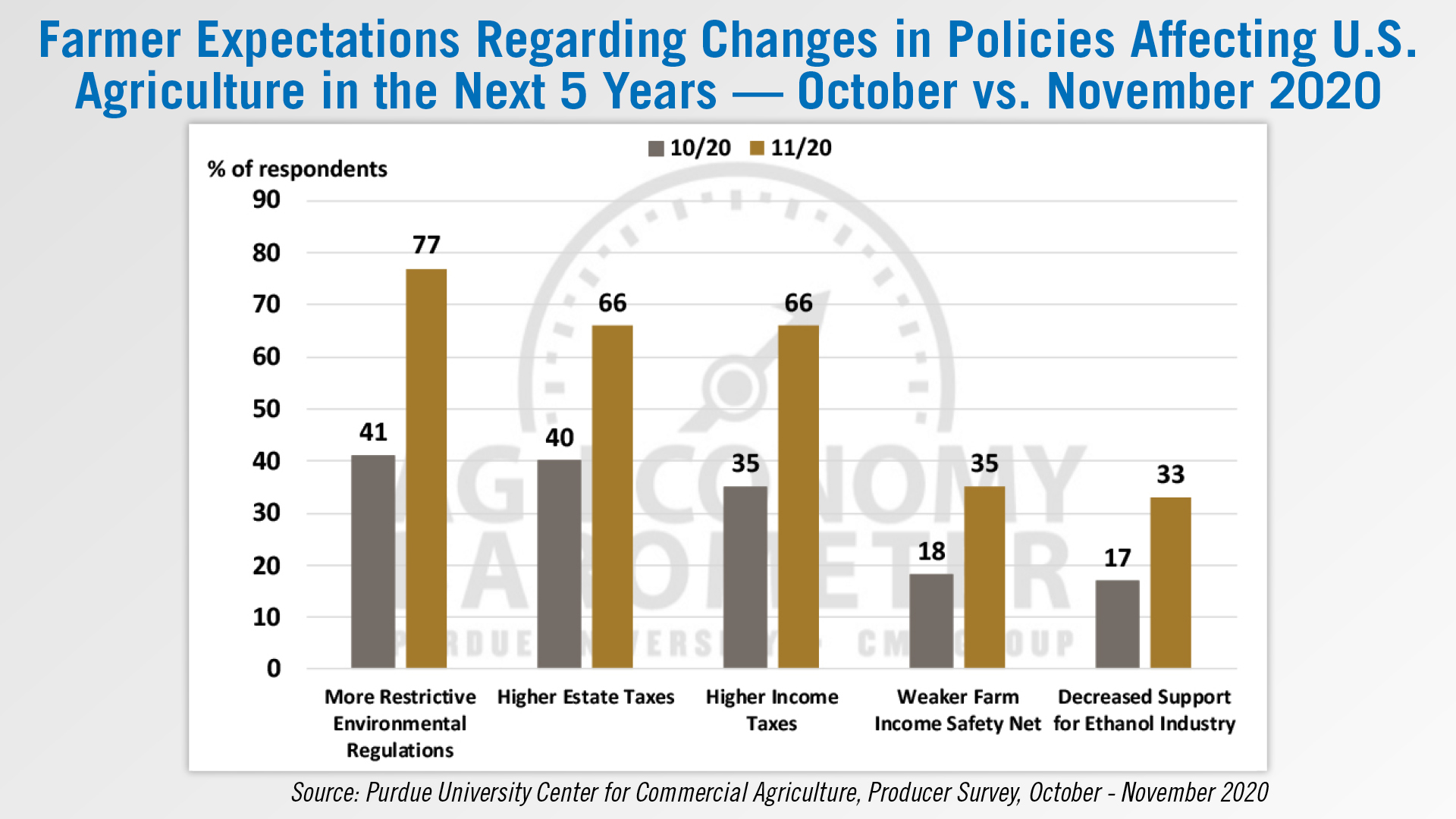

Farmer Sentiment Pulls Back Post-Election

According to the November update of the Purdue University Ag Economy Barometer, farmer sentiment has declined from October readings after 6 months of increases.

The barometer read 167 in the most recent update, down from 183 in the previous month. The decline in sentiment was attributed to farmers’ weakened future expectations, though their optimism on current conditions rose due to rallying commodity prices. Farmer optimism on making large investments in their operations fell slightly in November but remained above pre-COVID levels.

When asked about their expectations for policy changes affecting U.S. agriculture in the next 5 years, 77% of farmers said they expect more restrictive environmental regulations, up from 41% in the October survey. Some 66% of farmers in the November survey expected higher taxes rates in the next 5 years, up from the 40% who expected the same in the October survey. Some 35% of farmers surveyed in November said they expect a weaker farm income safety net in the next 5 years, and 33% expect decreased support for the ethanol industry.

Deere FY20 Ag Sales Down 6%

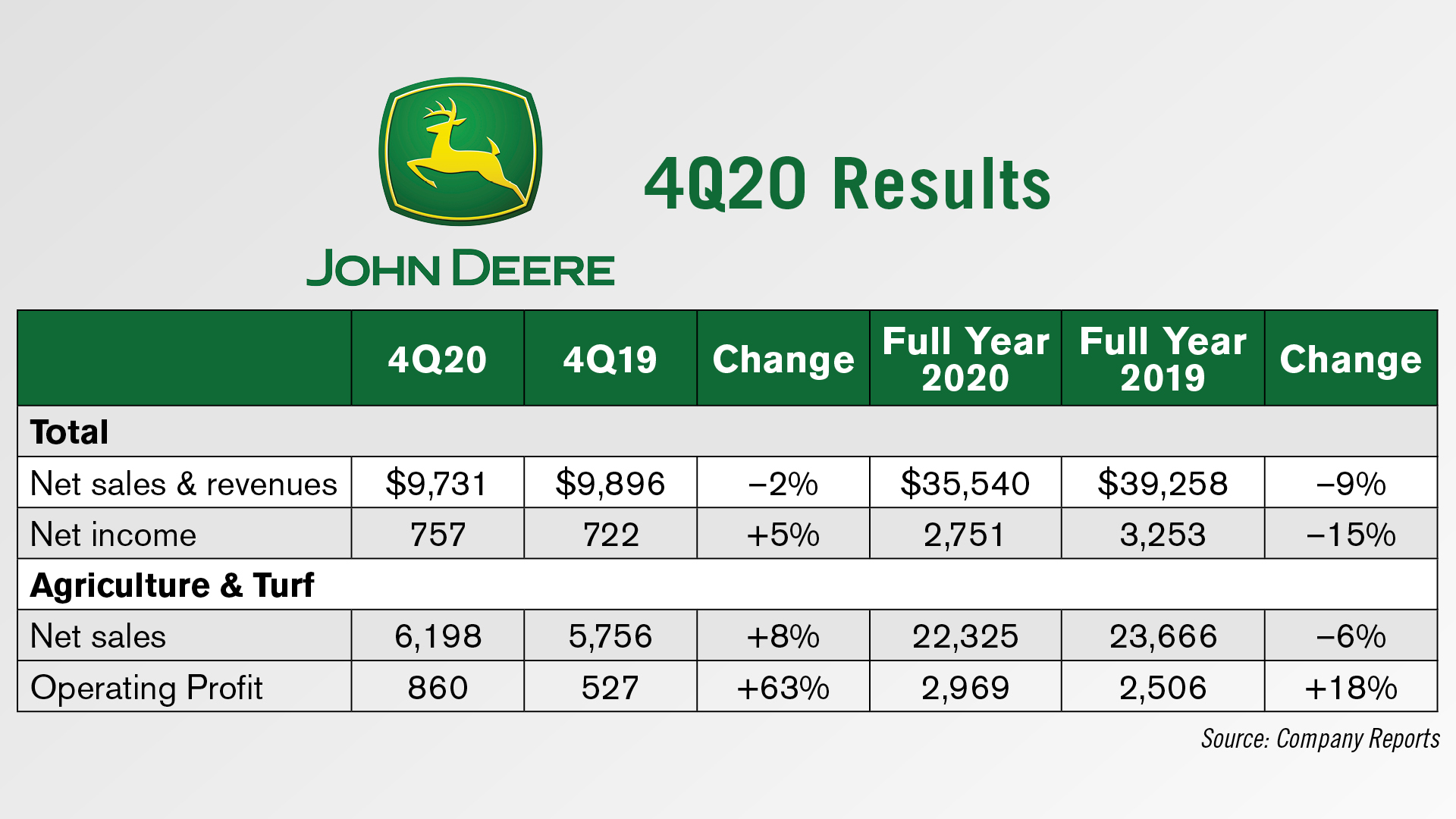

Deere & Co. reported net income of $757 million for the fourth quarter ended Nov. 1, 2020, compared with net income of $722 million for the quarter ended Nov. 3, 2019. For fiscal 2020, net income attributable to Deere was $2.8 billion, compared with $3.3 billion in 2019.

Worldwide net sales and revenues decreased 2%, to $9.7 billion, for the fourth quarter of 2020 and declined 9%, to $35.5 billion, for the full year. Equipment operations net sales were $8.7 billion for the quarter and $31.3 billion for the year, compared with corresponding totals of $8.7 billion and $34.9 billion in 2019

Ag & Turf sales for the quarter were $6.2 billion, up 8% from the same period in 2019. For the full year 2020, Ag & Turf division sales dropped 6% to $22.3 billion.

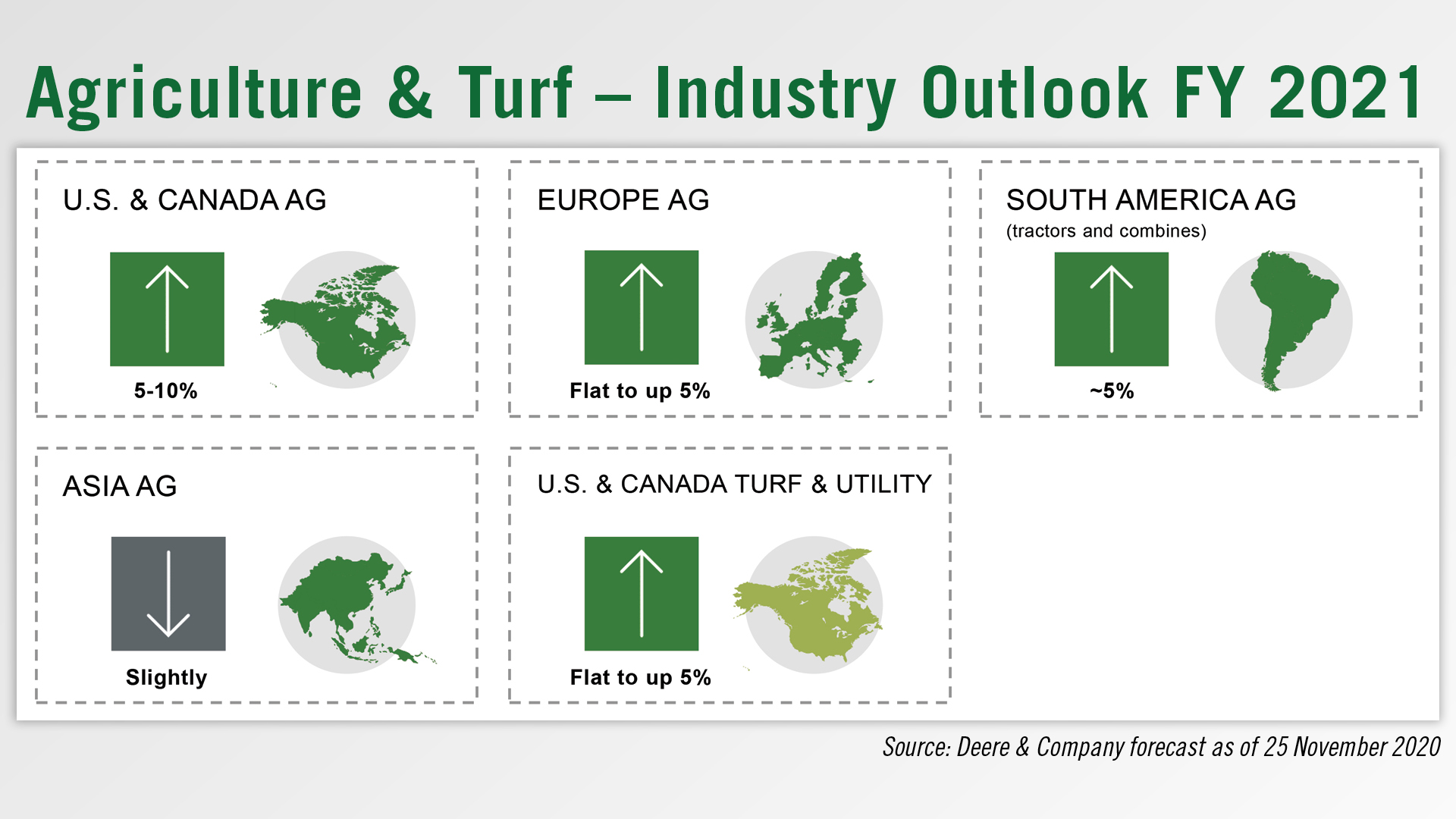

Looking ahead, Deere’s worldwide sales of ag and turf equipment are forecast to increase by 10-15% for fiscal year 2021. Ag equipment industry sales in the U.S. and Canada are forecast to rise 5-10% driven by gains in larger models. Full-year industry sales in the EU28 member nations are forecast to be flat to up 5%. In South America, industry sales of tractors and combines are forecast to be up about 5%, while Asian sales are expected to be slightly lower. Industry sales of turf and utility equipment in the U.S. and Canada are forecast to be flat to up 5%.

![[Technology Corner] What an OEM Partnership Means to an Autonomy Startup](https://www.agequipmentintelligence.com/ext/resources/2024/09/26/What-an-OEM-Partnership-Means-to-an-Autonomy-Startup.png?height=290&t=1727457531&width=400)

Post a comment

Report Abusive Comment