By Sébastien Pouliot, Principal Agricultural Economist, Farm Credit Canada

The ongoing pandemic is set to test the resilience of farms in 2020. Statistics Canada’s estimates of 2019 farm cash receipts (FCR) suggest a relatively positive year for agriculture. FCR increased in 2019 by $3.6 billion, or 5.7%. This is the strongest percentage growth observed since 2008. A good chunk of that growth, about $1.7 billion, comes from cannabis production. Excluding cannabis, FCR grew by 2.9%.

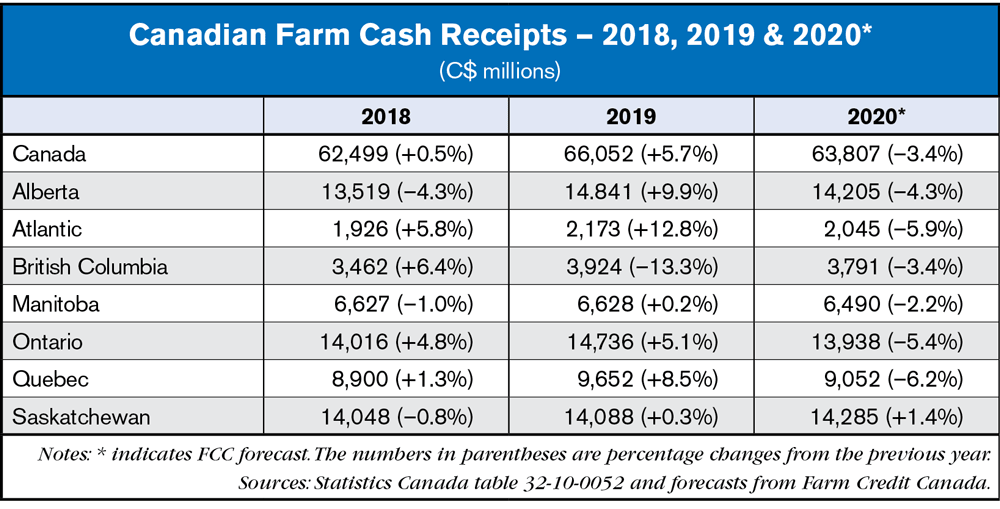

The table below shows the provincial estimates of FCR for 2018 and 2019 and our 2020 forecasts.

2019 in Review

Cash receipts evolve differently across provinces, depending on their mix of agricultural activity:

- In the Atlantic, strong growth comes from a large increase in crop receipts.

- In Quebec, Ontario and Alberta, growth is split evenly between growth in crops and livestock receipts.

- Manitoba and Saskatchewan recorded crop receipts declines and marginal increases in livestock receipts.

- British Columbia recorded large growth in its crop receipts and moderate growth in its livestock receipts.

What to Expect in 2020

The first quarter of 2020 was relatively positive. FCR grew by 5.5% compared to the first quarter of 2019. Once again, the picture looks different if we put aside cannabis production: FCR grew 0.8%, excluding cannabis receipts. Crop receipts (excluding cannabis receipts) declined 4.7%, while livestock receipts were up 3.9% as the COVID-19 crisis had no significant impact until the end of March. FCR grew in Ontario, Quebec and British Columbia but declined in Manitoba and Saskatchewan.

Since the end of the first quarter, farm income has plunged for several sectors. There’s a considerable degree of uncertainty for the rest of the year. Our 2020 forecasts consider the different COVID-19 impacts across ag sectors.

- We expect Canada’s total FCR to decline by about 3.4% in 2020 – the worst year-over-year performance since 2003. Note that these estimates include anticipated agri-stability and other direct payments.

- The provinces most negatively impacted are those with a greater share of their farm income from livestock. Farm prices for cattle and hog are significantly down, and production quotas were cut for milk, poultry and eggs.

- Receipts from grains, oilseeds and pulses are projected to climb, assuming average yields. As such, we expect FCR in Saskatchewan to grow.

- In Manitoba, growth in grains, oilseeds and pulses will not be sufficient to compensate from losses in the hog sector.

Farm financial planning must stay top of mind for operations. Managing cost growth will be key. In 2019, operating expenses climbed by 5.6%. Net cash income rose 5.8%, still far from its 2017 peak. Farm debt increased by 8.2% in 2019. Low interest rates will help operations meet their debt obligations that are likely to continue increasing in 2020. There are a few early indicators to monitor for a possible rebound of the farm economy. Any growth in FCR would alleviate some of the financial stress in the industry.

Post a comment

Report Abusive Comment