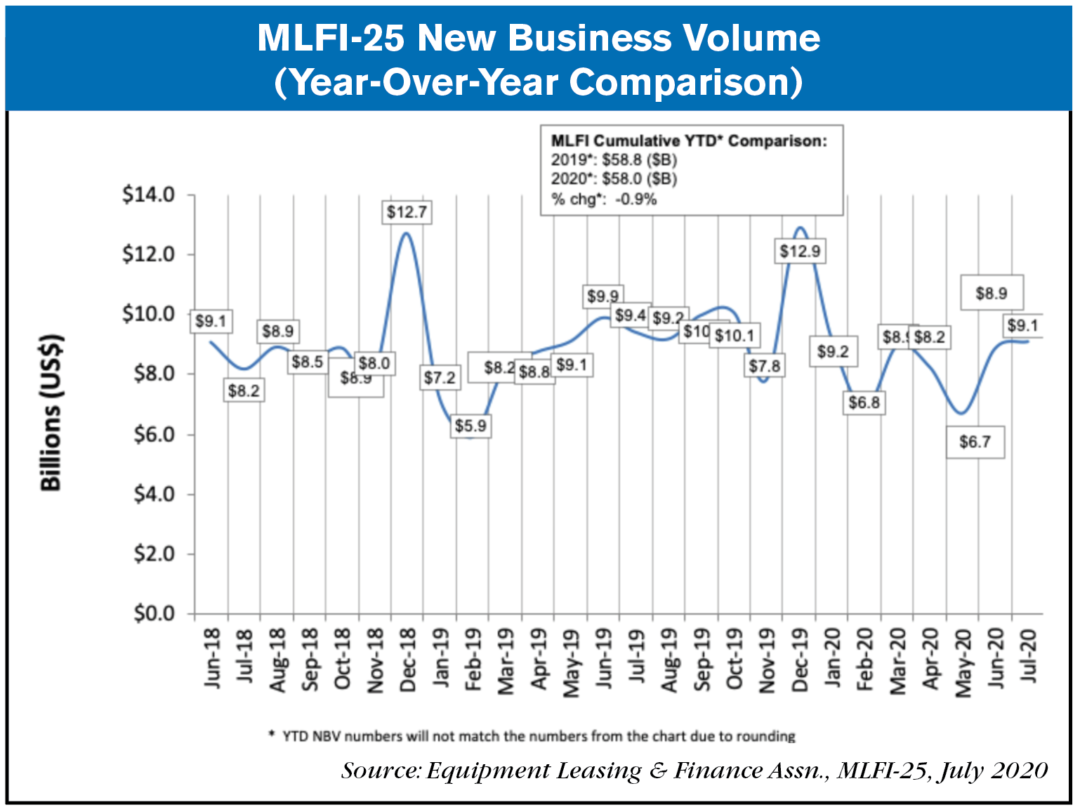

The Equipment Leasing and Finance Association’s (ELFA) Monthly Leasing and Finance Index (MLFI-25), which reports economic activity from 25 companies representing a cross section of the $900 billion equipment finance sector, showed their overall new business volume for July was $9.1 billion, down 3% year-over-year from new business volume in July 2019. Volume was up 3% month-to-month from $8.9 billion in June. Year-to-date, cumulative new business volume was down 1% compared to 2019.

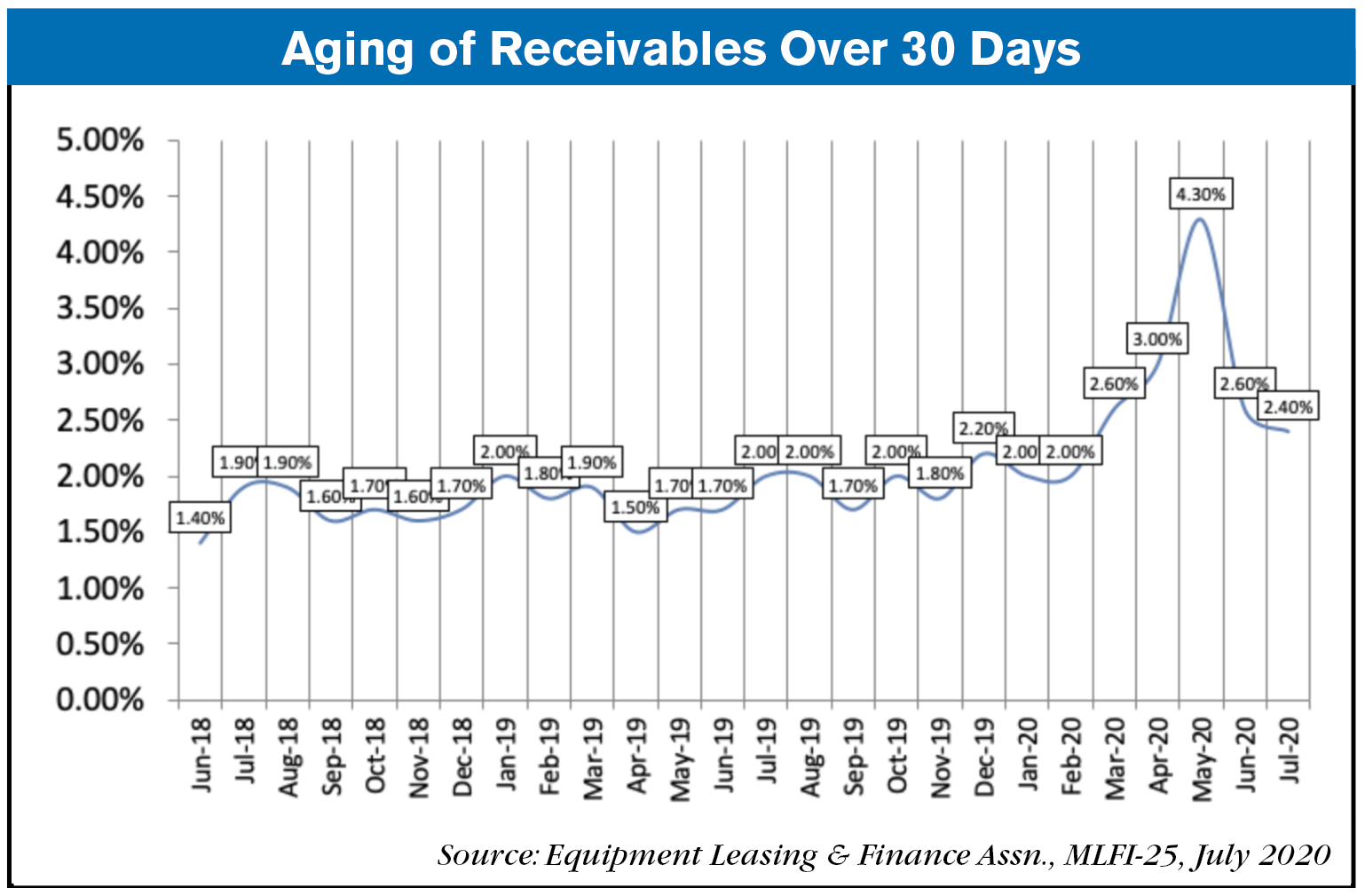

Receivables over 30 days were 2.4%, down from 2.6% the previous month and up from 2% the same period in 2019. Charge-offs were 0.7%, up from 0.7% the previous month, and up from 0.37% in the year-earlier period.

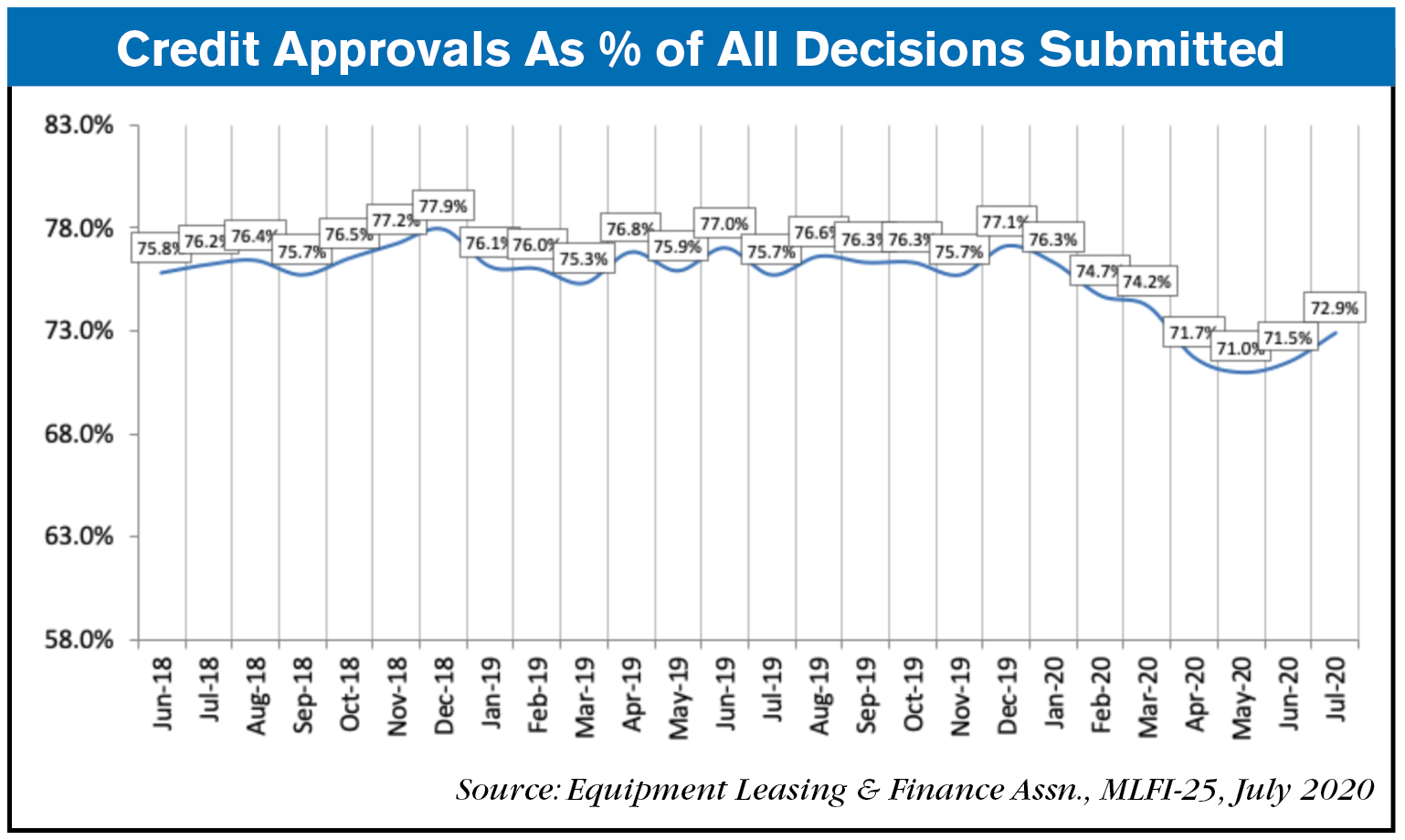

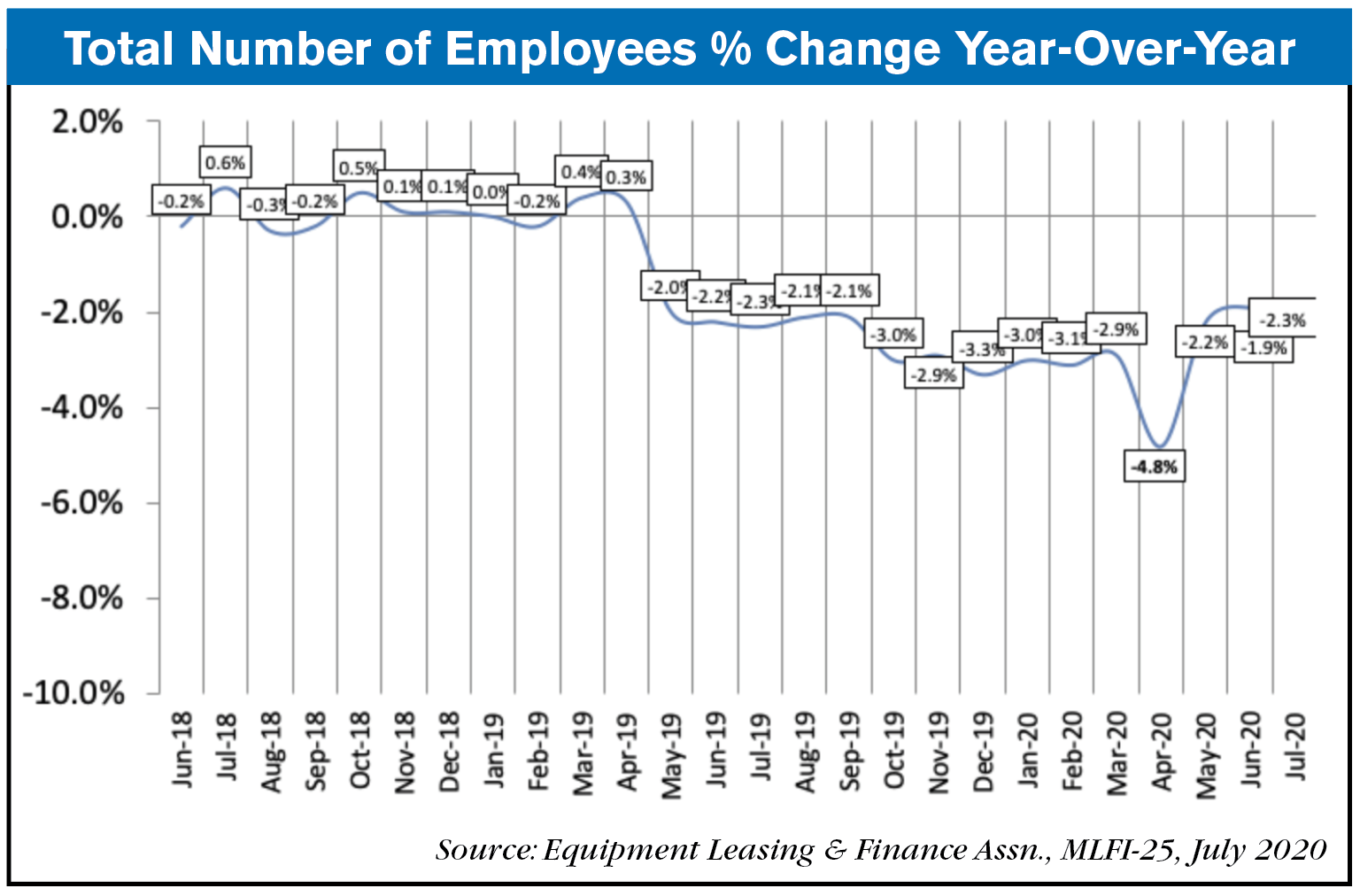

Credit approvals totaled 72.9%, up from 71.5% in June. Total headcount for equipment finance companies was down 2.3% year-over-year.

Separately, the Equipment Leasing & Finance Foundation’s Monthly Confidence Index (MCI-EFI) in August is 48.4, an increase from the July index of 45.3

ELFA President and CEO Ralph Petta said, “The July data gives voice to anecdotal evidence from ELFA members that, in the face of rising Covid-19 cases in some areas of the country, equipment demand remains solid in certain market sectors and weak in others. Some middle market businesses and corporate customers continue to operate in pre-pandemic form. Low interest rates, a gravity-defying equities market, and abundant liquidity all serve to provide fuel for a strong housing market; however, too many small businesses and the hospitality and restaurant sectors are struggling to turn a profit and keep their people employed. This is not sustainable long-term, and the hope is that, as we move into the third quarter, economic growth turns a corner and Americans return to work.”

Stefan Breuer, Managing Director, MUFG Americas Capital Leasing & Finance LLC, said, “Continued incremental improvements in the reported leasing indices have been supported by the enormous stimulus programs of the past several months and the high level of liquidity in the financial markets. Our primarily large corporate customer base has been focused on resizing and prioritizing their capital expenditures and on executing funding programs in the current market environment. Recent stimulus program delays and the upcoming national election uncertainties for many clients appear to be a growing concern and seem to be providing an incentive to complete transactions without delay.”

Post a comment

Report Abusive Comment