Titan International Inc. (TWI), a global manufacturer of agricultural and other off-highway wheels, tires, assemblies, and undercarriage products, reported results for the fourth quarter and year ended Dec. 31, 2019.

Net sales for the fourth quarter of 2019 were $301.8 million, compared to net sales of $363.4 million for the fourth quarter of 2018, representing a $61.6 million, or 17%, decrease. Net loss applicable to common shareholders for the fourth quarter of 2019 was $24.8 million compared to net loss applicable to common shareholders of $13.4 million in the fourth quarter of 2018. The fourth quarter 2019 adjusted net loss attributable to Titan was $24.4 million compared to net loss attributable to Titan of $12.3 million in the comparable prior year period.

Net sales for the year ended Dec. 31, 2019 were $1.45 billion, compared to net sales of $1.6 billion for the full year 2018, representing a $153.7 million decrease. The adjusted net loss attributable to Titan for the year was $45.7 million compared to adjusted net income attributable to Titan of $16.1 million in the comparable prior year period.

"We have concluded a challenging year for Titan and our industry,” said Paul Reitz, president and chief executive officer. "This comes on the heels of a very successful 2018. Titan, along with many of our customers, started 2019 with expectations for promise of further growth, but ultimately it produced significant volatility and uncertainty with poor Ag conditions due to North America weather and the China trade battles. The fourth quarter was especially challenging with our primary OE customers producing below retail demand levels, which drove our sales well below the volume at which we could produce profitability.”

“With the first phase of the China trade deal completed, we've seen North American farmer sentiment improve and expect them to hit the fields hard this spring,” said Reitz. “"Also, we anticipate our North American Ag OE customers should return to normalcy in terms of their production at retail levels, and we have seen early signs of this during the current quarter. In addition, we expect increases in our aftermarket sales, particularly in North American Ag, again with increases already seen during the early part of 2020. We believe there are a number of triggers in place that could drive markets to improve later in 2020. We hope to gain more visibility for the year over the coming months and expect to provide an update after there is more clarity.”

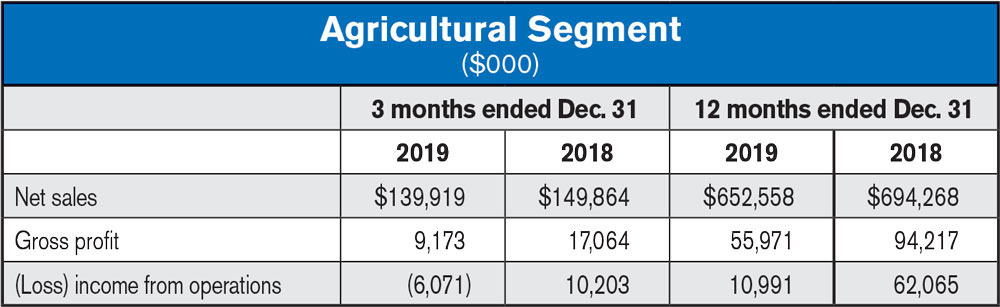

Agricultural Segment Results

During the quarter, lower sales volume contributed 15% of the decrease in agricultural net sales, while unfavorable currency translation, primarily in Latin America and Europe, decreased net sales by 2%. Positive price/mix increased net sales by 10.3% during the current quarter.

Lower sales volumes were primarily caused by challenging market conditions and economic softness in all geographies as well as ongoing global trade issues, which continue to cause significant uncertainty for Titan's customers. The decrease in gross profit was primarily driven by the impact of lower sales volume and the significant impact on production efficiencies.

During the year ended Dec. 31, 2019, a volume decrease of 13.2% and unfavorable foreign currency translation of 3.3% contributed to the decrease in net sales while favorable price/mix, experienced by all geographic locations except for Australia, partially offset this decrease with a 10.5% positive impact on net sales.

Lower sales volumes were primarily caused by challenging market conditions and economic softness in most geographies as well as ongoing global trade issues. The decrease in gross profit was driven by lower sales volumes, unfavorable foreign currency translation and production inefficiencies. In addition, we experienced underperformance in our North American Wheel operations from reductions of steel inventory at higher than current prices, which compressed gross profit by approximately $12 million during the year.

Post a comment

Report Abusive Comment