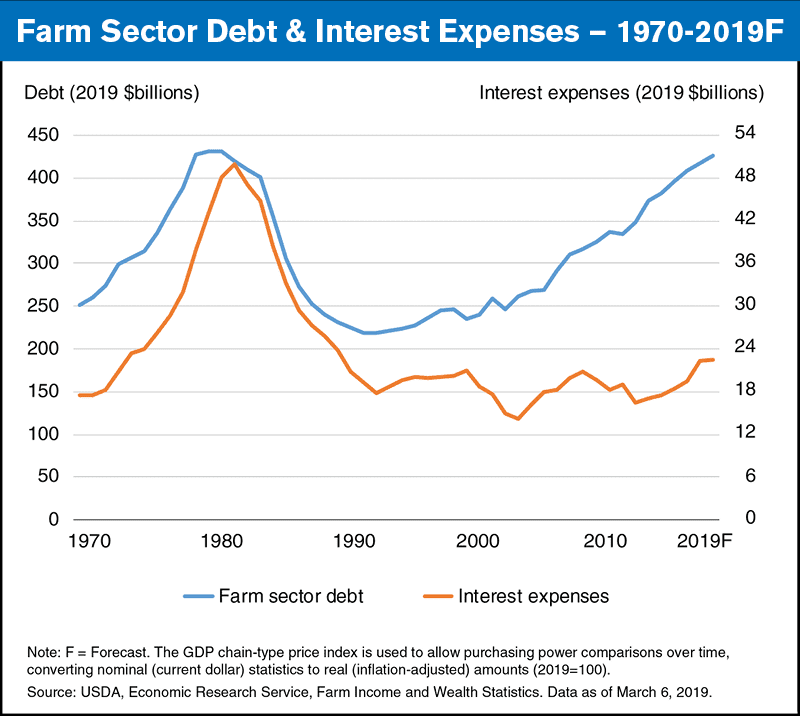

Farm sector debt has reached levels near the peak levels of the late 1970s and early 1980s. High levels of debt increase a farm’s risk of going out of business. From 1993 to 2017, real (inflation-adjusted) farm debt increased by 87%, or 4% per year on average. USDA’s Economic Research Service forecasts farm debt to increase 2% in both 2018 and 2019. When adjusted for inflation, total farm sector debt in 2019 is forecast to be 4% ($4 billion) below the peak reached in 1980.

Interest paid on farm debt remained relatively stable from 1990 through 2013, as interest rates declined. However, interest expenses in 2019 are forecast to increase 38% ($6 billion) compared to 2013. Interest expenses in 2019 are forecast to be 18% above the 30 year average, 19% above the 10 year average, but 55% below the peak in 1982.

Find additional information and analysis on ERS’s Farm Sector Income and Finances topic page.

![[Technology Corner] What an OEM Partnership Means to an Autonomy Startup](https://www.agequipmentintelligence.com/ext/resources/2024/09/26/What-an-OEM-Partnership-Means-to-an-Autonomy-Startup.png?height=290&t=1727457531&width=400)

Post a comment

Report Abusive Comment