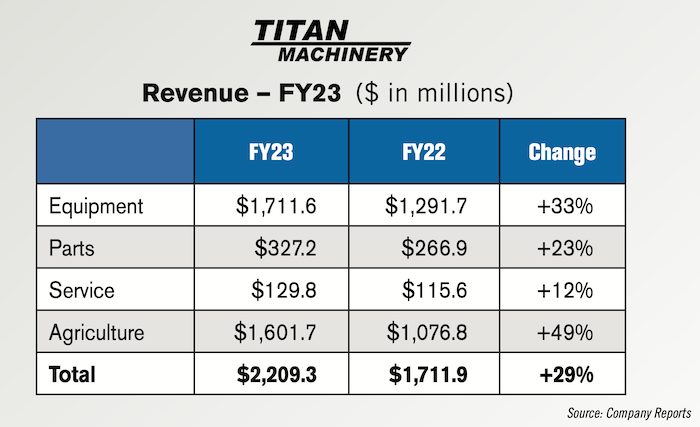

Titan Machinery today released its fiscal year 2023 earnings, reporting $2.2 billion in revenue for the year, a 29% year-over-year increase.

For the fourth quarter of fiscal 2023, revenue increased to $583 million, compared to $507.6 million in the fourth quarter last year. Equipment revenue was $471 million for the fourth quarter of fiscal 2023, compared to $413.2 million in the fourth quarter last year. Parts revenue was $72.2 million for the fourth quarter of fiscal 2023, compared to $58.5 million in the fourth quarter last year. Revenue generated from service was $28 million for the fourth quarter of fiscal 2023, compared to $26.2 million in the fourth quarter last year. Revenue from rental and other was $11.8 million for the fourth quarter of fiscal 2023, compared to $9.8 million in the fourth quarter last year.

Agriculture revenue for the fourth quarter of fiscal 2023 was $440.9 million, compared to $346.3 million in the fourth quarter last year. The revenue increase was positively impacted by organic growth as well as the acquisitions of Jaycox Implement in December 2021, Mark's Machinery in April 2022, and Heartland Ag Systems in August 2022.

Revenue increased 29.1% to $2.2 billion for fiscal 2023. Net income for fiscal 2023 was $101.9 million, or a record $4.49 per diluted share which included approximately $0.21 of benefits associated with manufacturer incentive plans. This compares to $66 million, or $2.92 per diluted share, for the prior year which included approximately $0.47 of benefits associated with manufacturer incentive plans, a gain on the sale of the Montana and Wyoming construction store locations and a partial release of an income tax valuation allowance.

Equipment revenue for fiscal year 2023 was up 33% to $1.7 billion from $1.3 billion in Titan’s fiscal year 2022. Parts revenue for the year was up 23% to $327 million and service revenue was up 12% to $130 million. Among its market segments, only the dealership’s ag revenue saw year-over-year increases, rising 49% to $1.6 billion in 2023 revenue.

Chairman and CEO David Meyer stated the following in the press release:

The fourth quarter was negatively impacted by delayed new equipment shipments. This abnormal congestion at the very end of the fiscal year limited our ability to deliver equipment to customers and recognize revenue, which resulted in an increase of pre-sold units coming on to our balance sheet at year end. While this impacted our financial performance in the fourth quarter, it is ultimately a timing nuance, as we expect to catch up on the backlog as we progress throughout the year. We are carrying significant demand into fiscal 2024 and continue to believe that we are experiencing an extended cycle that is being supported by strong Ag fundamentals which should drive sustained demand throughout the fiscal year. Equipment availability will likely remain a limiting factor in the near-term, but we are focused on those elements we can control and have an incredible foundation for another strong year as laid out in the modeling assumptions we are introducing today.

In a March 16 note to investors, RW Baird analysts gave their take on Titan Machinery’s earnings, saying:

“A uniquely favorable operating environment — record high used equipment prices, extremely tight supply environment — led to strong growth and record equipment margins in [Titan’s] FY23. The supply of equipment is clearly increasing, while demand remains solid we see rising risks from potential margin normalization and higher inventory levels.”

![[Technology Corner] What are the Top 5 Applications in Autonomy Right Now?](https://www.agequipmentintelligence.com/ext/resources/2024/11/08/What-are-the-Top-5-Applications-in-Autonomy-Right-Now-.png?height=290&t=1731094940&width=400)

Post a comment

Report Abusive Comment