According to the results of the 2023 Rural Lifestyle Dealer Business Dealer Outlook & Trends survey, dealers are forecasting growth in their parts and service revenue from rural lifestyle customers for 2023.

Revenue Forecasts. In their service revenue forecasts for 2023, half of dealers are forecasting growth of 2% or more, with 15.1% forecasting growth of 8% or more. Just 8.5% forecast a decline in service revenue over 2%.

Looking at their parts revenue, 42% of rural lifestyle dealers are forecasting growth for 2023, with 11.3% forecasting growth of 8% or more. The most common forecast for 2023 was for no change in parts revenue at 48%. Another 9% of dealers forecast a decline in their 2023 parts revenue of 2% or more.

Wholegoods revenue projections were the least optimistic among rural lifestyle dealers. Over half of surveyed dealers forecast a decline of 2% or more, with over one-third expecting wholegoods revenue down 8% or more. Some 22% of dealers forecast wholegoods growth of 2% or more.

One dealer put his forecast for 2023 into perspective. “Since we are coming off of a couple of fantastic record years, we will probably lower our inventory levels a little,” the dealer said. “And keep in mind, when I project lower sales in 2023, it will be lower than 2020-22, but perhaps still better than 2017-19.” The survey found 94% of dealers were profitable in 2022.

Another dealer said the following: “With the (past) drastic increase in sales, it’s good to see a slowdown so inventory levels can start returning to normal.”

Equipment Categories. Over the past couple of years, many dealers say they could have sold even more equipment if they could have gotten their hands on it. Perhaps that is why the number of dealers turning inventory more than 4 times per year was sliced in half over the past 12 months. Roughly 14% of dealers said they turned inventory more than 4 times last year, down from 29% the year prior. Most dealers (57%) made 3 or 4 turns, and another 29% made 1 or 2.

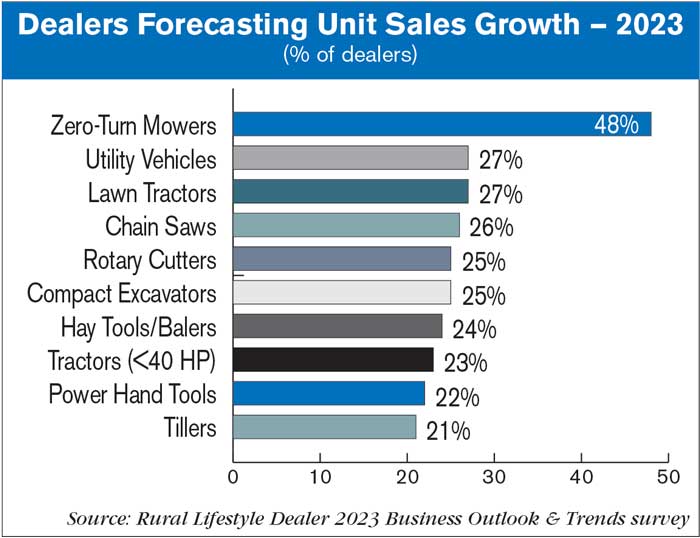

Looking at what equipment categories were forecast for the most growth in 2023, 48% of dealers expect growth in zero-turn mowers, followed by utility vehicles and lawn tractors at 27% each. Chain saws at 26% and rotary cutters at 25% made the top 5 picks for wholegoods growth among rural lifestyle dealers.

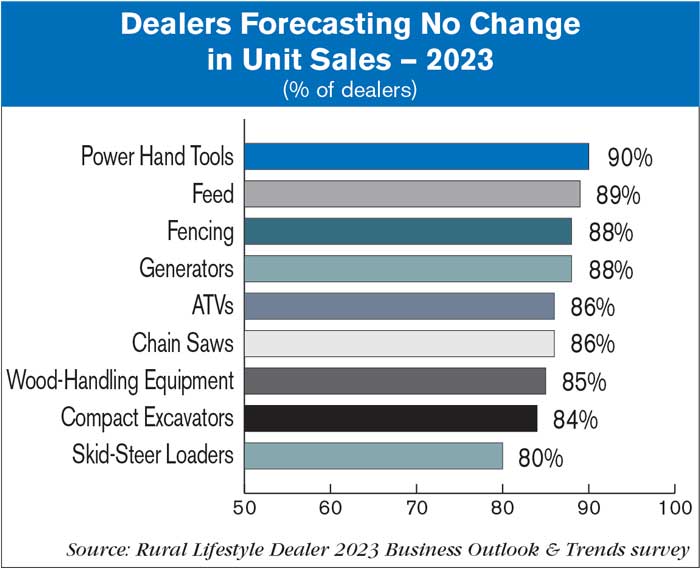

Additionally there are 26 categories where the majority of dealers see 2023 sales at least remaining flat with last year. Power hand tools had the highest percentage of dealers forecasting no change in sales at 90%, followed by feed at 89% and fencing at 88%.

Over the course of 2023, most dealers (68%) do not plan on adding equipment lines. For those dealers who are considering it, skid steer loaders were the most popular category at 42%, followed by utility vehicles (36%) and tractors under 40 horsepower (30%).

Electric Equipment. One expanding product category is battery-powered equipment. Some dealers are hoping for battery power to come to even larger machines like tractors and RTVs (rugged terrain vehicles). Others aren’t nearly as enthusiastic.

One dealer thinks that within the next 5 years, 30% of new residential mowers will be powered by battery. But another dealer doesn’t see market share growing beyond 10%, although handheld equipment will garner 95% of the market. Another dealer said it is inevitable that battery-powered equipment will continue to capture market share as battery technology becomes more reliable and affordable.

One dealer said that any significant growth in battery power will come down to a consumer’s choices, or lack thereof.

“Battery equipment will grow quite a bit, but not necessarily because it is what consumers want,” the dealer said. “It will grow because that is what consumers will have available to purchase. I’m not sure if that will be due to the government trying to influence purchasing, or manufacturers shifting more production capacity to battery products.”

That same dealer is worried their typical customer will not take a liking to battery-powered equipment. There is also concern over the “throwaway” nature of some battery-powered equipment, which can be a drag on a dealer’s aftermarket business.

A full breakdown of the 2023 Rural Lifestyle Dealer Business Dealer Outlook & Trends survey will be featured in the March issue of Farm Equipment.

Post a comment

Report Abusive Comment