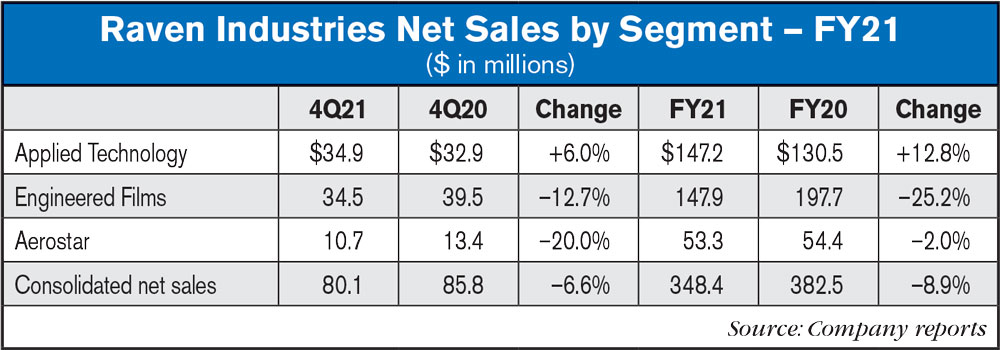

Consolidated net sales for the fourth quarter of fiscal 2021 were $80.1 million, down 6.6% vs. the fourth quarter of fiscal 2020. Applied Technology generated growth in both the OEM and aftermarket channels, which was more than offset by declines in Engineered Films and Aerostar. Improved end-market fundamentals drove strong growth for Applied Technology's best-in-class ag technology solutions. In Engineered Films, the division's end-markets continued to face challenges related to the pandemic, resulting in lower sales volume. Aerostar was impacted by unfavorable timing of government contracts, leading to a year-over-year decline in revenue.

Net income for the fourth quarter of fiscal 2021 was $0.3 million. compared to $3.3 million in last year's fourth quarter. The Company's investment in Raven Autonomy reduced net income attributable to Raven by $3.4 million in the fourth quarter of fiscal 2021 compared to $2.3 million in the prior year.

Net sales for Applied Technology in the fourth quarter of fiscal 2021 were $34.9 million, increasing $2 million or 6% vs. the fourth quarter of the prior year. The year-over-year sales growth was driven by increased volumes in both the OEM and aftermarket channels as improving commodity prices and growing optimism within the ag market resulted in a rise in demand.

Division operating income in the fourth quarter of fiscal 2021 was $5.2 million, down $0.3 million or 6% vs. the fourth quarter of fiscal 2020. Included in the results was investment in research and development and selling expenses to advance Raven Autonomy of $4.4 million on a pre-tax basis, an increase of $1.6 million vs. the prior year. The underlying profitability of Applied Technology before the impact of strategic investments continues to be very strong as the division delivers the next advancements in ag technology.

Fiscal 2021 Results

Consolidated net sales for fiscal 2021 were $348.4 million, down 8.9% vs. fiscal 2020. Net sales growth in Applied Technology was more than offset by declines in both Engineered Films and Aerostar. The year-over-year growth in Applied Technology was driven by increased volumes to OEMs, including last-time buy activity. In Engineered Films, the division's end-markets were significantly affected by the global pandemic, resulting in a decline in demand throughout the fiscal year. The year-over-year decline in revenue for Aerostar was primarily driven by pandemic related travel restrictions enacted by the Department of Defense.

Consolidated operating income for fiscal 2021 was $19.7 million, down $20.2 million or 50.8%, vs. $39.9 million in fiscal 2020. The year-over-year decline was primarily driven by increased investment in Raven Autonomy, totaling $16.8 million in fiscal 2021, compared to $3.2 million in the prior year. Lower sales volume and corresponding negative operating leverage in Engineered Films and Aerostar also contributed to the decline in operating income, partially offset by increased sales volume in Applied Technology. Prior year operating income included a pre-tax gain of $1.9 million on the sale of an Applied Technology facility in Austin, Texas.

Net income attributable to Raven for fiscal 2021 was $18.9 million vs. net income attributable to Raven of $35.2 million in fiscal 2020.

Fiscal 2022 Outlook

"In fiscal 2022, Applied Technology is expected to drive growth in revenue as the division leverages its industry-leading product portfolio and customer relationships," said Dan Rykhus, president and CEO. "Order activity strengthened in the fourth quarter of fiscal 2021 and is building momentum through the first quarter of fiscal 2022. In addition, we are seeing strength in the agriculture industry as increasing commodity prices have created optimism in the ag market for the first time in nearly a decade. In Raven Autonomy, we expect to deliver AutoCart systems in advance of the fall harvest and commercialize the Dot Power Platform. We will continue to aggressively invest in Raven Autonomy as we build the foundation for a step-change in long-term growth.

"Fiscal 2022 will be an exciting year for our company as we build out each of our strategic platforms for growth while leveraging the strength of our underlying businesses. Substantial order activity and improving market fundamentals provide confidence in our ability to drive strong year-over-year growth in Applied Technology and Engineered Films. As we execute on these opportunities, we will remain focused on aggressively investing to advance Raven Autonomy, Raven Composites and Raven Thunderhead while making significant progress on our multi-year plan to drive a step-change in our long-term growth," concluded Rykhus.

Related Content

Ag Equipment Manufacturers — Executive Compensations: Ag Equipment Intelligence has gathered financial data from the filings of the ag industry’s key publicly-traded manufacturers and compiled its own list of these companies’ executives’ compensations.

Post a comment

Report Abusive Comment