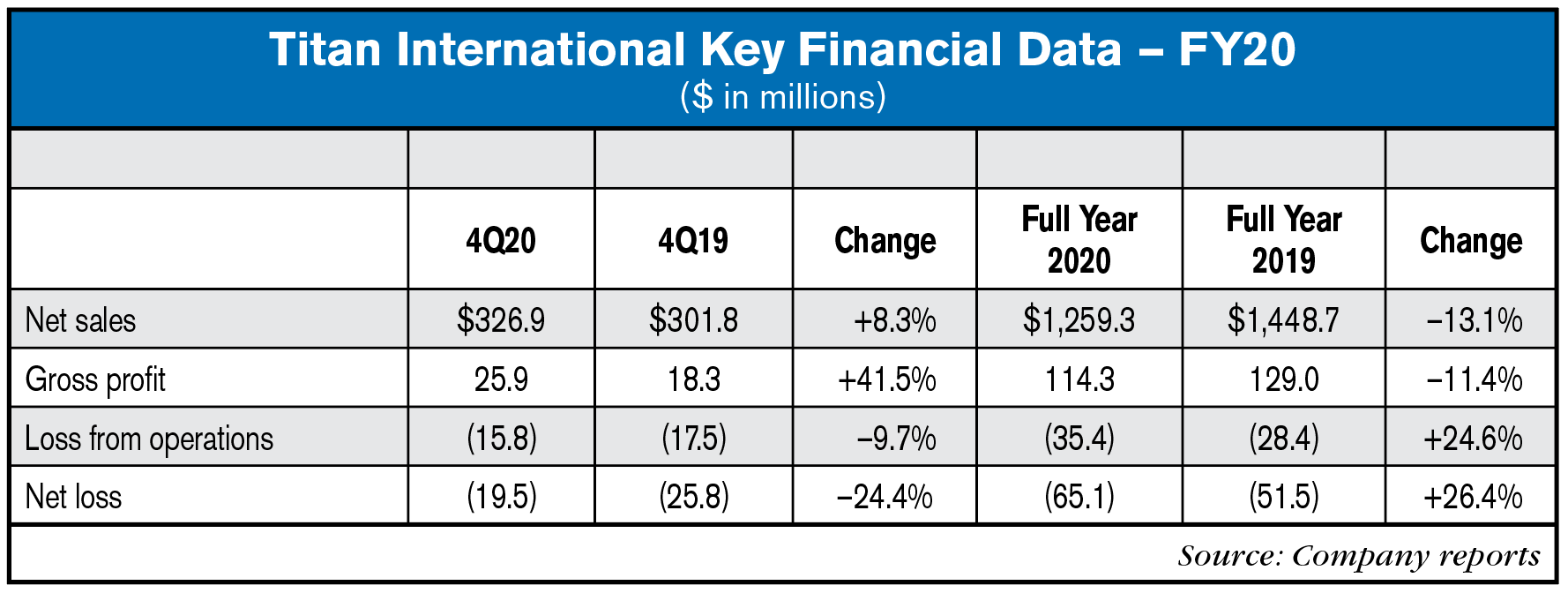

Net sales for the fourth quarter ended Dec. 31, 2020, were $326.9 million, compared to $301.8 million in the comparable quarter of 2019, an increase of 8.3% driven by sales decreases in both the Agriculture and Earthmoving/Construction segments. Overall, net sales volume increased 20.5% from the comparable prior year quarter, with the most significant growth coming from Agriculture in North America, Latin America and Europe driven by stronger OEM customer demand. Unfavorable currency translation decreased net sales by 6.4% while unfavorable price/mix of 5.8% further decreased net sales during the quarter.

Net sales for the year ended Dec. 31, 2020, were $1.26 billion, compared to $1.45 billion in the comparable full year 2019, a decrease of 13.1% driven by sales decreases in all segments. This decrease reflected the challenges in the earthmoving/construction market as a result of a slowdown of the global construction market, particularly in Europe. Approximately $57 million in reduced sales, in comparison to the same period of 2019, was attributable to disrupted markets in Europe, Latin America and Asia resulting from the COVID-19 pandemic. Overall, net sales volume was down 8.1% and unfavorable currency translation further decreased net sales by 5% during the year ended Dec. 31, 2020 as compared to 2019.

Gross profit for the fourth quarter ended Dec. 31, 2020, was $25.9 million, compared to $18.3 million in the comparable prior year period. Gross margin was 7.9% of net sales for the quarter, compared to 6.1% of net sales in the comparable prior year period.

Gross profit for the year ended Dec. 31, 2020, was $114.3 million, compared to $129 million in 2019. Gross margin was 9.1% of net sales for the year ended Dec. 31, 2020 compared to 8.9% of net sales in 2019. The decrease in gross profit was driven by lower sales volume and approximately $15 million unfavorable gross profit impact from the COVID-19 pandemic. Further, gross profit were negatively impacted by an impairment charge of $13.8 million related to certain machinery and equipment located at TTRC.

Loss from operations for the fourth quarter of 2020 was $15.8 million, or 4.8% of net sales, compared to a loss of $17.5 million, or 5.8% of net sales, for the fourth quarter of 2019. Excluding the fourth quarter adjustments mentioned above, the Company posted a positive net operating profit of $2.7 million during the current year quarter.

Loss from operations for the year ended Dec. 31, 2020 was $35.4 million, or 2.8% of net sales, compared to a loss of $28.4 million, or 2% of net sales, for the year ended Dec. 31, 2019. This increase in the loss from operations was driven by the items previously discussed, but most notably the asset impairment charges totaling $20.8 million and the $5 million legal accrual recorded in 2020. Excluding one-time adjustments mentioned above the loss from operations for the full year was $7.8 million.

Agriculture Segment

During the quarter, higher sales volume contributed 32.3% of the increase in Agricultural net sales, while unfavorable currency translation, primarily in Latin America and Russia, decreased net sales by 9.4%. Unfavorable price/mix reduced net sales by 7.6% during the current quarter. Higher sales volumes were driven by improving market conditions with the most significant growth in North America, Latin America and Europe driven by stronger OEM customer demand. The increase in gross profit was driven by the impact of higher sales volume and the related impact on production efficiencies as well as favorable global material prices.

During the year ended Dec. 31, 2020, unfavorable foreign currency translation of 6.8% and unfavorable price/mix of 0.8% contributed to the decrease in net sales. This was partially offset by a volume increase of 4.8% experienced by the majority of our geographic locations except for our North America wheel operations and our undercarriage business in Europe. Higher sales volumes were the result of improving market conditions during the fourth quarter following challenging market conditions and economic softness due to the impact of the COVID-19 pandemic for much of 2020. The increase in gross profit and margin was driven by favorable global raw material prices and operational improvements and efficiencies experienced during 2020. Particularly, North American wheel improved operations and experienced efficient supply chains during 2020 as compared to elevated steel inventories and related costs in the second and third quarters of 2019.

Commentary

"The new year is already looking like a completely different story compared to 2020," stated Paul Reitz, president and chief executive officer. "The confidence of U.S. farmers is at record levels with the tailwinds from strong commodity prices and healthy government payments received last year. Dealers are hungry for inventory as channels have been depleted to the lowest levels seen in the past 20 years.

"We finished the year with strong momentum as the results of our fourth quarter reflect the continued improvement in our financial position. We finished the year with a significant turnaround during Q4, as demand from many of our customers, particularly in the agriculture markets, continued to strengthen as the quarter progressed.

"The positive trends that we saw late in 2020 have only increased during the first few months of 2021. We expect this favorable trend in South America to continue along with North America demand accelerating through 2021 due to strong farmer income and commodity prices combined with low levels of inventory in many channels. Along with market improvements, we are seeing an improved pricing environment. In the first quarter of 2021, we have increased prices to offset rising raw material costs. We will continue to increase prices to offset higher production costs, and as the year progresses, we expect to improve our pricing leverage to manage our gross margins. With the business trending positively in many ways, we are looking toward a noticeable EBITDA improvement in 2021.

"The recent surge in agricultural demand, coming off the tail of the global pandemic, has created a high degree of volatility for our customer base and for Titan. We are rapidly hiring and training people to meet this growing demand, while in the midst of restrictions and challenges in the marketplace. We are currently in discussions with major OEM's on long-term supply agreements that would be a win-win for both sides in today's ever changing world, and time is of the essence for everyone."

Related Content

Ag Equipment Manufacturers — Executive Compensations: Ag Equipment Intelligence has gathered financial data from the filings of the ag industry’s key publicly-traded manufacturers and compiled its own list of these companies’ executives’ compensations.

Post a comment

Report Abusive Comment