The latest episode of On the Record is now available! In this week's show we discuss the increases dealers are reporting in equipment demand, while inventory challenges continue. We also dig into No-Till Farmer's recent Operational Benchmark Study and where growers are planning to spend their money in the year ahead. And, we report on Alamo Group's record sales in 2020.

This episode of On the Record is brought to you by Weasler Engineering.

Deliver a seamless transfer of power between a tractor and its attached machinery with one of Weasler’s three ASABE-compliant drive shaft product lines; the Standard, the Classic and the Professional. Weasler’s Newest product line – the Standard- offers a selection of pre-configured driveshafts. The Classic and Professional lines offer variety of standard components to choose from, allowing you to customize your PTO drive shaft to meet the specifications of your job. Learn more about what Weasler can do for you by visiting Weasler.com.

On the Record is now available as a podcast! We encourage you to subscribe in iTunes, the Google Play Store, Soundcloud, Stitcher Radio and TuneIn Radio. Or if you have another app you use for listening to podcasts, let us know and we’ll make an effort to get it listed there as well.

We’re interested in getting your feedback. Please feel free to send along any suggestions or story ideas. You can send comments to kschmidt@lessitermedia.com.

Demand on the Rise, Delays Continue

The combination of an old farm equipment fleet, rising commodity prices, tax right offs and economic stimulus is driving demand for farm equipment after years of stunted sales.

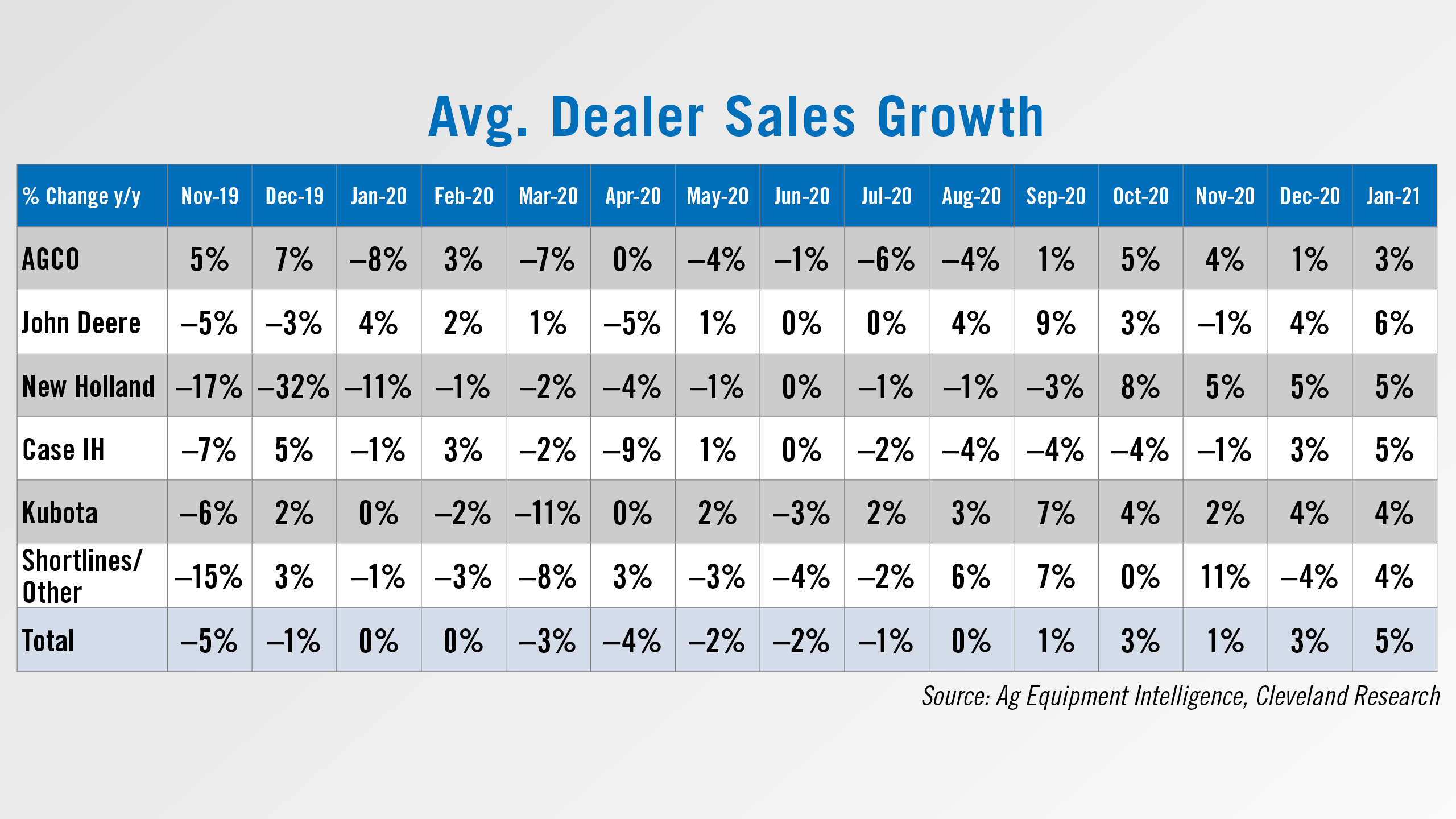

According to the latest Dealer Sentiments report, dealers reported sales were up 5% year-over-year in January.

Dealers’ outlook for 2021 sales is for 7% growth, in line with the previous month. A net 52% of dealers expect positive sales growth for the full year.

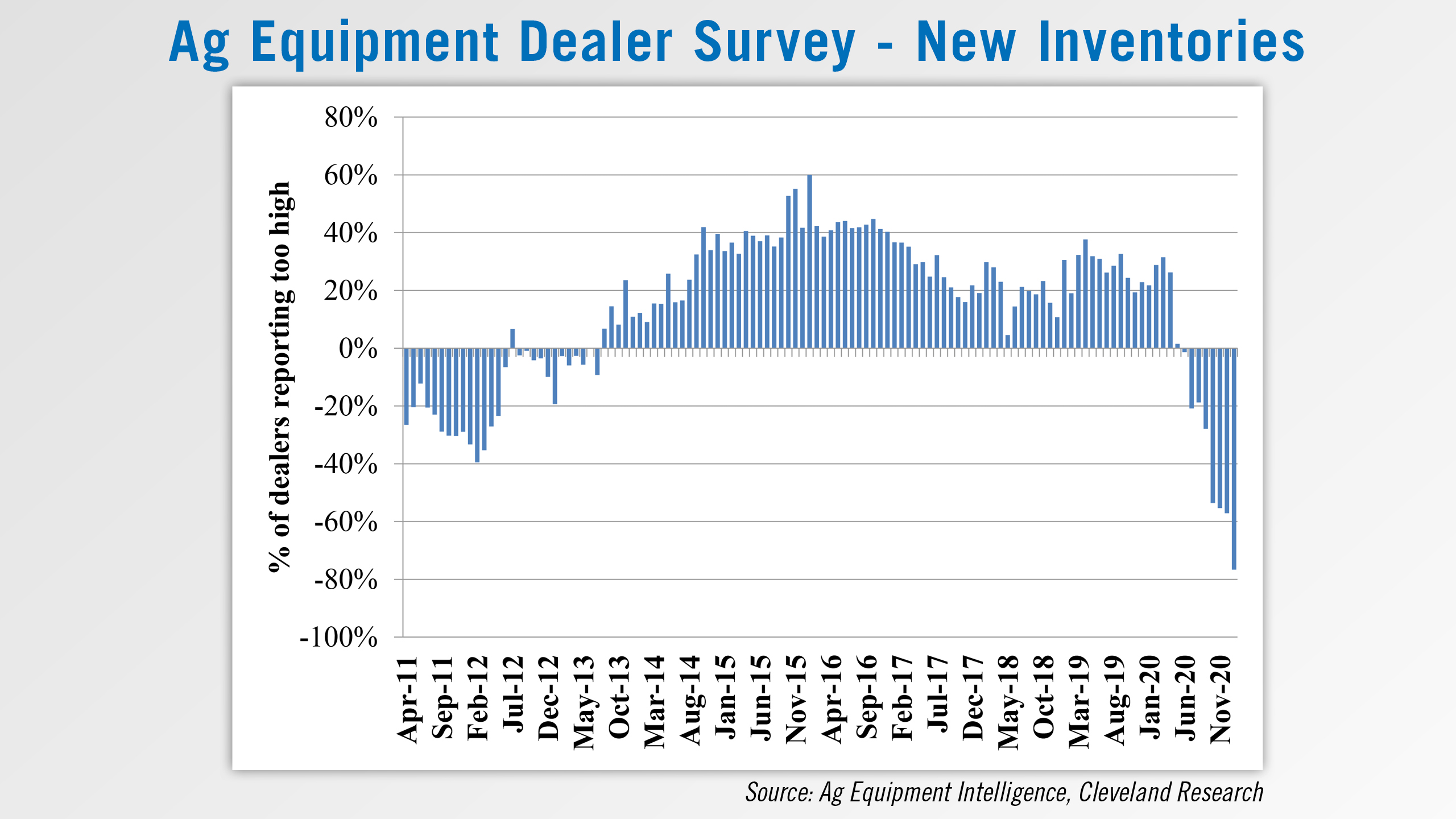

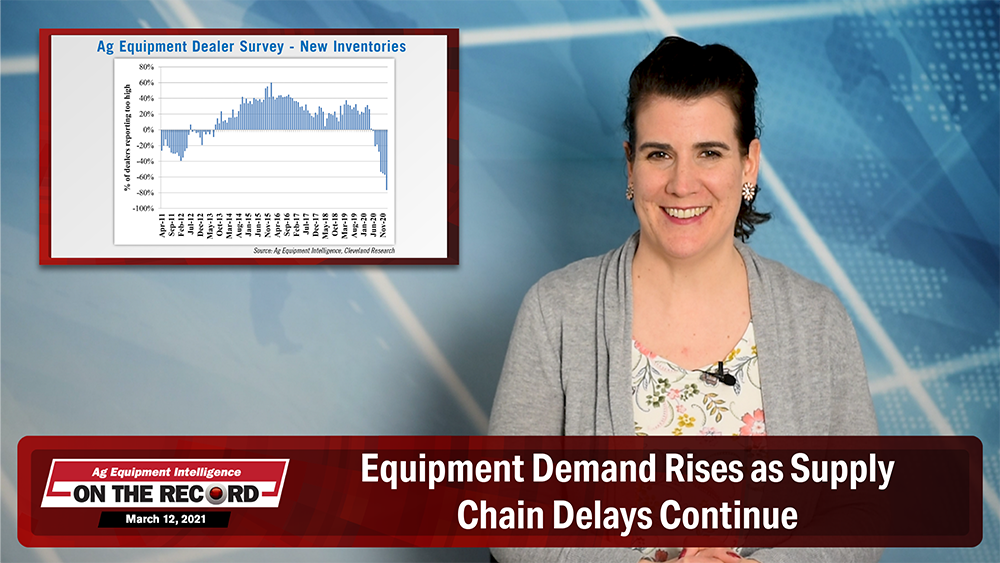

While dealers are positive on their sales outlook, new wholegoods inventory continues to be a challenge. A net 77% of dealers reported their new equipment inventory was too low vs. 57% who said inventory was too low in December.

One dealer noted that the availability of inventory is going to be an issue for all dealers, but the other disruptions in their business supply chain via parts and service will be even more apparent this year than last.

Another dealer said, “There is no end in sight for large ag equipment delays. Supply chains are struggling with parts. It seems like anything coming from Europe has been very difficult to get.”

Dealers on the Move

This week’s Dealer on the Move is Quality Equipment. The North Carolina based John Deere dealership group opened a new store in Pittsboro, N.C. This is the group’s 28th location.

No-Tillers Pushing Precision Purchases

The marriage between ag technology and no-till has typically been a stable one. While recent years have seen farmers be more judicious with their precision expenditures, demanding more return on investment, no-tillers have tended to maintain or increase their spending on ag technology products and services.

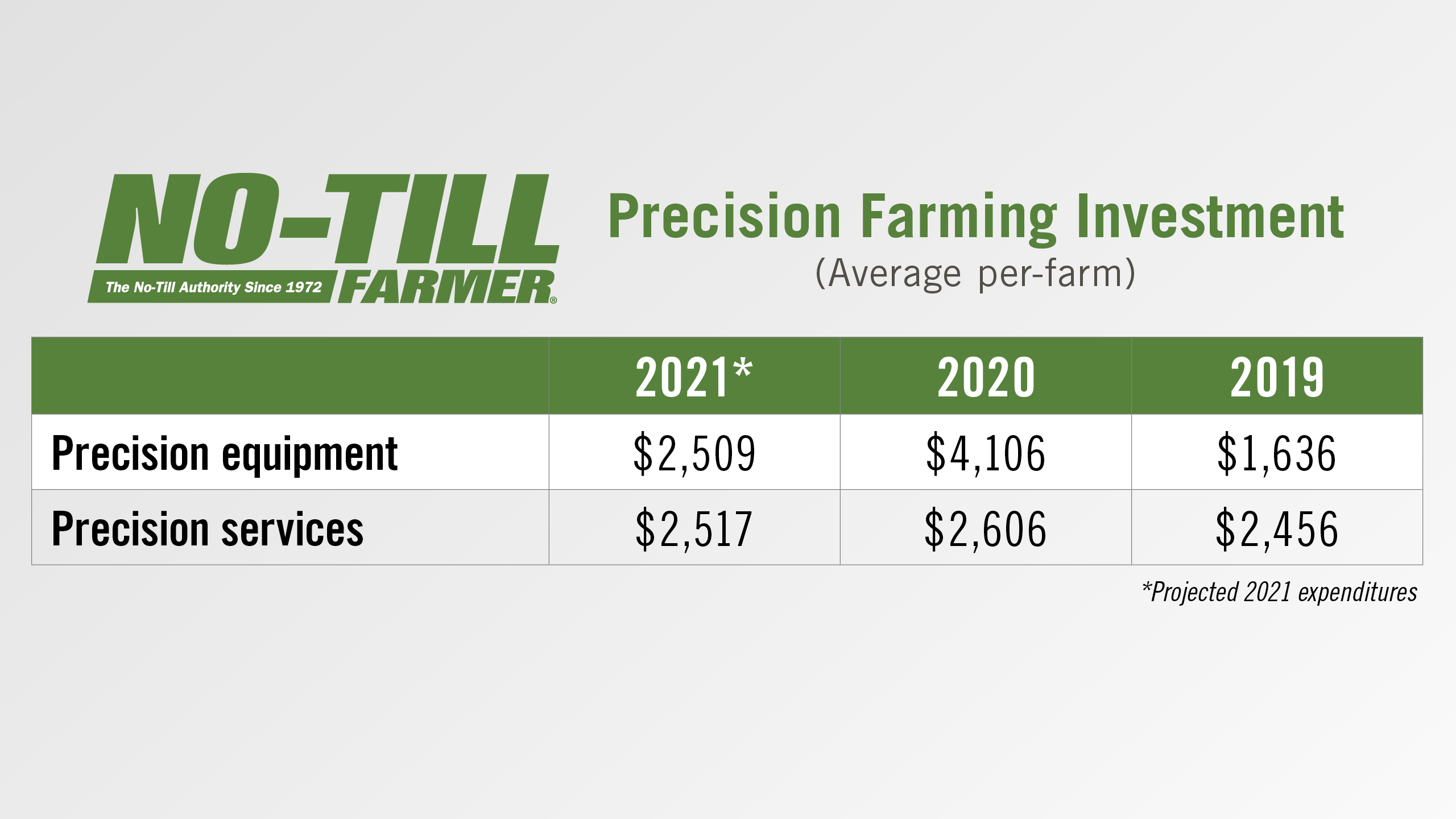

Results of the 13th annual No-Till Operational Benchmark Study revealed a 150% increase in the average per-farm investment in precision technology, jumping from more than $1,600 in 2019 to more than $4,000 in 2020.

There was also an increase in no-tillers’ year-over-year investment in precision services. While growers anticipated spending only $1,400 on precision services in 2020, those expenses actually averaged about $2,600, compared to the 2019 average of about $1,800 per farm.

While not a large amount in absolute terms, the actual expense was an 85% increase over what was forecast.

So what kind of ag tech investments are no-tillers anticipating in 2021? Estimates are on the conservative side, with farmers forecasting precision equipment expenses to decrease — albeit very slightly — in 2021, to about $2,500 per farm.

On the service side, no-tillers are anticipating spending about the same per farm, which would be consistent with 2020.

However, it’s worth noting that survey projections made at the start of the year, don’t always coincide with end of the year totals and historically, actual precision expenditures have exceeded initial projections.

No-Tillers Plan to Spend Less on Equipment

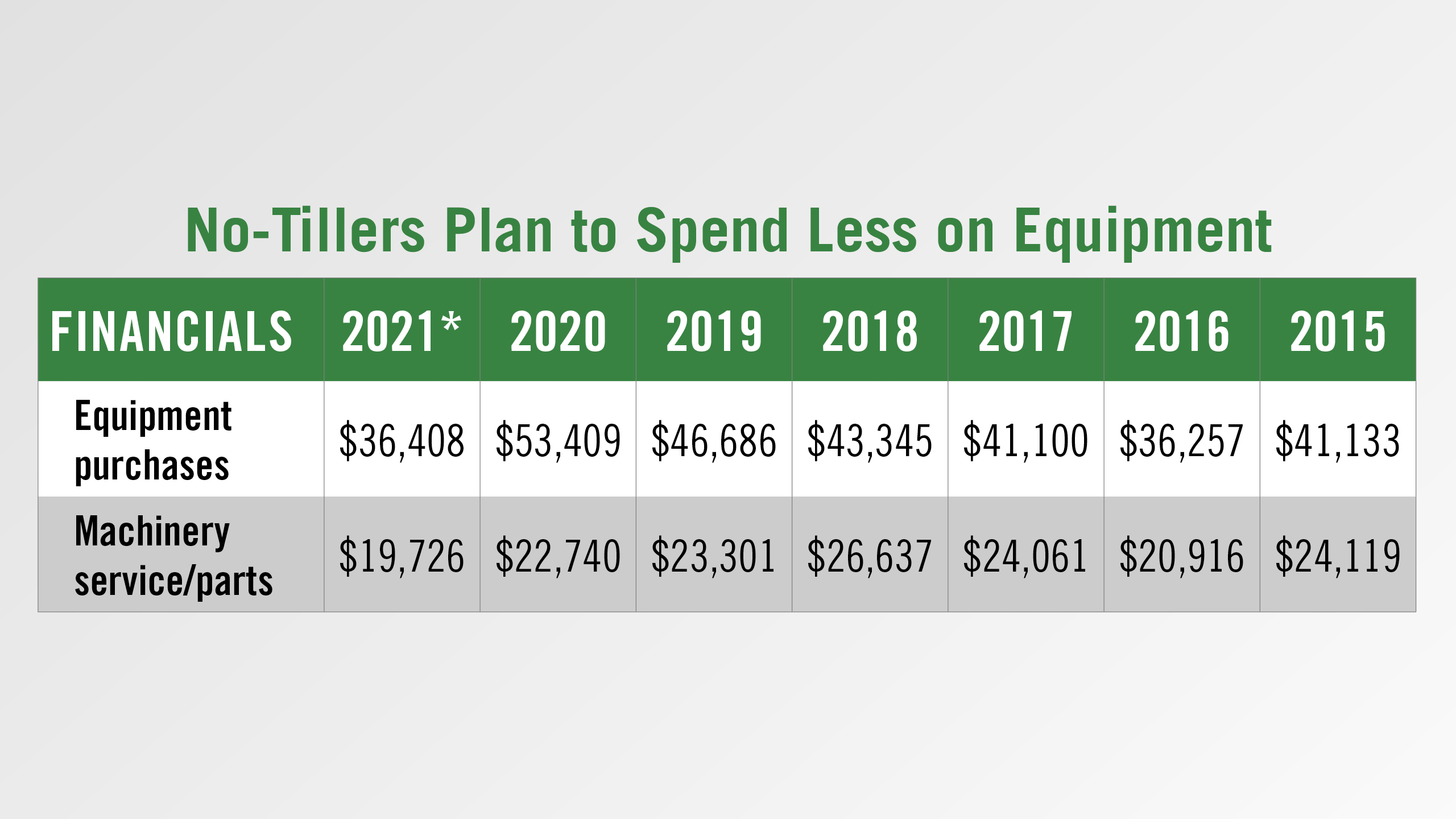

While dealers are forecasting sales growth in 2021, no-till farmers forecast their machinery related spending will be down this year. No-Till Farmer recently released its 13th Annual No-Till Operational Benchmark Study.

According to the study, the 2020 average net income of $61,851 was nearly 29% higher than 2019’s average income of $48,063 — the highest net income has been since 2014 when that totaled $73,011. The improved financial picture should be viewed with some context, however, as it may have more to do with governmental payments related to the COVID-19 pandemic than beneficial market conditions.

No-tillers reportedly spent an average of $53,409 on equipment purchases in 2020, which was up $46,686 in 2019. However, the forecast for 2021 is down significantly to $36,408.

When it comes to service and parts, no-tillers spent an average of $22,740 in 2020, down just slightly from 2019’s $23,301. For 2021, however, growers are expecting a larger decline, budgeting an average of $19,726, perhaps because they’ve spent money on newer equipment and are therefore expecting they won’t have the same upkeep expenses.

Alamo Group Reports Record Sales

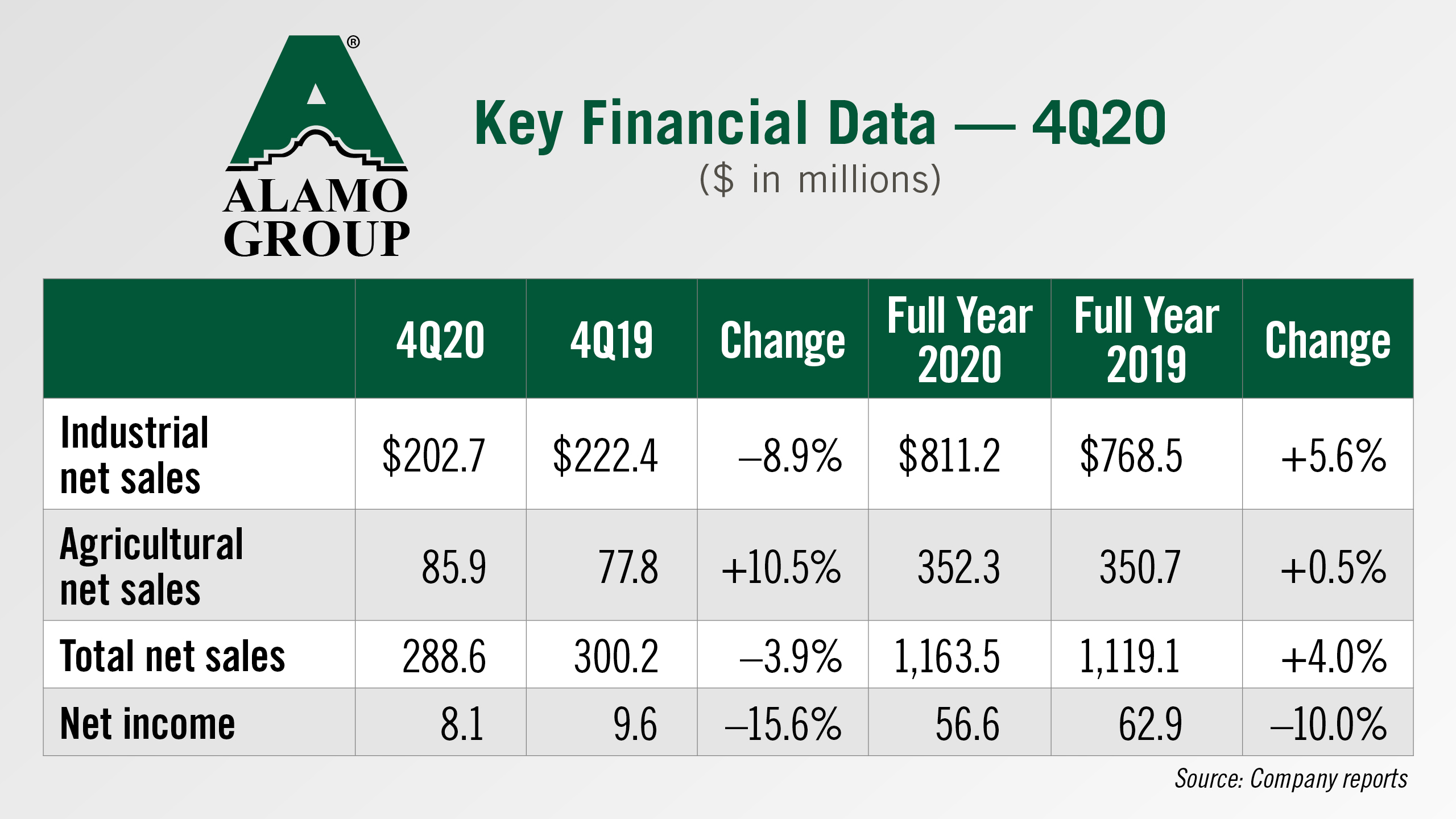

Shortline manufacturer Alamo Group reported record sales of $1.16 billion in 2020. That is up 4% compared to $1.12 billion in 2019.

Alamo’s Agricultural Division net sales in the fourth quarter of 2020 were nearly $86 million compared to about $78 million in the prior year, an increase of 10.5%.

For the full year, net sales in the Ag Division were about $352 million in 2020 vs. $350 million in 2019.

The company says the Agricultural Division continues to benefit from somewhat improved overall market conditions that started in the second half of 2020 and has resulted in the Division finishing the year with a record level of backlog that bodes well for the 2021 outlook. However, the division is also experiencing some operational issues related to the pandemic as well as longer lead times and cost inflation in purchased components.

![[Technology Corner] What an OEM Partnership Means to an Autonomy Startup](https://www.agequipmentintelligence.com/ext/resources/2024/09/26/What-an-OEM-Partnership-Means-to-an-Autonomy-Startup.png?height=290&t=1727457531&width=400)

Post a comment

Report Abusive Comment