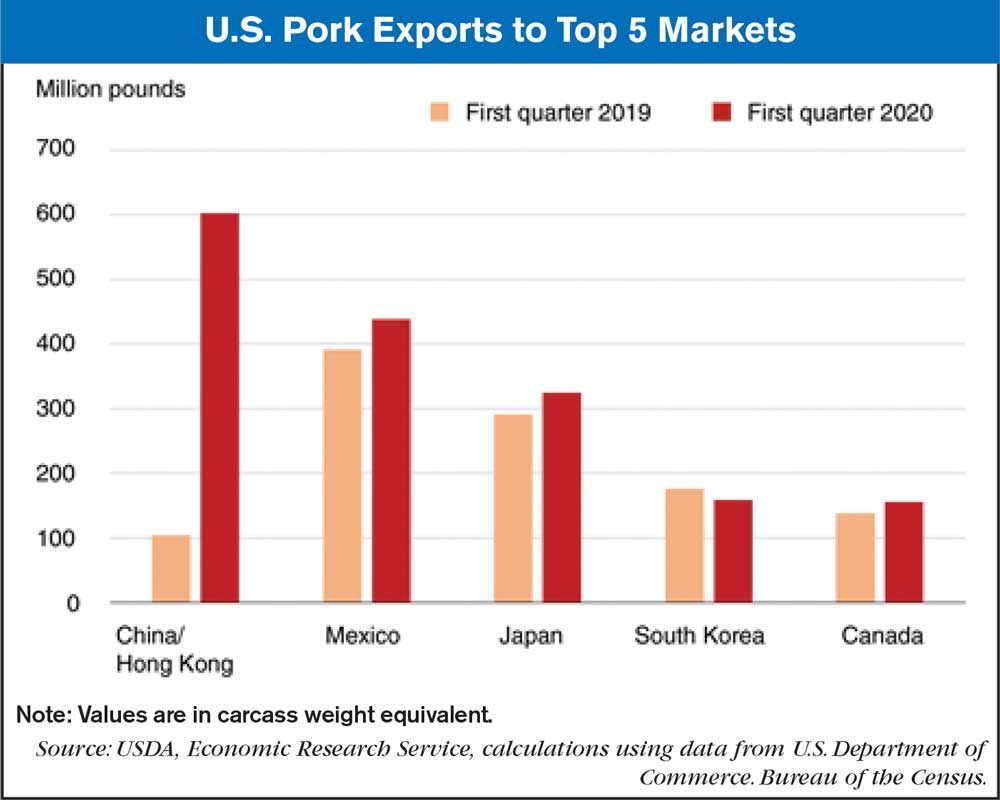

Significantly larger pork sales to China boosted U.S. pork exports during first quarter 2020 to a record high volume of over 2 million pounds. Sales to China (including Hong Kong) were a record 597,000 pounds, up nearly fivefold, and more than 50% above earlier quarterly highs in 2008 and 2011. China/Hong Kong sales outpaced growth in pork exports to other top markets, which include Mexico, Japan and Canada. China/Hong Kong was the top export market, accounting for almost 30% of first quarter U.S. pork exports.

The export boom is driven by a shortfall in China’s pork output, following an African swine fever (ASF) epidemic that shrank China’s swine herds by 40% or more during 2018-19. China’s COVID-19 lockdown, from January through March 2020, further constrained supplies. According to official Chinese data, the country’s first quarter 2020 pork output was down almost 30% from a year earlier — a 9.3-billion-pound decline — and consumer prices for pork were up more than 122%.

Robust sales to China are expected to continue. According to official statistics for March 2020, China’s swine herd was still more than 29% smaller than before the epidemic. Even if China avoids new ASF outbreaks and succeeds in rebuilding production capacity, biological lags in sow gestation and growth of finished hogs will delay China’s restoration of domestic pork supplies until 2021 or later. Exemptions to punitive tariffs imposed on U.S. pork were granted beginning in March 2020, giving a further boost to Chinese purchases.

This chart was drawn from the Economic Research Service’s May 2020 Livestock, Dairy and Poultry Outlook report.

![[Technology Corner] Quantifying the Impact of a Precision Ag Pioneer](https://www.agequipmentintelligence.com/ext/resources/2024/08/23/Quantifying-the-Impact-of-a-Precision-Ag-Pioneer.png?height=290&t=1724422794&width=400)

Post a comment

Report Abusive Comment