Valmont Industries, a global provider of engineered products and services for infrastructure development and irrigation equipment and services for agriculture, today reported financial results for the second quarter ended June 26, 2021.

Second Quarter 2021 Highlights

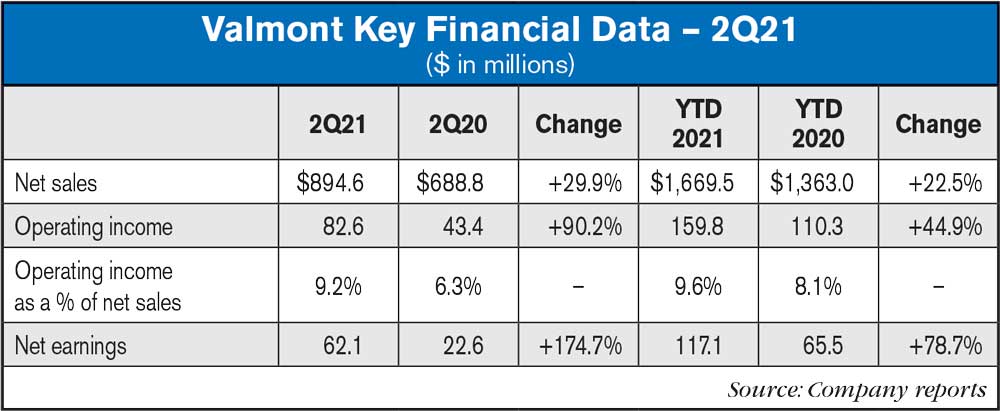

- Record Net Sales of $894.6 million, an increase of 29.9% with growth in all segments, led by significantly higher sales in Irrigation and Utility Support Structures

- Operating Income improved to $82.6 million, or 9.2% of sales ($90.9 million or 10.2% adjusted) compared to $43.4 million or 6.3% of sales last year ($65.7 million or 9.5% adjusted), despite continued inflationary pressures

- Record global backlog of more than $1.34 billion, an increase of 17.5% since the end of fiscal 2020, reflecting strong market demand

- Received purchase orders and project awards totaling $72 million to supply Valmont Solar Solutions to the utility and agricultural markets

- Generated operating cash flow of $37 million; cash and cash equivalents at end of second quarter were $199.3 million

- Completed two acquisitions in the Irrigation segment; purchased 100% of the shares of Prospera Technologies, Ltd. and acquired 100% of the assets of PivoTrac

- Commenced operations at a new greenfield Coatings facility in Pittsburgh, PA

"We achieved record second-quarter sales, grew adjusted operating income nearly 40% year-over-year, despite persistent inflationary pressures that meaningfully impacted our Utility business, and delivered adjusted earnings per share growth of more than 50%," said Stephen G. Kaniewski, president and CEO. "These solid results reflect the strength of our businesses, our continued focus on pricing actions to help offset inflation and the outstanding execution by our teams around the world. Sales growth was led by significantly higher sales in the Irrigation segment, as strong global agricultural market fundamentals continue to drive positive farmer sentiment, and deliveries of the large Egypt project continued. Higher volumes in Utility Support Structures were driven by continued strong underlying market demand for improving grid resiliency and increasing usage of renewable energy. Record second quarter sales in Engineered Support Structures and a focus on pricing, cost optimization, and the benefits of previous restructuring actions helped improve operating profit margins to nearly 12%. Coatings segment sales grew more than 22%, led by higher volumes as general economic trends are improving globally. We generated positive free cash flow despite significant increases in working capital to support robust sales growth."

Second Quarter 2021 Segment Review

Agriculture

Irrigation Segment (31.5% of Sales)

Global sales of $282 million increased 87.2% year-over-year, due to higher volumes across all markets, particularly in North America, the Middle East and Brazil, favorable pricing, and higher technology sales.

North American sales of $156.1 million increased 57.6% compared to 2020. Sales growth was led by higher volumes and higher average selling prices due to continued strength in agricultural markets, and higher industrial tubing sales.

International sales of $125.9 million grew 144% year-over-year. Sales growth was led by ongoing deliveries of the large project for Egypt, strong demand in Brazil and higher sales in Europe.

Operating Income improved to $42 million, or 14.9% of sales ($42.9 million or 15.2% adjusted) compared to $22.4 million, or 14.8% of sales in 2020. Profitability growth was driven by higher volumes, favorable pricing and improved operational efficiencies, partially offset by higher R&D expense of approximately $3.1 million for technology growth investments and intangible asset amortization.

Updating 2021 Financial Outlook and Key Assumptions

The Company is updating its full-year outlook and providing key assumptions for the remainder of 2021. Valmont now expects full-year Net Sales to increase 16% to 19%, and Irrigation segment sales to increase 45% to 50%. GAAP diluted EPS is expected to be $9.90 to $10.60 and adjusted diluted EPS is expected to be $10.40 to $11.10. The increased guidance reflects the Company's strong year-to-date results, strength in global agricultural markets, continued favorable end-market demand across all businesses and expected recovery of cost inflation.

![[Technology Corner] What an OEM Partnership Means to an Autonomy Startup](https://www.agequipmentintelligence.com/ext/resources/2024/09/26/What-an-OEM-Partnership-Means-to-an-Autonomy-Startup.png?height=290&t=1727457531&width=400)

Post a comment

Report Abusive Comment