CNH Industrial reported net sales of Industrial Activities up 4% (up 4% at constant currency), primarily driven by an 11% increase in Agriculture. Consolidated revenues were $6.5 billion, adjusted net income was $156 million, and positive free cash flow of Industrial Activities was $1 billion. At quarter end, available liquidity was $13.2 billion.

“CNH Industrial’s third quarter 2020 results were positively impacted by a general improvement vs. the first half of 2020, in market demand across most of our businesses and countries and, in particular, in the agriculture sector in North America," said Suzanne Heywood, Chair and Acting CEO. "Results were also supported by our continued cost containment and cash preservation actions. As a result, we have reduced working capital in a quarter that is usually seasonally weak, have generated positive free cash flow of $1 billion, and have increased our available liquidity to $13.2 billion."

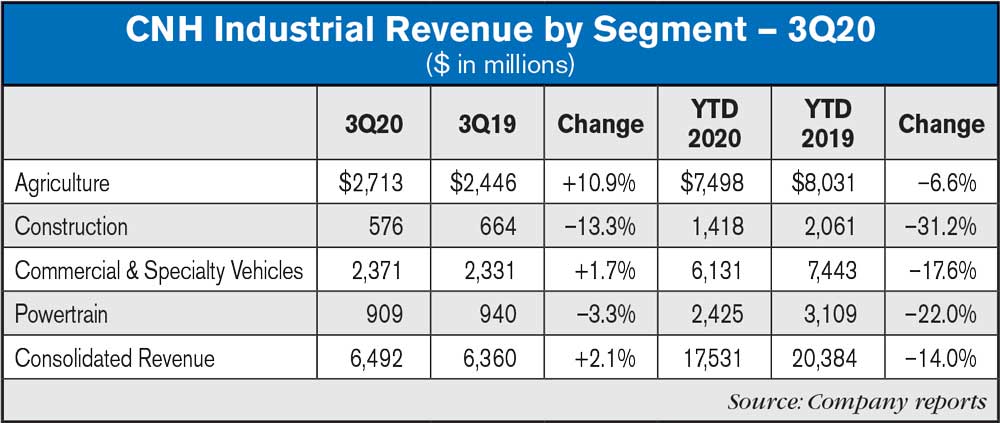

Revenue by Segment

Agriculture: Demand was up in all key regions. In North America, tractor demand was up 24% for tractors under 140 horsepower, and up 8% for tractors over 140 horsepower; combines were up 16%. In Europe, tractor and combine markets were up 5% and 14%, respectively. South America tractor markets were up 1% and combine markets were down 17%. Significant increase in demand was also reported in Rest of World. Net sales are up 11% (up 14% at constant currency) mainly driven by higher volumes in North America, Europe and Rest of World, and favorable price realization.

Construction: Global demand of construction end-markets showed 10% and 12% increases in compact and service equipment sub-segment and in general construction equipment, respectively, while road building and site preparation equipment decreased 7%. Demand increased 24% in Rest of World (+54% in China) but decreased 15% in Europe. Compact equipment was up 14% in North America. Net sales were down 13%, mainly due to continued channel inventory destocking actions and a weaker pricing environment, primarily in North America. Retail deliveries up in North America, bringing the reduction on channel inventory to more than 35% since the beginning of the year.

Commercial & Speciality Vehicles: European truck market was up 7% year-over-year, with light-duty trucks (“LCV”) up 13%, and medium and heavy trucks down 5%. Order book is strong in Europe. South American truck market was up 9% in LCV and down 8% in medium and heavy trucks. European bus market decreased 17%, and South American market decreased 34%.

Powertrain: Net sales were down 3%, driven by volume reduction, mainly for light and medium engines in Europe, partially offset by an increase in Rest of World. Sales to external customers accounted for 53% of total net sales (51% in the third quarter of 2019).

2020 Outlook

The Company is providing the following outlook for 2020. This assumes that its end markets are not further impacted by the pandemic during the final weeks of the year and that, with all the health and safety measures they have put in place, its plants and suppliers are able to keep operating with minimal disruptions:

- Net sales of Industrial Activities down between 10-15% year on year including currency translation effects

- Free cash flow of Industrial Activities positive between $0.4 billion and $0.7 billion

- Solid available liquidity to be maintained to year-end and into 2021, with the only capital markets maturity in the year for $600 million already covered by the CNH Industrial Capital LLC $500 million 1.875% Notes issued in October.

![[Technology Corner] What are the Top 5 Applications in Autonomy Right Now?](https://www.agequipmentintelligence.com/ext/resources/2024/11/08/What-are-the-Top-5-Applications-in-Autonomy-Right-Now-.png?height=290&t=1731094940&width=400)

Post a comment

Report Abusive Comment