Valmont Industries, a global provider of engineered products and services for infrastructure development and irrigation equipment and services for agriculture, has reported financial results for the first quarter ended March 28, 2020.

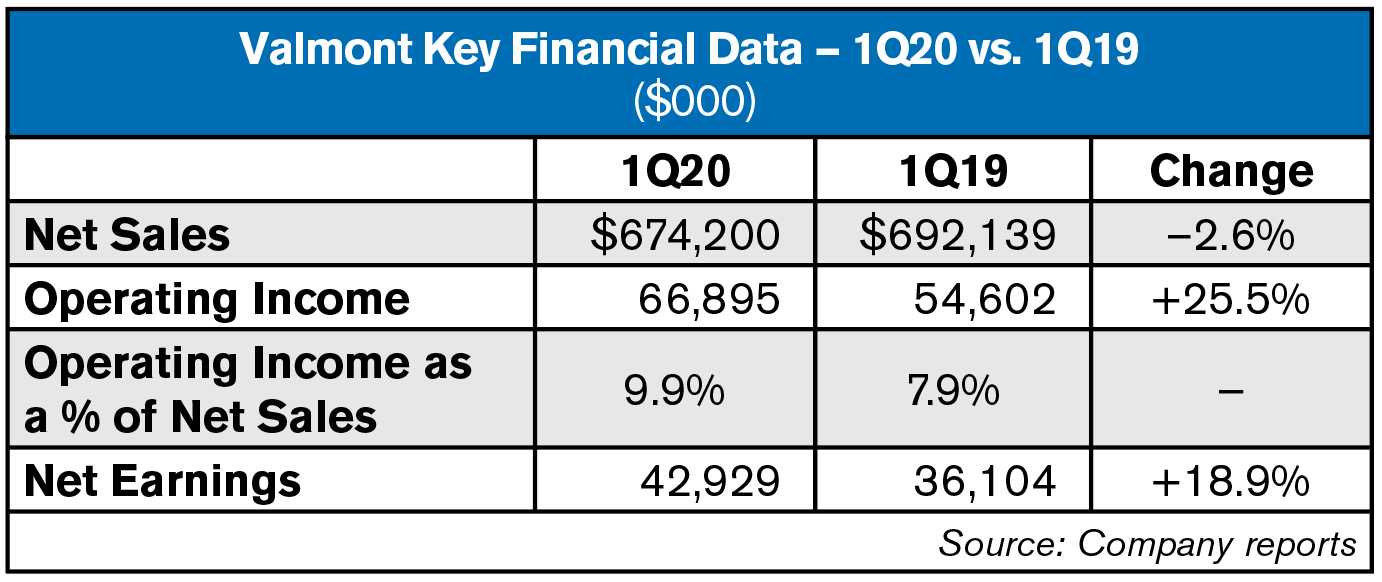

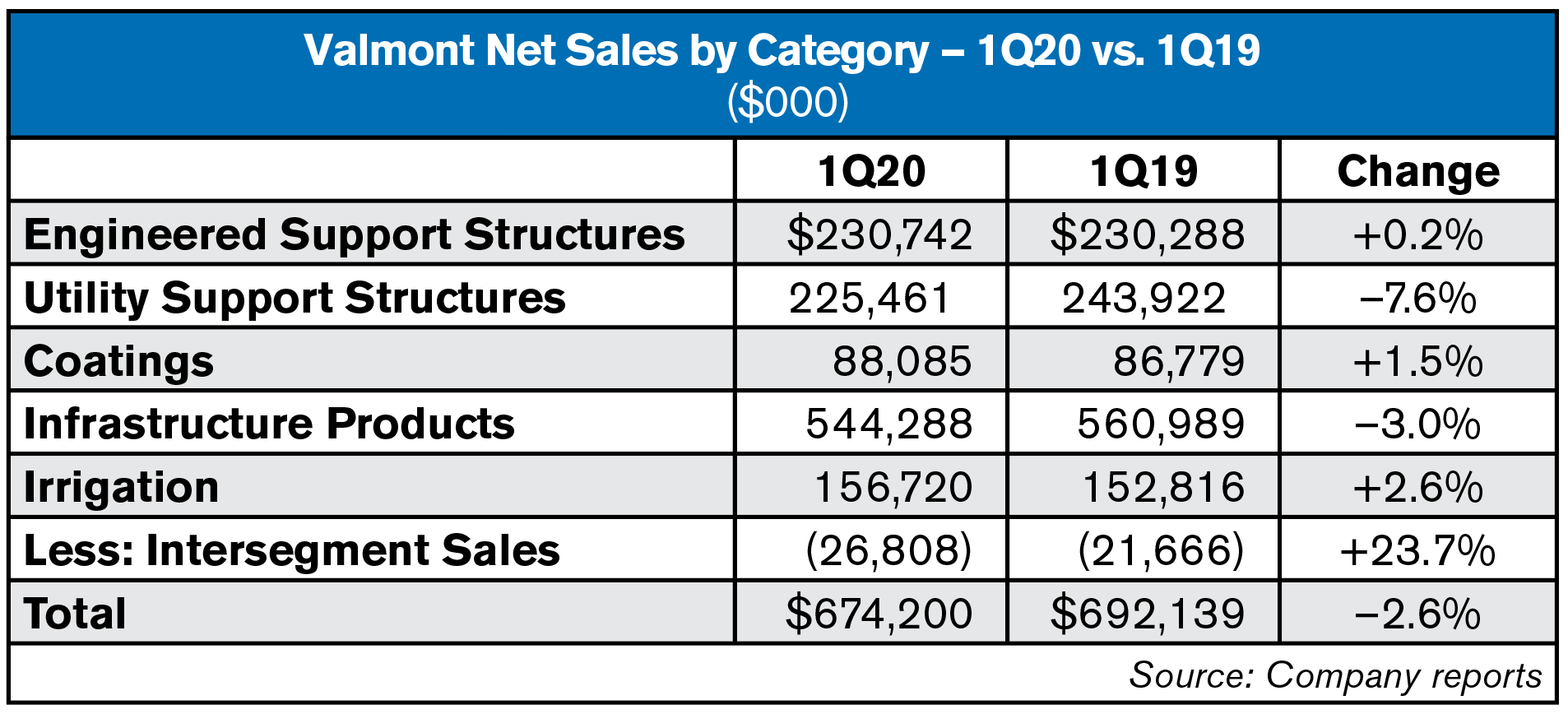

The company reported net sales of $674.2 million, a decline of 2.6%. Strong North American sales were more than offset by anticipated lower sales in the Utility Support Structures segment due to a $30 million solar tracker project in 2019 that did not repeat this year, and approximately $10 million of unfavorable currency translation impact

Operating income grew 22.5% to $66.9 million, or 9.9% of sales compared to $54.6 million or 7.9% of sales; all segments contributed to the improvement.

"We had a strong first quarter in the majority of the regions where we operate, despite COVID-19 interruptions," said Stephen G. Kaniewski, president and chief executive officer. "As discussed in previous quarters, our sales and profitability improvements were primarily driven by three strategic focus areas: capacity expansions in North America to meet strong infrastructure market demand and better serve our customers, improved operational efficiencies and pricing discipline while seeing deflation in raw material costs. We are very pleased with our results across all segments, with revenue and profitability exceeding our expectations.”

Agriculture

Irrigation Segment (23.2% of Sales)

Agricultural irrigation equipment, parts, services and tubular products, water management solutions, and technology for precision agriculture

Global sales of $156.7 million increased 2.6% compared to last year.

North American sales of $106.6 million were down 1.8% compared to 2019. Higher volumes of systems, aftermarket parts and advanced technology solutions were more than offset by lower industrial tubing sales.

International sales of $50.1 million grew 13.1% compared to last year, despite $2.7 million of unfavorable currency translation impacts. Volumes were higher in most regions. Record first-quarter sales in local currency in Brazil, and a recovering market in Australia, led to the sales growth.

Segment operating income was $23.7 million, or 15.1% of sales, compared to $20.1 million, or 13.2% of sales in 2019. Profitability improvement from higher selling prices and improved volumes of aftermarket parts was partially offset by approximately $0.8 million of planned higher R&D expense for technology investments.

COVID-19 Business Continuity and Operations Update

On March 26, 2020, the Company provided perspectives and observations on the COVID-19 impact on the business. Valmont is considered an essential business because of the products and services that serve critical infrastructure sectors and food security, as defined by many governments around the world. In response to the situation, a cross-functional taskforce was assembled in February 2020 to monitor this evolving situation. Valmont has activated a business continuity plan that encompasses all segments and regions of operation.

Since the March communication, one additional manufacturing facility in South Africa has temporarily ceased operations due to preemptive government mandates. Valmont facilities currently impacted include operations in Argentina, France, India, Malaysia, New Zealand, Philippines and South Africa, but all are anticipated to resume operations in early May. All other Valmont facilities remain open and fully operational. Deliberate and proactive steps have been taken to protect all stakeholders and minimize the operational and financial impacts of COVID-19 on the business. At present, multiple sources of supply for raw materials and other critical components are in place, and Valmont is currently not experiencing any delays in its global supply chain.

2020 Outlook

As a result of the evolving impact of COVID-19 on the global economy, the company is now anticipating and planning for slowdown in customer demand and increased business disruption, primarily beginning in the second quarter. The extent and duration of these impacts are not presently able to be quantified, and therefore future impacts are difficult to determine. For these reasons, Valmont believes it is prudent to withdraw its full year 2020 guidance.

In lieu of annual guidance and to help the financial community understand business impact and sensitivities, the company is providing key assumptions and indications for the second quarter and second half of 2020.

Second Quarter Financial Outlook

- Net sales estimated to be between $645 million and $665 million

- Operating margins estimated to be in the range of 7-8.5% of net sales

- Irrigation segment revenue expected to be down 5-10% from prior year, due to recent disruptions to food supply chains, ethanol demand and unfavorable currency translation impacts

- Coatings segment revenue expected to be down 20-25% from prior year, as a result of recent industrial production levels and GDP trends

- Anticipate positive operating cash flows

- Assume no additional closures of large manufacturing facilities globally due to COVID-19

Second Half 2020 Key Assumptions and Perspectives

- Planning and anticipating for recessionary forces to potentially impact global demand and revenues due to volatile market demand profiles

- Anticipating lower raw material costs and assuming no significant supply chain interruptions

- Expecting lower working capital requirements associated with reduced market demand

- Balance sheet that reflects strong financial and operational position, with ample liquidity and room under debt covenants

- Prepared to execute additional cost management measures, as appropriate

- Assuming no additional closures of large manufacturing facilities globally due to COVID-19

For a list of all ag equipment manufacturer announcements pertaining to the COVID-19 pandemic, click here.

![[Technology Corner] Pessl Instruments CEO Talks Dealer Benefits From Lindsay Corp. Investment](https://www.agequipmentintelligence.com/ext/resources/2024/04/25/Pessl-Instruments-CEO-Talks-Dealer-Benefits-From-Lindsay-Corp.-Investment.png?height=290&t=1714144307&width=400)

Post a comment

Report Abusive Comment