Bankers responding to the Dallas Federal Reserve Bank’s first quarter survey reported overall better conditions across most regions of the Eleventh District. They noted that a mild winter has allowed some farmers to be ahead of schedule. Above-normal rainfall so far in 2020 may contribute to better crop yields. Unfortunately, survey participants also noted that the negative impact on commodity prices from the coronavirus (COVID-19) outbreak has changed the outlook for 2020 from one of challenge to one of extreme concern.

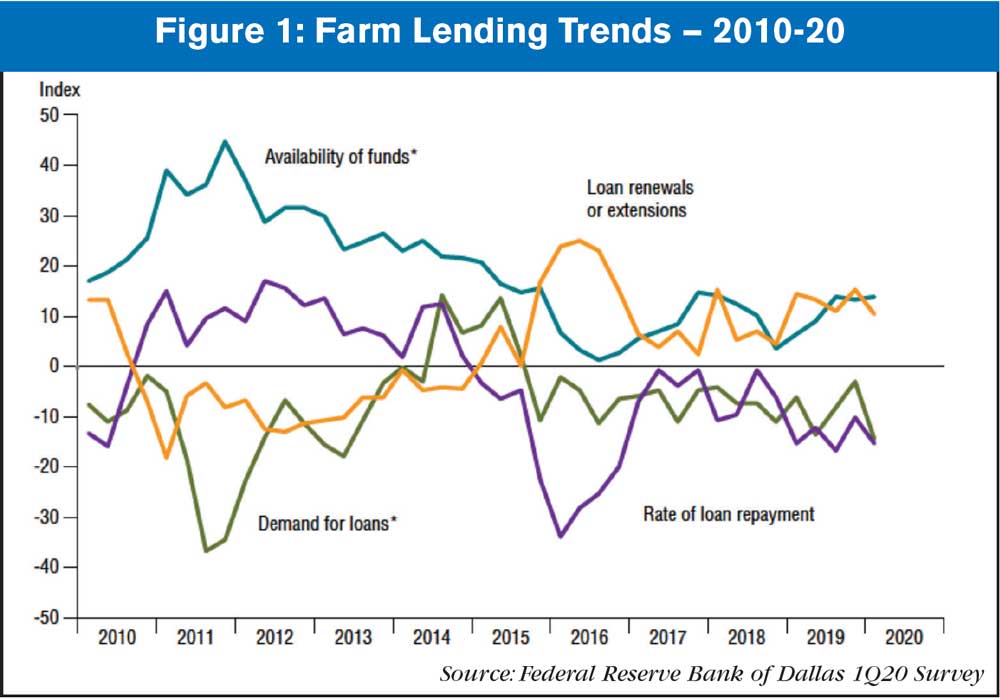

Demand for agricultural loans continued to decline, with the loan demand index registering its 18th quarter in negative territory. Loan renewals or extensions increased and the rate of loan repayment continued to decline. Loan volume fell across all major categories compared with a year ago (Figure 1).

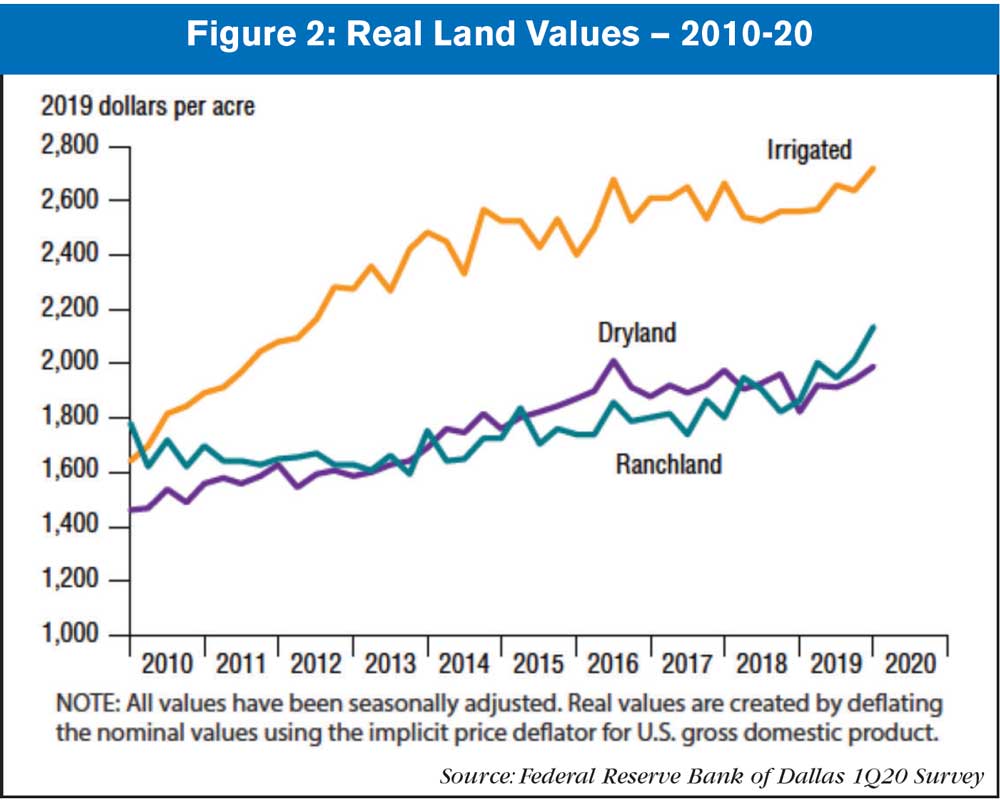

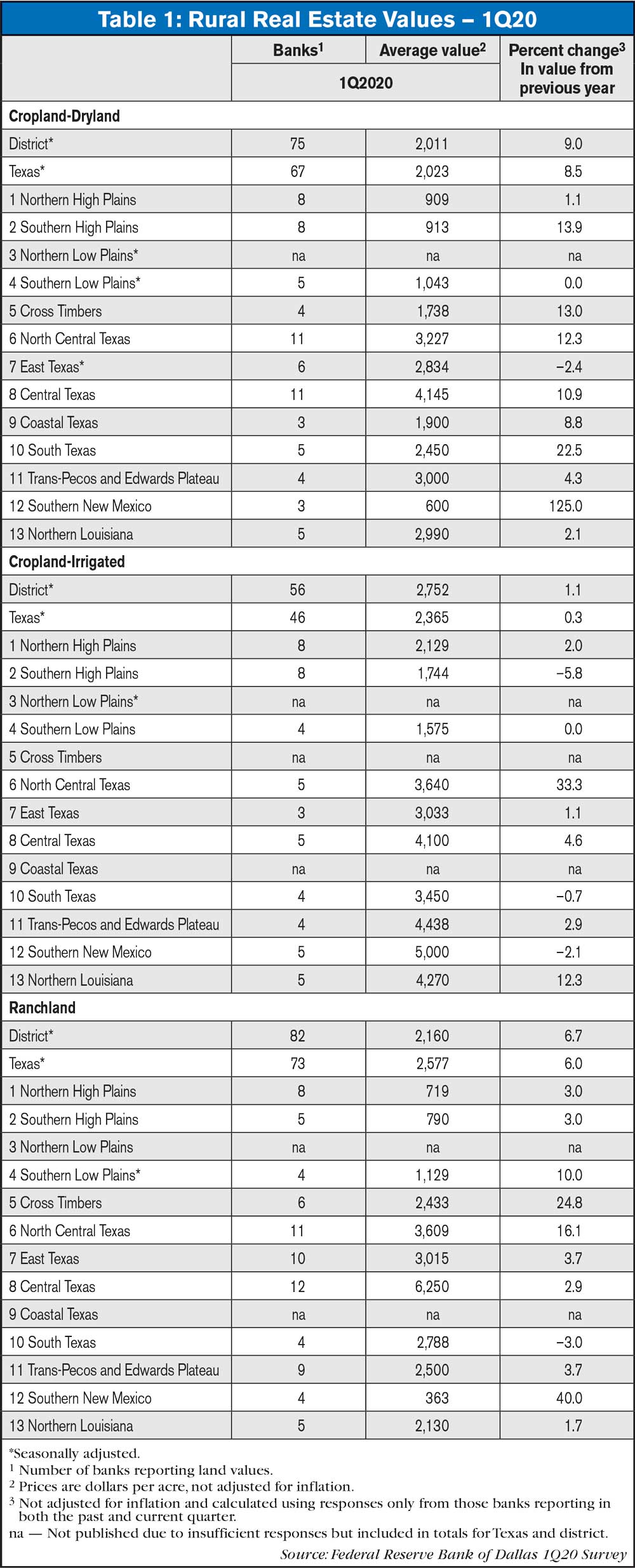

All district land values increased this quarter (Figure 2). According to bankers who responded in both this quarter and first quarter 2019, nominal dry cropland and ranchland values increased year-over-year in Texas, northern Louisiana and southern New Mexico. Irrigated cropland only fell in southern New Mexico (Table 1).

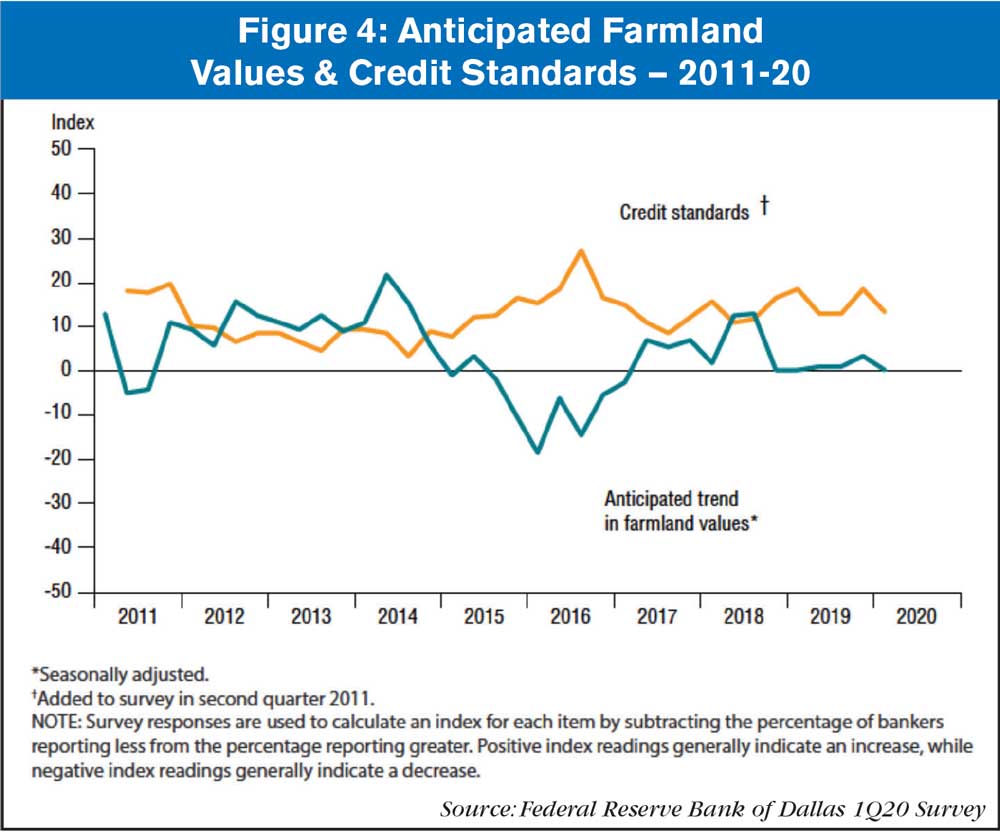

The anticipated trend in farmland values index was flat in first quarter 2020 after increasing slightly in fourth quarter 2019. The credit standards index went down, indicating some loosening of standards on net (Figure 4).

![[Technology Corner] Quantifying the Impact of a Precision Ag Pioneer](https://www.agequipmentintelligence.com/ext/resources/2024/08/23/Quantifying-the-Impact-of-a-Precision-Ag-Pioneer.png?height=290&t=1724422794&width=400)

Post a comment

Report Abusive Comment