In this episode of On the Record we take a look at the how dealer optimism has continued to fall, hitting a near record low, in May. In the Technology Corner Michaela Paukner follows up her last segment with a look at AGCO’s tech stack. We also discuss the California’s Occupational Safety & Health Standards Board’s rejection of a petition to amend a 70s era regulation limiting autonomous equipment. Also in this episode a look at Kubota’s dealer development plans and the full-line and tractor manufacturer results of EDA’s dealer manufacturer relations report.

To learn more about Agrisolutions and their globally recognized brands, such as Bellota, Ingersoll Tillage and Trinity Logistics, visit Agrisolutionscorp.com.

On the Record is now available as a podcast! We encourage you to subscribe in iTunes, the Google Play Store, Soundcloud, Stitcher Radio and TuneIn Radio. Or if you have another app you use for listening to podcasts, let us know and we’ll make an effort to get it listed there as well.

We’re interested in getting your feedback. Please feel free to send along any suggestions or story ideas. You can send comments to kschmidt@lessitermedia.com.

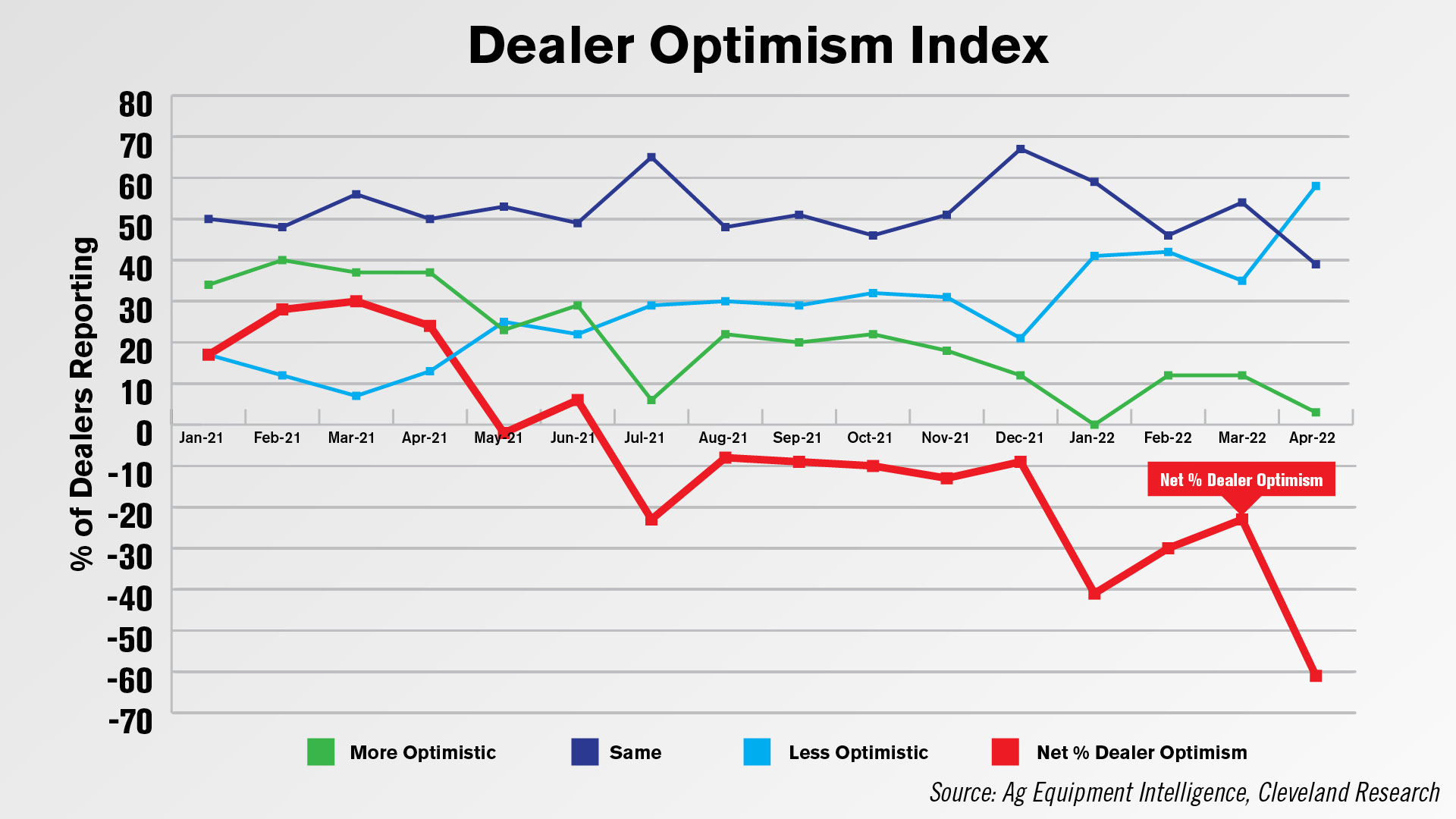

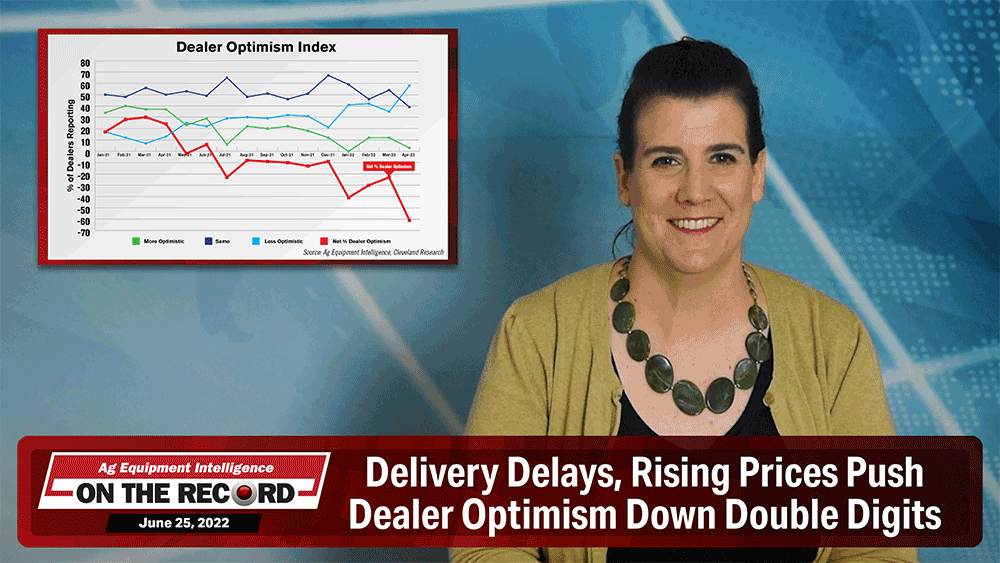

Dealer Sentiment Sees Big Dip in May

Our monthly Dealer Optimism Index has been trending negative since July of 2021 but had seen modest improvement in recent months. The latest reading, however, saw a 38 point drop. Each month, we ask dealers to rate their optimism vs. the month prior as either more optimist, the same or less optimistic. The May reading showed a net 61% of dealers reported being less optimistic. This is the second lowest reading since we started measuring optimism in 2011. March 2020 is the only month to see a lower reading, when a net 66% of dealers said they were less optimistic.

The May reading showed a net 61% of dealers reported being less optimistic. This is the second lowest reading since we started measuring optimism in 2011. March 2020 is the only month to see a lower reading, when a net 66% of dealers said they were less optimistic.

Dealer commentary suggests the drop in optimism is from a combination of manufacturers continuing to cut discounts while raising prices, the rising interest rates and equipment deliveries continuing to be behind.

One dealer from the Corn Belt commented, “We are becoming less optimistic for 2022 and 2023 as our equipment supply shrinks with little to no improvement on deliveries.”

Dealers on the Move

This week’s Dealer on the Move is Hills Machinery. The Case IH dealer opened two new facilities in Mills River and Leland, N.C.. Hills Machinery now has 9 locations. According to the company, the two new locations "ultimately put equipment owners throughout the territory within 90 miles of a Hills location no matter where their jobsite or farm is."

Technology Corner

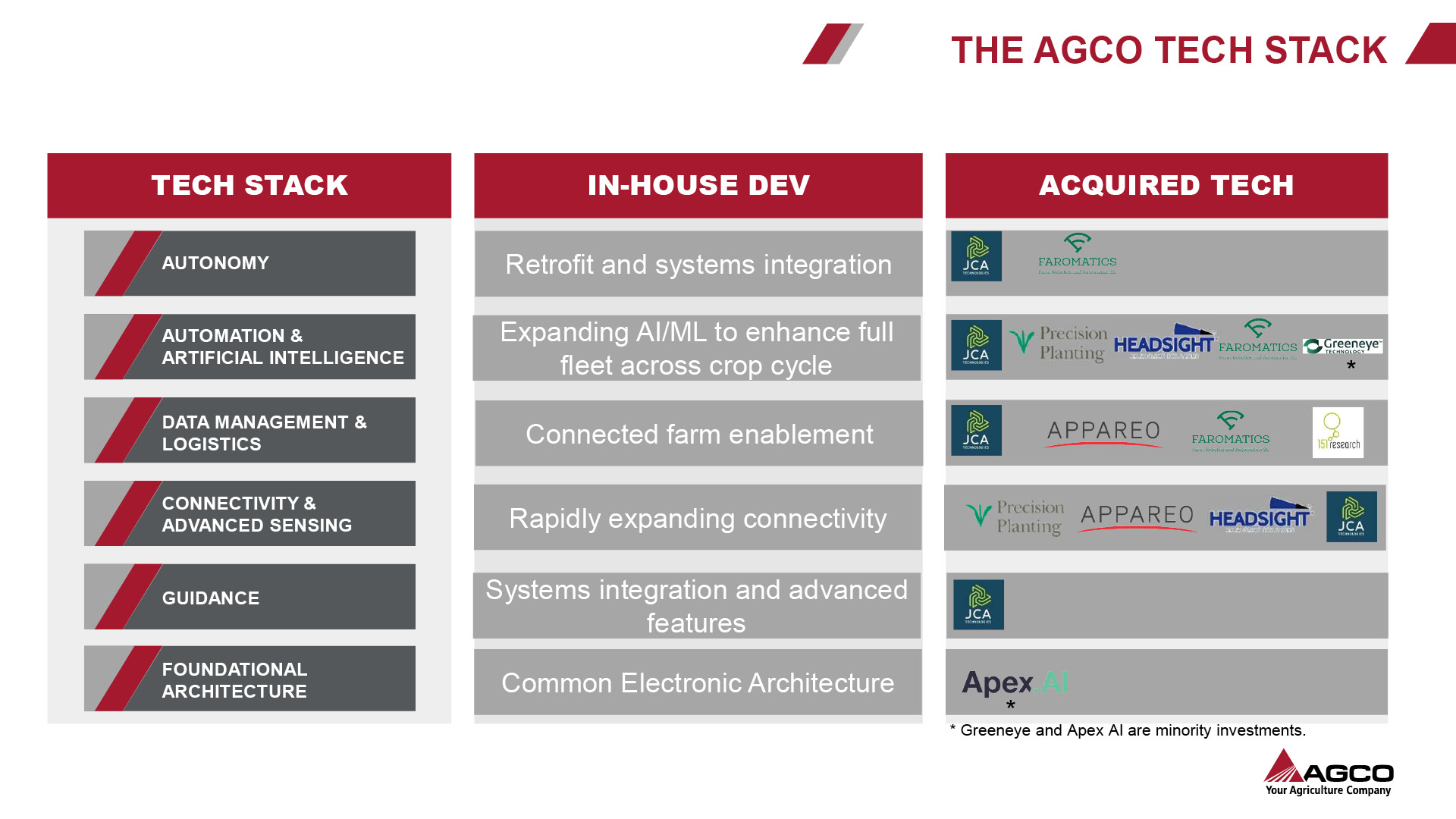

AGCO is taking a retrofit first approach to autonomy and its tech stack. The OEM is designing technology that will fit farmers’ operations, which often include a mixed fleet and the need to improve efficiency without buying a brand new machine. Here’s how AGCO illustrates its tech stack and the in-house development, acquisitions and investments that support it.

Here’s how AGCO illustrates its tech stack and the in-house development, acquisitions and investments that support it.

Autonomous software development companies Apex.AI and JCA Industries are foundational components of AGCO’s tech stack. AGCO acquired JCA in May and announced an expanded partnership with Apex.AI in June.

As you can see, JCA enables all levels of AGCO’s tech stack. Precision Planting; software, hardware and electronics manufacturer Appareo; and precision harvesting company Headsight complement the connectivity and advanced sensing of AGCO’s machines.

Faromatics, a precision livestock farming company, adds to AGCO’s autonomous, automation, artificial intelligence, data management and logistics capabilities. The acquisition of 151 Research, a research and product development firm focused on grain, enables farm connectivity, and a minority investment in smart spraying company Greeneye Technology allows AGCO to enhance its AI and machine learning capabilities.

Not pictured on the above graphic is AGCO’s recently announced investment in OPTIfarm, a precision livestock software company.

Seth Crawford, AGCO’s senior vice president and general manager of precision ag and digital, says internal strategic discussions identified that AGCO had the foundation to advance its artificial intelligence and autonomy capabilities on its own, but it would take too long to go it alone.

“We feel, from a retrofit-first approach, that we have a great brand with Precision Planting, and it's very well accepted and recognized by farmers as a technology that can be retrofitted onto anybody’s machine. We didn't feel that we needed to go get brands. We felt that we needed to go get the capabilities. So that's what we've done. Not many people have heard of JCA or Appareo or Headsight, but if you look at the products that are out there across the farms, quite often they have some place in a lot of the farms, and we see that as a real opportunity for us to continuing to build on our capabilities organically, continuing to grow the businesses we’ve acquired and continue to keep an eye out for investments.”

Crawford says thinking retrofit-first is a huge differentiator between AGCO and its competitors, and it’s the best business opportunity for AGCO as it puts the farmer first. Retrofit falls into a different channel than its competitors’ autonomous options — and it’s a channel that AGCO is already familiar with in its global markets, particularly in Western Europe.

Crawford spoke in depth about AGCO’s retrofit-first strategy in the latest episode of the Precision Farming Dealer podcast. Listen to the episode here.

Autonomous Outlook Delivered Setback by 1970s-Era Regulations

On June 16, Monarch Tractor’s petition (with the support of AEM and Far West Dealers Assn.) to amend a 1970s-era California regulation thwarting progress in autonomous farming was denied by a 4-3 vote by the California’s Occupational Safety & Health Standards Board.

Penned 3 decades before GPS was even introduced to farming, the regulation states “all self-propelled equipment shall, when under its own power and in motion, have an operator stationed at the vehicular controls.” Far West Equipment Dealers Association (FWEDA) joined a coalition of agricultural interests including producers supporting the petition to advance the use of autonomous equipment to improve worker safety, and address labor shortages and an increasing demand for emerging agricultural technology that offers sustainable career development for the future. Growers say driverless equipment would allow them to increase productivity with efficiency and continuous 24-hour operations.

Far West Equipment Dealers Association (FWEDA) joined a coalition of agricultural interests including producers supporting the petition to advance the use of autonomous equipment to improve worker safety, and address labor shortages and an increasing demand for emerging agricultural technology that offers sustainable career development for the future. Growers say driverless equipment would allow them to increase productivity with efficiency and continuous 24-hour operations.

“This is a significant setback in deploying real-world solutions to improve worker safety, increase productivity and adapt emerging technology,” FWEDA President & CEO Joani Woelfel said.

The agency wrote in its decision that the technology “is still very new” and requires human supervision. “While some study has been done in this emerging industry, the current dataset is too small to allow for Cal/OSHA to conclude that safety provided by an autonomous tractor is equivalent to safety provided by a human operator. More information, including information gleaned from the Petitioner’s recently-granted temporary experimental variance, is necessary for determining if an amendment to the regulation is needed. Such data and information will help inform that rulemaking process, should it occur.”

You can find additional coverage and details of the denied petition on AgEquipmentIntelligence.com

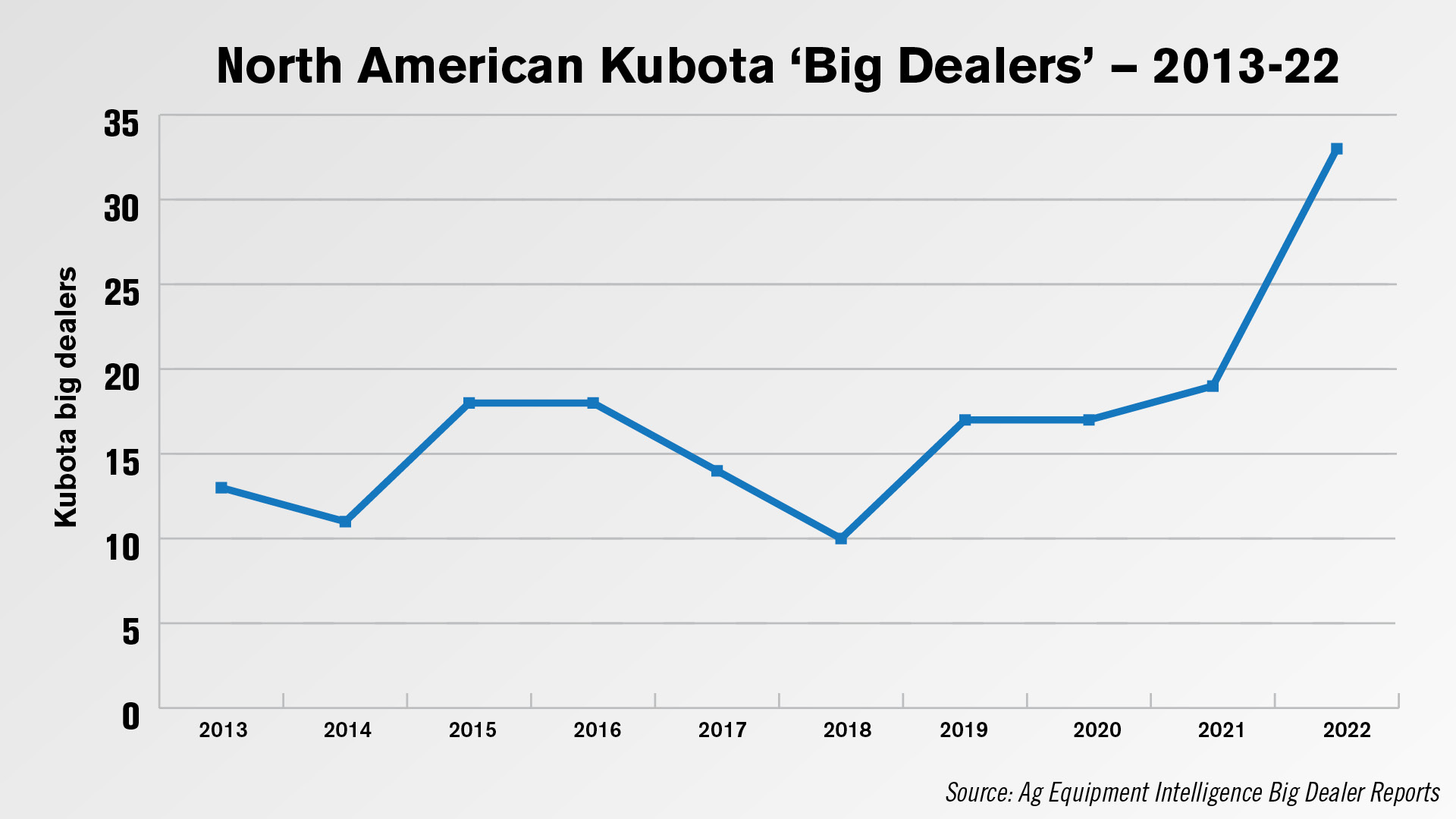

Kubota Sees More Big, Kubota-Only Dealers

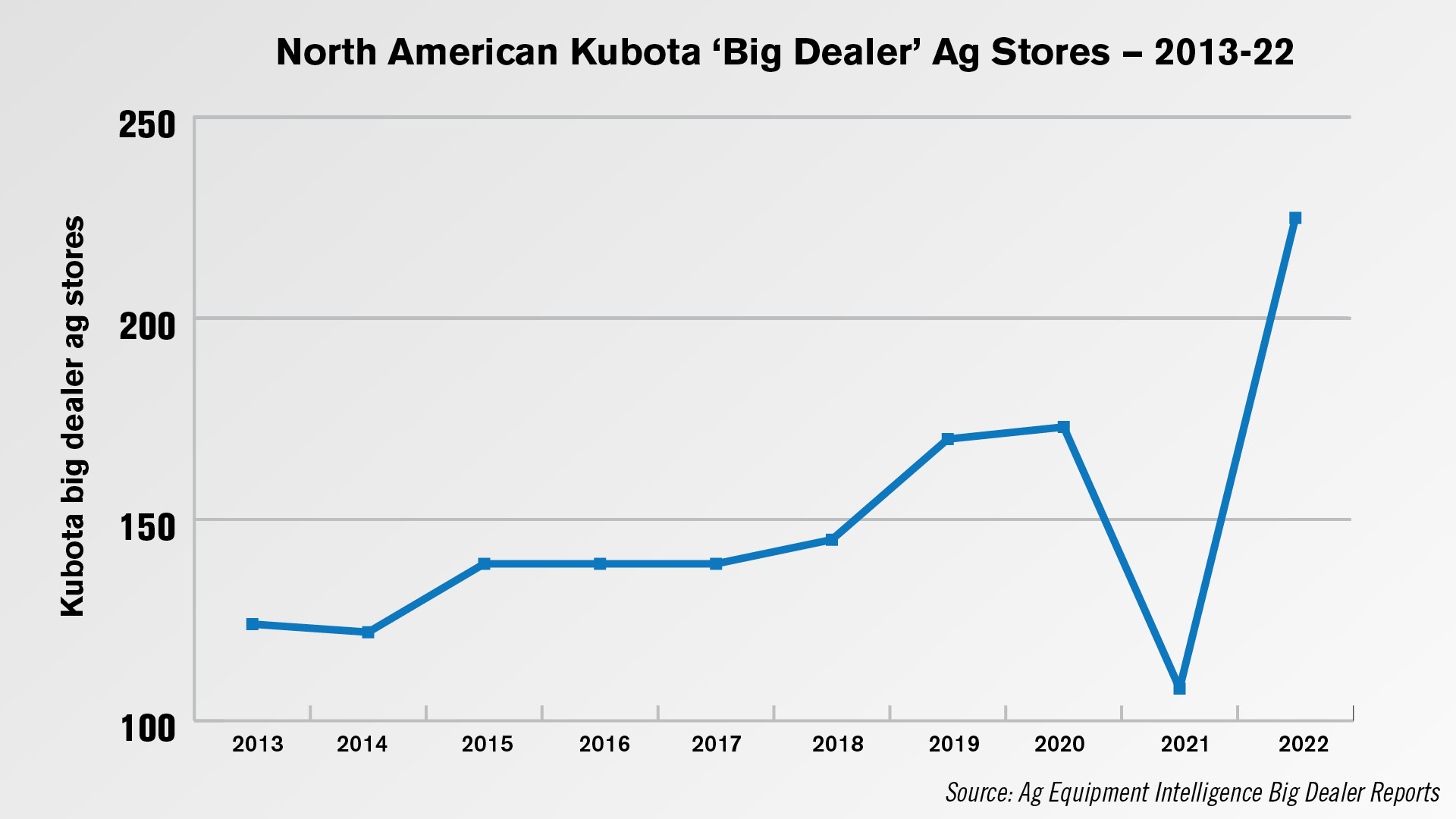

Thanks, Kim. Based on the results of this year’s Ag Equipment Intelligence Big Dealer Report, Kubota continues to see an increase in its number of big dealers, as well as the stores owned by those big dealers. A big dealer is defined as having 5 or more ag equipment locations. There were 33 Kubota big dealers reported this year, up from 19 in 2021. This increase was due to a combination of growth among Kubota dealers as well as data that was missing in previous reports. Only 13 Kubota big dealers were reported in 2013.

There were 33 Kubota big dealers reported this year, up from 19 in 2021. This increase was due to a combination of growth among Kubota dealers as well as data that was missing in previous reports. Only 13 Kubota big dealers were reported in 2013. The number of ag equipment locations owned by big Kubota dealers also rose to 225 in 2022 vs. 108 in 2021. Big Kubota dealers owned 124 ag equipment stores in 2013.

The number of ag equipment locations owned by big Kubota dealers also rose to 225 in 2022 vs. 108 in 2021. Big Kubota dealers owned 124 ag equipment stores in 2013.

Speaking with George Russell, founder of Machinery Advisors Consortium and collaborator on the Big Dealer report, he pointed out movement by Kubota dealers toward Kubota-only branded stores and dealership groups with scale.

Alex Woods, senior vice president, sales operations, supply chain & parts at Kubota, said the rise of Kubota-only dealerships was not a brand purity effort by the manufacturer but rather an organic response to the company’s improved equipment offerings.

“I think that is something that’s happening largely organically. Because as we talked about before, if we can provide the dealer more products to sell, we get more and more share of the wallet. We're able to cover more and more of the total operating expenses of the dealership, then we’re able to earn that ability.

“We are not about brand purity. We’re not demanding that of our dealers. We think if we can continue to get a bigger and bigger share of the wallet, then it is just naturally moving our direction.”

Woods did say this Kubota-only dealer trend could slow down in the future, as equipment supply chains continue to struggle across the industry. Back to

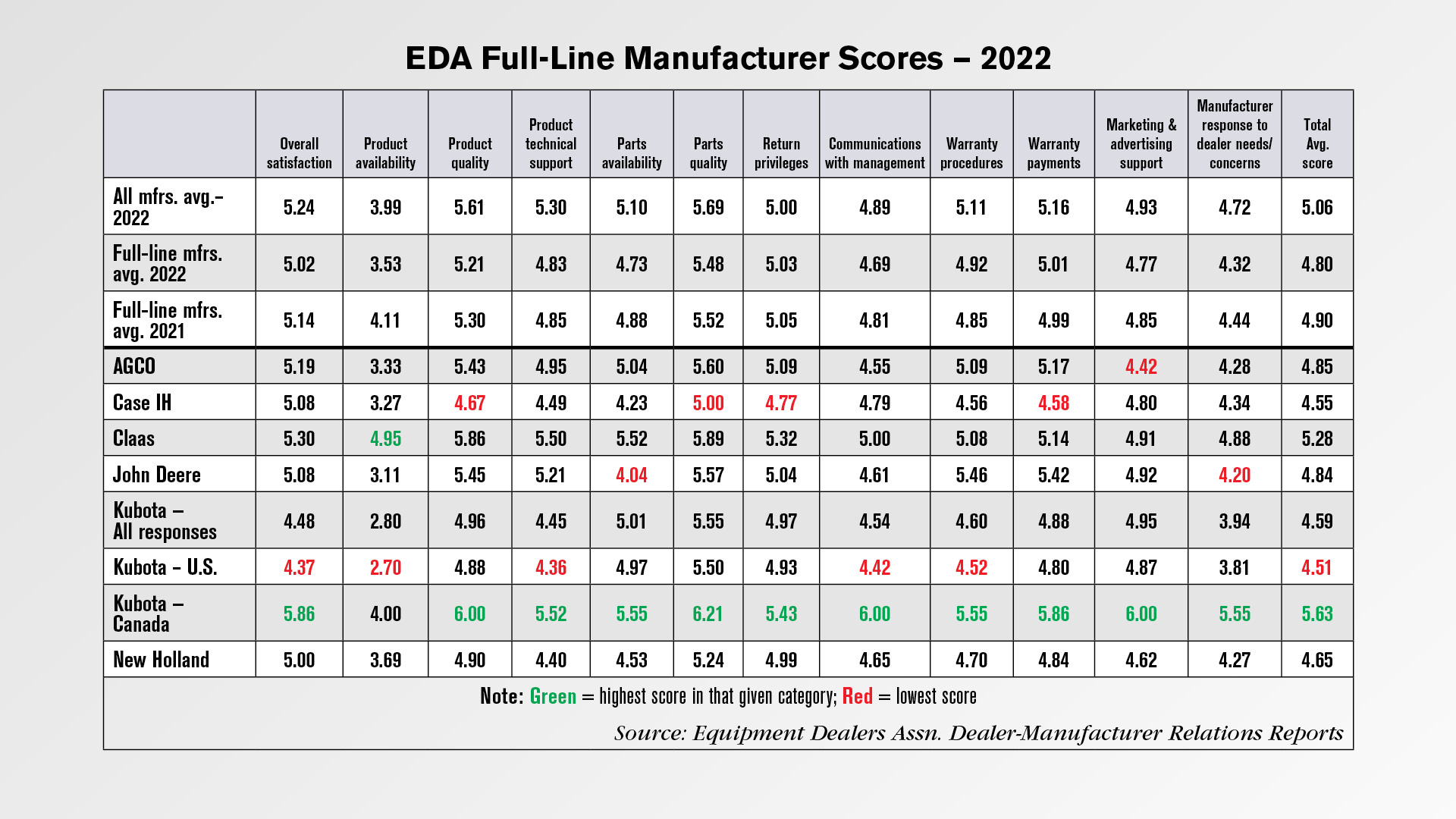

Kubota Canada & Branson Tractor Take Dealers Choice Honors

The Equipment Dealers Assn. has released its annual Dealer-Manufacture Relations report. New this year, Kubota was broken into three groups in the full-line category— Kubota Canada, Kubota USA and a combination of all responses. In its first year on the survey, Kubota Canada took top honors as the Dealers Choice for full-line manufacturer a total score of 5.63, above Kubota U.S.’s score of 4.51 and the total Kubota score of 4.59. This surpasses both the average total full-line manufacturer score of 4.80 and the total manufacturer average of 5.06. Kubota Canada took the lead in 11 of the 12 categories, with its highest score in parts quality at 6.21 and its lowest score in return privileges at 5.43. Claas was the only other full-line manufacturer to have the highest score in a category with a 4.95 in product availability.

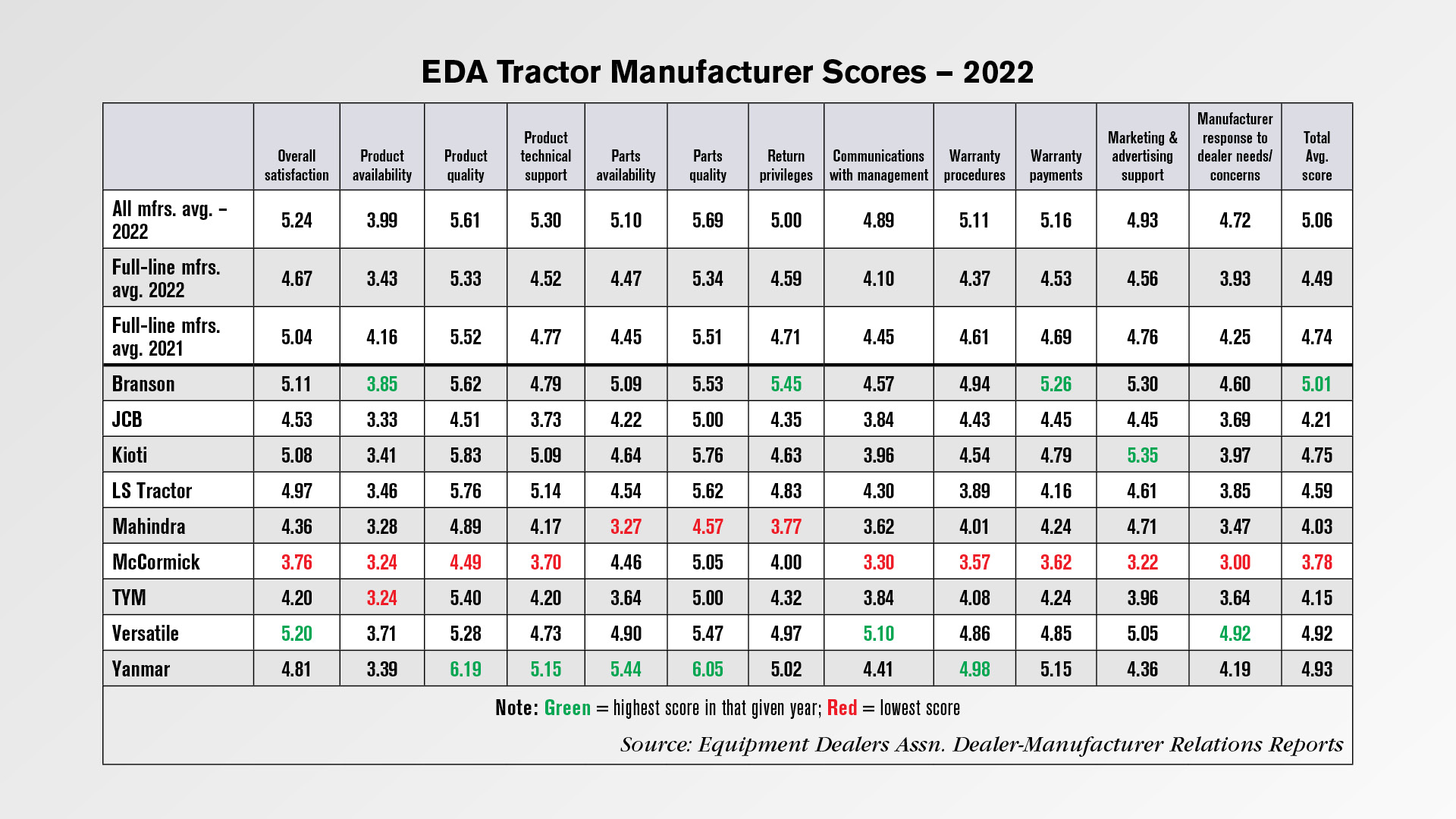

In its first year on the survey, Kubota Canada took top honors as the Dealers Choice for full-line manufacturer a total score of 5.63, above Kubota U.S.’s score of 4.51 and the total Kubota score of 4.59. This surpasses both the average total full-line manufacturer score of 4.80 and the total manufacturer average of 5.06. Kubota Canada took the lead in 11 of the 12 categories, with its highest score in parts quality at 6.21 and its lowest score in return privileges at 5.43. Claas was the only other full-line manufacturer to have the highest score in a category with a 4.95 in product availability. In the tractor manufacturer category, Branson kept its first place spot for the 3rd year in a row with an overall score of 5.01, down from a score of 5.79 last year and its lowest score in 9 years. Branson saw year-over-year declines in all category scores, with its highest score being a 5.62 in product quality and its lowest a 3.85 in product availability. However, Branson’s category scores beat the average for all tractor manufacturers in every category. Branson also took the highest score among tractor manufacturers in product availability (3.85), return privileges (5.45) and warranty payments (5.26).

In the tractor manufacturer category, Branson kept its first place spot for the 3rd year in a row with an overall score of 5.01, down from a score of 5.79 last year and its lowest score in 9 years. Branson saw year-over-year declines in all category scores, with its highest score being a 5.62 in product quality and its lowest a 3.85 in product availability. However, Branson’s category scores beat the average for all tractor manufacturers in every category. Branson also took the highest score among tractor manufacturers in product availability (3.85), return privileges (5.45) and warranty payments (5.26).

You can find extended coverage of the full-line and tractor manufacture results in the July-August issue of Farm Equipment. We’ll have coverage of the shortline and OPE manufacturers in the September issue.

![[Technology Corner] Quantifying the Impact of a Precision Ag Pioneer](https://www.agequipmentintelligence.com/ext/resources/2024/08/23/Quantifying-the-Impact-of-a-Precision-Ag-Pioneer.png?height=290&t=1724422794&width=400)

Post a comment

Report Abusive Comment