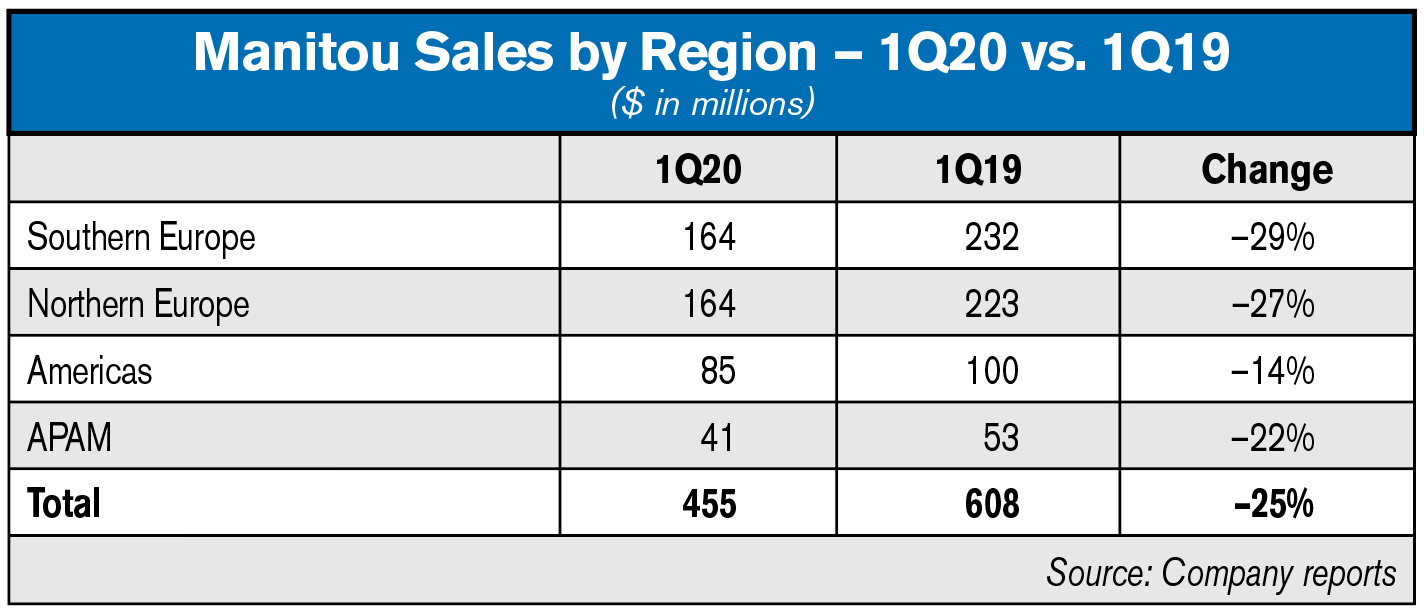

Manitou, manufacturer of equipment for agriculture, construction and other industries reported its first quarter revenues in 2020 down 25% to €421 million ($455 million) from €562 million ($608 million) in the first quarter of 2019. The company also reported order intake in the first quarter of 2020 at €400 million ($433 million), down x from €363 million ($393 million) in the first quarter of 2019. Besides Manitou equipment, the company is also known for its Gehl and Mustang branded equipment.

Michel Denis, president and chief executive officer, stated, “First quarter business was suddenly interrupted by the globalization of the COVID-19 crisis, which massively affected the construction sector and, to a lesser extent, the industry. Agricultural demands and service activities remain less impacted due to the greater resilience of these sectors."

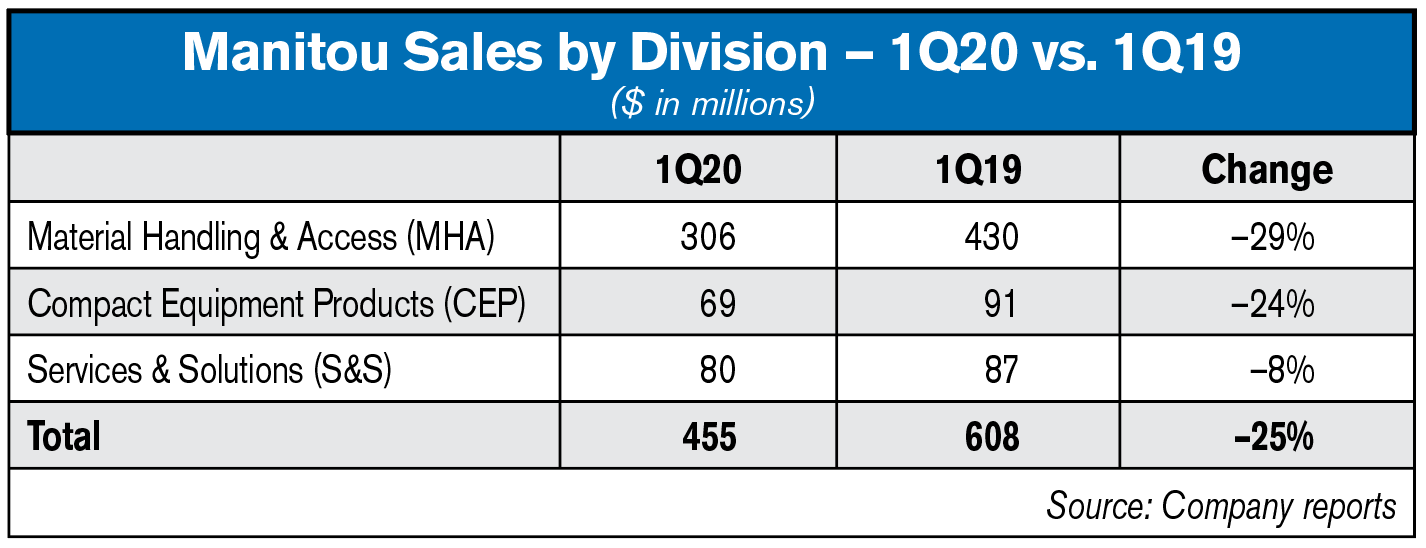

With sales revenue of €283 million ($306 million) for the quarter, the Material Handling & Access (MHA) Division recorded a 29% decrease (also down 29% at constant exchange rates) compared with the first quarter of 2019. Under the combined effect of the wait-and-see attitude of rentals who had not yet ordered by the end of 2019 and the COVID-19 crisis, the division's business was down sharply in the quarter.

The Compact Equipment Products (CEP) Division posted sales revenues of €64 million ($69 million), a decrease of 24% (down 26% at constant exchange rates) compared with the first quarter of 2019. The beginning of the current fiscal year showed an acceleration in demand, particularly from American rental companies, before this dynamic was stopped by the COVID-19 crisis.

The Services & Solutions (S&S) Division recorded an 8% decrease in its revenue (down 11% at constant exchange rates) compared with the first quarter of 2019 at €74 million ($80 million). The division was able to maintain reduced activity throughout the containment period, enabling it to limit the impact of the COVID-19 crisis.

COVID-19 Comments

The COVID-19 crisis led the group to shut down production activities in France, Italy and then India in mid-March, while maintaining, where legislation allowed, the marketing of spare parts and service, as well as the core functions to support its activities. Geographies have been more or less affected by adaptation measures or restrictions on commercial activities. From a business point of view, the strength of the dealer network across all geographies has so far ensured a good resilience of the order book despite the sharp downturn in some markets and geographies. After securing the health and safety of the sites, the French and Italian industrial operations were very gradually reactivated in mid-April. The implementation of new measures and the restarting of the supply chain should impact industrial performance for many months to come.

For a list of all ag equipment manufacturer announcements pertaining to the COVID-19 pandemic, click here.

Post a comment

Report Abusive Comment