Raven Industries, Inc. (the Company; NASDAQ:RAVN) has reported financial results for the third quarter that ended Oct. 31, 2020.

Third Quarter Fiscal 2021 Noteworthy Items

- Net sales in Applied Technology increased 22% vs. the prior year, driven by growth in the OEM channel;

- Company invested $4.6 million, or $0.10 per share after-tax, primarily in incremental research and development activities, to advance Raven Autonomy;

- Aerostar achieved year-over-year revenue growth of 15% driven by the delivery of aerostat systems and the execution of a record number of customer flight campaigns;

- Company generated $21 million in free cash flow led by strong profitability and management of net working capital;

- Engineered Films' net sales declined 22% vs. the prior year as the division's end-markets continued to face economic challenges resulting from the global pandemic;

- Company announced executive leadership changes to accelerate execution of its growth strategy and to further position itself for long-term success;

Third Quarter Results

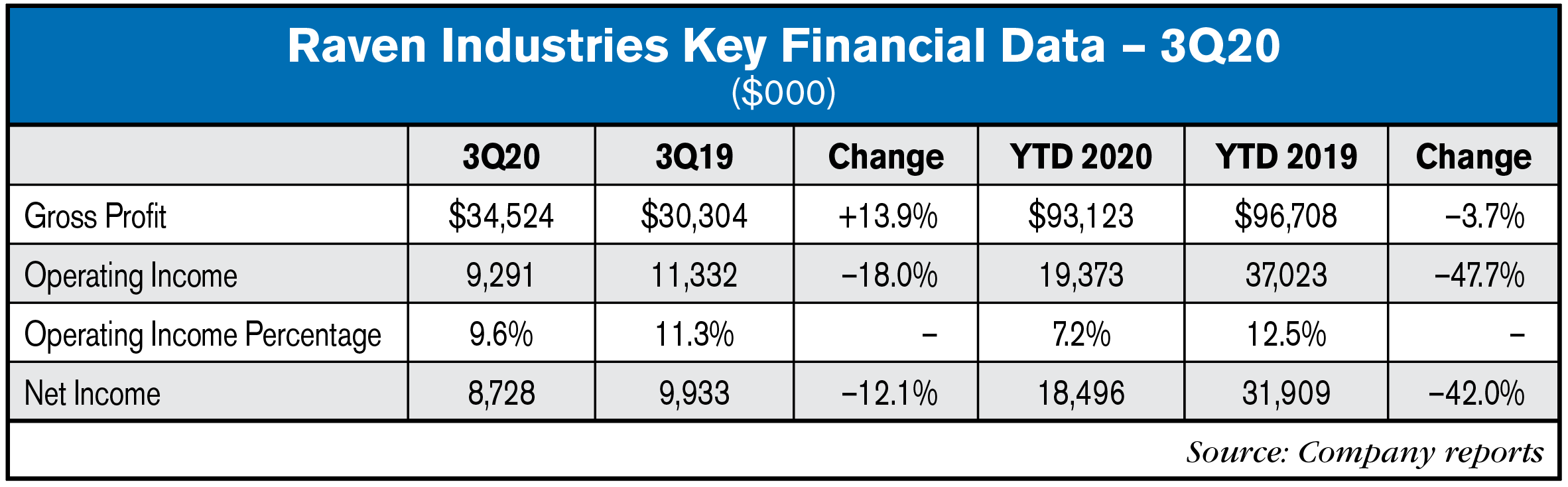

Consolidated net sales for the third quarter of fiscal 2021 were $96.6 million, down 3.9% vs. the third quarter of fiscal 2020. Applied Technology and Aerostar achieved significant year-over-year growth, but this was offset by a decline in Engineered Films. Strong growth in OEM sales drove the increase in Applied Technology. Aerostar achieved year-over-year growth by executing on a record number of successful stratospheric balloon flight campaigns and completing the delivery of aerostats on its current contract. The global pandemic continued to present challenges for Engineered Films' end-markets, leading to the year-over-year decline in revenue.

Consolidated operating income for the third quarter of fiscal 2021 was $9.3 million, vs. operating income of $11.3 million in the third quarter of fiscal 2020. Included in the results for the third quarter of fiscal 2021 were $4.6 million of incremental research and development and selling expenses to advance Raven Autonomy. The strong profitability performance in this year's third quarter was driven by improved gross profit margin, which increased from 30.1% to 35.7% year-over-year. Applied Technology and Engineered Films improved gross profit margins materially vs. the prior year, on improved volume and overhead reduction measures, respectively. Prudent cost containment actions, outside of committed investments in platforms for growth, also contributed to the strong profit performance in this year's third quarter. Prior year third quarter operating income included a pre-tax gain of $1.9 million on the sale of an Applied Technology facility in Austin, Texas.

Net income for the third quarter of fiscal 2021 was $8.7 million, or $0.24 per diluted share, compared to $9.9 million, or $0.28 per diluted share, in last year's third quarter. The Company's investment in Raven Autonomy reduced net income attributable to Raven by $3.6 million, or $0.10 per diluted share, in the third quarter of fiscal 2021. Prior year net income included a $1.5 million, or $0.04 per diluted share, gain on sale of a facility in Austin, Texas.

Balance Sheet and Cash Flow

At the end of the third quarter of fiscal 2021, cash and cash equivalents totaled $38.2 million, increasing $22.4 million vs. the previous quarter. The sequential increase in cash was led by improved profitability and a reduction in net working capital requirements. Total liquidity at the end of the third quarter totaled $138.2 million.

Applied Technology Division

Net sales for Applied Technology in the third quarter of fiscal 2021 were $34.8 million, increasing $6.3 million or 22.2% vs. the third quarter of the prior year. The year-over-year sales growth was primarily driven by higher volumes to OEMs, both domestically and internationally. This growth included last-time buy activity associated with the division's strategic decision to exit a commercial relationship. Excluding the benefit of the last-time buy activity, the division achieved growth over the prior year while overcoming certain production inefficiencies caused by process changes in response to the pandemic.

Division operating income in the third quarter of fiscal 2021 was $5.8 million, down $1.2 million or 17.6% vs. the third quarter of fiscal 2020. The profitability of the division was very strong and included an incremental investment of $4.5 million year-over-year into Raven Autonomy. The prior year results included a pre-tax gain of $1.9 million on the sale of the division's facility in Austin, Texas.

Update on Strategic Platforms for Growth

In the third quarter, the Company continued to aggressively and strategically invest in Raven Autonomy, the Company's strategic platform for growth within the Applied Technology Division. Field testing continues to progress, preparing for initial product launches for both the Raven Dot Power Platform and tractor autonomous power units (APUs) next year. Raven is commercializing its first available solutions in driverless ag technology, allowing ag professionals to be safer, more efficient and run their operations with less reliance on human variability. The Company plans to introduce additional smart implements leveraging these APUs as it continues to advance agriculture solutions.

In Raven Composites, the Company invested in research and development equipment to support new product development efforts. This specialty equipment was installed and became operational subsequent to the end of the third quarter. Additionally, the Company continues to develop new products and strengthen strategic relationships in targeted markets while building out greenfield operations. Larger scale manufacturing equipment to advance Raven Composites is on order and expected to be operational during the first quarter of fiscal 2022.

For Raven Thunderhead, Aerostar continues to develop and demonstrate the functionalities of the technology. The Company achieved milestones throughout the quarter on flight durations, mission functionalities and successful flight campaigns. The stratosphere is the next frontier, and Aerostar is at the forefront of capitalizing on the significant opportunity.

![[Technology Corner] What an OEM Partnership Means to an Autonomy Startup](https://www.agequipmentintelligence.com/ext/resources/2024/09/26/What-an-OEM-Partnership-Means-to-an-Autonomy-Startup.png?height=290&t=1727457531&width=400)

Post a comment

Report Abusive Comment