Valmont Industries, a global provider of engineered products and services for infrastructure development and irrigation equipment and services for agriculture, has reported financial results for the third quarter ended Sept. 26, 2020.

Third Quarter 2020 Highlights

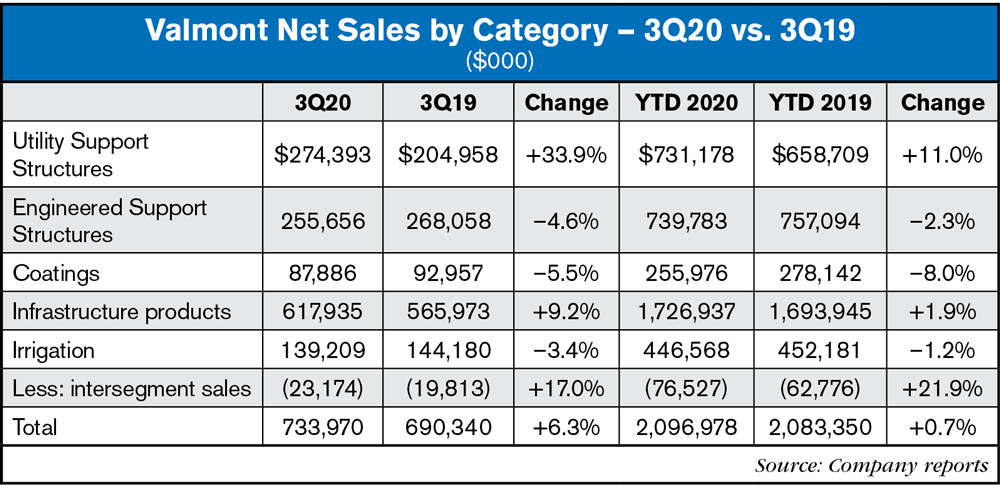

- Net Sales of $734 million increased 6.3% led primarily by significantly higher Utility Support Structures segment sales and improved international market demand

- Operating Income of $61.5 million, or 8.4% of sales ($67.1 million or 9.1% of sales adjusted) compared to $61.1 million or 8.8% of sales last year

- Generated strong operating cash flow of $122.3 million, driven by higher operating income and strategic working capital management; cash and cash equivalents were $443.1 million at end of third quarter

- Announced a $240 million multi-year order for irrigation products and services to provide modern irrigation and technology solutions for a ~500,000 acre agricultural development project in Egypt

"We achieved higher revenue year-over-year from operational excellence and increased volumes, and delivered earnings growth through our focus on pricing and market leadership, despite an extraordinary macro environment,” said Stephen G. Kaniewski, president and CEO. “Sales and profitability were better than anticipated, as we remained highly focused on execution and pricing across the portfolio. Sales growth was driven by strong demand in the Utility Support Structures segment, including significantly higher sales of renewable energy products. I am pleased with the solid operating performance in the Engineered Support Structures and Coatings segments, and the Irrigation segment delivered solid performance despite end-market instability, benefiting from continued strength in international markets and recent acquisitions. We recognized another quarter of very strong operating cash flows, driven by our strategic priorities for working capital management.”

Third Quarter 2020 Segment Review

Infrastructure

Utility Support Structures Segment (37.4% of Sales)

Steel, concrete and composite structures for utility markets, including transmission, distribution, substations, and renewable energy generation equipment

Sales of $274.4 million grew 33.9% year-over-year, led by higher sales in the international businesses, including significantly higher solar tracker project sales. In North American markets, sales growth was led by continued robust market demand, strategic capacity additions in existing North American operations and favorable pricing, partially offset by deflation due to lower steel costs.

Operating income was $25.9 million or 9.4% of sales ($29.2 million adjusted or 10.6% of sales) compared to $20.4 million, or 9.9% of sales in 2019. Profitability growth was led by higher volumes, improved operations performance, and favorable pricing.

Engineered Support Structures Segment (34.8% of Sales)

Poles, towers and components for the lighting, traffic and wireless communication markets, engineered access systems, integrated structure solutions for smart cities, and highway safety products

Sales of $255.7 million decreased 4.6% year-over-year. Higher sales of wireless communication products were more than offset by lower volumes of lighting and traffic products and lower Access Systems sales.

Lighting and traffic sales of $181.6 million decreased 5.1% year-over-year. In North America, lower volumes in transportation and commercial lighting markets led to lower sales. In international markets, sales were lower due to economic disruptions from COVID-19 impacts, which impacted end-market demand.

Wireless communication structures and components increased 4.8% to $50.7 million compared to last year. Higher volumes in Europe, favorable pricing, and wireless carriers’ continued capital spending in North American markets led to higher sales.

Access Systems sales of $23.4 million decreased 17.6% year-over-year due to lower volumes from strategically exiting product lines.

Operating income was $25.4 million or 9.9% of sales ($26.3 million adjusted1 or 10.3% of sales), compared to $21.8 million or 8.1% of sales in 2019. Profitability improvement was driven by favorable pricing, improved operations performance and the non-recurrence of one-time losses in the Access Systems business in third quarter 2019.

Coatings Segment (12% of Sales)

Galvanizing, painting and anodizing services to preserve and protect metal products

Sales of $87.9 million decreased 5.5% year-over-year. Higher internal volumes and favorable pricing were more than offset by lower external volumes in North American markets due to economic impacts from COVID-19 on end customers.

Operating income was $12.4 million or 14.1% of sales ($13.7 million adjusted or 15.6% of sales), compared to $13.9 million or 14.9% of sales in 2019. Operating margin improvement on an adjusted basis was due to improved operational efficiencies and favorable pricing, partially offset by lower volumes.

Agriculture

Irrigation Segment (19% of Sales)

Irrigation equipment for agricultural markets, including center pivots, parts, services and tubular products, water management solutions, and technology for precision agriculture

Global sales of $139.2 million decreased 3.4% year-over-year, primarily due to $6.3 million of unfavorable currency impacts mostly from the depreciation of the Brazilian Real, otherwise sales were similar to last year.

North American sales of $75.8 million decreased 8.5% compared to 2019. Higher irrigation system volumes were more than offset by lower volumes of other products including industrial tubing sales.

International sales of $63.4 million increased 3.3% year-over-year and increased 13.7% in local currencies. Sales growth was led by higher sales in South American markets including continued strong demand in Brazil, higher sales in Europe and Australia, and sales from recent acquisitions.

Segment operating income was $14.7 million, or 10.6% of sales, compared to $18.2 million, or 12.6% of sales in 2019. Lower profitability was due to lower sales volumes, partially offset by pricing. Higher SG&A expense included $1.2 million of incremental R&D expense for technology growth investments.

During the quarter, the Company announced it had entered into a $240 million, multi-year supply agreement to bring modern irrigation and technology solutions to Egypt. Once completed, the project will be the largest "Connected Farm of Engaged Acres" in the world, demonstrating the growing global demand for more efficient and reliable food production, and increasing national investments in agriculture to feed growing populations and address food security issues. Project deliveries will begin in fourth quarter 2020.

Fourth-Quarter 2020 Financial Outlook and Key Assumptions

While the pandemic's impacts on global economic factors and pace of economic recovery remain uncertain, the Company is currently providing a greater level of transparency, including key assumptions and indications for fourth quarter 2020, to help the financial community understand short-term impacts and expectations.

Financial Outlook

| Metrics | Estimates |

| Net Sales | $715-735 million |

| GAAP Operating Profit Margin | 6.5-7.5% |

| Adjusted Operating Profit Margin | 8-9% |

| Segment Sales: Irrigation | ~12-15% increase (vs. prior year) |

Key Assumptions

- Irrigation sales estimate driven by expected timing of international project deliveries

- Tax rate of ~25%

- Positive operating cash flows

- Stable raw material costs and no significant supply chain interruptions

- No closures of large manufacturing facilities or workforce disruptions

Kaniewski added, "We continue to prioritize employee safety and well-being while focusing on growth and performance, providing our customers with the essential products and solutions they need. The strong global backlog of approximately $600 million in our Utility Support Structures segment is providing a good line of sight well into 2021. In the Engineered Support Structures segment, we expect demand to remain strong in wireless communications markets as 5G build-outs continue to ramp. Our Coatings business is trending in line with industrial production levels and will improve over time as the general economy improves. The large, multi-year international irrigation project and favorable international market trends are providing increased momentum leading into 2021 and we are optimistic that recent increases in commodity prices may improve grower sentiment in North American irrigation markets. Additionally, our balance sheet and cash flows remain very strong and we expect to deliver free cash flow of more than 1.2x net earnings for 2020. Our strategies remain focused on long-term growth with a strong emphasis on Return on Invested Capital, ESG principles, operational excellence and strengthening our organization for the future."

![[Technology Corner] Pessl Instruments CEO Talks Dealer Benefits From Lindsay Corp. Investment](https://www.agequipmentintelligence.com/ext/resources/2024/04/25/Pessl-Instruments-CEO-Talks-Dealer-Benefits-From-Lindsay-Corp.-Investment.png?height=290&t=1714144307&width=400)

Post a comment

Report Abusive Comment