The latest episode of On the Record is now available! In this week’s episode, we discuss Ag Equipment Intelligence’s soon to be released Big Dealer Report. In the Technology Corner, Jack Zemlicka looks into a CoBank’s report that suggests wireless network sharing could be an affordable way to expand digital coverage. Also in this episode: a look at first quarter farm equipment sales compared to last year, Art’s Way’s latest earnings and a big drop in farmer sentiment amid the COVID-19 crisis.

On the Record is brought to you by B&D Rollers.

This episode of On the Record is brought to you by B&D Rollers. B&D Rollers is the only manufacturer in the world to make new aftermarket hay conditioner rollers. The Crusher hay conditioning rollers have the ability to run on any machine, regardless of color or brand. Between 2018 and 2019, B&D Rollers saw 93.7% growth purely in hay conditioning rollers and is continuing to see similar growth trends into 2020. For more information or OEM inquiries, visit bdrollers.com.

On the Record is now available as a podcast! We encourage you to subscribe in iTunes, the Google Play Store, Soundcloud, Stitcher Radio and TuneIn Radio. Or if you have another app you use for listening to podcasts, let us know and we’ll make an effort to get it listed there as well.

We’re interested in getting your feedback. Please feel free to send along any suggestions or story ideas. You can send comments to kschmidt@lessitermedia.com.

Big Dealerships Get Bigger

In an environment marked by trade conflicts, the coronavirus outbreak and ongoing low commodity prices, North American agriculture has few assurances about what’s ahead. But the one thing they can count on is dealer consolidation.

In the past year, the number of farm equipment dealerships that operate 5 or more ag store locations increased by 4 from 187 to 191, according to Ag Equipment Intelligence’s 2020 Big Dealer Report.

In the past 10 years, Big Dealer groups have grown by nearly 12%. But the most striking growth during the past decade has come in the ranks of the largest dealers. Those operating 20 or more store locations have grown by 300%, from 8 in 2011 to 24 in 2020, while the number of dealership groups operating between 15-19 stores have grown by 360%, from just 5 in 2011 to 23 in 2020.

During this period, dealerships operating 5-9 retail locations declined by 23%, falling from 128 groups in 2011 to 99 in 2020.

The impact of the growth of biggest dealers can also be seen in the number of stores they operate. In 2011, 13 dealership networks with 15 or more store locations operated an estimated 311 stores. This year, those with 15 or more stores has grown to 47 groups that operate nearly 1,100 individual store locations. On average, these Big Dealers operate slightly more than 23 locations each.

The 2020 Big Dealer report will be issued to Ag Equipment Intelligence subscribers and available to others next week.

A Shared Solution to Rural Broadband

Improving the reach and reliability of digital broadband into rural areas, including farm operations in less densely populated parts of the country, remains a challenge.

But a potentially cost-effective solution outlined in a new report from CoBank’s Knowledge Exchange division suggests that wireless network sharing could be an affordable way to expand digital coverage.

As explained by Jeff Johnston, lead communications economist with CoBank, network sharing involves multiple wireless operators sharing radio equipment on a wireless tower to provide connectivity to their respective customers.

Network sharing is a way for national wireless operators to reduce their network cost structure in rural America. The average cost of a new tower can cost upwards of $200,000 for a single company. Splitting the cost among 3 companies would allow operators to provide coverage in rural areas at a third of the cost, Johnston says.

One of the primary benefits for the farm equipment dealers would be increased market opportunity to expand precision product and service revenue.

Johnston also acknowledges the solution has barriers to getting widespread buy in, including a potential reluctance by large tower owners to allow network sharing because less equipment on a tower equates to less revenue for operators.

1Q20 Ag Equipment Sales Tumble

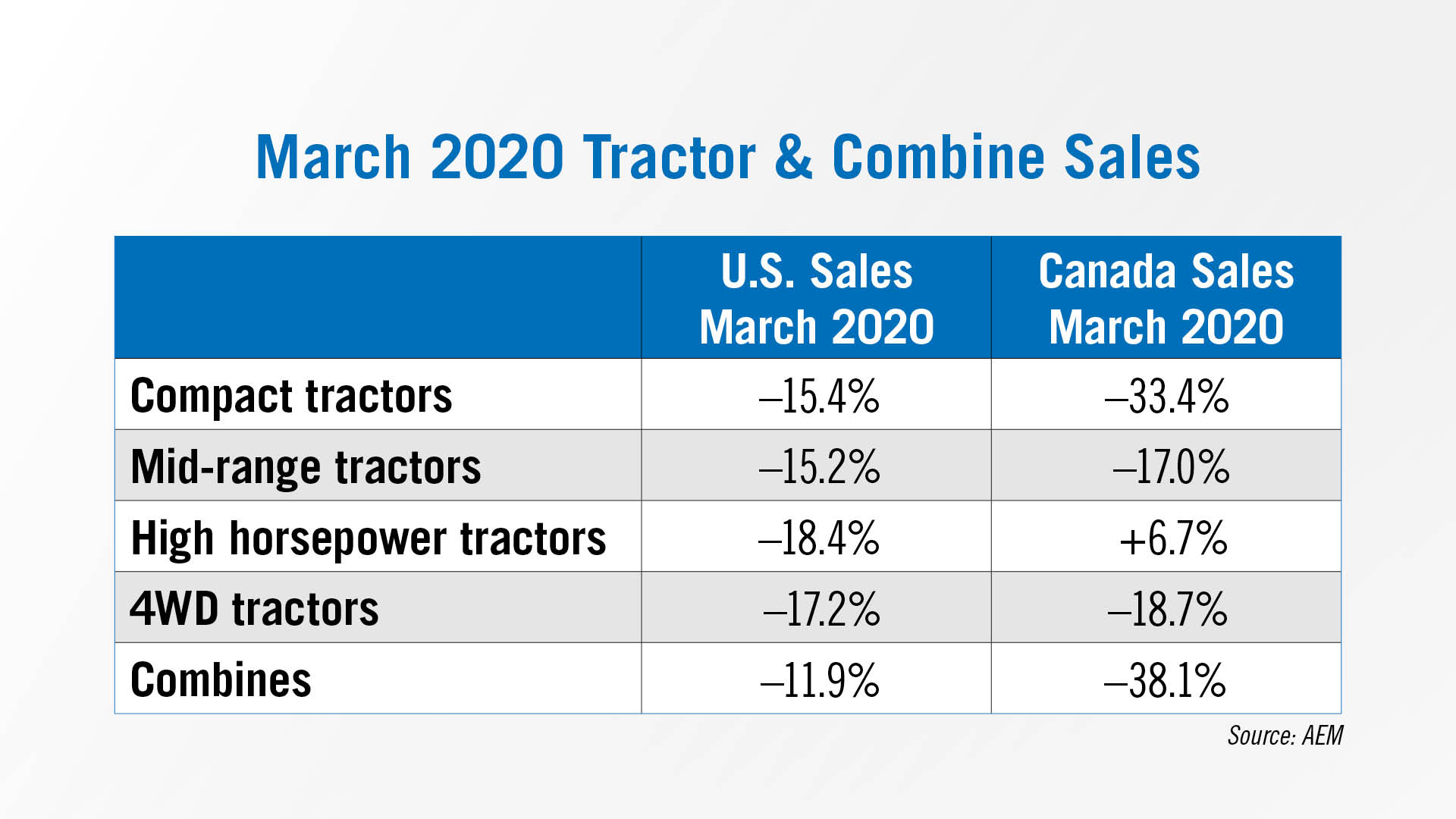

The first quarter of 2020 ended on a sour note for sales of farm tractors and combines in both the U.S. and Canada. All equipment categories in March, except for over 100 horsepower tractors in Canada, were down double digits for the month, according to sales figures released by the Assn. of Equipment Manufacturers.

The most telling sign for sales was the drop off in sales of the under 40 horsepower tractor category. This equipment is often purchased by residential consumers and hobby farmers who are likely experiencing the early pressures from COVID-19, according to analysts. The compact tractor sales decline in March was the largest since October 2009, more than 10 years ago.

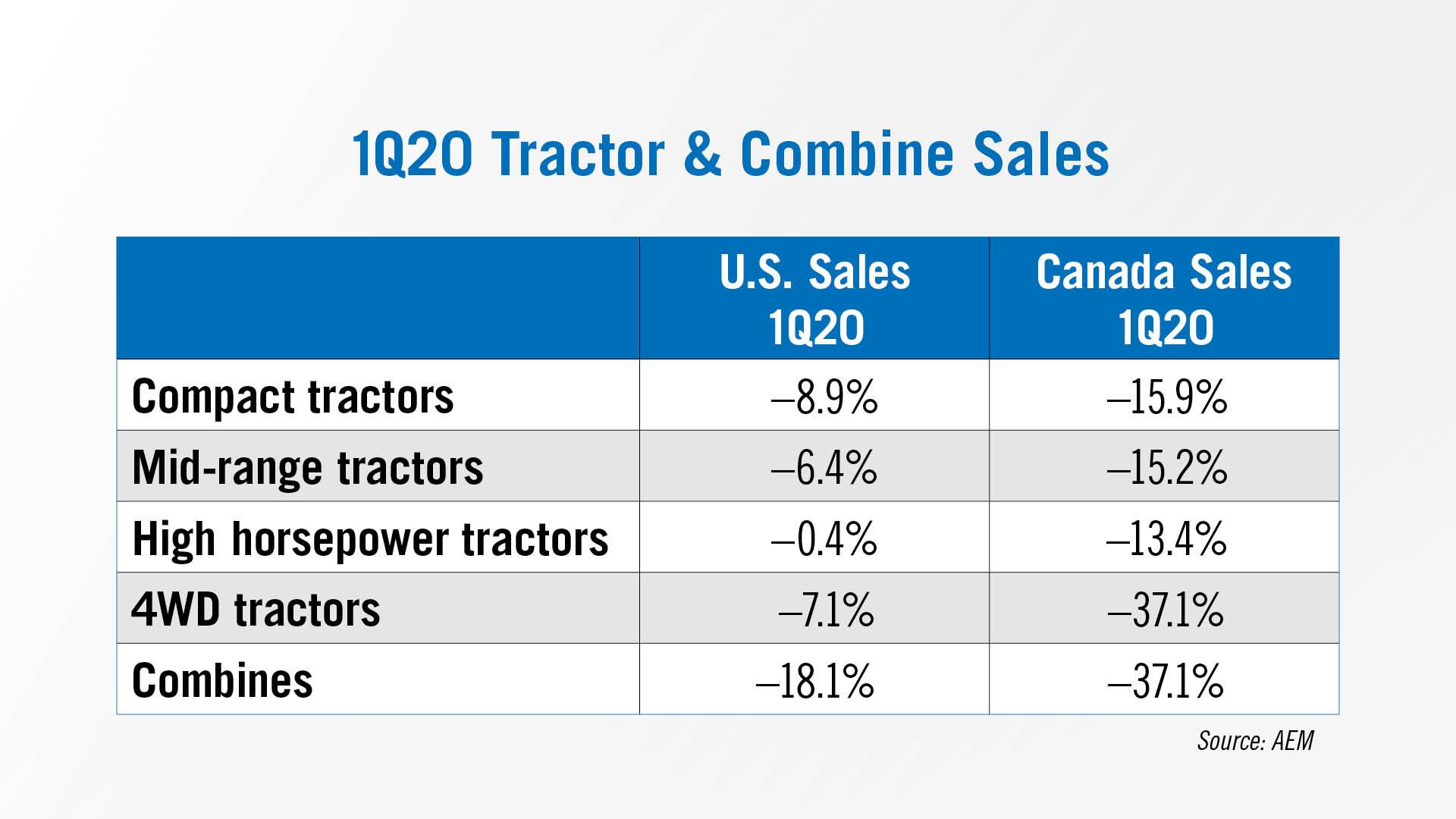

For the first quarter of 2020 vs. the same period in 2019, ag equipment sales in the U.S. were improved overall compared to March figures. But first quarter sales in Canada were mixed and generally continued the trend Canadian ag machinery dealers have been experiencing during the past 2 years or more.

Year-to-date compact tractor sales in the U.S. fell nearly 9% and were down by more than 33% in Canada. In the 40-100 horsepower category, U.S. unit sales were off 6.4% and down by more than 15% in Canada.

Sales of tractors over 100 horsepower were down by less than 1% in the U.S. and off by 13.4% in Canada. Year-to-date 4WD tractor sales in the U.S. were off by about 7%, but down by more than 37% in Canada during the first quarter of the year.

Through the first 3 months of the year, U.S. combine sales are off slightly more than 18%, but Canadian sales of harvesters were 37% lower compared to the first quarter of 2019.

Art’s Way 1Q20 Revenues Up 22%

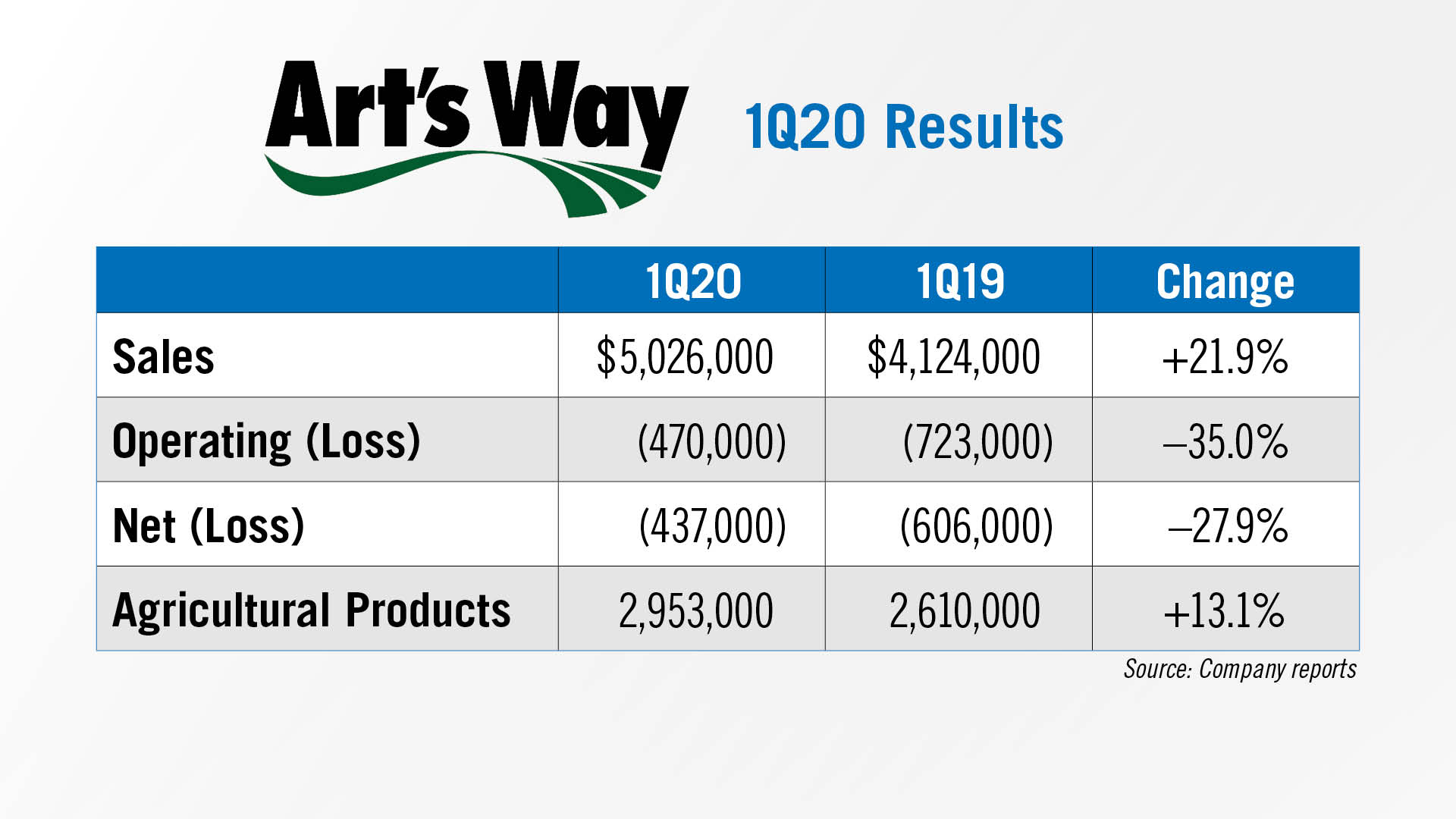

Art’s Way Manufacturing announced its financial results for the first quarter of its fiscal year 2020 on April 13.

Consolidated sales for the first quarter were $5 million, up 21.9% from the $4.1 million reported during the same period in fiscal 2019, an increase of $902,000. The company says the increase is due to increased sales across all three of the company’s business segments. Consolidated net loss for the quarter was $437,000, compared to net loss of $606,000 for the same period in fiscal 2019.

First quarter sales in the Agricultural Products segment were $3 million, up 13.1% or $343,000 compared to $2.6 million for the same period in fiscal 2019. The company said the revenue improvement was due to increased demand across manure spreader, dump box and grinder product lines.

Chairman of the Art's Way Board of Directors, Marc McConnell, said the company lowered its expectations for the year due to the impact of COVID-19. “The impact of COVID-19 has brought new challenges to our business and leaves us uncertain as to what to expect from a demand perspective for the balance of the year.”

Farmer Sentiment Sees Biggest Drop in 5 Years

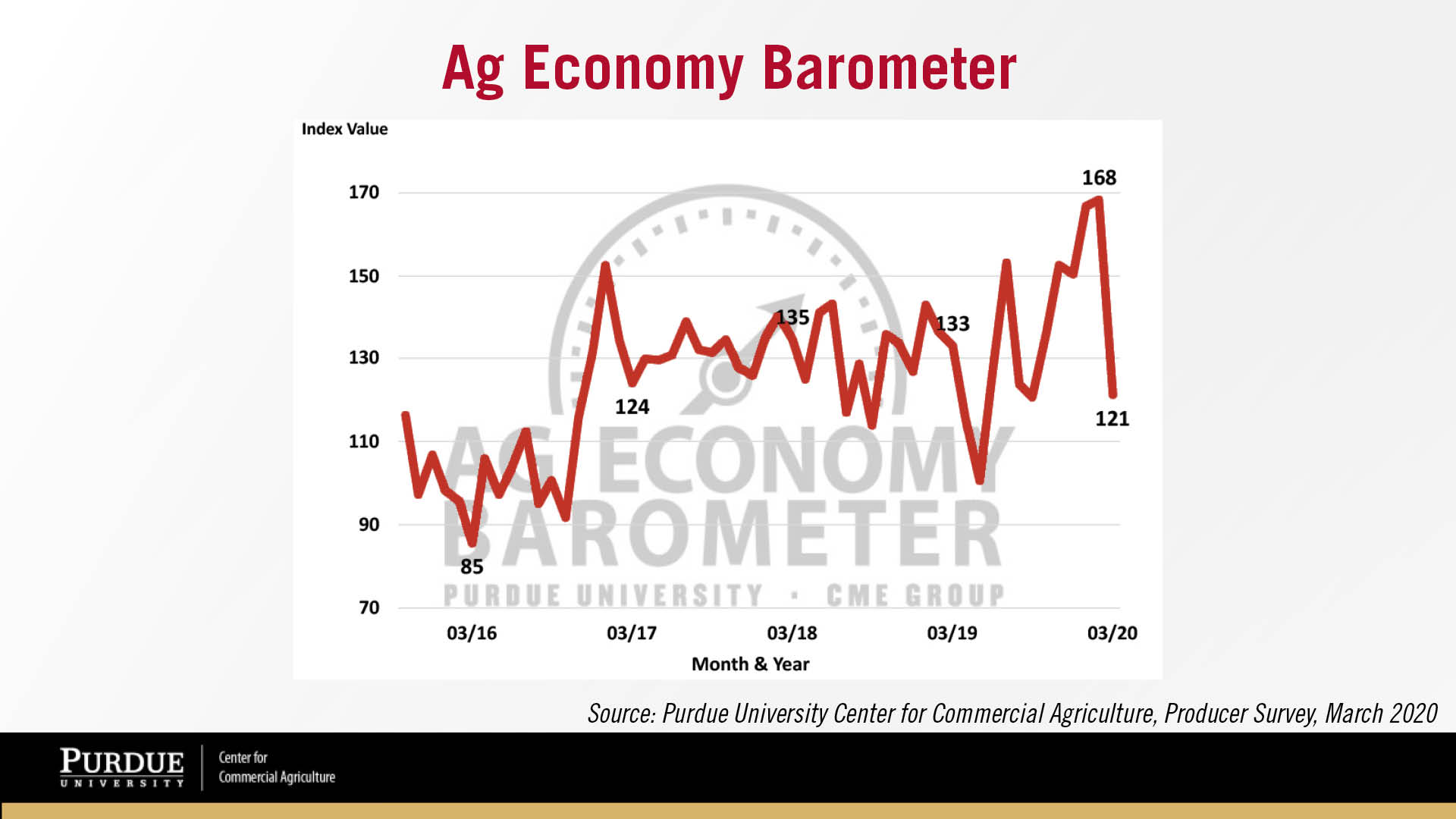

Purdue’s Ag Economy Barometer saw the largest one-month decline in its history in March. The reading for the month was 121, down 47 points from February.

Declines in agricultural commodity prices and concerns about the coronavirus crisis impact on the U.S. economy and agricultural sector weighed heavily on farmer sentiment in March. This month’s decline in the barometer erased the sentiment improvement that took place this past fall and winter and leaves the index unchanged from its September 2019 reading.

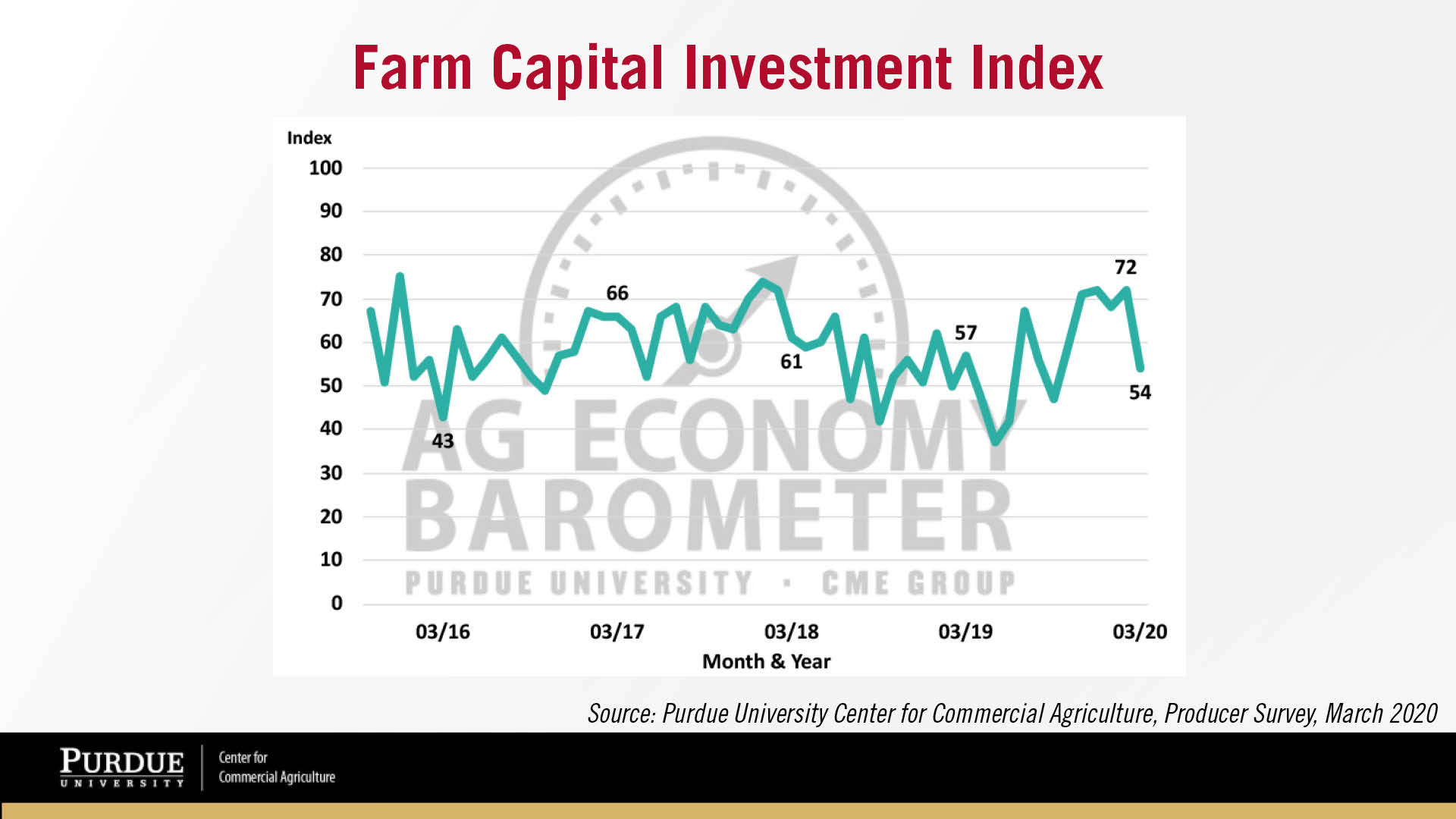

Farmers’ concerns about a deteriorating agricultural business climate were also evident in their responses regarding possible capital investments, which includes machinery, buildings and farmland. The Farm Capital Investment Index fell 18 points to an index value of 54, its lowest reading since last May, when many farmers were faced with wet weather and delayed planting.

Post a comment

Report Abusive Comment