Deutz, a global manufacturer of drive systems, registered an overall decline in business performance in the first quarter of 2020, as it had expected. This was due in large part to the global fall in demand in key customer industries – heavily exacerbated by the coronavirus crisis – which caused a further contraction in the reporting period and prompted the Company to withdraw its previous guidance for 2020 at the end of March.

At the same time, the Company announced that it would temporarily suspend much of its production in Europe in April and apply for short-time working, as many of its customers had already closed their factories and efficient production was no longer possible. In the reporting period, the Deutz engine business was also impacted by customers selling the inventories of engines they had built up before new emissions standards came into force – a phenomenon that had already led to a low level of orders on hand at the end of 2019. Deutz has launched an efficiency program, Transform for Growth, in order to shore up its earnings performance in difficult market conditions. A detailed list of measures is currently being drawn up with the aim of further increasing the Group’s competitiveness and reducing complexity along the entire value chain.

The operating loss (EBIT before exceptional items) amounted to $13.3 million in the first quarter of 2020, compared with an operating profit of $28.4 million in the prior-year period. This decline was largely attributable to the sharp fall in revenue – caused by the coronavirus crisis and customers selling the inventories of engines they had built up before new emissions standards came into force – and the resulting diseconomies of scale. There was also a heavy drag on operating profit because of payments made under continuation agreements with suppliers that are going through insolvency proceedings. The EBIT margin before exceptional items stood at minus 3.5% in the first quarter of 2020, compared with 5.5% in the prior-year period. The decline in operating profit caused net income to deteriorate to a net loss of $11.3 million. The positive income tax situation was predominantly attributable to deferred tax income.

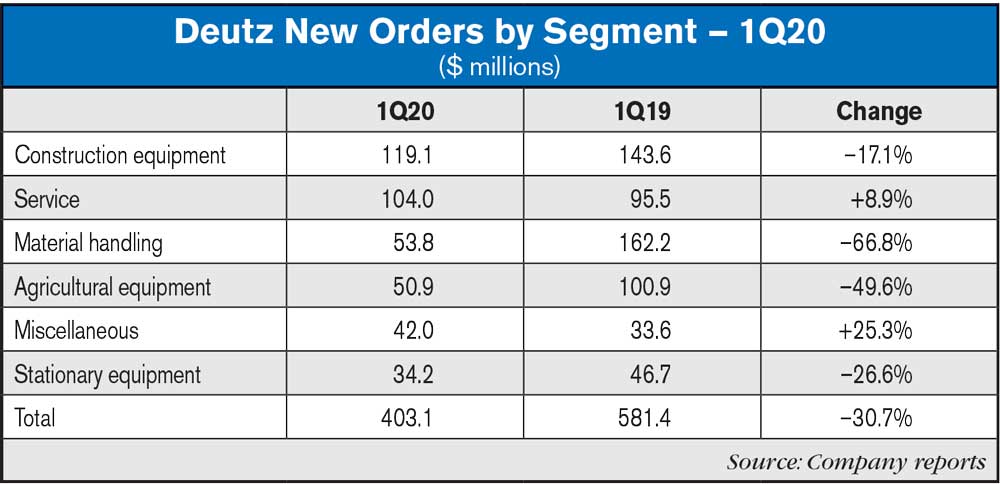

In the first quarter of 2020, Deutz took new orders totaling $403.1 million. The decrease of 30.7% compared with the first three months of 2019 was due not only to the high level of new orders in the prior-year period as a result of customers building up their inventories of engines before new emissions standards came into force, but also – crucially – to a much sharper fall in demand caused by the coronavirus crisis.

The Construction Equipment, Material Handling, Agricultural Machinery and Stationary Equipment application segments recorded a significant reduction in new orders, whereas the Miscellaneous application segment and the service business notched up substantial increases of 25.3% and 8.9% respectively. The rise in new orders in the Miscellaneous application segment was primarily attributable to Deutz winning a number of tenders for rail vehicle drive systems. The growth in the service business was attributable both to increased revenue from parts sales to existing customers and to newly signed service agreements.

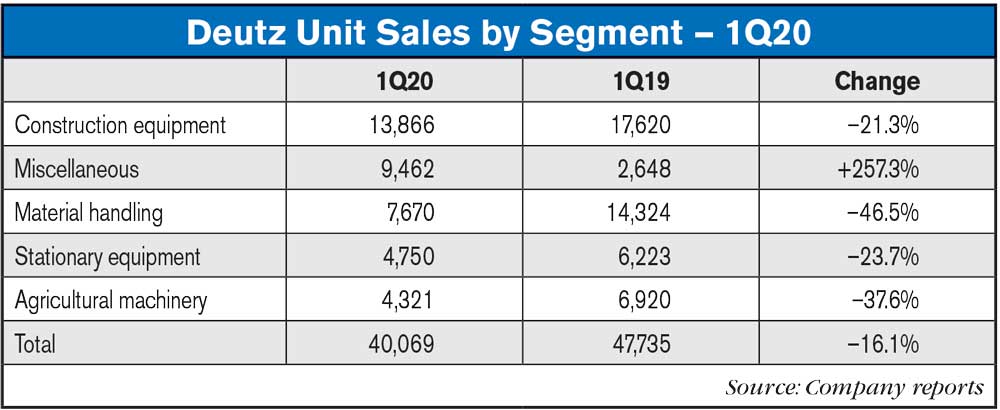

The Deutz Group’s unit sales totaled 40,069 engines in the reporting period, which was 16.1% fewer than in the first quarter of 2019. Among the application segments, the only one with a significant increase in unit sales was Miscellaneous with a rise of 257.3%. This improvement was essentially due to the launch of trolling motors made by Deutz subsidiary Torqeedo, which recorded an almost fivefold increase in unit sales after selling a total of 8,523 electric motors. The driving factors behind the drop in unit sales in the other application segments were weaker demand in the market and, in particular, adverse effects resulting from customers running down inventories of engines that had been purchased ahead of new emissions standards coming into force.

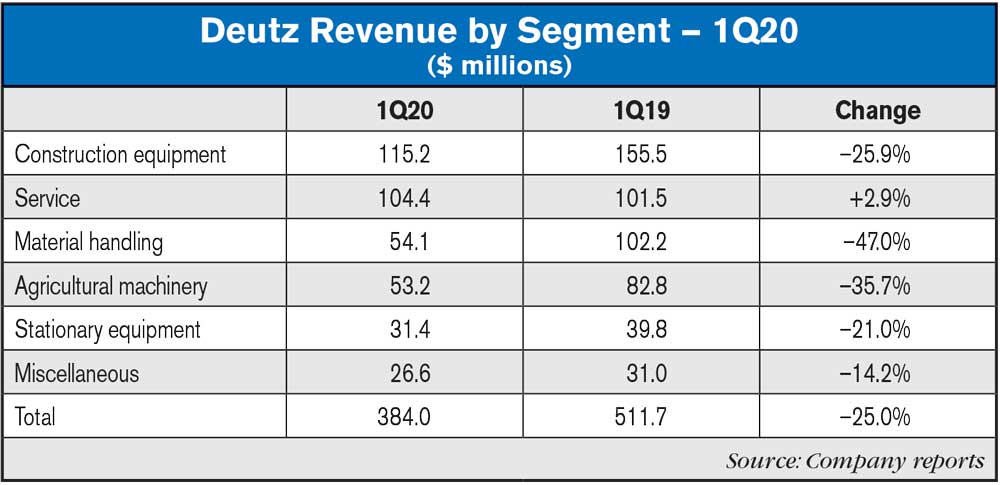

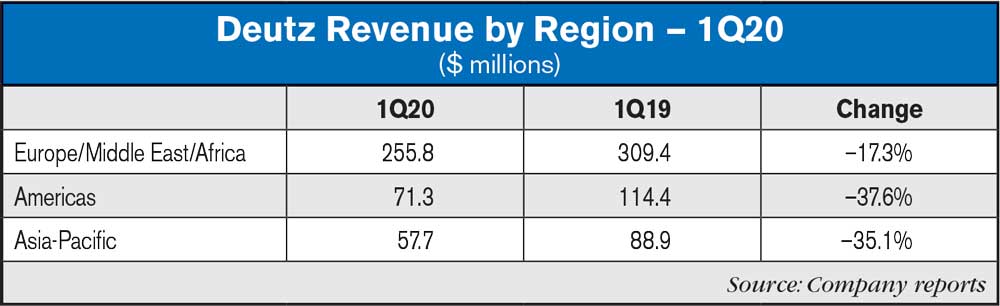

The Deutz Group’s revenue fell by 25% compared to the first three months of 2019 to $384 million. This downward trend was attributable to the impact of the coronavirus crisis and adverse effects resulting from customers running down inventories of engines that had been purchased ahead of new emissions standards coming into force. Among the application segments, only the service business continued to expand, with revenue rising by 2.9%. Revenue growth was particularly satisfying in on-site customer service, which registered a sharp increase for a number of reasons, including the signing up of new customers by DPS Power Group, which Deutz acquired in late 2019.

Outlook

At the end of the reporting period, in light of the worsening economic impact of the coronavirus pandemic, Deutz withdrew the initial guidance for 2020, which had been communicated at the time of publication of the annual report. The progression and timeline of the coronavirus crisis going forward is very difficult to predict, as is its impact. Consequently, it is still not possible to provide updated guidance for 2020. In agreement with the Supervisory Board, the Board of Management of Deutz Ag has decided to propose to the Annual General Meeting on June 25, 2020, that the dividend payment for the 2019 financial year be suspended in order to help maintain the Company’s financial stability and flexibility. Deutz is currently also at an advanced stage of negotiations about obtaining a further credit line for a low triple-digit million euro amount.

Post a comment

Report Abusive Comment