Nitrogen fertilizers are a key component in the production of field crops. Fertilizer constitutes an average of 36 percent of a farmer’s operating costs for corn, 35% for wheat, and 30% for sorghum, according to estimates in USDA, Economic Research Service’s (ERS) 2020 Commodity Costs and Returns data product, published in October 2021.

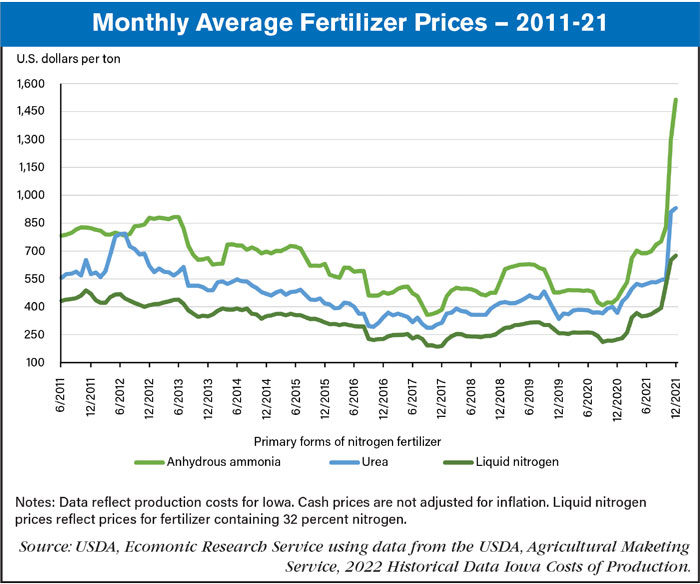

Given the importance of applying fertilizer to meet yield goals for most field crops, a rapid escalation in fertilizer prices affects a wide variety of farming activities and decisions. Data for Iowa production costs — used as a proxy for U.S. expenses because of Iowa’s central location and its importance in field crop production — indicate a steady decline in fertilizer prices from 2013 through 2017 before gradually rising through 2019. In late 2021, fertilizer prices began to spike alongside rising prices of natural gas—a primary input in nitrogen fertilizer production. By December 2021, average monthly spot prices of natural gas at the Henry Hub distribution hub in Louisiana, as published by the U.S. Energy Information Administration, were 45% higher than in December 2020. U.S. farmers use three primary forms of nitrogen fertilizer: anhydrous ammonia, urea and liquid nitrogen. ERS estimates an annual price increase of 235% for anhydrous ammonia, 149% for urea, and 192% for liquid nitrogen (32%) using data provided by USDA’s Agricultural Marketing Service (AMS) as of December 2021. Researchers expect the spike in fertilizer prices to affect producer decisions going into the 2022/23 marketing year.

This chart is drawn from ERS’ January 2022 Feed Grains Outlook.

![[Technology Corner] What are the Top 5 Applications in Autonomy Right Now?](https://www.agequipmentintelligence.com/ext/resources/2024/11/08/What-are-the-Top-5-Applications-in-Autonomy-Right-Now-.png?height=290&t=1731094940&width=400)

Post a comment

Report Abusive Comment