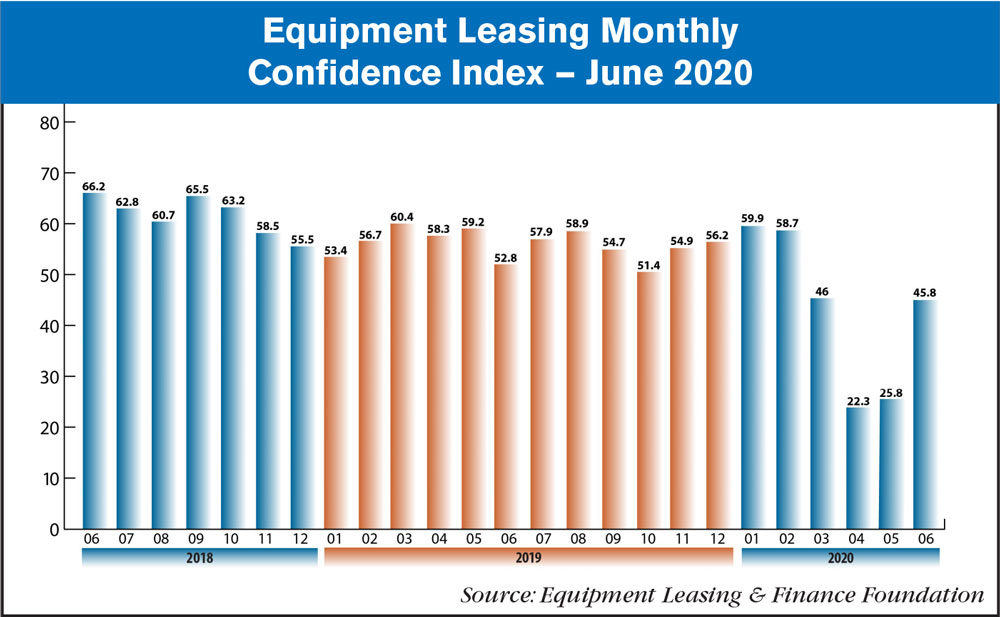

The Equipment Leasing & Finance Foundation (the Foundation) has released the June 2020 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI). The index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $900 billion equipment finance sector. Overall, confidence in the equipment finance market increased to 45.8, up from the May index of 25.8.

The Foundation also releases highlights of the COVID-19 Impact Survey of the Equipment Finance Industry, a monthly survey of industry leaders designed to track the impact of the coronavirus pandemic on the equipment finance industry.

When asked about the outlook for the future, MCI-EFI survey respondent Daniel Krajewski, president and CEO, Sertant Capital, said, “Despite the reduction in overall demand, the market size still remains extensive. We continue to find opportunity and have seen an uptick in application activity. We do have continued concern over the political environment and the divide that continues to exist in Washington.”

June 2020 Survey Results

The overall MCI-EFI is 45.8, an increase from 25.8 in May.

- When asked to assess their business conditions over the next four months, 37% of executives responding said they believe business conditions will improve over the next four months, up from 3.3% in May. 18.5% believe business conditions will remain the same over the next four months, an increase from 10% the previous month. 44.4% believe business conditions will worsen, a decrease from 86.7% in May.

- 18.5% of the survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase over the next four months, up from 6.7% in May. 44.4% believe demand will “remain the same” during the same four-month time period, an increase from 6.7% the previous month. 37% believe demand will decline, a decrease from 86.7% in May.

- 7.4% of the respondents expect more access to capital to fund equipment acquisitions over the next four months, up from none in May. 85.2% of executives indicate they expect the “same” access to capital to fund business, an increase from 73.3% last month. 7.4% expect “less” access to capital, a decrease from 26.7% the previous month.

- When asked, 7.4% of the executives report they expect to hire more employees over the next four months, a decrease from 16.7% in May. 85.2% expect no change in headcount over the next four months, an increase from 60% last month. 7.4% expect to hire fewer employees, down from 23.3% the previous month.

- None of the leadership evaluate the current U.S. economy as “excellent,” unchanged from the previous month. 22.2% of the leadership evaluate the current U.S. economy as “fair,” up from 10% in May. 77.8% evaluate it as “poor,” down from 90% last month.

- 55.6% of the survey respondents believe that U.S. economic conditions will get “better” over the next six months, an increase from 20% in May. 25.9% indicate they believe the U.S. economy will “stay the same” over the next six months, a decrease from 30% last month. 18.5% believe economic conditions in the U.S. will worsen over the next six months, down from 50% the previous month.

- In June, 14.8% of respondents indicate they believe their company will increase spending on business development activities during the next six months, a decrease from 23.3% last month. 74.1% believe there will be “no change” in business development spending, up from 33.3% in May. 11.1% believe there will be a decrease in spending, a decrease from 43.3% last month.

June 2020 Survey Comments from Industry Executive Leadership

Bank, Small Ticket

“I am encouraged that businesses are re-opening and getting back to work. Over the next three to six months many businesses will recover and others will forever be changed in detrimental ways. I believe in the adaptive spirit of business leaders and their ability to change business models and find ways to build and grow in new directions to find success.” David Normandin, CLFP, president and CEO, Wintrust Specialty Finance

Independent, Small Ticket

“I’m hopeful that the PPP loan relief programs have had a positive impact on keeping small businesses afloat. I think we will see in the next two months whether it helped limit failures or just postponed them.” Quentin Cote, CLFP, president, Mintaka Financial, LLC

Bank, Middle Ticket

“The team is adjusting to the new normal. We are conducting a small number of customer visits based on customer requests and where physical distancing is practiced. All visits are day trips and we have not presently activated overnight travel. We are adapting sales strategies to ensure we are meeting customers’ expectations and to grow market share.” Michael Romanowski, president, Farm Credit Leasing

Independent, Middle Ticket

“As most jurisdictions across the U.S. begin to reopen, many of America’s businesses will find a way to restart and prosper again. Never underestimate the tenacity of American entrepreneurs.” Bruce J. Winter, president, FSG Capital, Inc.

Post a comment

Report Abusive Comment