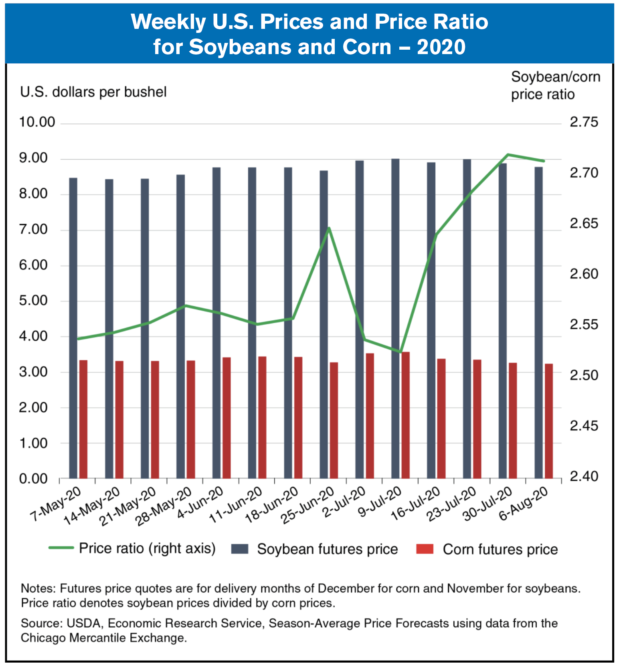

The soybean-to-corn price ratio is often used as one of several tools in measuring profitability of soybeans and corn. The current ratio of U.S. soybean to corn prices has recently risen, sending a signal to farmers that the relative profitability of soybeans has increased over corn.

Soybeans and corn are crops that compete for acreage in production and are complements in feed use. Their futures prices—the price of a contract to deliver a bushel of soybeans or corn at a certain time in the future—are used to calculate a ratio through dividing the soybean price by the corn price. Higher price ratios indicate that soybeans are relatively more profitable than corn. This ratio, which averaged 2.51 over the past 20 years, can tell farmers whether planting, harvesting, and storing one or the other crop might be advantageous. The ratio can also be used by livestock producers to indicate the price direction for feed ingredients.

When the USDA, National Agricultural Statistics Service's June 2020 Acreage report indicated that less corn acreage had been planted than expected in early spring, futures prices for corn in marketing year 2020/21 increased by 8 percent. Soybean futures prices increased at the same time. Since late June, expectations of higher corn yields eroded the futures price for corn by 2.4%, while the price for soybeans increased by 1.1%. This differential in prices led to an increase in the soybean-to-corn price ratio from 2.64 to 2.71, a 2.5% increase from late June. This chart and associated data are drawn from the Economic Research Service’s Season-Average Price Forecasts data product.

According to USDA’s August World Agricultural Supply and Demand Estimates report, corn cash receipts are forecast down 3% while soybean cash receipts are forecast up 22%.

![[Technology Corner] What are the Top 5 Applications in Autonomy Right Now?](https://www.agequipmentintelligence.com/ext/resources/2024/11/08/What-are-the-Top-5-Applications-in-Autonomy-Right-Now-.png?height=290&t=1731094940&width=400)

Post a comment

Report Abusive Comment