The Ag Economy Barometer rose to a reading of 167 in January, a 17-point jump from December when the index stood at 150. Virtually all of the rise in this month’s barometer was attributable to a sharp rise in optimism about future conditions in agriculture. The Index of Future Expectations climbed 24 points to 179, while the Index of Current Conditions at 142 was essentially unchanged from the December reading of 141. This month’s Ag Economy Barometer survey, which is based on responses from a nationwide survey of 400 agricultural producers, was conducted from Jan. 13-17, 2020. The sharp improvement in future expectations coincided with President Trump’s signing of the Phase One Trade Agreement between the U.S. and China on Jan. 15th. In the agreement, China agreed to increase purchases of U.S. manufacturing, energy, and agricultural goods and services by at least $200 billion over 2 years, but it did not include specific information regarding which U.S. goods and services would benefit from the purchases.

Agricultural producers have become noticeably more optimistic about the future of agricultural trade over the last several months. As recently as October, just 55% of the farmers in our survey said they expect to see U.S. ag exports increase over the next 5 years. That changed in November and continued through the January survey as 70-71% of survey respondents said they expect to see ag exports rise in the upcoming years. At the same time, the percentage of producers with a pessimistic ag export outlook declined, as just 4% of respondents in January said they expect to see an export decline. That represents a shift from late summer when 10-12% of producers in our survey said they expect exports to decline over the next 5 years.

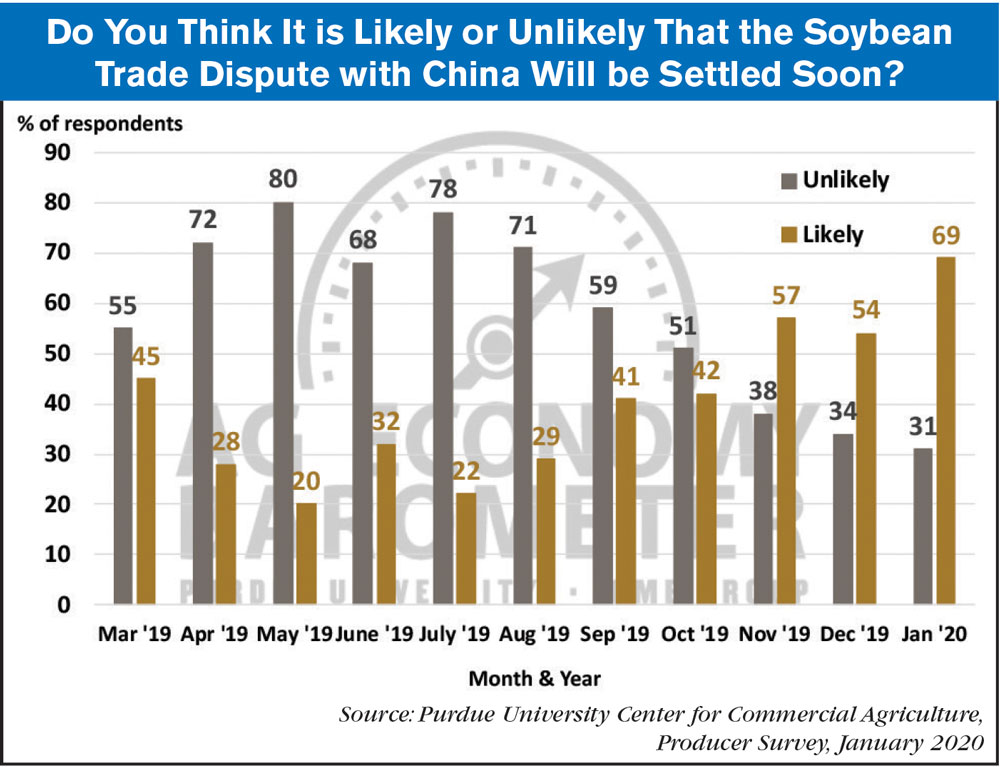

Part of the improvement in farmers’ trade outlook can be traced to a shift in their expectations regarding the trade dispute with China. Although the Phase One Trade Agreement with China did not explicitly address the soybean trade dispute, the percentage of farmers who expect the soybean trade dispute to be settled soon rose to 69% in January from 54% in December. That percentage has been rising steadily since July when just 22% of producers said they expected a quick resolution to the soybean trade dispute. At the same time, 80% of farmers in January said they expect a favorable outcome to the trade dispute with China compared to 72% who felt that way in December.

Despite the big improvement in future expectations among farmers in our survey, the Farm Capital Investment Index in January actually fell 4 points below December’s to a reading of 68. The index is based upon a question that asks farmers whether now is a good or bad time to make large investments in things like farm machinery and buildings. The index has ranged from the high 60s to the low 70s since November and, despite the small decline in the January reading, remains much stronger than it was in late summer and early fall when it ranged from the high 40s to the high 50s.

Post a comment

Report Abusive Comment