The latest episode of On the Record is now available! In this week's program, we discuss the judges ruling on the North Dakota dealer protection law that had been challenged by manufacturers. In the Technology Corner, Jack Zemlicka discusses dealers hiring plans for the precision farming department. Also in this episode, we also look at the latest dealer survey from Stifel on third quarter sales and examine more results from the 2021 Dealer Business Outlook & Trends Report.

On the Record is brought to you by Bellota.

For Bellota, the key to quality in their planting and tillage parts is the perfect balance between hardness and toughness that is attributed to the 8 million product units they produce every year.

Professionals around the world understand that working with Bellota products makes their tilling, planting and seeding work more precise and uniform, producing less breakages and time-consuming stops. Improve profitability with Bellota’s durable, long lasting line of products. Visit BellotaAgrisolutions.com

Bellota - a growing brand of Agrisolutions.

On the Record is now available as a podcast! We encourage you to subscribe in iTunes, the Google Play Store, Soundcloud, Stitcher Radio and TuneIn Radio. Or if you have another app you use for listening to podcasts, let us know and we’ll make an effort to get it listed there as well.

We’re interested in getting your feedback. Please feel free to send along any suggestions or story ideas. You can send comments to kschmidt@lessitermedia.com.

Judge Upholds North Dakota Dealer Protection Law

On Oct. 19, a judge ruled to uphold a North Dakota dealer protection law that originally should have gone into effect back in August of 2017.

The law, introduced by the Pioneer Equipment Dealers Assn., was overwhelmingly passed by the legislation and signed into law by Governor Doug Burgum in March 2017. The law addressed several manufacturer contract issues, including the prohibition of mandatory equipment and parts purchases, minimum order requirements, and “purity” requirements stipulating the separation of facilities/personnel/display space/etc.

It also addressed the requirement that manufacturers reimburse dealers for warranty parts, labor and transportation at the respective dealer’s non-warranty customer pay rate.

Four months later manufacturers, including AGCO, CNH Industrial, John Deere and Kubota, along with the Assn. of Equipment Manufacturers, filed a lawsuit and motion for a preliminary injunction on the law.

The judge granted the manufacturers’ motion for an injunction, which effectively put a stay on the law until the Judge could make a decision regarding the merits of the manufacturers’ complaint.

With the latest ruling, Matthew Larsgaard, president and CEO of the Pioneer Equipment Dealers Assn., says the decision helps provide more stability for North Dakota farm equipment dealers following a recent and fundamental shift in some manufacturers’ contract requirements.

Ideally, Larsgaard says, Pioneer EDA believes that equitable contract terms should be negotiated outside of the legislative arena whenever possible. “It is our continual goal to work with our manufacturers at that level,” he says, “with legislation only as a last resort. At the end of the day, dealers and manufacturers are partners in serving our farm customers – we need to work together.”

He goes on to say, “Obviously, we are very happy with the decision, however we are now ready to put this behind us and continue to work with our manufacturer partners to address industry concerns such as defeating Right to Repair legislations and promoting business friendly policies.

Dealers on the Move

This week’s Dealer on the Move is Atlantic Tractor. The John Deere dealership announced it will open a new location in Mechanicsville, Md., in the spring of 2021. The dealership currently has 11 locations in Maryland, Delaware and southeastern Pennsylvania.

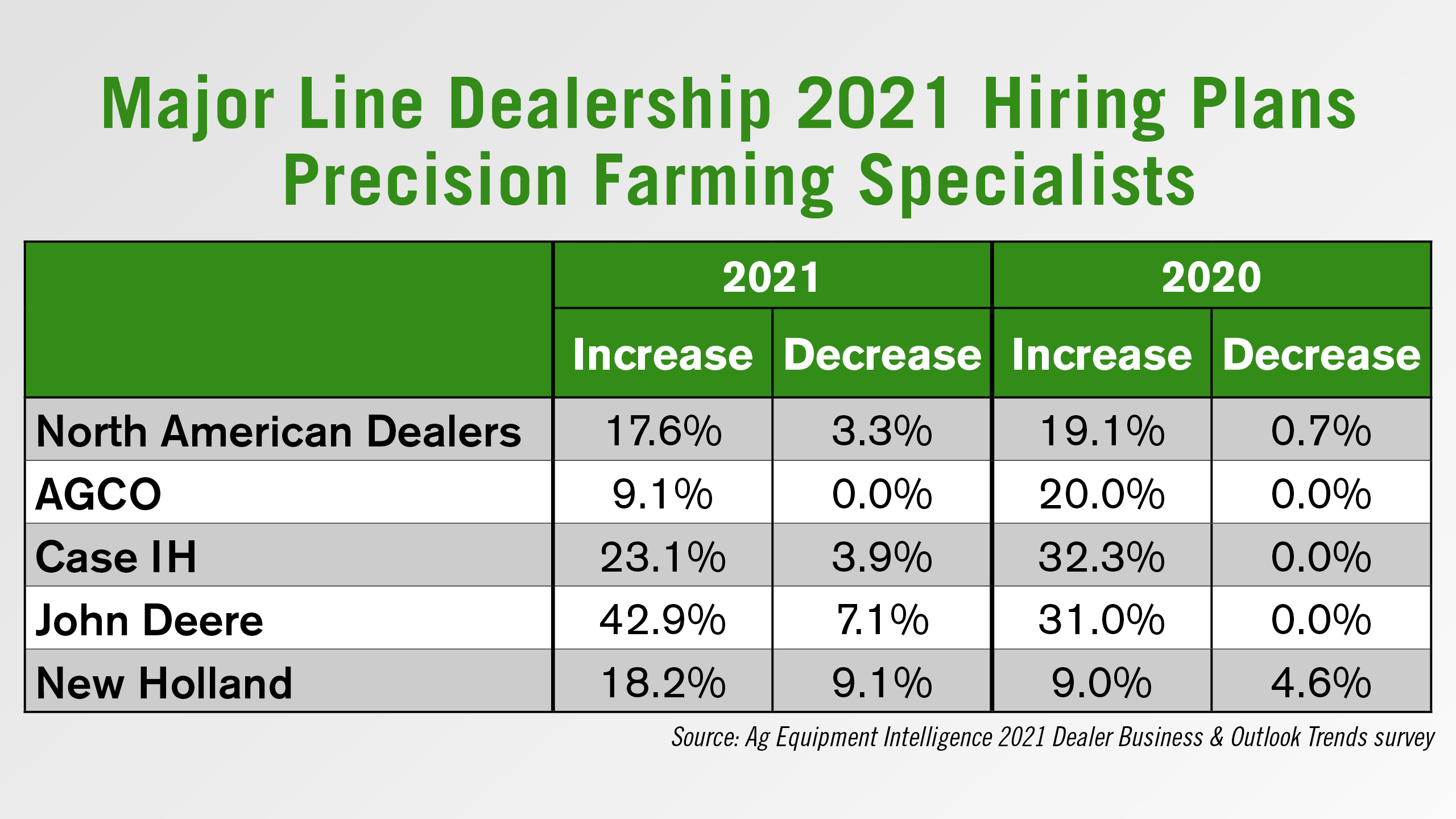

OEM Dealers Forecast Dip in Precision Hiring

For the second year in a row, precision farming ranked high on dealers’ list of best bets for improving unit sales, according to Ag Equipment Intelligence’s 2021 Dealer Business Outlook & Trends report.

While the category lost its first place slot from last year’s report, it still ranked second among 21 different areas, with more than 93% of dealers betting on precision systems to remain the same or improve unit sales in 2021.

But in the age of doing more with less, dealers are less optimistic with hiring additional precision staff in the coming year. Some 17.6% of U.S. dealers plan to add staff to this category in 2021, down from 19.1% reported in last year’s study.

About 80% of dealers anticipate no change in precision staff in the coming year, consistent with 2020, while about 3% forecast a reduction or reallocation of precision specialists, compared to less than 1% this year.

Precision specialist was the only staffing area dealers didn’t forecast an increase in hiring compared to 2020, among the 6 categories included in the 2021 study.

Breaking out the major farm equipment manufacturers’ precision hiring plans, the highest percentage of John Deere dealers plan to increase precision hiring in 2021. Nearly 43% plan to add specialists in the coming year, an increase of about 12% over 2020.

New Holland dealers are also forecasting an increase in precision hires, doubling their outlook from a little more than 9% this year to about 18% in 2021.

However, both Deere and New Holland also had the highest percentage of dealers forecasting a reduction or reallocation of precision staff in 2021.AGCO dealers forecast the biggest year-over-year decline with about 9% planning to add precision specialists next year, compared to 20% this year. Case IH dealers also expect hiring to slow on the precision side in 2021, with about 23% planning to add staff, compared to about 32% this year.

For more information and analysis from the 2021 AEI Dealer Business Outlook & Trend report, visit www.AgEquipmentIntelligence.com.

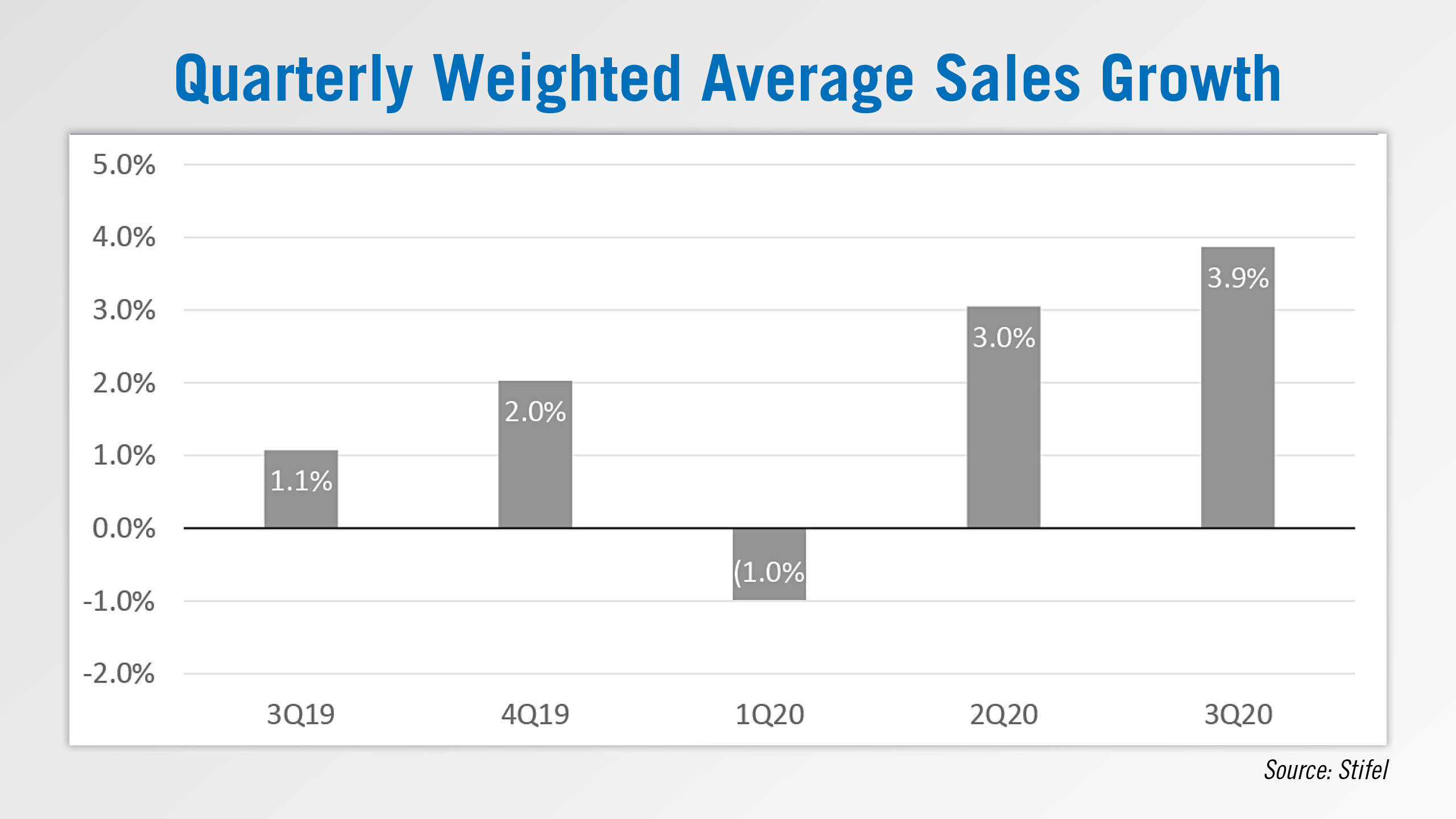

Dealers Report Sales Up 3.9% in 3Q

Dealers are reporting that their sales in third quarter increased by nearly 4%, according to a survey conducted by investment banker Stifel.

This compares to a 3% increase in second quarter and a 1% decline in the first quarter of 2020.

The Stifel survey indicated that a net 29% of dealers saw better than expected sales in the third quarter vs. a net 16% in the previous quarter.

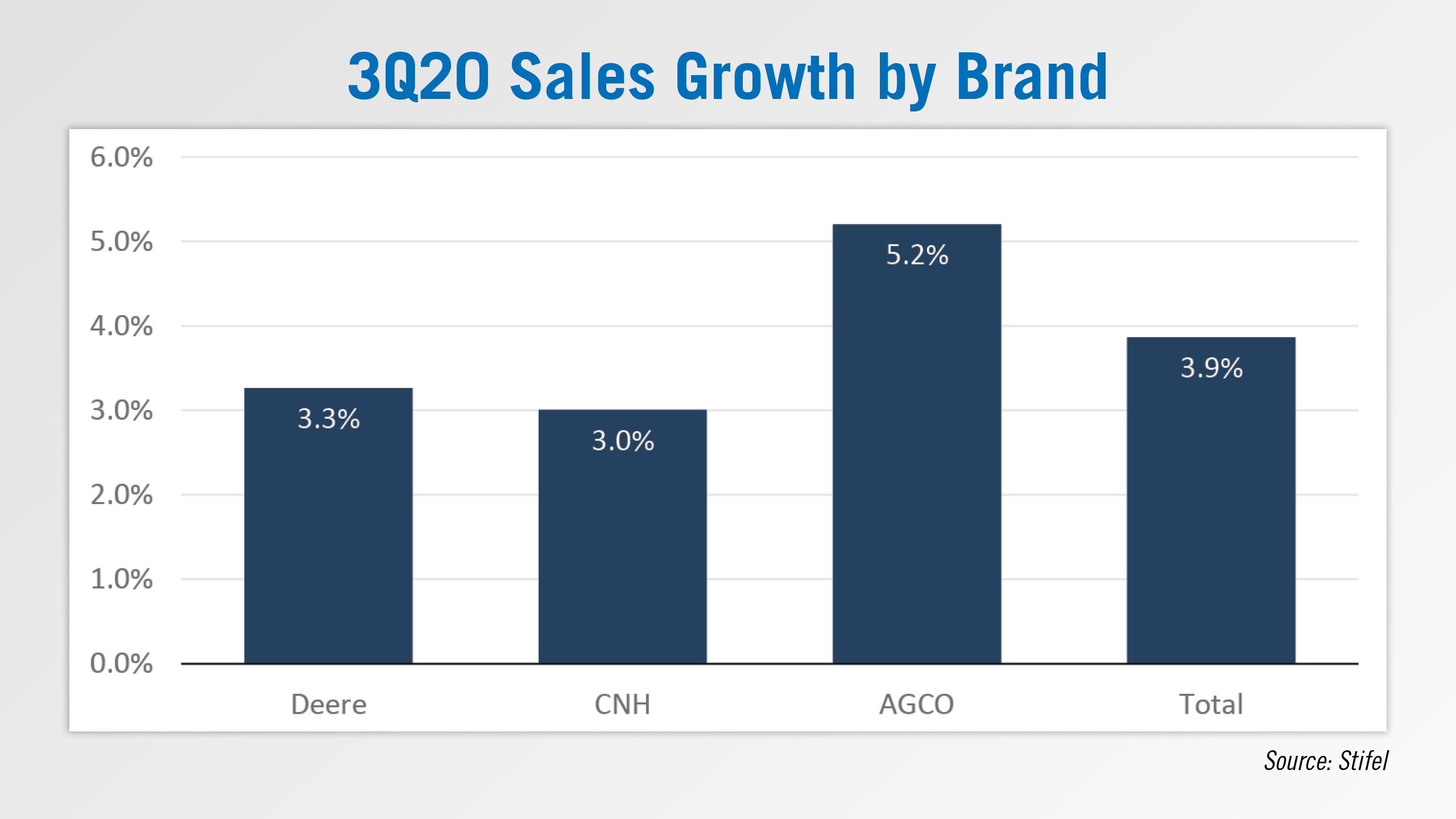

“AGCO dealers generally had the most positive responses regarding current trends, which we would attribute to the excitement around the accelerated roll out of the Fendt brand domestically and other new product introductions,” said Stanley Elliott, analyst with Stifel.

AGCO dealers reported that their sales were up 5.2% during the most recent quarter, while Deere dealers said their sales were up by 3.3% and CNH dealer sales increased by 3%.

Regarding the outlook, dealers now expect the next 3 month sales to increase 3.8%, which is up from the 3.2% increase in second quarter of 2020. A net 36% of dealers expect sales to strengthen over the next 3 months vs. a net 17% in the last quarter.

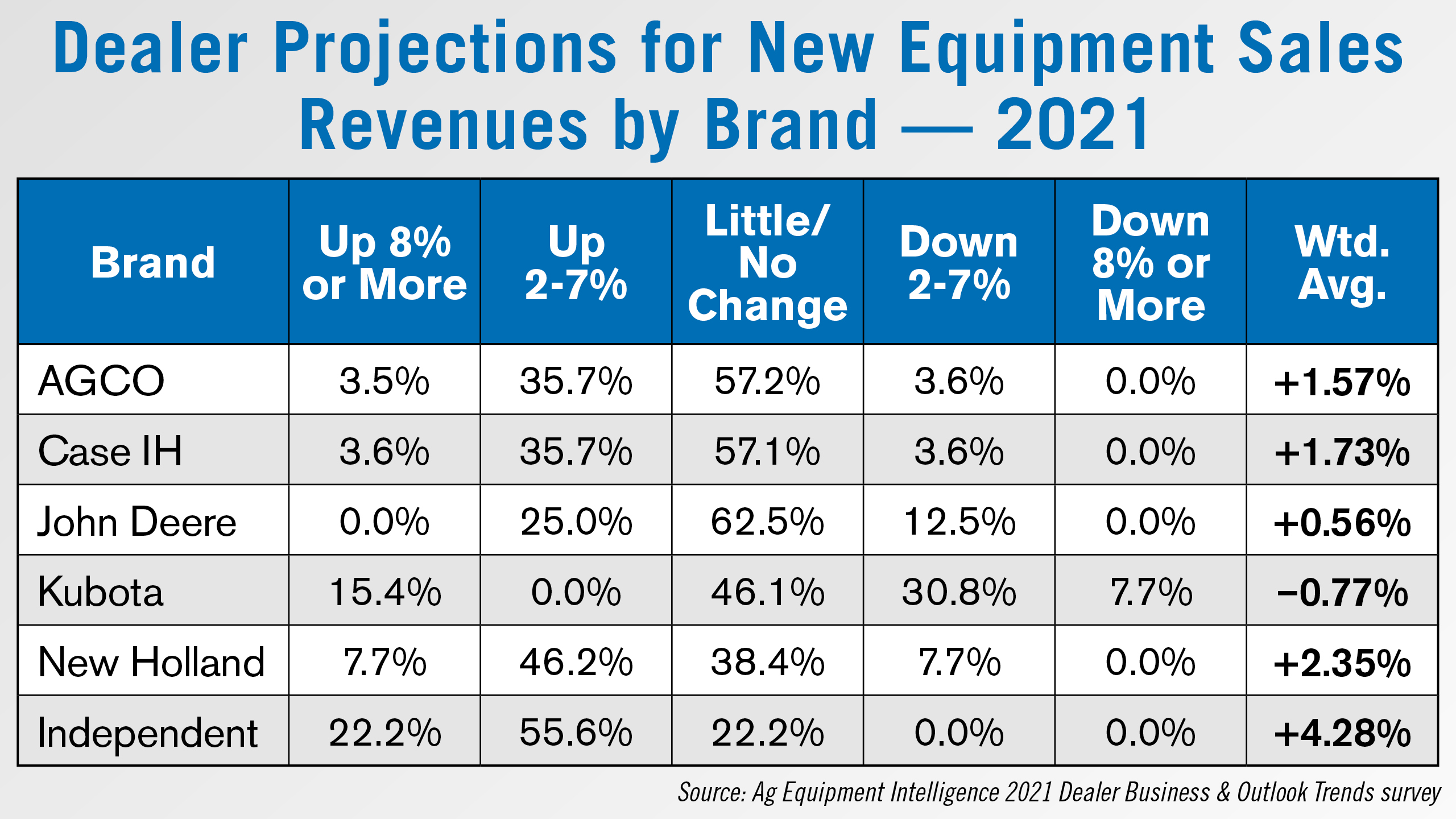

Independent Dealers Most Optimistic

According to Ag Equipment Intelligence’s 2021 Dealer Business Outlook & Trends Report, independent dealers are the most optimistic in their forecasts for growing new equipment revenues in the year ahead.

Nearly 78% of independent dealers project revenues up 2% or more in 2021. Among them, 22.2% are projecting new equipment revenue increases of 8% or more. No independent dealers in this year’s survey had negative projections for new equipment revenues going into next year.

New Holland dealers were next with 54% forecasting new equipment revenues to be up by at least 2% in 2021.

About 39% of Case IH dealers forecast growth next year, while 57% forecast little to no change in their new equipment revenues in 2021.

For AGCO dealers, 39% are forecasting new equipment revenue growth in 2021, and 57% are predicting revenues to be flat in the year ahead.

A quarter of John Deere dealers say their new equipment revenues will be up 2-7% in 2021, and nearly 63% forecast flat revenues from new equipment next year.

Kubota dealers were the least optimistic, with just 15% forecasting new equipment revenue growth next year.

The complete Dealer Business Outlook & Trends report was sent to Ag Equipment Intelligence subscribers this week.

![[Technology Corner] What an OEM Partnership Means to an Autonomy Startup](https://www.agequipmentintelligence.com/ext/resources/2024/09/26/What-an-OEM-Partnership-Means-to-an-Autonomy-Startup.png?height=290&t=1727457531&width=400)

Post a comment

Report Abusive Comment