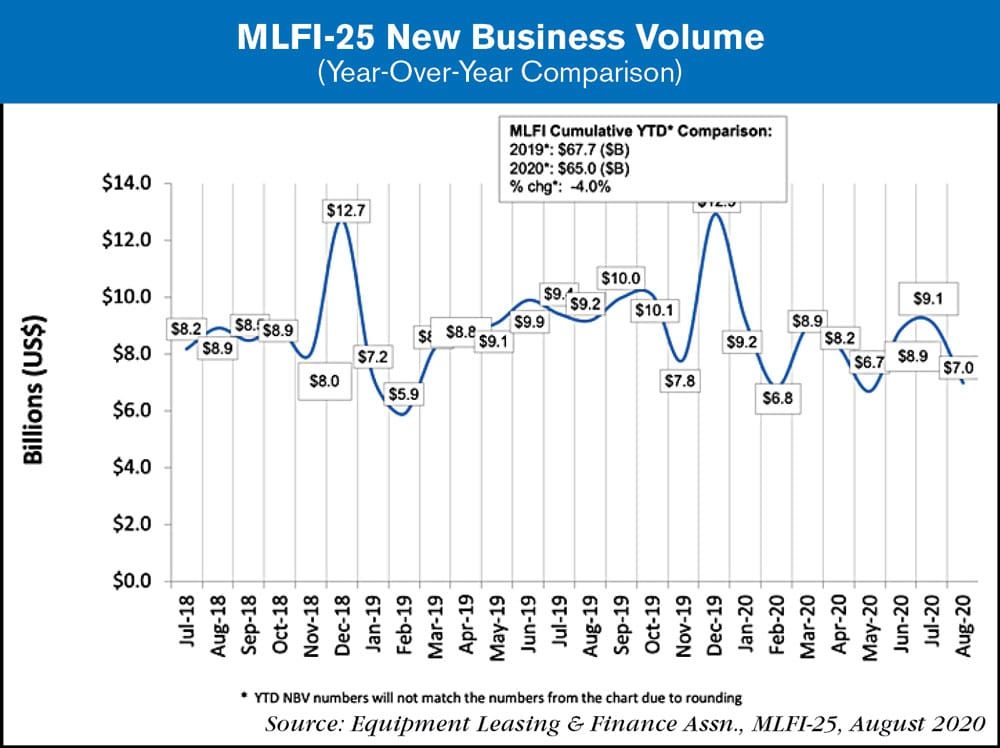

The Equipment Leasing and Finance Association’s (ELFA) Monthly Leasing and Finance Index (MLFI-25), which reports economic activity from 25 companies representing a cross section of the $900 billion equipment finance sector, showed their overall new business volume for August was $7 billion, down 24% year-over-year from new business volume in August 2019. Volume was down 23% month-to-month from $9.1 billion in July. Year-to-date, cumulative new business volume was down 4% compared to 2019.

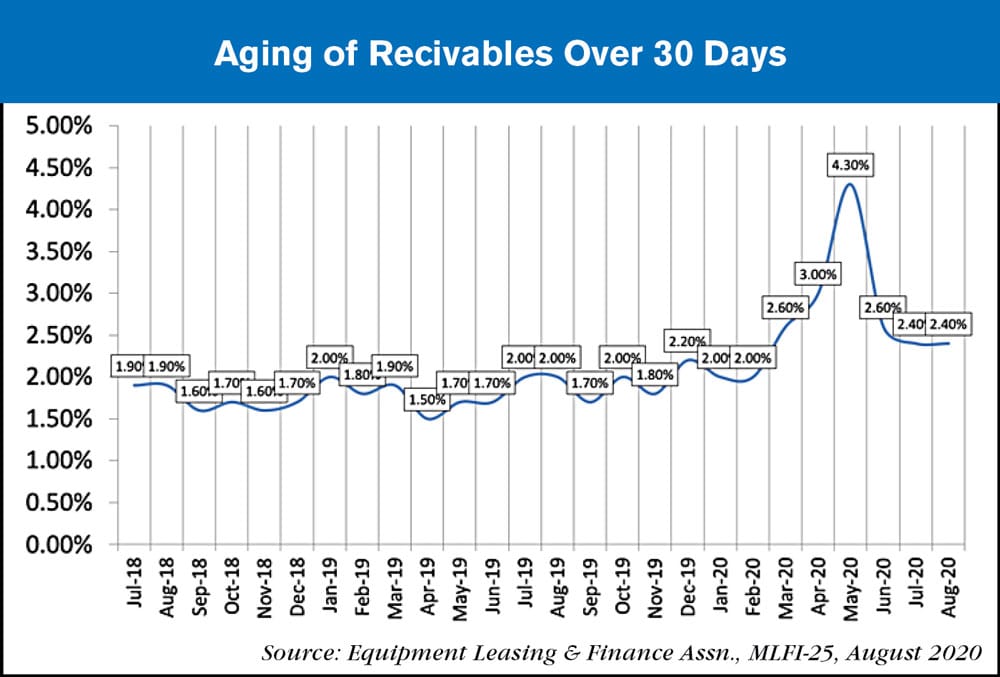

Receivables over 30 days were 2.4%, unchanged from the previous month and up from 2% the same period in 2019. Charge-offs were 0.8%, up from 0.7% the previous month, and up from 0.4% in the year-earlier period.

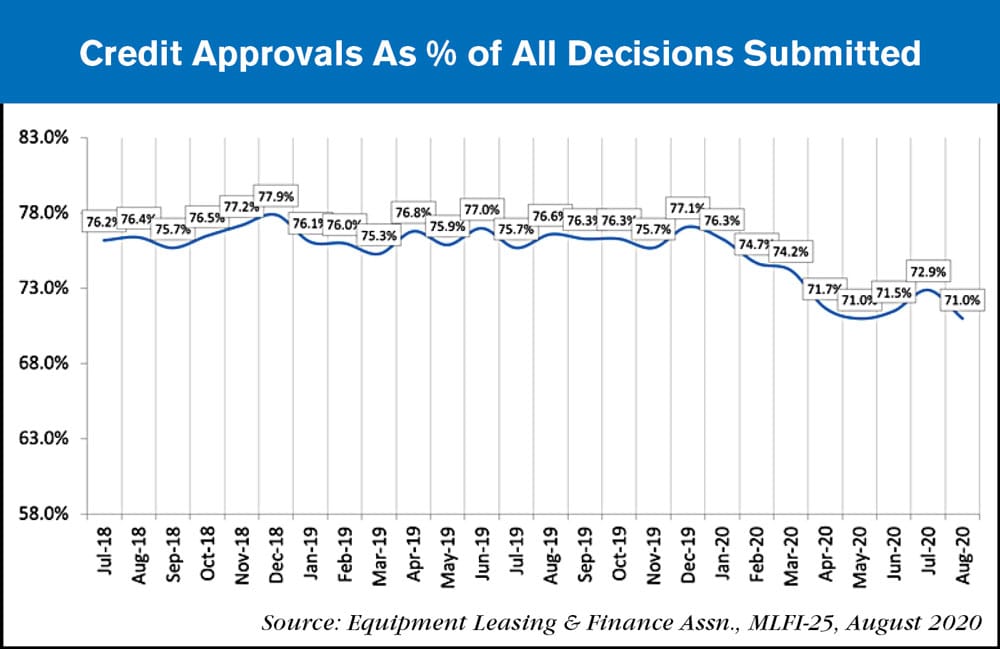

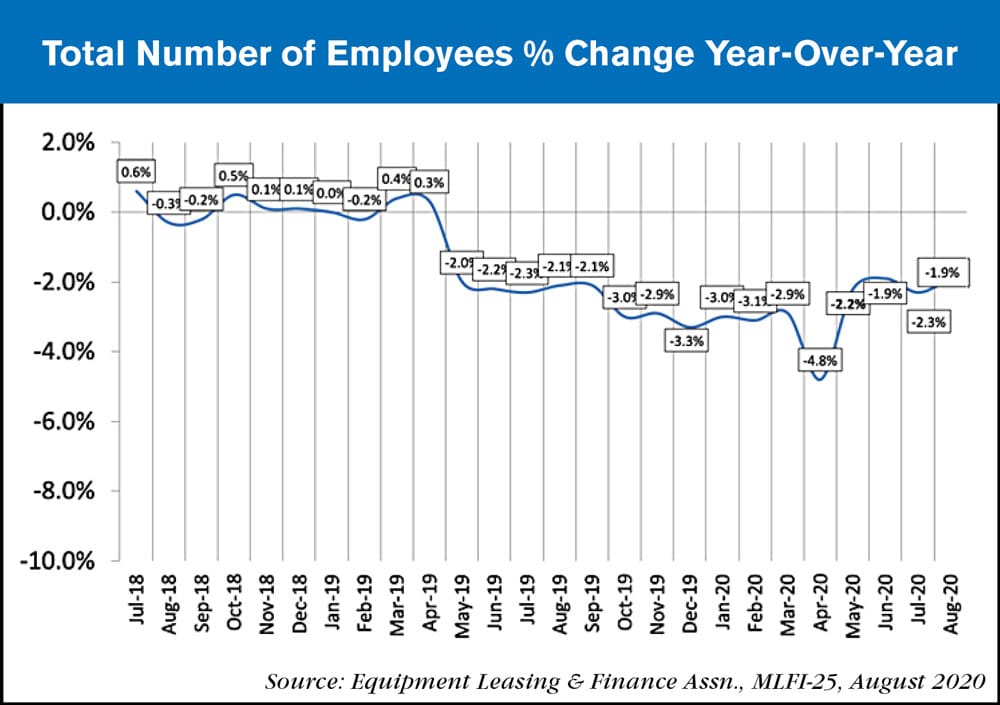

Credit approvals totaled 71%, down from 72.9% in July. Total headcount for equipment finance companies was down 1.9% year-over-year.

Separately, the Equipment Leasing & Finance Foundation’s Monthly Confidence Index (MCI-EFI) in September is 56.5, an increase from the August index of 48.4.

ELFA president and CEO Ralph Petta said, “The sizeable drop in new business volume is testament to an economy that continues to struggle in certain industry sectors. Seasonality also plays a role in the noticeable decline in equipment investment in the month of August. The hope is that Congress’s inability to enact additional stimulus legislation to combat the pandemic will not slow an economic recovery that many economists, including the Fed, are projecting for the third and fourth quarters.”

Willis Kleinjan, founder and CEO, Northland Capital Equipment Finance, said, “The new monthly data gives reason for continued apprehension about the overall economy as COVID-19 maintains its grip on the country. We have seen with many of our customers in agriculture and construction that these essential industries continue to experience growth as they are minimally impacted by the virus. Low interest rates continue to fuel those businesses and industries that are the least affected by the pandemic and are using this opportunity to expand.”

Post a comment

Report Abusive Comment