Quincy, Ill. — Titan International, a global manufacturer of off-highway wheels, tires, assemblies and undercarriage products, has reported results for the first quarter ended March 31, 2020 and provided an update as to the impact on its business of the COVID-19 pandemic and the steps it is taking to address that impact.

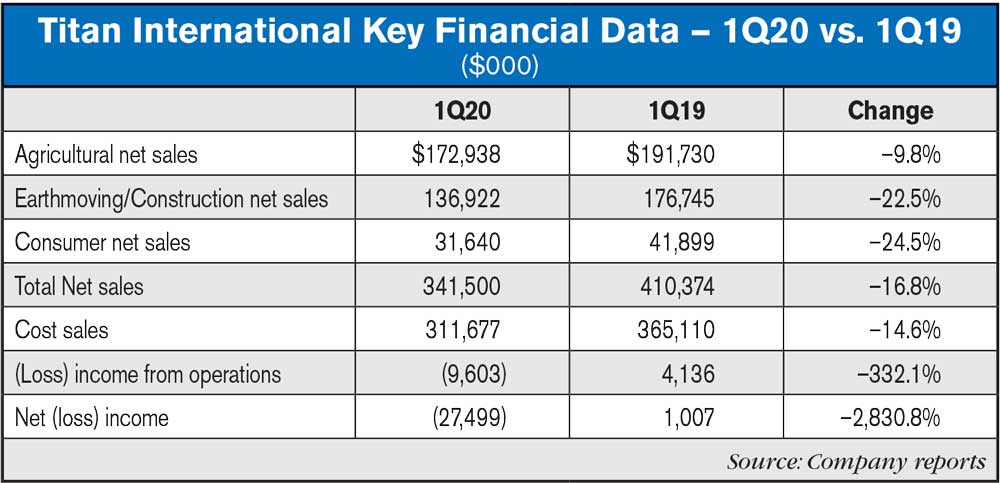

Net sales for the first quarter of 2020 were $341.5 million, compared to net sales of $410.4 million for the first quarter of 2019, representing a $68.9 million, or 16.8%, decrease. On a constant currency basis, net sales for the first quarter 2020 would have been $354.2 million. Net loss applicable to common shareholders for the first quarter of 2020 was $25.5 million, and first quarter 2020 adjusted net loss attributable to Titan was $10.6 million.

"As we announced on March 4th in our earnings release concerning our fiscal year 2019 results, we expected a solid rebound in full-year 2020 EBITDA driven by internal actions and relatively stable sales compared to 2019," stated Paul Reitz, President and Chief Executive Officer. "The COVID-19 pandemic has severely impacted the world since then, making it difficult to forecast demand in the coming months. We expect the months ahead will be challenging as order trends have pulled back, but we do believe that a significant portion of that demand will shift to the second half of this year and not be completely lost. As a result, we have and will continue to be comprehensive in taking immediate cost control actions along with appropriate cash preservation measures.

"As COVID-19 progressed globally, Titan initially felt its impact in China with the government mandated lock-down and curtailment of business operations from late January through February 2020. The impact on the Company expanded into Europe through travel restrictions, social distancing, mandatory stay-at-home orders and sanitization of our facilities. Due to these and other related COVID-19 restrictions, we experienced disruptions in production during the tail end of the first quarter, which continued into the second quarter. The Company began to experience the impact of COVID-19 in South America during the latter part of March, continuing through the early part of April due to similar stay-at-home restrictions in place as Europe. At our major tire plant in São Paulo, we implemented stringent practices and supported our employees with company-provided transportation, which has resulted in nearly 100% attendance since we restarted operations in April.

"Within North America, our facilities have remained open throughout this time with social distancing and sanitization protocols implemented as recommended by the CDC, WHO and government. Our Australian and Russian operations have experienced a lesser impact than our operations in the other geographies other than enhanced sanitization of our facilities.

"We currently expect the biggest impact to our operations from government mandates to have already occurred in April while in May we will have most of our production online, but at lower levels in response to customer demand. With the current uncertainty in the earthmoving/construction market from COVID-19 and the global economic contraction, the demand in that segment is more unclear than within agriculture. In the second quarter, agriculture production is expected to continue at better levels than construction, as most governments typically take actions to protect their food supply and farmers are currently active in the fields. That activity is expected to continue to support demand for our tires within the aftermarket, while full year OEM demand remains difficult to predict at this time.

"While the current volatility and uncertain demand outlook implies a sales decline from our 2019 levels, we currently anticipate EBITDA will approximate 2019 levels. Important steps we are taking to maintain EBITDA in a down market include the measures previously outlined during our fourth quarter earnings release along with certain other intensified efforts throughout 2020 as we align production and costs with the current business environment. The current market conditions and the ongoing impact of the COVID-19 global pandemic continues to create a dynamic and fluid situation with our customers as they shift schedules in the current period and are providing limited visibility into their plans for the second half of the year."

Agricultural Segment Results

During the quarter, lower sales volume in North America, Europe and Australia contributed 1.8% of this decrease while unfavorable currency translation, primarily in Latin America and Europe, decreased net sales by 3.4%. Unfavorable price/mix further decreased net sales by 4.7%. Lower sales volumes were primarily caused by continued weakness in the commodity markets and the effect of the COVID-19 pandemic which continues to cause significant uncertainty for customers in most geographies, most notably OEM customers. The decrease in gross profit is primarily attributable to the impact of lower sales volume and unfavorable foreign currency translation. Unfavorable North American gross profit was driven by lower OEM volume and mix, within our North American Wheel operations.

Post a comment

Report Abusive Comment