While more optimistic than they were a year ago, North American farm equipment dealers continue to acknowledge that booming machinery sales in 2018 probably isn’t in the offing. But the fact that their wholegoods inventory levels have improved significantly from a year ago is creating a more level playing field in which to operate.

According to Ag Equipment Intelligence’s January 2018 Dealer Sentiments & Business Conditions report, the huge backlog of both new and used equipment continues to diminish.

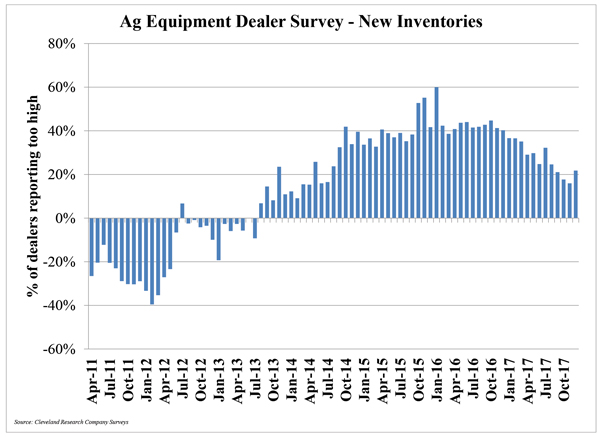

A year ago, a net 40% of dealers reported their new equipment inventory was “too high” (45% too high, 50% about right, 5% too low). A year later only 22% of dealers say the new wholegoods unit levels are too high (32% too high, 57% about right, 11% too low), which represents an 18% year-over-year improvement.

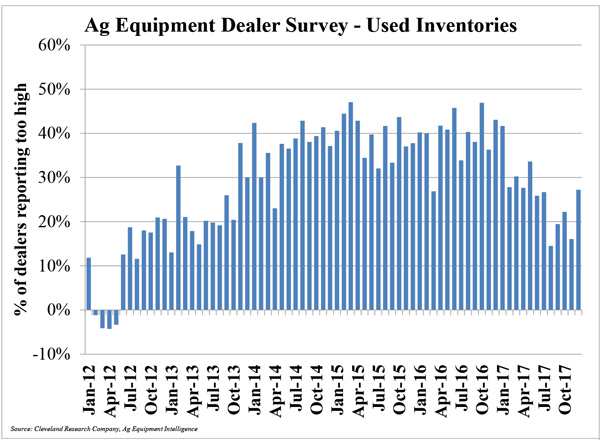

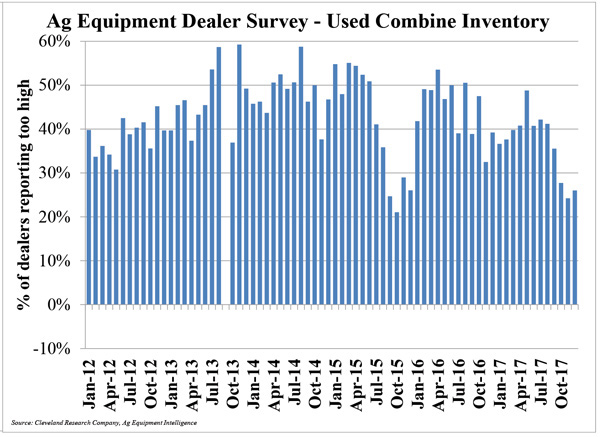

Used equipment levels are showing the same trend. The most recent survey results indicate that a net 27% of dealers reported used equipment inventory as too high (34% too high, 60% about right, 7% too low). In the January 2017 findings, a net 43% of dealers reported used equipment inventory as too high (47% too high, 49% about right, 4% too low), a 16% year-over-year improvement.

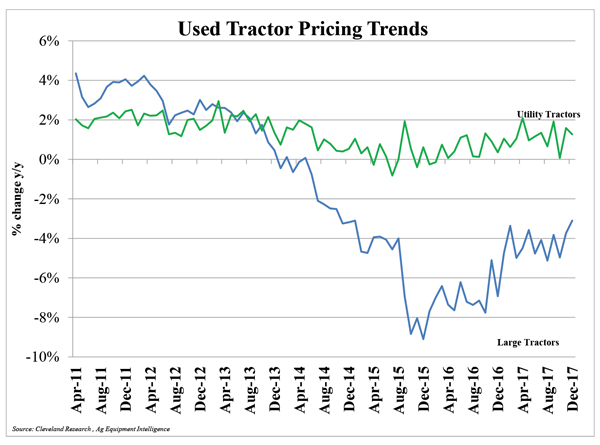

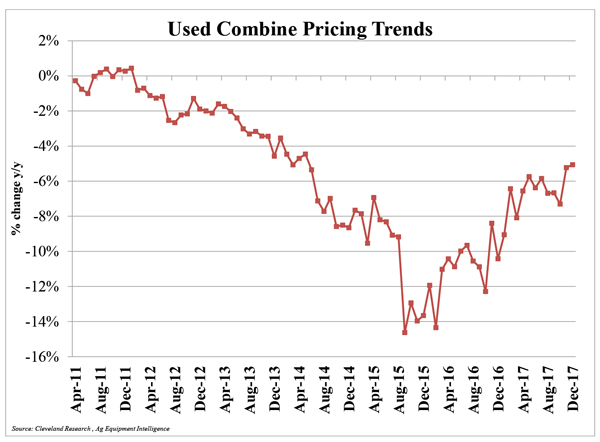

While the pricing environment for used equipment has remained choppy this past year, the general trend also indicates dealers’ prices have improved somewhat starting in mid-year 2016.

Improved Inventories

One reason behind dealers’ growing optimism centers on lower equipment inventories on their lots. In our most recent study, only 16% of dealers are reporting their new equipment inventories are “too high.” A year earlier, 41% of dealers said their new equipment backlogs were “too high.” Used equipment levels are also more manageable at this point, with 16% of dealers reporting used equipment levels are “too high.” This compares with 36% of dealers who told us their used equipment inventories were “too high.”

Post a comment

Report Abusive Comment