Quincy, Ill. — Titan International, Inc. (NYSE: TWI), a global manufacturer of off-highway wheels, tires, assemblies, and undercarriage products, today reported results for the second quarter ended June 30, 2020.

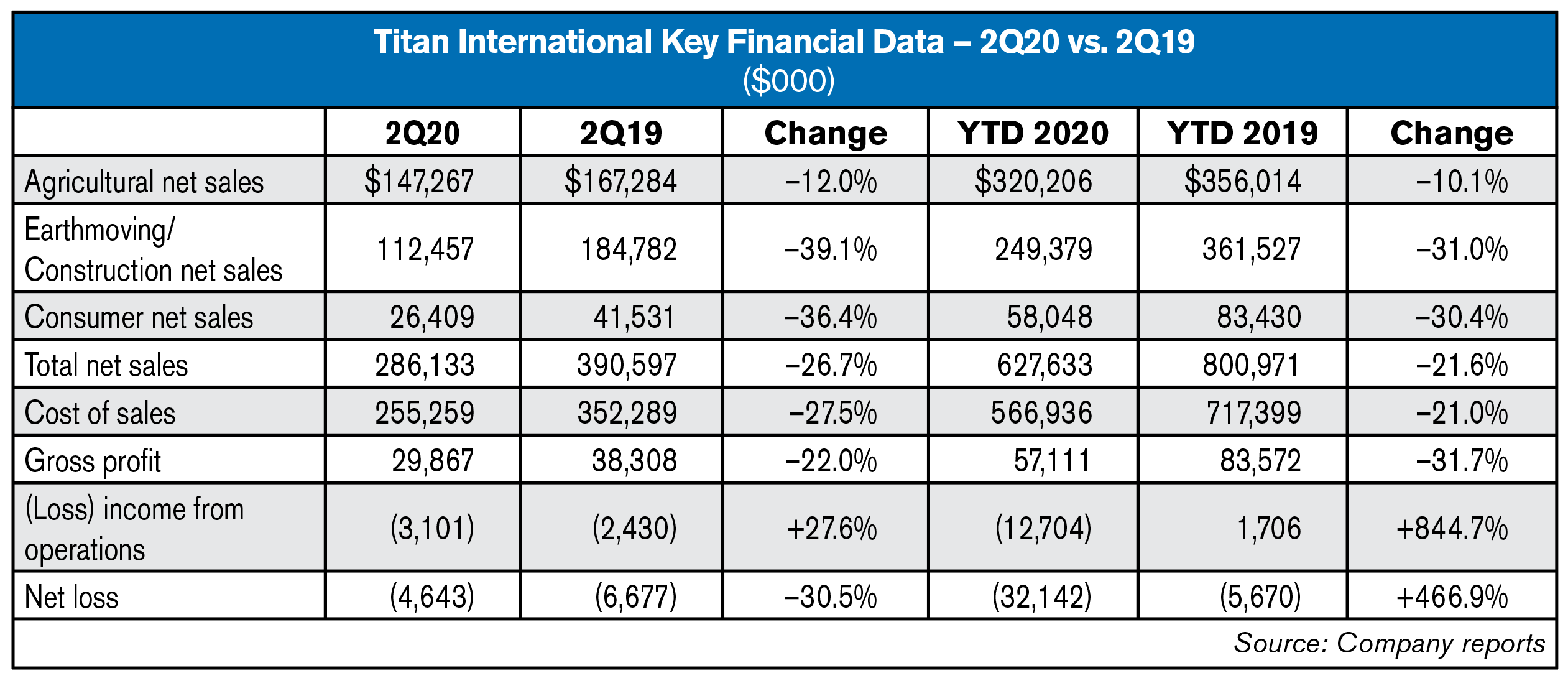

Net sales for the second quarter of 2020 were $286.1 million, compared to net sales of $390.6 million for the second quarter of 2019, representing a $104.5 million, or 26.7%, decrease. Overall net sales volume was down 24% from the comparable prior year quarter, due primarily to challenges in the earthmoving/construction market as a result of a slowdown of the global construction market, particularly in Europe. Approximately $31 million in reduced sales, in comparison to the same period of 2019, was attributable to plant closures and disruptive markets in Europe, Asia and Latin America resulting from the COVID-19 pandemic. Net sales for the first six months of 2020 were $627.6 million, compared to net sales of $801 million for the first six months of 2019, representing a $173.3 million, or 21.6%, decrease. On a constant currency basis, net sales for the first six months of 2020 would have been $660.1 million.

Gross profit for the second quarter ended June 30, 2020 was $29.9 million, compared to $38.3 million in the comparable prior year period. Gross margin was 10.4% of net sales for the quarter, compared to 9.8% of net sales in the comparable prior year period. The decrease in gross profit was driven by the impact of lower sales volume across most geographic regions. The decrease in gross profit was also impacted by a $1 million reserve for impairment of inventory for the closure of our Saltville, Virginia wheel operations. The unfavorable gross profit impact from the COVID-19 pandemic mentioned above was approximately $7 million. Gross profit for the first six months of 2020 was $57.1 million, compared to $83.6 million in the comparable prior year period. Gross margin was 9.1% of net sales for the first six months of 2020, compared to 10.4% of net sales in the comparable prior year period.

"Our strong focus on protecting the balance sheet, via cash preservation, accessing additional liquidity and improving our working capital position are each positive takeaways from the second quarter," stated Paul Reitz, president and CEO. "We were able to increase our cash balance nearly $20 million during the quarter while maintaining a similar net debt position. This improved position will aid Titan as we continue to navigate the effects of the COVID-19 pandemic.

"As expected, Titan had significant disruptions with plant shutdowns due to dislocation in demand primarily from OEM customers, along with some government restrictions during April. During the remainder of the quarter production levels improved; however, we continued to experience disruptions due to lower demand from our customers. Our ITM undercarriage business saw the deepest impact from lower customer demand across most geographies, particularly within the construction market.

"We entered the second quarter expecting this period to be the most challenging of the year and perhaps in Titan's long history. Our results demonstrate that we've navigated the challenges quite well, but like many companies we remain in an environment with limited demand visibility from our customers and also where the information we are receiving is often conflicting and changing rapidly. We continue to see an unusually high level of drop-in orders and we must remain nimble and flexible to quickly respond to meet those customer demands. Typically, we experience a sales slowdown in the third quarter due to the normal summer maintenance shutdowns and employee holidays, which we anticipate will be further exacerbated by the effects of the continuing COVID-19 pandemic. Therefore, we'll continue to remain diligently focused on making timely decisions and taking quick actions to adjust to demand fluctuations. Also, the liquidity actions we have taken have better positioned us to handle this crisis and we remain hopeful for some potential rebound in demand later in the year leading into 2021."

Agricultural Segment Results

During the quarter, lower sales volume in North America, Europe and Latin America contributed 8.4% of this decrease in net sales while unfavorable currency translation, primarily in Latin America, Europe and Russia, decreased net sales by 6.8%. Favorable price/mix increased net sales by 4.9%. Lower sales volumes were primarily caused by continued weakness in the commodity markets and the effect of the COVID-19 pandemic which continues to cause significant uncertainty for customers in most geographies, most notably OEM customers. The increase in gross profit is primarily attributable to production efficiencies from company-wide cost reduction initiatives and lower raw material costs.

During the six months ended June 30, 2020, lower sales volume in North America, Europe and Latin America contributed 4.8% of this decrease while unfavorable currency translation, primarily in Latin America, Europe and Russia, decreased net sales by 4.9%. Unfavorable price/mix further decreased net sales by 0.3%. Lower sales volumes were primarily caused by continued weakness in the commodity markets and the effect of the COVID-19 pandemic which continues to cause significant uncertainty for customers in most geographies, most notably OEM customers. The decrease in gross profit is primarily attributable to the impact of lower sales volume and unfavorable foreign currency translation.

Post a comment

Report Abusive Comment