The latest episode of On the Record is now available! In this week’s episode we dig into a report from the University of Illinois that projects an $89 per acre decline for the 2020 corn crop, which could point to a drop in tractor sales. And we take a look at preliminary results from both the latest Precision Farming Dealer and Strip-Till Farmer benchmark surveys. Also in this episode we look at deteriorating ag credit conditions and Deutz’s latest earnings.

On the Record is brought to you by B&D Rollers.

This episode of On the Record is brought to you by B&D Rollers. B&D Rollers is the only manufacturer in the world to make new aftermarket hay conditioner rollers. The Crusher hay conditioning rollers have the ability to run on any machine, regardless of color or brand. Between 2018 and 2019, B&D Rollers saw 93.7% growth purely in hay conditioning rollers and is continuing to see similar growth trends into 2020. For more information or OEM inquiries, visit bdrollers.com.

On the Record is now available as a podcast! We encourage you to subscribe in iTunes, the Google Play Store, Soundcloud, Stitcher Radio and TuneIn Radio. Or if you have another app you use for listening to podcasts, let us know and we’ll make an effort to get it listed there as well.

We’re interested in getting your feedback. Please feel free to send along any suggestions or story ideas. You can send comments to kschmidt@lessitermedia.com.

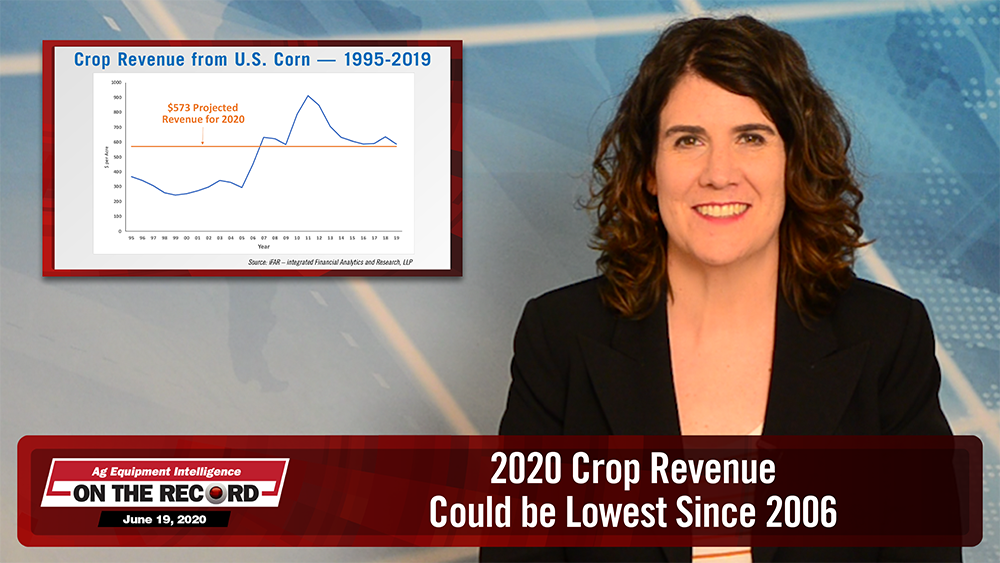

COVID-19 Batters Corn Prices

U.S. farmers are already feeling the negative effects of the COVID-19 outbreak on the price of corn and, according to a report issued earlier this month, it will be felt beyond 2020.

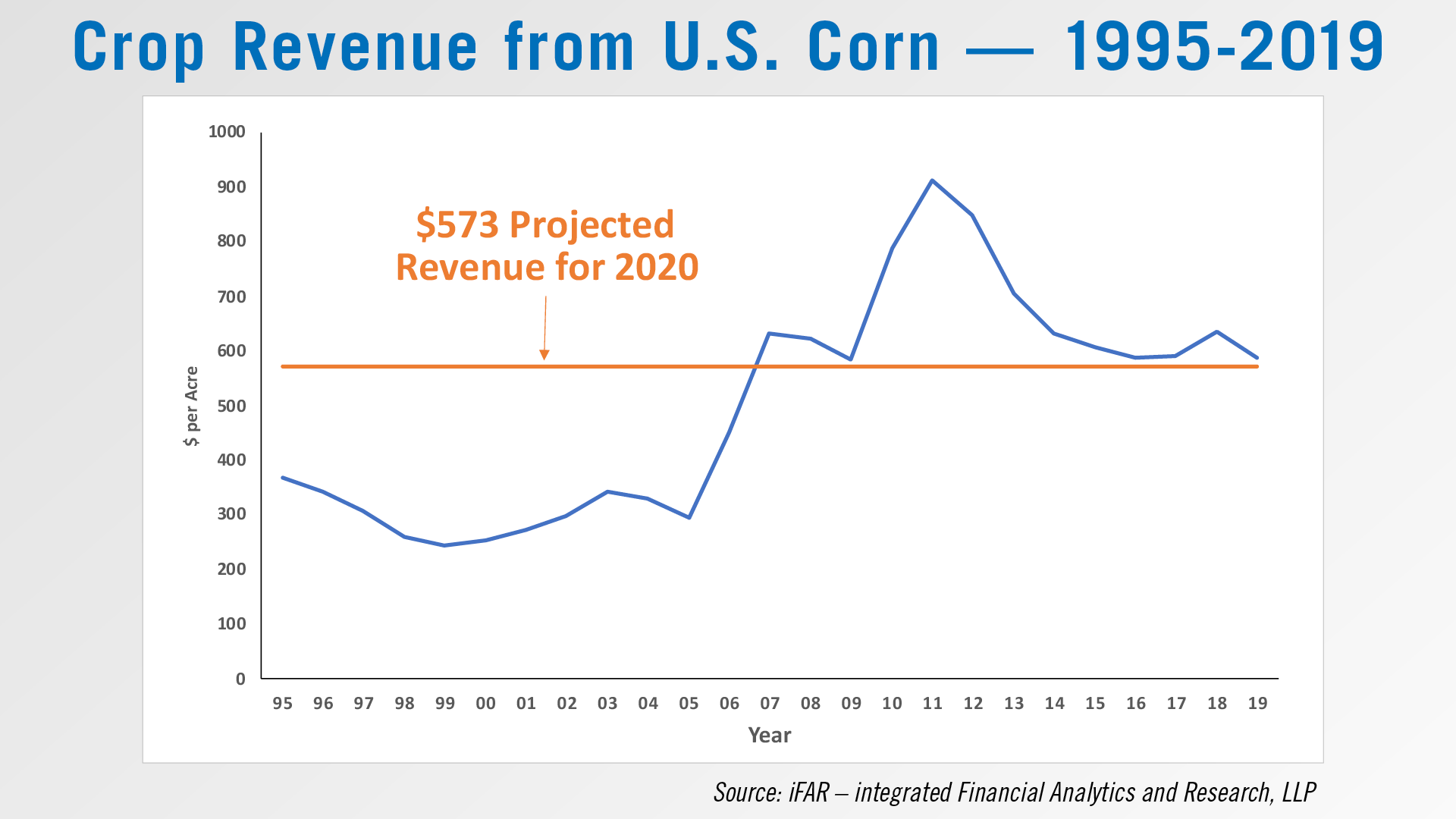

The report, which was analyzed by Dr. Gary Schnitkey and Jonathan Coppess of the University of Illinois, projects a $59 per acre average revenue decline for the 2019 corn crop and an $89 per acre average decline for 2020 crop compared to pre-COVID-19 projections.

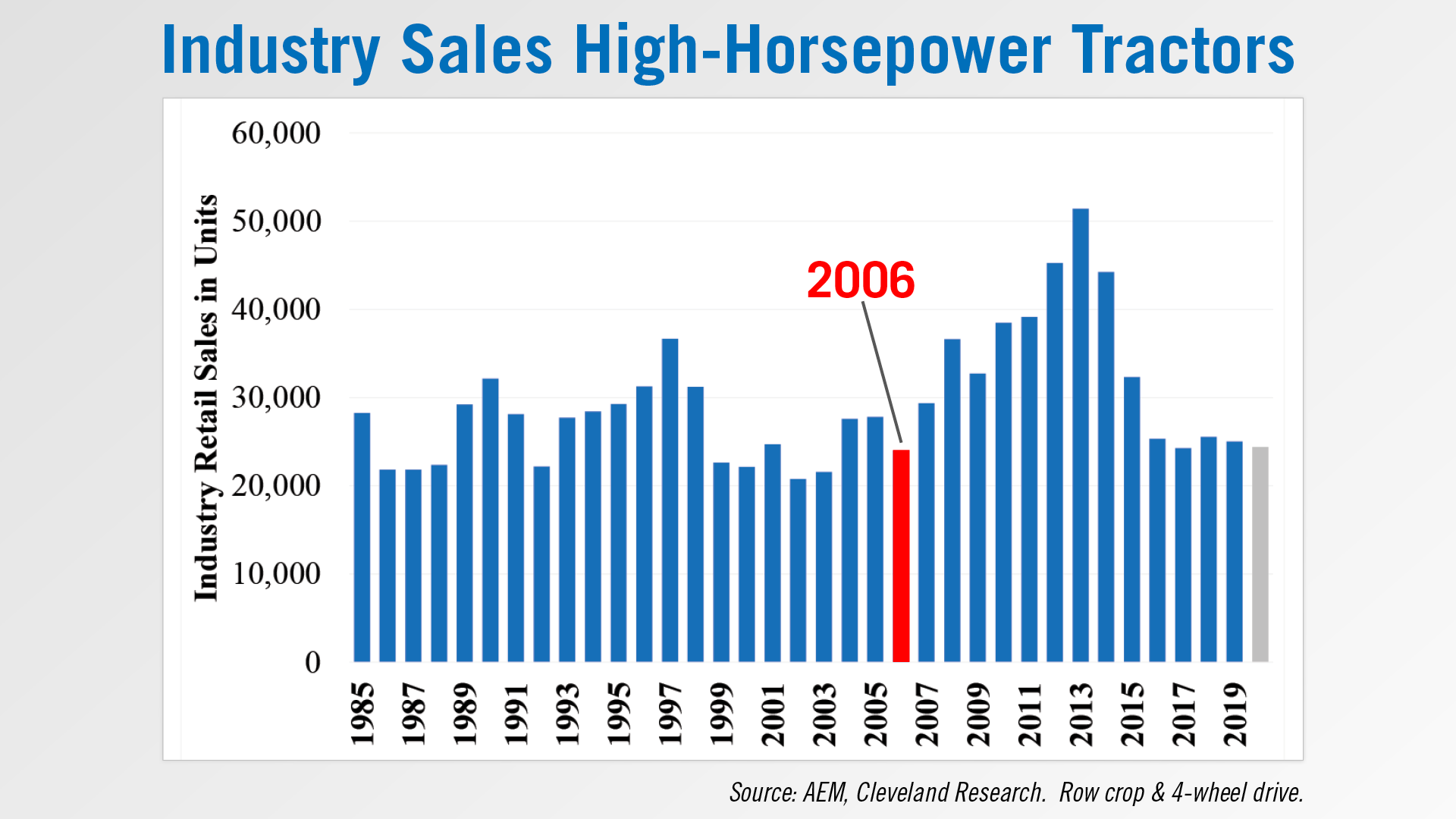

If realized, the 2020 crop year revenue would be the lowest corn revenues since 2006. That year, U.S. sales of row-crop and 4WD tractors fell 14%.

According to the report, the residual impacts from COVID-19 on corn prices are very likely to persist into 2021 and possibly beyond as two of corn’s largest uses, livestock feed and ethanol, have been significantly impacted by COVID-19.

Price declines associated with 2019 crop will result in revenue losses. Even after accounting for increases in the 2019 Commodity title and CFAP payments, total revenue declines by $15 per acre on the 2019 crop.

For 2020, a post-COVID price of $3.20 per bushel and a national yield of 179 bushels per acre results in crop revenue of $573 per acre. Crop revenue of $573 would be $49 per acre below the average crop revenue from 2014-2019. $573 would be the lowest crop revenue since 2006.

A June 16 report from the University of Illinois indicates the per-bushel price of corn could trend even lower.

According to the report, the current U.S. yield estimate from USDA is 178.5 bushels per acre. Given this yield estimate and average of actual May futures prices, the harvest price is projected to be $3.10 per bushel, and cash prices would usually be lower. A $3.10 harvest price would suggest cash prices below $3.00 this fall.

Dealers On the Move

This week’s Dealer on the Move is RDO Equipment. The John Deere dealership group opened a new location in Dayton, Minn. The new 45,000 square foot store combines the parts support of RDO’s former Brooklyn Park location and the Topcon technology focus of its former store in Bloomington.

Dealers Take Conservative Precision Outlook

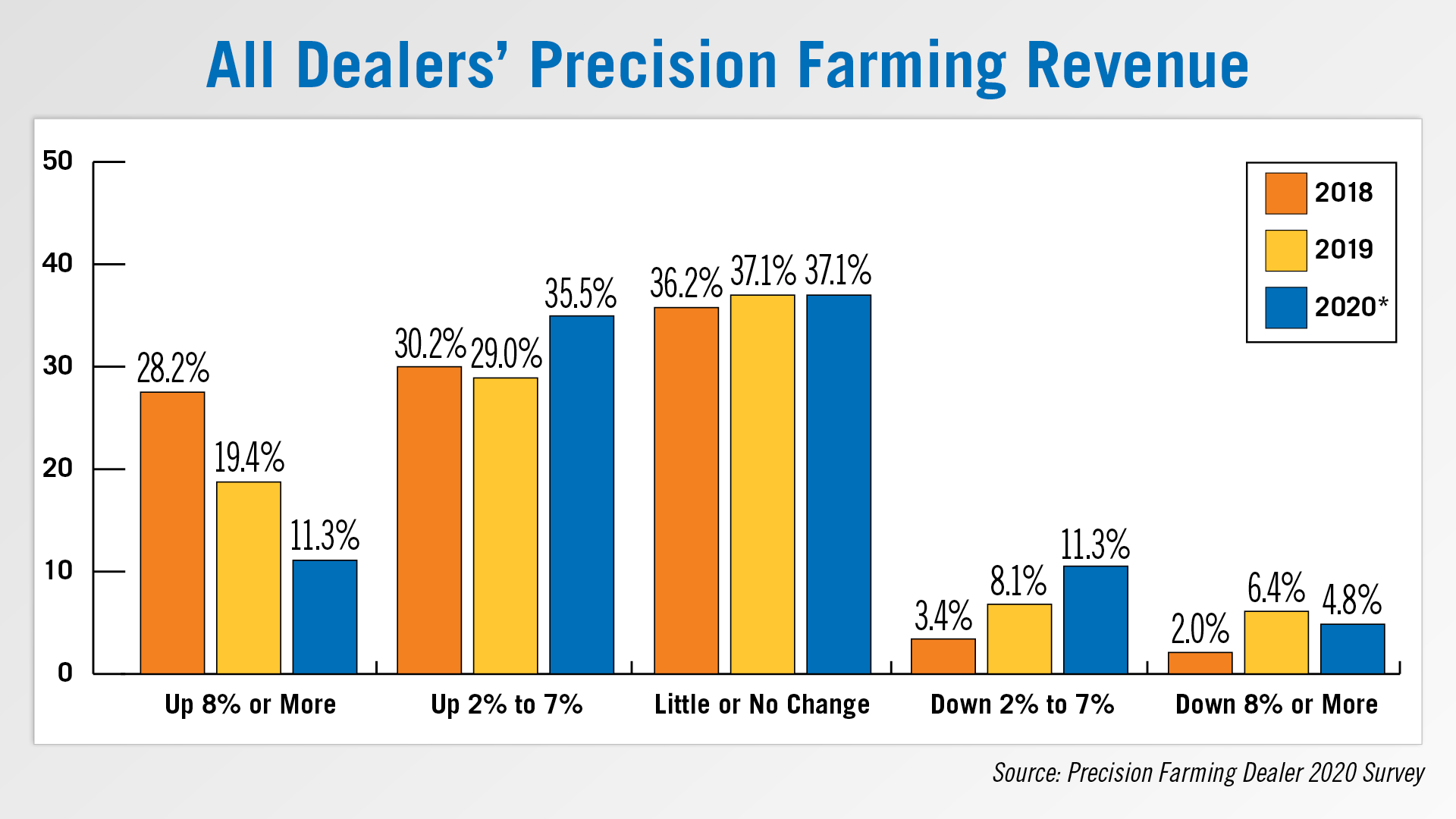

The results of the eighth annual Precision Farming Dealer benchmark study — with contributions from dozens of farm equipment dealers, input retailers and independent precision companies — trend toward a conservative reality and a cautious outlook for the majority of respondents.

The 2020 data — collected during the first and second quarters — reflect the influence of an inconsistent ag economy, further complicated by the impact of global coronavirus pandemic on dealerships’ precision revenue.

Still, precision dealers generally maintained a positive financial forecast, tempered somewhat by adjusted expectations and shifting sales and service priorities.

Comparing responses gathered from 24 different states, Canada and overseas, about 19% of dealers reported precision revenue growth of 8% or more in 2019, nearly on par with the 20% who forecasted this level in last year’s report.

While close to meeting projections, 2019 marked the first time in 5 years that dealers didn’t exceed their higher-end revenue expectations. In last year’s report, 28% of dealers reported precision revenue growth of 8% or more in 2018, slightly ahead of the 26% forecasted.

So what are dealers expecting this year? Overall, some 48% forecast revenue growth of at least 2% over 2019, with about 11% projecting growth of at least 8%.

This continues an increasingly conservative revenue outlook going back the last 3 years. Some 37% of dealers expect little or no change in 2020 revenue, while about 16% forecast revenue declines of at least 2% — the highest total in the history of the benchmark study.

You can find the complete 2020 benchmark study report and analysis coming in the Summer issue of Precision Farming Dealer and extended coverage of past studies at PrecisionFarmingDealer.com.

Strip-Tillers Remain Loyal to Planter Attachments Top Strip-Tillers Purchase Plans

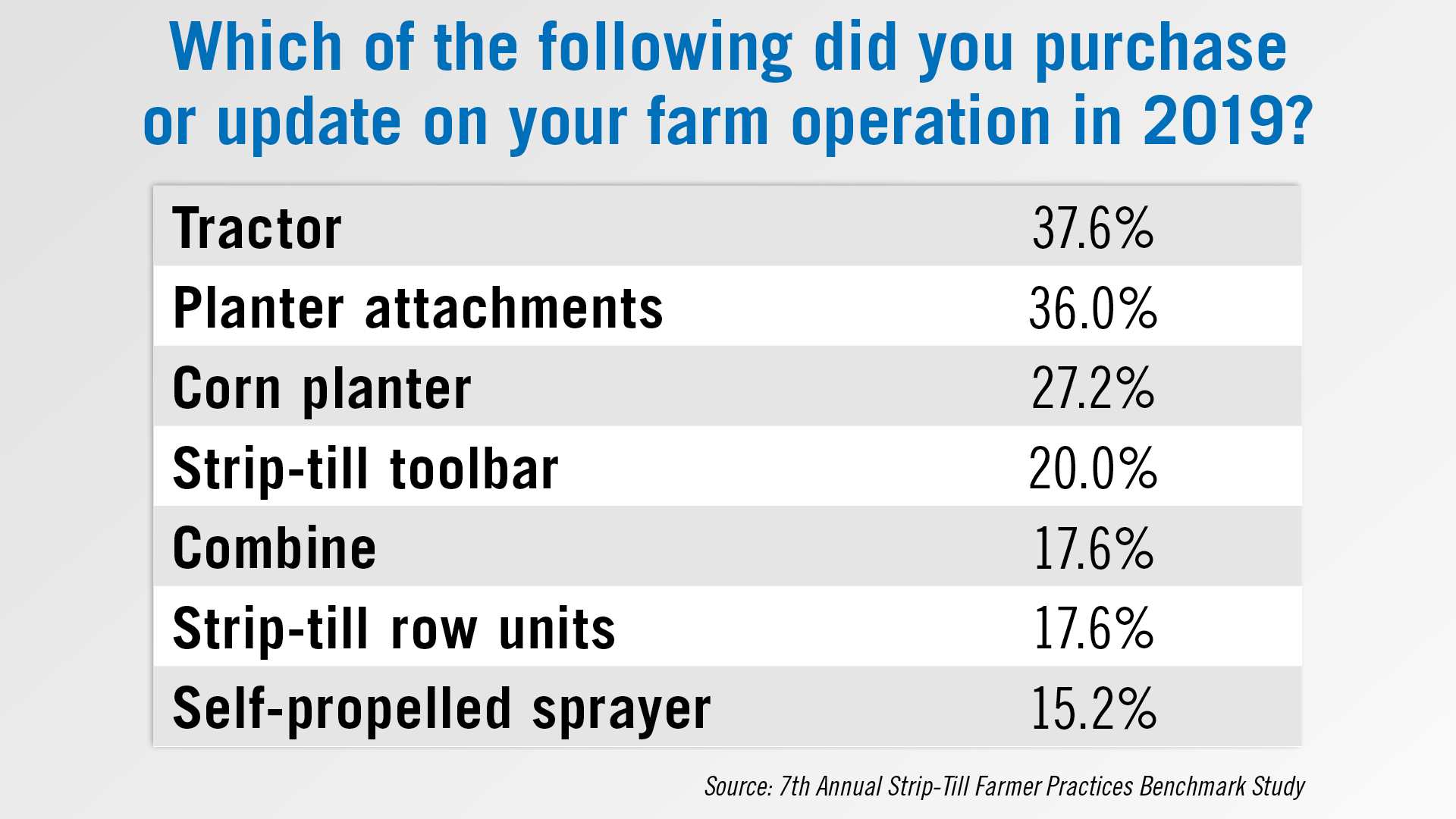

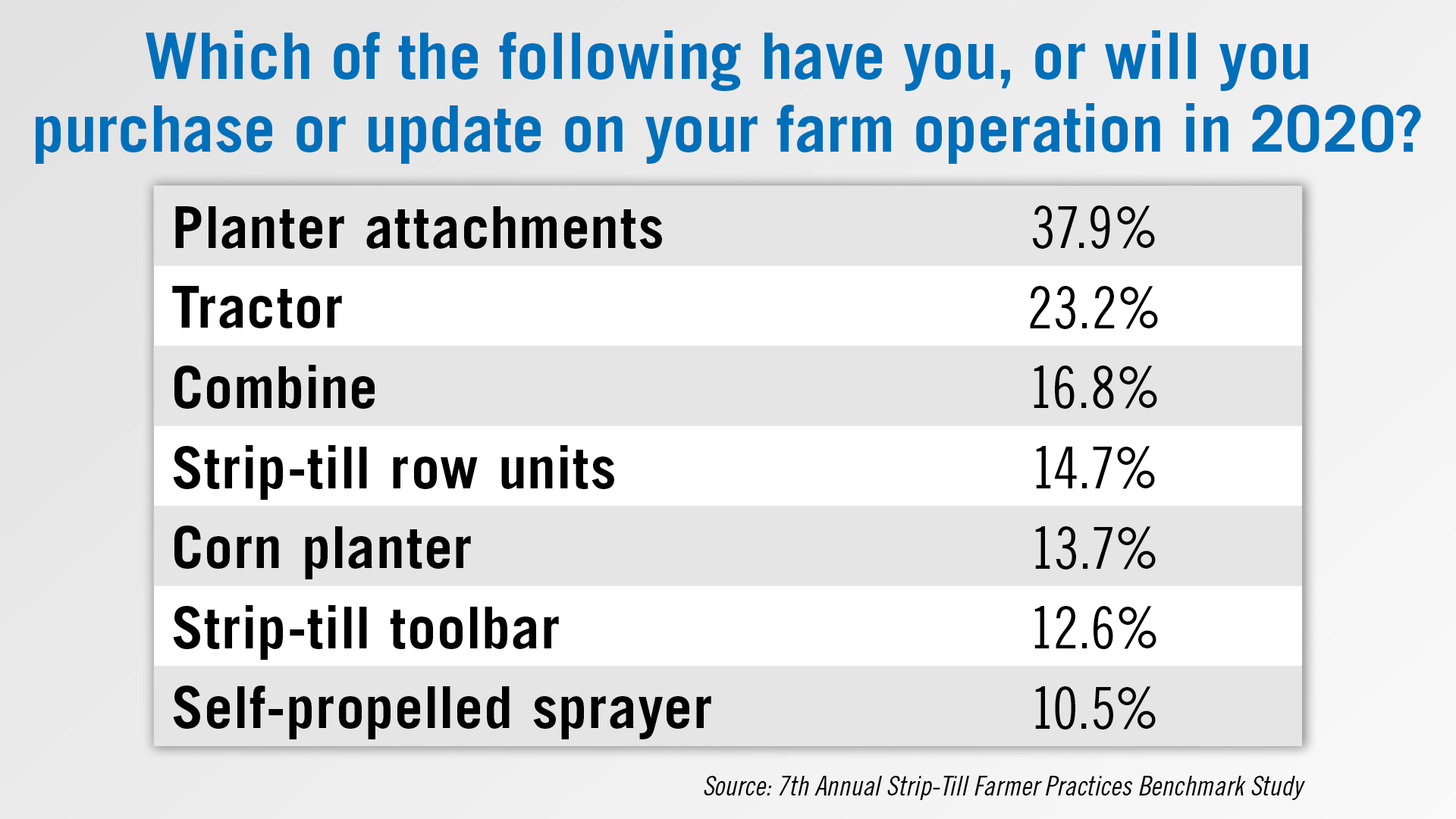

Over 300 farmers responded to the seventh Annual Strip-Till Practices study from Strip-Till Farmer, a sister publication to Ag Equipment Intelligence. Surveyed farmers answered questions about their strip-tilling habits and equipment setups that strip-tillers are putting to work on their farms.

Farmers were asked about what equipment they purchased or updated on their farms in 2019, with nearly 38% of farmers saying they purchased a new tractor. Additionally, 36% purchased planter attachments in 2019, and just over 27% said they bought a new corn planter. Similar to last year’s survey, self-propelled sprayers was at the bottom of the list for purchases in 2019.

When asked what they have or plan to purchase in 2020, planter attachments lead the way at 38% of strip-tillers planning to purchase this equipment. It was followed by tractors at 23% and combines at 17%. Only 11% of farmers said they planned to purchase a sprayer in 2020.

Farmers were also surveyed about what brands they utilize in their strip-till operation. For the sixth year in a row, Kuhn Krause was the most popular brand with 21% of strip-tillers using their equipment. Orthman came in nearly 12.5%. Slightly over 10% of strip-tillers reported using a Case IH unit.

The full results of the report will be available from Strip-Till Farmer later this summer.

Ag Credit Conditions Decline in 2020

Ag credit conditions in the U.S. have taken a hit going into 2020. Associate research editor Ben Thorpe has more on this story.

As commodity prices have dropped, so has farm income, loan repayment rates and loan interest rates. One dealer surveyed in Ag Equipment Intelligence’s May 2020 Dealer Sentiments update said they’d seen tightening credit conditions, having 9 credit declines in one week compared to 3 declines in all of 2019.

Reports from the Kansas City Fed’s Tenth District and the Chicago Fed’s Seventh District showed how COVID-19 is impacting ag credit conditions in these regions.

Among surveyed bankers in the Chicago Fed’s report, 42% reported lower rates of loan repayment for non-real estate farm loans. Nearly half of surveyed bankers reported higher year-over-year levels of loan renewals and extensions in the first quarter. Nearly one fifth of bankers said they were requiring more collateral for loans in the first quarter of 2020 compared to the same quarter last year.

Some 17% of surveyed bankers in the Chicago Fed’s Seventh District reported a year-over-year increase in loan demand, while 19% reported lowered demand. Some 14% of bankers reported they had more funds available to lend, while 7% said they had less.

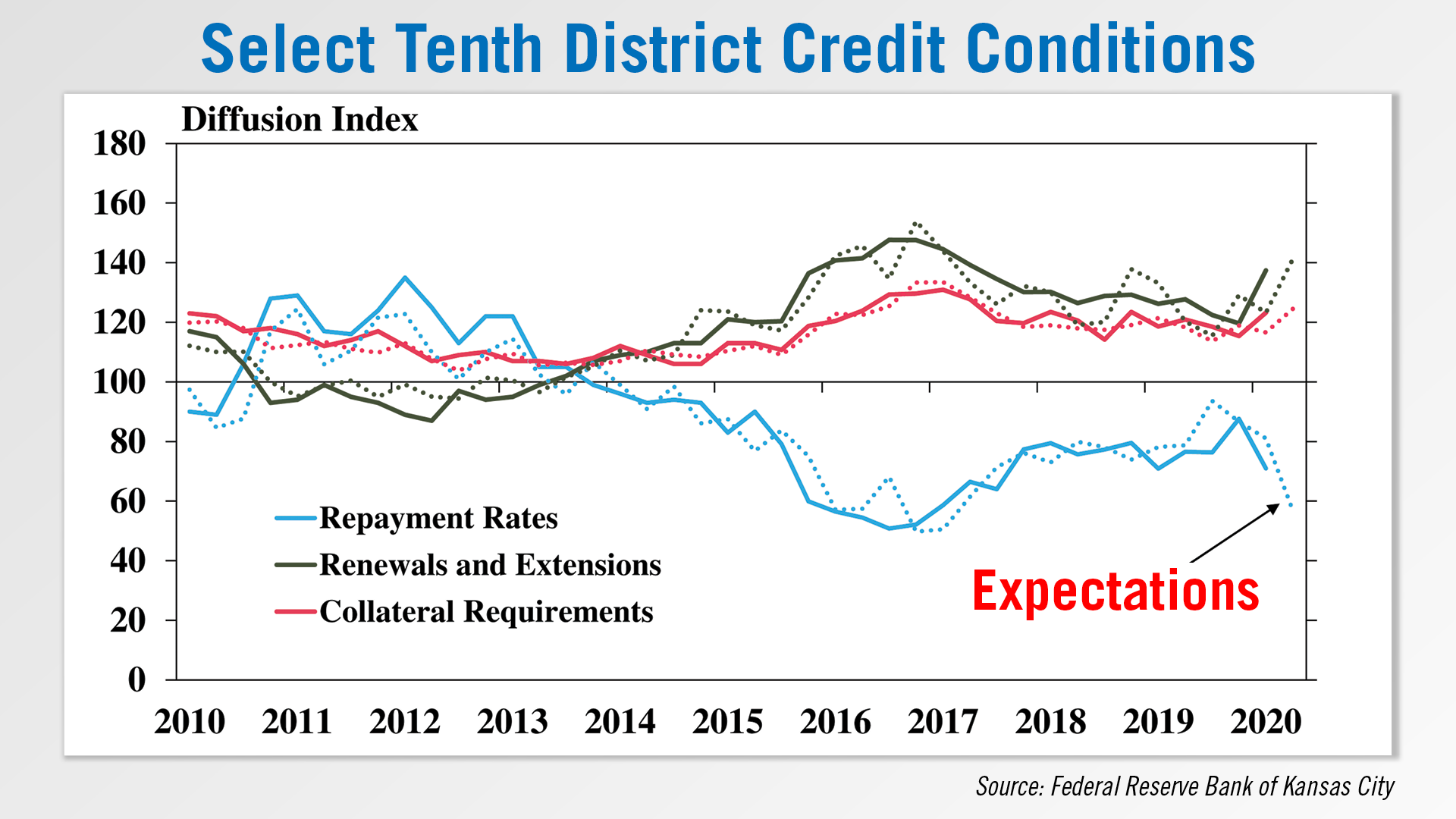

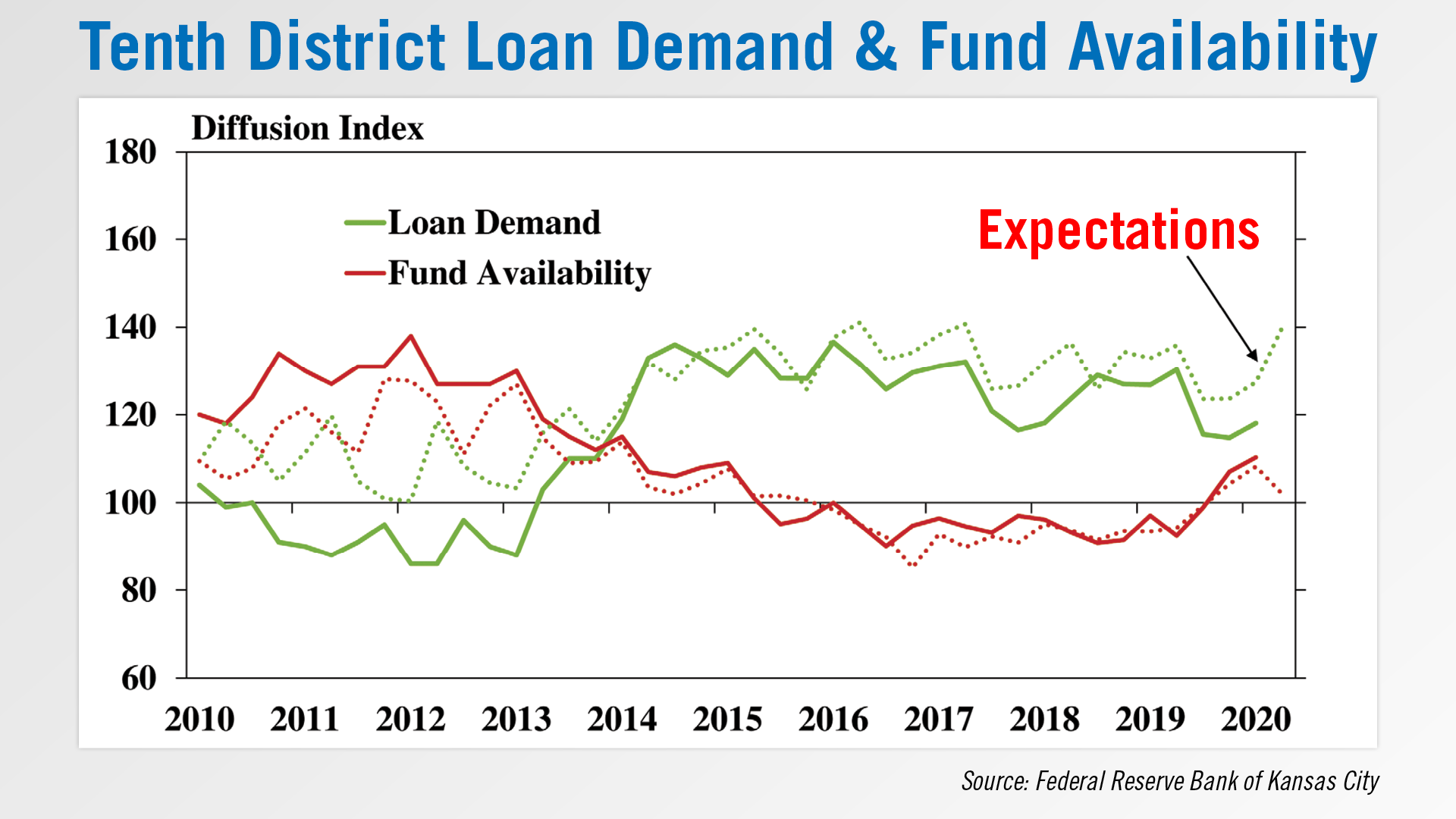

Surveyed bankers in the Kansas City Fed’s Tenth District reported increases in both their collateral requirements and the rate of farm loans renewals and extensions in the first quarter of 2020. At the same time, loan repayment rates dipped.

Fund availability for loans and loan demand in the Tenth District increased for the second consecutive quarter. Survey respondents forecast a dip in fund availability and an increase in loan demand going into the second quarter. Additionally, interest rates on all types of farm loans declined sharply alongside the recent decrease in benchmark interest rates. Almost two thirds of surveyed bankers in the Tenth District reported farm income lower year-over-year in the first quarter of 2020, the highest percentage since early 2017.

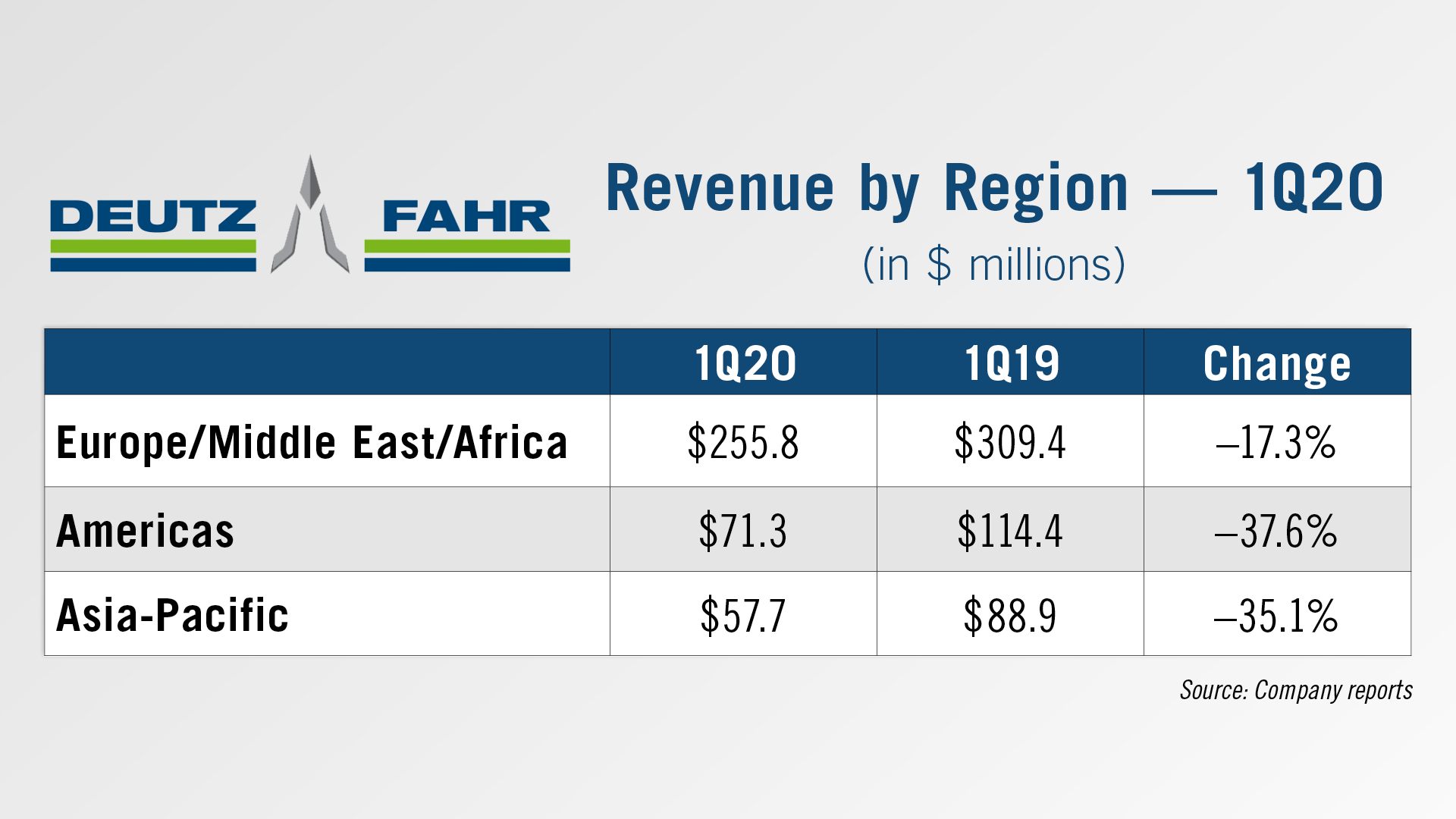

Deutz Reports 1Q20 NA Revenue Down 37.6%

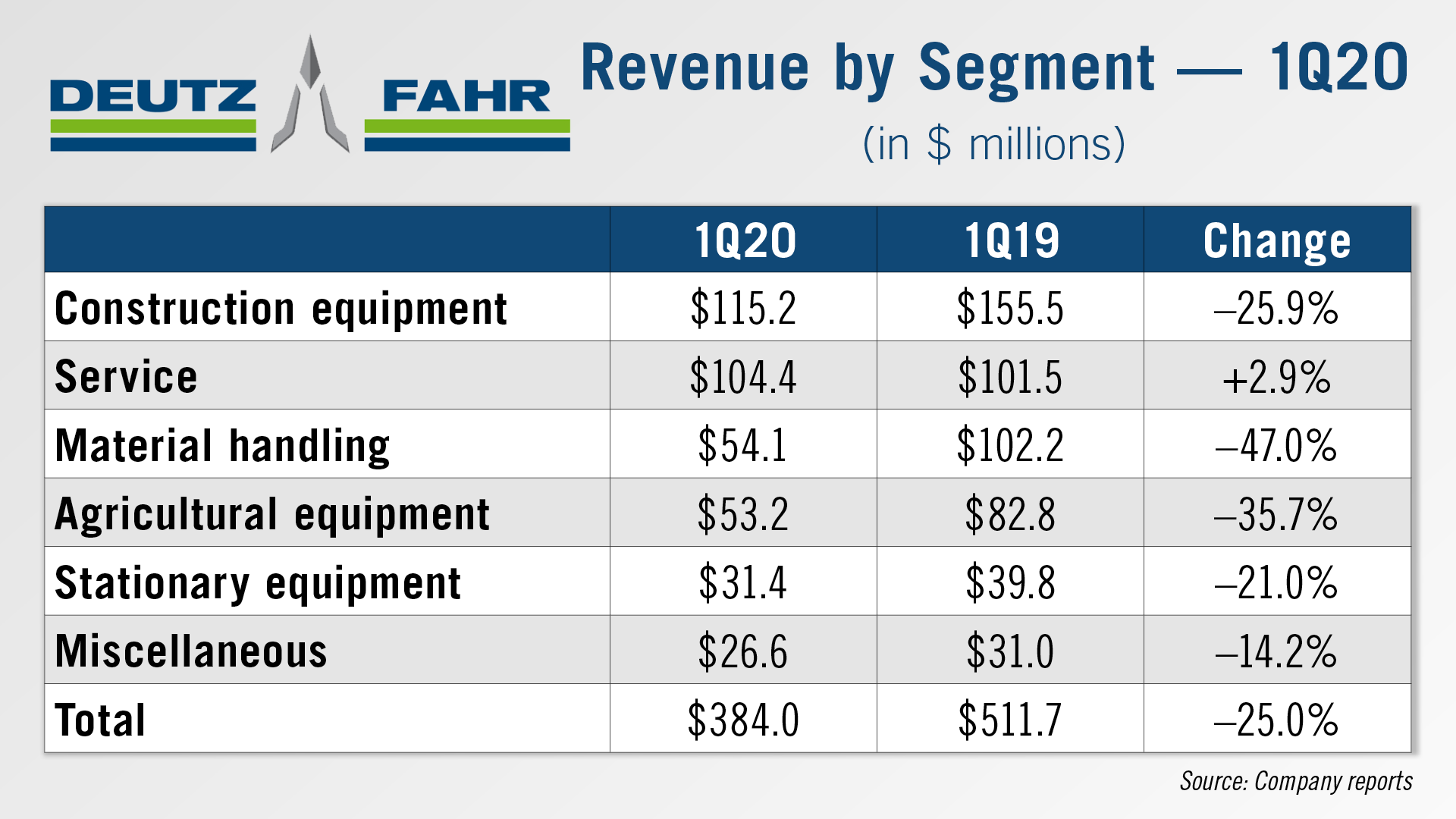

Deutz, a global manufacturer of drive systems, reported a rough start to the year in its first quarter earnings report. The company showed decreases in all but one of its segments, as well as in unit sales. The company said this was due in large part to a global fall in demand in key customer industries, which was heavily influenced by the spread of COVID-19.

Deutz’s revenue fell by 25% year-over-year to $384 million in the first quarter of 2020. Among its segments, only the service business showed positive gains, with revenue rising about 3%. All other segments’ revenue fell in the first quarter, with construction revenue down 26% and agricultural revenue down nearly 36%.

By region, the company reported decreases across the board in the first quarter. The greatest decline in revenue was in the Americas, with Deutz reporting $71.3 million in revenue, down nearly 38% from the same quarter last year. Revenues in the Asia/Pacific region were down 35% from the same quarter last year. Deutz’s smallest decrease was in the Europe/Middle East/Africa region, where revenues dropped more 17% from the same period last year.

Post a comment

Report Abusive Comment