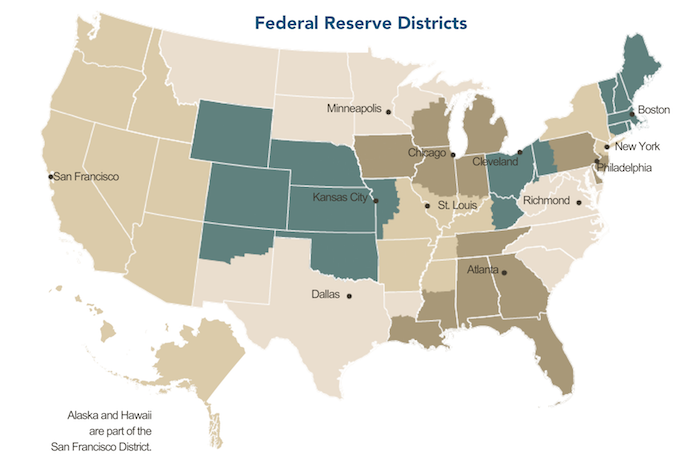

The Federal Reserve Bank released the January 2019 edition of its Beige Book. The report contains observations on the economic situation for each of the 12 Federal Reserve Districts. Overall, it was found that “the agriculture sector struggled as prices generally remained low despite recent increases.”

Several of the districts included commentary on agriculture within their areas of responsibility. Following are their comments.

The Sixth District – Atlanta

Agriculture conditions across the District were mixed. Recent reports showed most of the District was drought free with the exception of parts of south Florida where there were abnormally dry to moderate drought conditions. The USDA designated some counties in Alabama, Florida, Georgia, and Mississippi as natural disaster areas due to damages and losses attributed to Hurricane Michael, Tropical Storm Gordon, and flooding. The December forecast for Florida’s orange crops was unchanged from the prior month, but up significantly from last year’s production. In mid-December, weekly cash prices for corn, cotton, and beef were up while rice, soybean, broiler and egg prices were down on a year-over-year basis.

The Seventh District – Chicago

Prices for corn, soybeans, and wheat moved higher over the reporting period, supported in part by news that trade talks between the U.S. and China had resumed and that China had purchased some U.S. soybeans. A second round of payments from the Federal Government’s Market Facilitation Program also supported farm incomes (primarily for soybean producers), although payments have been disrupted by the government shutdown. The shutdown also slowed the release of government reports on agricultural market conditions, leading to greater uncertainty for market participants.

Contacts noted that the profitability of the 2018 harvest was still unclear as a large amount of the harvest remained unsold. Lower ethanol prices weighed on ethanol producers, and there were reports of plant closures as well as expectations of more closures in the future. Cattle, egg and dairy prices all rose, though dairies generally continued to face difficult operating conditions. Hog prices fell over the reporting period. Contacts noted that rising input prices for crop and livestock producers as well as higher interest rates were shrinking margins.

The Eighth District – St. Louis

District agriculture conditions have improved slightly since the previous report. The percentage of winter wheat rated fair or better remained approximately unchanged from the end of October to the end of November and remains at 93%. This is an increase from 89% of winter wheat rated fair or better at the end of 2017. Contacts continued to report very high crop yields for 2018. However, farmers still face headwinds due to low crop prices and continued trade concerns.

The Ninth District — Minneapolis

Agricultural conditions in the District were stable at low levels. District oil and gas drilling activity slowed notably recently in response to a rapid decline in the price of crude oil. An industry contact reported that expectations for capital expenditures in the Bakken oil patch have shifted downward dramatically. However, as of late December, the drilling rig count in the region was unchanged from a month earlier. District iron ore mines were operating at near capacity, with a recent estimate suggesting 2018 production would be up slightly from the previous year.

The Tenth District – Kansas City

The Tenth District farm economy remained weak despite a slight improvement in prices of some agricultural commodities. In the crop sector, prices increased slightly from the prior period. Corn and wheat prices were slightly higher than year-ago levels, but soybean prices remained lower as uncertainty surrounding trade persisted. Although good yields contributed to higher 2018 corn and soybean production in Nebraska, below average yields in Missouri could put downward pressure on farm income. Cotton prices fell sharply since the prior period on expectations of lower ginning activity which, combined with lower 2018 production in Oklahoma due to poor yields, could also reduce revenues. In the livestock sector, cattle prices increased slightly compared to the previous survey period while hog prices were slightly lower.

The Eleventh District – Dallas

Ample soil moisture has boosted agricultural producers’ outlook for 2019, although prices for several crops remain low. The new farm bill offers farmers greater flexibility in choosing coverage options and reintroduced cotton as a covered commodity after it was removed in the 2014 farm bill. This cotton safety net is meaningful for many cotton growers as they secure financing for the upcoming crop season. Conditions in the livestock sector generally remained favorable, but milk prices have fallen over the reporting period and may cause strain on dairies.

The Twelfth District – San Francisco

Conditions in the agriculture sector deteriorated slightly and prices declined modestly as demand from abroad weakened in response to trade policy changes and the stronger dollar. Many contacts cited trade policy changes and the appreciation of the dollar as drivers of weaker sales in the sector. Demand from abroad for a variety of crops declined noticeably, hurting profitability for certain growers across the district. A few contacts reported higher inventory levels for crops such as soybeans and perishable fruits, while growers sought alternative markets for their products. A contact in California noted that the outlook for crop yields in the new year improved modestly after rainfall beat expectations over the reporting period.

Post a comment

Report Abusive Comment