USDA currently projects farm income in 2019 to reach $88 billion – the highest net farm income since 2014’s $92 billion but still 29% below 2013’s record high. In addition, nearly 40% of that income — some $33 billion in total — is related to trade assistance, disaster assistance, the farm bill and insurance indemnities and has yet to be fully received by farmers and ranchers.

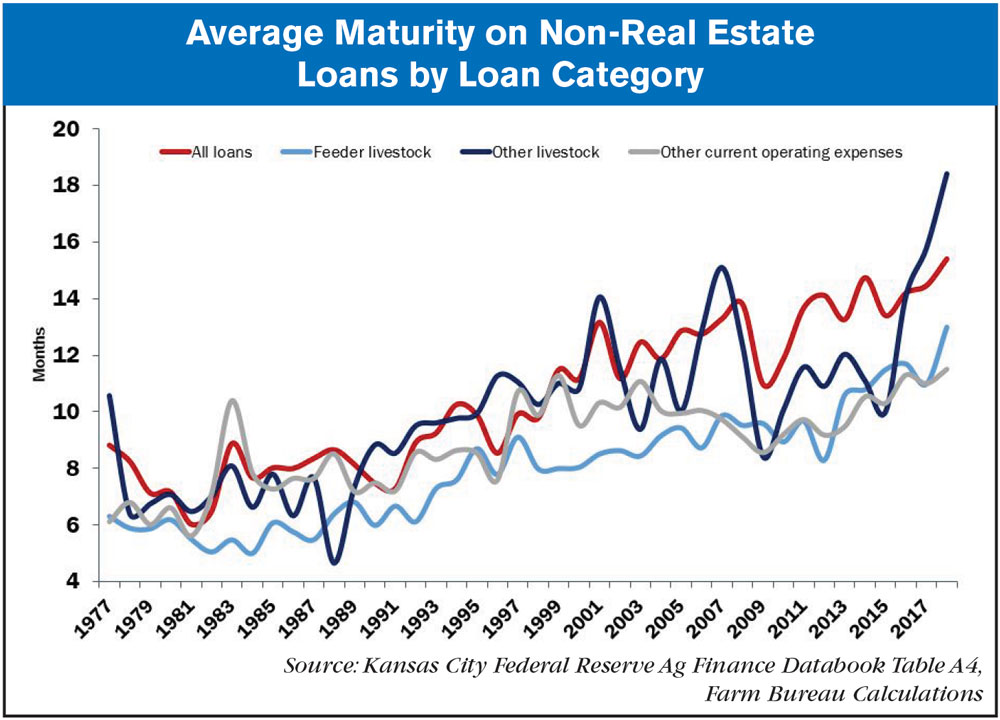

Moreover, farm debt in 2019 is projected to be a record high $416 billion, with $257 billion in real estate debt and $159 billion in non-real estate debt. The repayment terms on this debt, according to data from the Kansas City Federal Reserve, reached all-time highs for a variety of categories. All non-real estate loans saw an average maturity of 15.4 months, feeder livestock had an average maturity period of 13 months, other livestock had a maturity period of 18 months and other operating expenses, i.e., loans primarily for crop production expenses and the care of feeding livestock, had an average maturity period of 11.5 months — all record highs. Put simply, farmers are taking longer to service their debt — a trend made easier due to historically low interest rates.

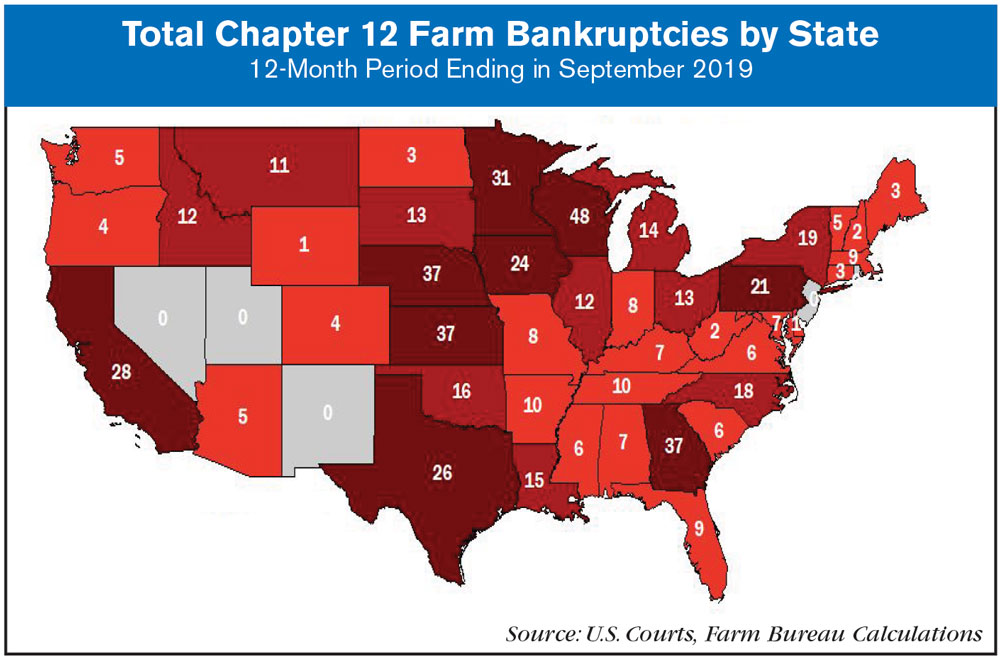

Chapter 12 Bankruptcy by State

With record-high debt, and more farmers extending their repayment terms, it should come as no surprise that Chapter 12 farm bankruptcies remain elevated. Data from the U.S. Courts reveals that for the 12 month period ending September 2019, Chapter 12 farm bankruptcies totaled 580 filings, up 24% from the prior year and the highest level since 676 filings in 2011. For the third quarter of 2019, Chapter 12 bankruptcies decreased slightly to 160 filings, down 2% from the previous quarter.

Total bankruptcies filed by state vary significantly, from no bankruptcies in some states to more than 20 filings in others. Bankruptcy filings were the highest in Wisconsin at 48 filings, followed by 37 filings in Georgia, Nebraska and Kansas. Iowa, Kansas, Maryland, Minnesota, Nebraska, New Hampshire, South Dakota, Wisconsin and West Virginia all experienced Chapter 12 bankruptcy filings at or above 10 year highs.

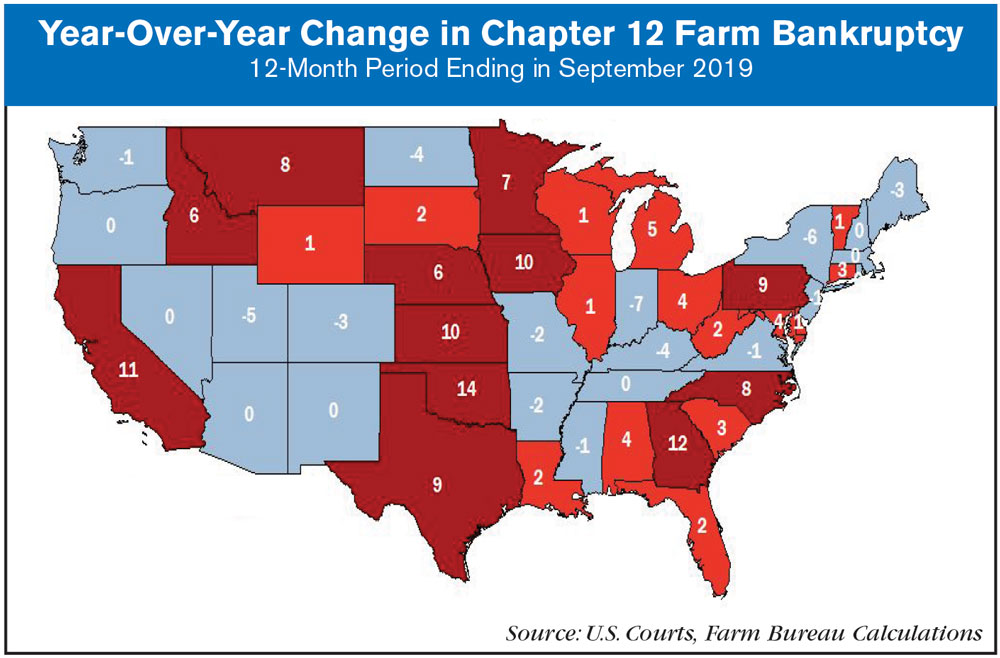

The increase in farm bankruptcies was the highest in Oklahoma at 14, followed by Georgia at 12, California at 11 and Iowa and Kansas at 10 each. Oklahoma had the sharpest increase in bankruptcy filings, increasing from two filings last year to 17 during the previous 12 months.

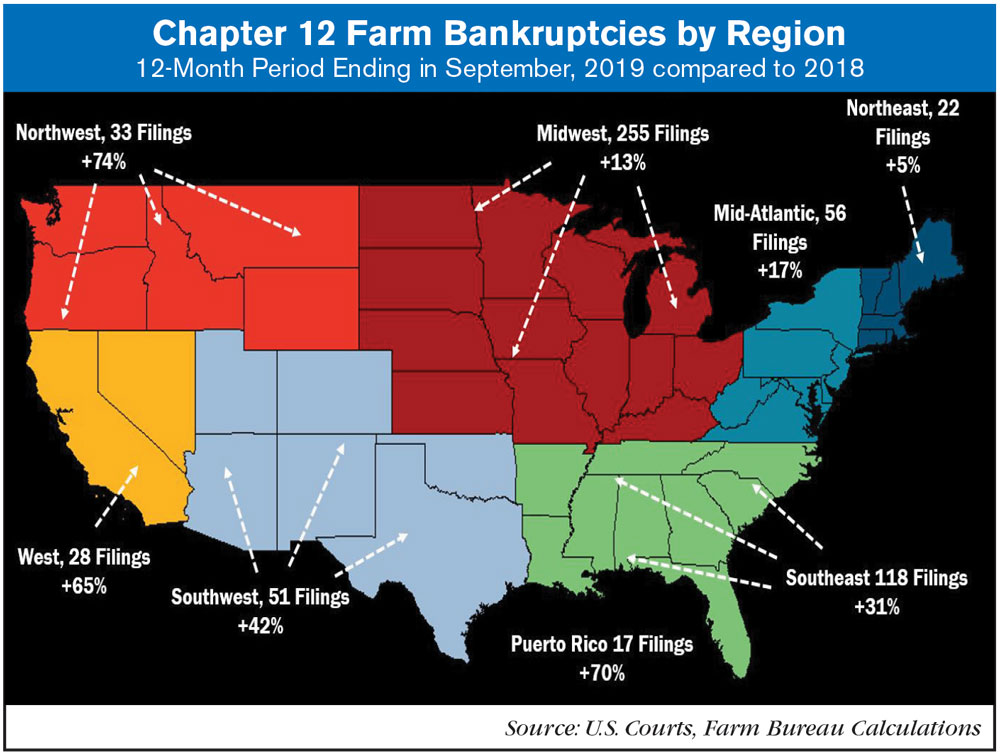

Chapter 12 Bankruptcies by Region

All regions of the U.S. saw higher bankruptcy rates over the previous 12 months compared to the prior year. More than 40% of the farm bankruptcies, 255, were in the 13-state Midwest region. Bankruptcies in the Midwest were up 13% compared to prior-year levels and were at the highest level in more than a decade. Following the Midwest, the Southeast had 118 Chapter 12 bankruptcies over the past year, representing an increase of 31% compared to year-ago levels.

Summary

Chapter 12 farm bankruptcies continue to increase as farmers and ranchers struggle with a prolonged downturn in the farm economy that’s been made worse by unfair retaliatory tariffs on U.S. agriculture as well as two consecutive years of adverse planting, growing and harvesting conditions. Over the prior 12 months, Chapter 12 bankruptcies totaled 580 filings and were up 24% from the previous 12 months.

While filings remain well below the historical highs experienced in the 1980s, the trend is a concern. The support provided to farmers in 2018 and 2019 is expected to alleviate some of the financial stress, however, not all farmers will benefit from trade assistance, farm bill programs, crop insurance or disaster aid. As a result, it could take some time for the financial relief to manifest in the farm bankruptcy trends. Chapter 12 bankruptcies in the third quarter of 2019 were down only slightly, 2%, from the previous quarter.

![[Technology Corner] Quantifying the Impact of a Precision Ag Pioneer](https://www.agequipmentintelligence.com/ext/resources/2024/08/23/Quantifying-the-Impact-of-a-Precision-Ag-Pioneer.png?height=290&t=1724422794&width=400)

Post a comment

Report Abusive Comment