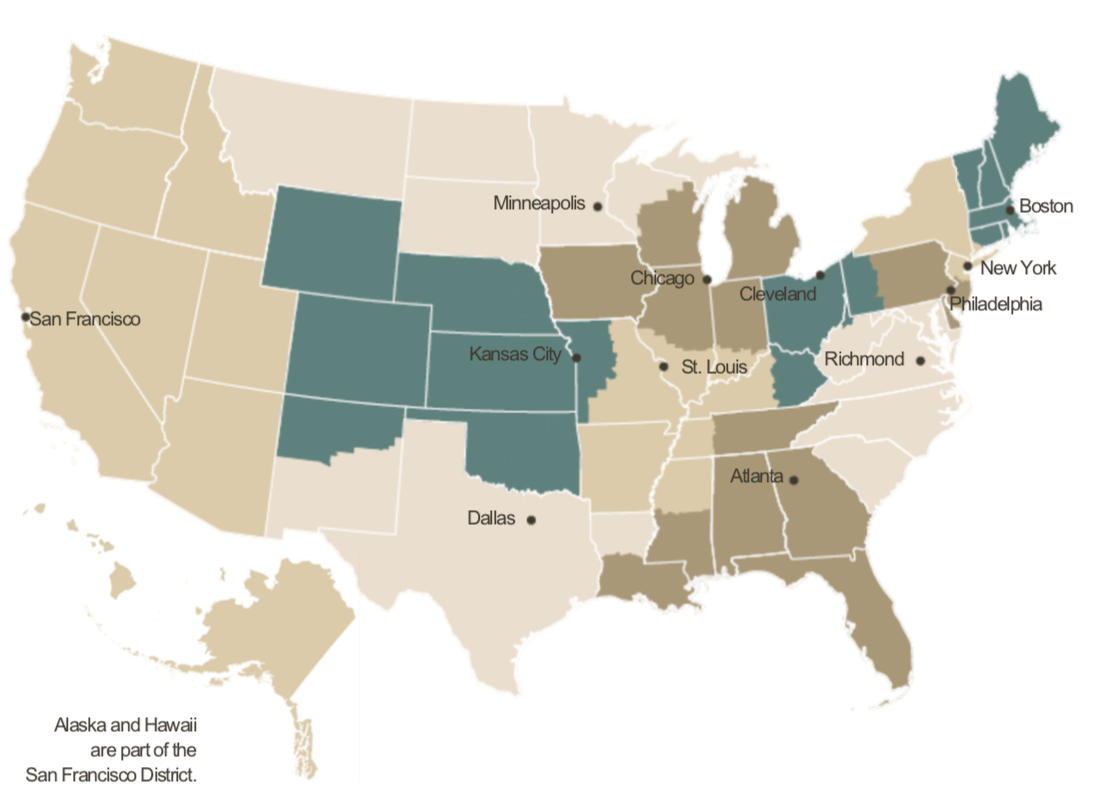

Most Federal Reserve Districts have characterized economic expansion as modest or moderate since the prior Beige Book period. However, four Districts described little or no growth, and five narratives noted that activity remained below pre-pandemic levels for at least some sectors. Moreover, Philadelphia and three of the four Midwestern Districts observed that activity began to slow in early November as COVID-19 cases surged. Reports tended to indicate higher-than-average growth of manufacturing, distribution and logistics, homebuilding, and existing home sales, although not without disruptions.

Banking contacts in numerous Districts reported some deterioration of loan portfolios, particularly for commercial lending into the retail and leisure and hospitality sectors. An increase in delinquencies in 2021 is more widely anticipated. Most Districts reported that firms’ outlooks remained positive; however, optimism has waned – many contacts cited concerns over the recent pandemic wave, mandated restrictions (recent and prospective), and the looming expiration dates for unemployment benefits and for moratoriums on evictions and foreclosures.

Atlanta: District 6

Agricultural conditions were mixed. While drought-free conditions prevailed in most of the District, some producers reported crop damage caused by recent hurricanes. Contacts noted increases in some agriculture commodity prices attributed to changes in supply and demand, the USDA Food Box program, and improved trade with China. Some contacts also noted that increased federal assistance helped improve balance sheets. Cotton harvesting progressed, though below the five-year average pace, while soybean and peanut harvesting were near their five-year averages. The USDA reported year-over-year prices paid to farmers in September were up for rice, soybeans, cattle, and eggs, but down for corn, cotton, broilers, and milk. On a month-over-month basis, prices increased for corn, cotton, soybeans, cattle, and eggs, but decreased for rice, broilers and milk.

Chicago: District 7

Farm income beat expectations for the growing season, as prices for key agricultural commodities moved higher and government support continued. Corn, soybean and wheat prices were up again, reflecting tighter stocks and increased exports. With the harvest nearly over, most of the District saw above-trend corn and soybean yields. Most specialty crops had solid yields as well. Favorable weather conditions allowed farmers to complete field work that had been skipped in prior years because of poor weather. Dairy prices were mixed, but up on net. Hog and cattle producers also benefited from higher overall prices, but expressed concern about rising feed costs.

St. Louis: District 8

District agriculture conditions have remained unchanged since our previous reporting period. Production forecasts for corn, cotton, and soybeans have decreased, while cotton production forecasts have increased. Production levels for corn, rice, and soybeans are expected to be significantly higher than in 2019, while cotton production is expected to see a moderate decline. District contacts expressed optimism, citing higher-than-expected yields due to excellent weather conditions and a strong rebound in prices.

Minneapolis: District 9

Agricultural conditions improved slightly due to solid harvests, recent increases in prices for some commodities, and federal relief aid. Respondents to the Minneapolis Fed’s third-quarter (October) survey of agricultural credit conditions mostly reported unchanged farm income compared with a year earlier, while the outlook for the fourth quarter was for increasing farm incomes.

Kansas City: District 10

The Tenth District farm economy improved moderately since the previous period alongside additional increases in agricultural commodity prices. Since early October, strengthening demand and downward revisions to production estimates led to sharp increases in corn and soybean prices and moderate increases in most other agricultural prices. Stronger profit opportunities than earlier in the year, in addition to substantial government payments to producers, supported farm sector finances. Although farm income generally remained low in aggregate, contacts reported lower rates of problem loans compared to a year ago. District contacts continued to express concerns, however, about the potential for renewed pressure in the months ahead, depending on the path of agricultural commodity prices, government support programs, and drought in some parts of the region.

Dallas: District 11

Drought conditions intensified, particularly in the western part of the district. Contacts remained concerned about the La Niña weather pattern and a dry winter diminishing 2021 crop prospects. The harvest was wrapping up for 2020 row crops, and prices pushed above breakeven levels for most producers. The livestock sector was facing headwinds of lower cattle prices and higher feed costs. Contacts were more optimistic about the agricultural sector in general with stronger prices, solid export demand, and a more hopeful economic outlook.

San Francisco: District 12

Activity in the agriculture sector increased slightly. The harvest for most agricultural crops, including grains and potatoes, has been completed in the Pacific Northwest and California, and ample water supply has contributed to high yields. International demand for wheat, raisins, and nuts has increased recently due to droughts in other parts of the world as well as a slight depreciation of the dollar. Despite the increase in exports, inventories remained elevated, especially for raisins, nuts, and almonds.

![[Technology Corner] Quantifying the Impact of a Precision Ag Pioneer](https://www.agequipmentintelligence.com/ext/resources/2024/08/23/Quantifying-the-Impact-of-a-Precision-Ag-Pioneer.png?height=290&t=1724422794&width=400)

Post a comment

Report Abusive Comment